Assassinations, Civil Unrest and Central Bank Complacency

July 2024 Edition: Issue 07 - Macro Chronicles: Unfiltered Insights

Hi there,

After yesterday’s insane global sell-off, we want to provide you with a recap of the last 30 days in the world and markets. There's a lot to unpack from July, with the rise in geopolitical uncertainty and insane market volatility.

If this is your first time reading the Macro Chronicles report, welcome aboard!

With just 91 days until the world turns its gaze to the United States, we’ve seen an event reminiscent of JFK's time, sparking even more division, especially in the West.

July 2024 will be remembered as one of the craziest months since the start of COVID. NATO and BRICS seem determined to keep driving this division further.

While we remain optimistic about the future, we also want to stay cautious as it feels like World War 3 could be looming on the horizon, if it’s not already happening...

So, let's dive in as we provide you with a roadmap of current events and how these will impact the market and your investment portfolio.

Macro Headliners

written by Nic A. Tartaglia

POLITICS

USA

Biden’s Demise Post Trump-Biden Debate

CNN shares how bad the polls have been for Biden showing high % believe that Biden does not have the cognitive health to stand as President of America.

Fascinating the shift on CNN and other media outlets, even democrats when they were claiming the accusations by republicans and on social media of Biden's mental decline was all FAKE. They’re tune sure changed after the debate because they can’t hide behind others speaking on Biden’s behalf. The truth is out.

Press Secretary Karine Jean-Pierre a few days after the debate with journalists reinforced that all of a sudden Joe Biden was not himself at the debate because he was “tired with jetlag” and was “fighting a cold”…….

The government wants you to reject reality and logic for their illusions and lies.

The Pro-Biden camp still refuses to live in reality and rejects the cognitive reality of Biden. This is insanity, and shows the reasoning why politicians and the government should never be trusted. They want to maintain power and will do so at the cost of truth and transparency. If the illusion collapses, they lose control of the narrative.

On the other hand, Democrat Megadonors and Disney Family heiress Abigail Disney has announced that she will be withholding all donations to Democrats until Joe Biden steps down. Major democrat donors told the largest pro-Biden super PAC that they have frozen $90 million in pledged donations in opposition to Biden.

Once they revealed the cognitive reality of Biden on stage in a debate, after refusing to allow him to debate and never allowing him to speak for more than a few minutes…… the cat is out of the bag……. The other side not stuck in the democrat vacuum chamber have been saying this for years……. Being called conspiracy theorists, claiming fake news and that the videos online were merely deep fakes to create ‘misinformation’. To the point that the republicans wanted his Doctor to be subpoenaed in front of the senate to get to the truth.

Former Obama Chief Strategist David Axelrod in an interview on CNN said “Biden is not winning this race, it’s more likely that he’ll lose by a landslide than win narrowly” and is “seriously out of touch with the concerns people have about his capacities moving forward.”

Republicans were coming after Biden and using hard leveraging the finally accepted reality of his mental state.

Not soon after the implosion from the debate against Trump, President Joe Biden finally announces he will be stepping down and gives his backing to Kamala Harris.

Side note on this - She will be as much of a puppet as Biden was. She is the most incompetent and weakest figure that can be put in that powerful seat. If she wins, not even prayers will save America.

Really Obama? Do you really think he means anything in that post about Biden Stepping down?

Kamala Harris’ Time To Shine?

Democrat legacies, Presidents Barack and Michel Obama, Bill and Hillary Clinton have come out officially backing Kamala Harris.

Many seem to use her gender and race as their biggest reason. Oh right because she has no other qualifications or accomplishments to utilize in her campaign. Which Biden by the way said he would use his time left in office to campaign on her behalf.

She went from being hidden during Biden’s Presidency with the accepted fact that she was the least popular VP of American History and now they've supposedly sky rocketed and the whole left is jumping behind her with their support to combat Trump in the 2024 elections.

What makes this even more ridiculous, is the fact that Joe Biden received 14 million votes from Democrats in the primaries, and all of a sudden, the establishment turns around and says, It’s Kamala’s turn. This, in itself is a form of a “political coup”, which many Democrats don’t even think of the hypocrisy of this political ploy.

A quote on the state of American politics:

“The world is a comedy to those that think, a tragedy to those who feel.”

Horace Walpole

Trump Assassination Attempt

1 shooter so far

Was established as a suspicious person before he managed to take 8 shots.

2 wounded, 1 killed and Trump was hit in the ear.

Shooter was 20 year old Thomas Matthew Crooks. Used a drone, placed a ladder, had a rangefinder (which had been established as suspicious), bomb detonator was on his person

Compilation of Videos Related To Assassination Attempt. Watch below

4 Major Senate Hearings on the Assassination attempt. Full videos of hearings provided below chronologically.

The Director of Secret Service Kimberly Cheatle resigned the day after the hearing amid huge calls for her to back down for her failures and DEI initiatives.

Commissioner of the Pennsylvania State Police, Col. Christopher Paris, and Fraternal Order of Police national president Patrick Yoes testified. Forbes

The Director of the FBI Christopher Wray

https://www.youtube.com/live/UZGWqZKGPTA?si=RKv13wRPCJwp71Qq

The acting Director of the Secret Service Ronald Rowe

More Craziness in American Laws and Regulations:

The SAVE Act has passed in the House which will require proof of US Citizenship to vote. 198 democrats voted against it, because according to them, Minorities like black people don’t have ID’s nor have access to getting them. They claim it is racist and discriminatory to demand ID to vote. But to buy alcohol, drugs, join the Army and so on all require ID.

Crazy California - Newsom signs into law AB 1955 requiring California Schools hide minor children’s gender dysphoria from their parents. Because somehow the government has established itself has having more rights over the child than the parents. How insane and dystopic. All in the name of “safety”

Newsom veto’s bill that would require annual review of homeless funds.

Nourish Co-op was mandated by the Michigan Department of Agriculture and Rural Development to destroy all their raw dairy products after receiving a cease and desist order from the State.

Supreme court rules Donald Trump is immune from criminal prosecution for official actions

Other Little Developments

Joe Biden awards NATO Secretary General Jens Stoltenberg The Presidential Medal of Freedom.

Biden attacks those who oppose his climate change agenda: “everyone who willfully denies the impacts of climate change is condemning the American people to a dangerous future, and is either really, really dumb or has some other motive.”

Democrat Senator Bob Menendez found guilty on all counts in the bribery trial.

Chicago mayor Johnson has decided to remove George Washington from the hallways of Chicago’s City Hall.

The US is set to begin its military command revamp in Japan.

JD Vance was selected as Trump’s VP choice

ISRAEL

Israeli Defence Minister Yoav Galant said the Israel army is in need of another 10,000 soldiers immediately. - Israeli army needs 10,000 soldiers ‘immediately,’ defense minister says (aa.com.tr)

Is this where the orthodox Jewish community will come into play? Forcing them to participate?

Key Conflict Developments vs Militants

Drone strike in Tel Aviv. Supposedly the Houthis were responsible and this was met with a response by Israel attacking the port in Al Hudaydah. Houthis warn that there are “no red lines” moving forward in their counter attacks.

Hezbollah fired a heavy barrage of rockets at Israel and the Iron Dome intercepts them

Israel saw a simultaneous attack by the Houthis and Hezbollah.

Hezbollah bombs a local area Druze Town in Northern Israel killing 12 children and teenagers

In the month of July, Israel delivers a multitude of air strikes targeting high level militant officials.

Hamas’s top military commander, Mohammed Deif, was killed in an Israeli air raid in southern Gaza on July 13.

Late Tuesday, July 30, an attack carried out by Israeli fighter jets targeted 62-year-old Fouad Shukur, one of Hezbollah's most senior military officers, based in Lebanon killing him. He was also known as Hajj Mohsin, a senior adviser to the terror group’s leader Hassan Nasrallah.

Ismail Haniyeh, top commander of Hamas assassinated in Iran

The conflict in the Middle East is not over yet. If anything, this could just be the beginning of the real conflict where the Middle East begins to demonstrate more collaboration in their efforts against Israel and the West who funds/backs them up.

The International Court of Justice is warning Israel that they are operating illegally and may suffer consequences. - Summary of the Advisory Opinion of 19 July 2024 (icj-cij.org)

TURKEY

Turkey’s President Erdogan threatens military action against Israel in response to continued war in Gaza. - Turkey Threatens to Invade Israel (fdd.org)

Remember this, Turkey is a NATO member. Is this where we begin to see the collapse of the NATO union?

CHINA

China, alongside Belarus conducts military drills near the Poland and Ukrainian border called Eagle Assault 2024, an 11 day drill. This included practicing the capture of an airport. And of course NATO decides to comment after calling China a “decisive enabler” of the Russian - Ukrainian war.

Joint Chinese, Russian Naval Drills in South China Sea:

“China’s People’s Liberation Army Navy and the Russian Navy wrapped up a joint exercise in the South China Sea and a separate joint naval patrol this week. The two navies finished what the PLAN calls Joint Sea 2024, which is known as Maritime Interaction 2024 to the Russians. The drills began on Monday in the South China Sea, near the southern China city of Zhanjiang. The city is also the headquarters of the PLAN South Sea Fleet, from where the PLAN and Russian ships taking part in the exercise departed…..During the exercise the combined force carried out various tactical drills, including joint live-fire air and missile defense drills.”

RUSSIA

Putin states that Russia will resume the production of banned short-range missile systems as a result of US break of promises, when they had withdrawn from the pact in 2019.

UKRAINE

Zelensky in a reversal says Russia should attend the 2nd Ukraine Summit. It is a remarkable development that he so much as stated the possibility, even if it doesn't actually materialize, given he's long been vehemently against any level of negotiations with Moscow so long as Putin is still in power.

At the same time, Zelensky is seen saying in an interview “All of us understand that we have to finish the war asap so as not to lose people’s lives.” As the American political landscape is shifting fast, this side of caring about losses and wanting to end it is new. And seems to align with his invitation for Russian representatives at the Ukrainian Summit.

More Western Funding

Biden announced another $225 million in war funding to Ukraine, including a Patriot system. The package also includes Stinger anti-aircraft missiles, ammunition for High Mobility Artillery Rocket Systems, or HIMARS, and more 155mm and 105mm artillery rounds, among other munitions.

Another $500 million in funding announced by Trudeau to support Ukraine.

“Prime Minister Justin Trudeau pledged another $500 million in military assistance to Ukraine in a one-on-one conversation with President Volodymyr Zelenskyy at the NATO summit in Washington, D.C. The funding announcement Wednesday comes amidst pressure from American politicians who are publicly critical of Canada for falling short of its defense spending commitments. NATO allies have agreed to spend at least the equivalent of two per cent of their national gross domestic product on defense. Canada's current spend is around 1.37 per cent. Trudeau also told Zelenskyy that Canada will begin to provide much of Ukraine's fighter jet pilot training.” - Canada pledges Ukraine aid, to buy submarines at NATO summit | CTV News

BELARUS

The president of Belarus, Lukashenko stated “We are ready to respond to provocations from the United States and the EU.”

INDIA

Indian Prime Minister Narendra Modi will visit Russia for the first time in 5 years.

“Russia remains a key supplier of cut-price oil and weapons to India, especially following sanctions on Moscow imposed by the United States and its allies, which came in response to the Russian invasion of Ukraine and shut most Western markets off to Russian exports. According to analysts, India now gets more than 40 percent of its oil imports from Russia.

Indian Secretary of Foreign Affairs Vinay Mohan Kwatra told reporters on Friday that due to strong energy cooperation, India-Russia trade increased to nearly $65bn in the 2023-24 financial year. India’s top exports to Russia include drugs and pharmaceutical products, telecom instruments, iron and steel, marine products and machinery. Its top imports from Russia include crude oil and petroleum products, coal and coke, pearls, precious and semiprecious stones, fertiliser, vegetable oil, gold and silver.”

BRAZIL

Brazilian President says “I think Biden has problems, the US Elections are important to the world.”

Joe Biden’s Allies Abroad Think It’s Untenable for Him to Stay on - Bloomberg

UK

Newly elected Prime Minister of Britain Keir Starmer of the labor party wins in a landslide after 14 years of conservative domination. In his winning speech, he states that “our country needs a bigger reset.” Sunak has officially been replaced. The party lost more than 250 of the seats it had held in the 650-seat Parliament since 2019

In a speech at a conference, Labor Party MP Rachel Maskell said “why does it matter if immigration means we need to wait a week more for the hospital?”

King Charles’ monarchy gets a $60 million pay raise, a 54% rise in annual income which taxpayers must burden the cost of sustaining the royal family. They live at the cost of citizens.

FRANCE

A coalition of the French left won majority seats to beat out what appeared to be a potential for the right if they had not done so. The results showed just over 180 seats for the New Popular Front leftist coalition, which placed first, ahead of Macron’s centrist alliance, with more than 160 seats. Marine Le Pen’s far-right National Rally and its allies were restricted to third place, although their more than 140 seats were still way ahead of the party’s previous best showing — 89 seats in 2022.

Shortly after it formed in June, the NPF outlined its ambitious economic program and how it would fund it:

raising the minimum wage

price controls on essential foods, electricity, gas and petrol

lowering the retirement age to 60

a new 90% tax on any annual income above €400,000 (£337,954)

heavy investment in green transition and public services

CANADA

The Canadian government seeks to acquire up to 12 submarines to guard the Arctic.

“As outlined in our defense policy update, Our North, Strong and Free, released in April 2024, our Arctic is now warming at four times the global average, making a vast and sensitive region more accessible to foreign actors who have growing capabilities and regional military ambitions. By 2050, the Arctic Ocean could become the most efficient shipping route between Europe and East Asia. Canada's Northwest Passage and the broader Arctic region are already more accessible, and competitors are seeking access, transportation routes, natural resources, critical minerals, and energy sources through more frequent and regular presence and activity. They are exploring Arctic waters and the sea floor, probing our infrastructure and collecting intelligence. In the maritime domain, Russian submarines are probing widely across the Atlantic, Arctic and Pacific Oceans and China is rapidly expanding its underwater fleet.

In response to these emerging security challenges, in Our North, Strong and Free, the Government of Canada committed to exploring options for renewing and expanding our submarine fleet, in order to allow Canada to detect and deter threats and control our maritime approaches. We made this commitment because Canada’s current fleet of four Victoria-class submarines is becoming increasingly obsolete and expensive to maintain. Canada needs a new fleet of submarines to protect our sovereignty from emerging security threats.”

Quick facts - Canada launching process to acquire up to 12 conventionally-powered submarines - Canada.ca

“As outlined in Our North, Strong and Free, the security situation in our Arctic and North is changing as the region becomes more accessible. We are seeing more Russian activity in our air approaches, and a growing number of Chinese dual-purpose research vessels and surveillance platforms collecting data about the Canadian North that is, by Chinese law, made available to China's military.

In Our North, Strong and Free: A Renewed Vision for Canada’s Defence, the Government of Canada announced $8.1 billion over five years and $73 billion over 20 years in new defense spending. This builds on historic investments the federal government has made to date to support members of our Armed Forces, strengthen Canada’s defense capabilities, and respond to global challenges.

In addition to the funded initiatives in Our North, Strong and Free, Canada also identified ten capabilities for which we will explore options, including:

renewing and expanding our submarine fleet;

acquiring new vehicles adapted to ice, snow and tundra;

enabling our Arctic and Offshore Patrol Vessels to embark and operate our maritime helicopters at sea;

making further contributions to the integrated air and missile defense of Canada and North America;

acquiring ground-based air defenses to defend critical infrastructure;

acquiring long-range air- and sea-launched missiles;

modernizing our artillery capabilities;

upgrading or replacing our tank and light armored vehicle fleets;

establishing a light armored vehicle production program; and

acquiring a suite of surveillance and strike drones and counter-drone capabilities.

Today, Canada is announcing that it is moving forward to engage industry on the renewal and expansion of Canada’s submarine fleet – in particular, the purchase of up to 12 conventionally-powered, under-ice capable submarines.

Four Victoria-class submarines were purchased from the British Government in 1998, and delivered to Canada over a four year period from 2000 to 2004. The first three submarines—Victoria, Windsor and Corner Brook—were commissioned into RCN service shortly after their arrival in Canada. The fourth, Chicoutimi, was delivered to Canada in 2004, but was not commissioned into RCN service until 2015, due to a fire in 2004 and subsequent work required.

The Government of Canada has committed to modernizing and operating the Victoria-class into the mid-to-late 2030s.”

DENMARK

Denmark seeks to be the first country to implement a carbon tax on farmer’s agriculture for every cow they possess to discourage meat consumption.

“Dairy farmers in Denmark face having to pay an annual tax of 672 krone ($96) per cow for the planet-heating emissions they generate. The country’s coalition government agreed this week to introduce the world’s first carbon emissions tax on agriculture. It will mean new levies on livestock starting in 2030.

Denmark is a major dairy and pork exporter, and agriculture is the country’s biggest source of emissions. The coalition agreement — which also entails investing 40 billion krone ($3.7 billion) in measures such as reforestation and establishing wetlands — is aimed at helping the country meet its climate goals.“With today’s agreement, we are investing billions in the biggest transformation of the Danish landscape in recent times,” Foreign Minister Lars Lokke Rasmussen said in a statement Tuesday. “At the same time, we will be the first country in the world with a (carbon) tax on agriculture.” The Danish dairy industry broadly welcomed the agreement and its goals, but it has angered some farmers.The move comes just months after farmers held protests across Europe, blocking roads with tractors and pelting the European Parliament with eggs over a long list of complaints, including gripes about environmental regulation and excessive red tape.” - Denmark to charge $100 per cow in world’s first carbon tax on farming | CNN Business

HUNGARY

The Hungarian Foreign Minister states that “We are under heavy attack from pro-war officials in the EU.”

CULTURE

Bangladesh Protests

Government had shut down the internet once protests reached the capital earlier on in the protests and implemented a shoot-on-sight curfew to prevent violent protests. Students protest in the 10’s of thousands against the government’s job quota system which has continued for nearly a month now. It has evolved to include also the brutality of government forces on the protestors and youth/students of the country. It is estimated that over 200 have been killed from military and police unleashed on protestors. They now protest the resignation of the current Prime Minister of Bangladesh Sheik Hasina who is in her 5th term as PM, nearly 15 years.

The initial driver of the protests began with students, frustrated by shortages of good jobs, demanding an end to a quota system for government jobs that they argued was discriminatory. Under it, 30% of such jobs were reserved for relatives of veterans who fought in Bangladesh’s war of independence against Pakistan in 1971. They said it benefited supporters of Hasina, whose Awami League party led the independence movement, and wanted it replaced with a merit-based system.In response, the Supreme Court scaled back the veterans’ quota down to 5%.

Now there are international and domestic calls for an outside and international institution to get involved as 10,000’s of student protesters are being rounded up for arrest.

And the current government has banned the opposition party. It’s starting to resemble the chaos in Venezuela.

This is still a developing story for Bangladesh. And clearly here as well, we are seeing a political culture cracking.

Venezuela Protests

Protests of 10,000’s have broken out in Venezuela in the face of their elections where President Nicolas Maduro, a communist who promised free everything to his people is seeing a cultural revolt as he seeks to solidify a guaranteed win under the disguise of “democracy”. Dozens have been killed so far with 1000’s arrested as their government unleashes their forces to suppress them.

International governments and institutions especially in the west are starting to indicate support for the proclaimed election winner which is not Nicolas Maduro but rather Edmundo Gonzalez.

“Meanwhile, protests erupted after the head of the National Electoral Council (CNE) - who is a member of Mr. Maduro's party and used to work as his legal adviser - declared the president re-elected for a third consecutive term. The CNE had earlier announced that Mr. Maduro had won with 51% of the votes, ahead of Edmundo González with 44%. However, the electoral authority has so far failed to publish detailed voting tallies, which the opposition says show that the result the CNE announced was fraudulent.

Attorney General Tarek Saab, a longtime ally of Mr. Maduro, warned that those arrested would be charged with "resisting authority and, in the most serious cases, terrorism".” -Fresh protests in Venezuela as anger grows at disputed election result (bbc.com)

The political culture is cracking and bringing a lot of pain and chaos to the people of Venezuela.

On a side note, here is an article on the natural rights of gun rights and how they are removed as a means to further dominate.

Gun Control Preceded the Tyranny in Venezuela (fee.org)

The United States

July 4th Chaos

In Chicago, the July 4th weekend saw 109 gun shots, killing 19 people.

The Mayor of Chicago blames systemic racism/white supremacy and Richard Nixon for the problems. Nothing has to do with the big government knowing everything welfarism going on in that city?

Why? No logical human can possibly understand the logic behind these delusions. It is all deflection to evade any responsibility and blame for the regression in their communities.

Pro-Hamas and Pro-Palestine protests see protestors burning American flags during the July 4th weekend and during Benjamin Netenyahu’s visit to Washington, later in the month. There is still this growing “I hate America” yet “give me everything” culture growing and disrupting the American equilibrium, among many other factors of course.

Just put “July 4th protestors burn American flags” and you will see plenty of videos on this issue.

Other Protests

A pro-communist march took place in Philadelphia waving communist flags

We Support Criminals…

Flash mob robs and ransacks Bay Area Mini-Mart causing $100,000 in damages.

The Office of Sacramento City Attorney Susana Alcala Wood has supposedly threatened to fine a local Target for reporting theft to the police, calling the reports a public nuisance.

The Chaos From Mass Migration Across The West

Four illegals from Venezuela seen on camera in Chicago on a train choking and robbing a man.

Many more stories like this on Youtube and google news. Just do a simple search to see all the news reported on this nearly everyday.

Locals in Dundalk Ireland, a small population of a little over 43,000 protest the conversion of a local school into a migrant center.

The tension across the UK on this issue is very much escalating and causing a lot of cultural and political tension.

Some more videos of protests and riots in the UK showing clear signs of a boiling point coming for this society.

Lagos Nigeria

Huge anti-current administration and anti-government protests erupt in the face of high costs to live and lack of opportunities. Nationalizing desires are growing and physical tension has seen some moments between some protestors and government forces. A lot of the youth are participating in these movements.

Here too the political culture is breaking.

This is a common trend across the world. It is not the end either. Far from it

FRANCE

The far left supporters begin riots and cause chaos in France after their win. .

In Lyon, you see rioters vandalize McDonalds and other local boutiques. This includes Antifa rioters creating blockades as an example.

Why does the left always want to destroy their communities? Objectively speaking, we never see the right aim to hurt and destroy their own communities

Olympics

There was something more “Diverse” & “Inclusive” behind the opening ceremony of the Olympics hosted by France. It angered, disturbed and confused many while many had no issues with it. The tableau on the Debilly Bridge over the Seine was, according to opening ceremony artistic director Thomas Jolly, supposed to celebrate diversity and pay tribute to feasting and French gastronomy. According to the official Olympics Games account on X, formerly Twitter, it was an "interpretation of the Greek God Dionysus." Supporters of the tableau praised its message of inclusivity and tolerance, applauding what Jolly said was "a message of love" in an Olympic Games with a historic number of "out" gay, lesbian, bi, trans, queer and nonbinary athletes.

But this is where the issue begins. Somehow a heavy amount of LGBTQ culture was represented and dominated the ceremony. So the question is what makes this French? What makes this about the Olympics? Other than having a Greek god…….

The scene seemed to evoke Leonardo da Vinci's The Last Supper, featuring the drag queens and other performers in a configuration reminiscent of Jesus Christ and his apostles. Thesis created a lot of problems with the Christian and Muslim communities. In case people wonder why also the Muslim communities, it is because Jesus is a prophet of Islam.

Can I clearly deny there is no resemblance? I cannot. What is the real truth? Who knows, I'll let you decide.

The other issue I hold more personally is that this has nothing to do with the Olympics, nor in any way creates an ambience or projection of what it means, or at least meant the Olympic Games. The other irony is that if I use the language and logic of those who are so heavily included in the opening ceremony by which I mean LGBTQ individuals, they would call the Olympics a patriarchal event to celebrate toxic masculinity of competition and beating your enemies. Yet here they are, showing the hypocrisy and fortitude of their philosophy that they will dance, sing and put on a show for the very things they criticize and hate all for the attention, to be at the front and center for all to witness their “truth”.

This is from the Olympic;s Youtube Channel. All remnants of the full ceremony and especially the “controversial” moment has sort of disappeared from major channels. Dig a little to find it. Here is the “Video Unavailable” from Olympic Youtube (40) SPECTACULAR Paris 2024 Opening Ceremony! 💥🇫🇷 | Highlights - YouTube

It did give a little of a Hunger Games vibe. Photo below from the movie to give a comparison.

Other Issues Overall

No A/C for rooms of athletes. Hottest period of the year in Europe.

Heavy vegan cafeteria, creating issues for athletes who eat meat. Became another controversy all because France wanted to be “carbon conscious”.

Trump Support

Waka Flocka, 50 Cent and many other rappers coming out supporting Trump.

The day of Trump’s assassination attempt, 50 Cent was performing in Boston and edited his “Get Rich or Die Tryin” cover to have Trump’s face while on stage.

“SAFE SUPPLY” DRUGS

The Ontario Police has shared that roughly half of the drugs seized in 2023 were prescribed opioids, which includes “safe supply” programs.

COVID Again

In the beginning of July, there was a Senate Homeland Security Committee Hearing on US Taxpayer-Funded High-Risk Virus Research.

https://www.youtube.com/live/xD7aERQ0wxA?si=8EvdcTtbi2_Kqik5

Continued Resistance In Israel

Continued protests from the Haredi Jews (ultra-orthodox) in Israel against the government's new ruling to force them into military service. The drafting will begin at the beginning of August where the Israeli military will be drafting 1,000 ultra-Orthodox Jewish men for the first time in its history

Ultra-Orthodox Jews called up: Israeli govt begins issuing conscription notices

Israel's Supreme Court rules ultra-Orthodox men must serve in military

How far are Israel's Ultra-Orthodox willing to go to avoid military service? | DW News

ECONOMICS

Summary of Major Central Bank Rate Decisions

“The Fed is an organized cartel of banksters who are creating inflation, ripping off the public, destroying the savings of the public.” - Murray Rothbard

Bank of England

rate cut of 0.25

From 5.25% down to 5%

Federal Reserve FED

no rate cut - Holding at 5.5%

Strong hint of rate cut by September (80% probability)

JP Morgan forecasts 50 basis rate cuts in both September and November meetings.

Central Bank of Canada

Second rate cut of 0.25

From 4.75% down to 4.5%

The European Central Bank

No rate cut

Holds at 3.75%

China

The People’s Bank of China

Cut the 7 day reverse repo rate to 1.7% down from 1.8%. First cut to this rate since august 2023.

Lowered the rates on its standing lending facility to 3.85%

China cut benchmark lending rates by 0.1 at the monthly fixing also.

The one year loan prime rate was lowered to 3.35% from 3.45%.

The five year loan prime rate was lowered to 3.85% from 3.95%.

Other Points on China

Bank of JiangXI collapsed in China

Holdings of US Treasuries held by China as of end May 2024 is $768 billion from $1.1 trillion. Down 30% since 2021.

ticdata.treasury.gov/resource-center/data-chart-center/tic/Documents/slt_table5.html

USA

Federal debt crosses $35 Trillion for the first time.

“A wise and frugal government, which shall leave men free to regulate their own pursuits of industry and improvement, and shall not take from the mouth of labor the bread it has earned - this is the sum of good government.” - Thomas Jefferson

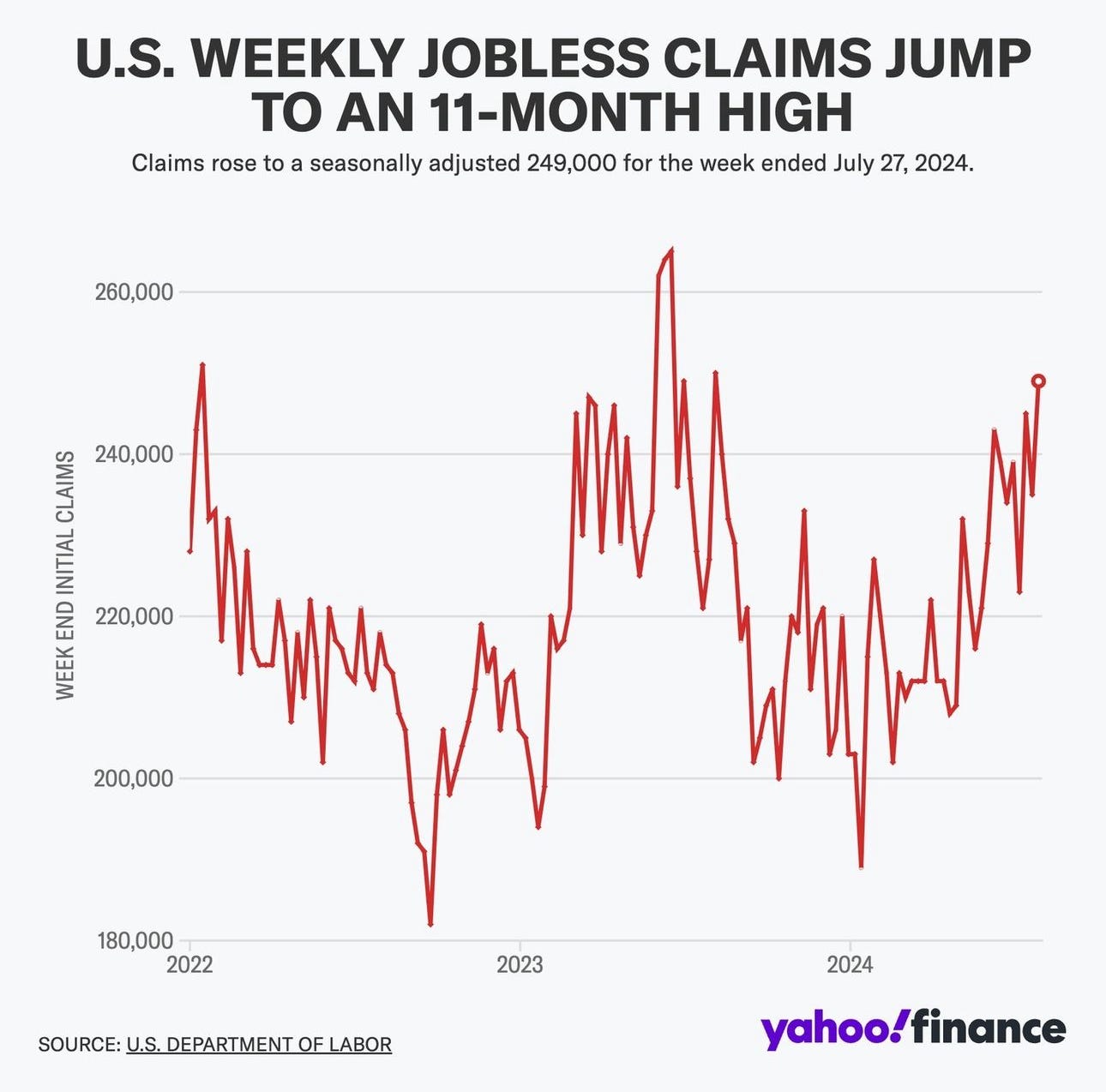

The last 2 months of official job numbers have been revised downwards by -111,000, and unemployment rises to 4.1%, highest since Nov 2021.

Source: Lobo Tiggre

The Biden administration cancels another $1.2 billion in student loans for public service workers.

Crowdstrike experiences tech outage by a supposed “flawed” - biggest IT outage in history

Boeing agrees to plead guilty to criminal conspiracy to defraud the US and faces a criminal fine of as much as $487.2 million USD.

State Farm has requested permission to increase home insurance rates by 30% for homeowners, 36% for condo owners and 52% for renters. They have warned California's Department of Insurance to let them raise as needed or else they will cease providing coverage in the State of California.

US Central Banks

Elizabeth Warren says federal reserve chair Jerome Powell is giving bank chief Executive Officers too much opportunity to influence key policies.

Funny she says that while ignoring how most of the federal insiders end up on Wall Street. I feel like eventually, the government will throw the FED under the bus to usurp more control over the monetary policies.

Federal Reserve Governor Adriana Kugler said she believes it would be appropriate to lower borrowing costs later this year if inflation continues to moderate alongside a cooling resilient labor market.

https://www.youtube.com/live/vv6n0oTJMRU?si=WBnAVTQs8NOGfXtW

BRICS

Russia’s Finance Ministry will allocate $1.4 Billion for purchases of foreign currency and gold from July 5th to August 6th.

“Countries of the BRICS economic bloc are currently working on the launch of a financial system that would be independent of the dominance of third parties, according to the Russian Ambassador to China Igor Morgulov.

The volume of Russia’s transactions in national currencies with fellow BRICS nations is constantly growing, the envoy said on Saturday in Beijing, speaking at the 12th World Peace Forum (WPF). Morgulov highlighted that Russia-China trade turnover had reached $240 billion and that 92% of settlements were being conducted in rubles and yuans.”

“We are leaving the dollar-dominated space and developing the mechanism and tools for a truly independent financial system,” the ambassador said, as cited by RIA Novosti. Morgulov also said that introducing a new single currency is still some way off but stressed that the group – which recently expanded and now comprises Brazil, Russia, India, China, South Africa, Ethiopia, Iran and Egypt – is “moving in this direction.”

New Potential Member

Brazil proposes Colombia as a potentially new BRICs member.

While China supports Kazakhstan joining BRICs. They serve a clear energy purpose to BRICs development.

India’s Central bank increased its Gold reserves by the most in almost 2 years last month adding more than 9 tons in June, bringing their total reserves to 841 tons.

New Financial Systems in Development

The Central Banks of India, Malaysia, Thailand, Singapore and the Philippines are working together to start an instant cross-border retail payment platform by 2026 aimed at linking each country's instant digital payment system.

“Nexus was conceptualized by the Innovation Hub of the Bank for International Settlements (BIS) to connect the payment systems of four ASEAN countries (Malaysia, Philippines, Singapore, and Thailand) and India, who would be the founding members and first mover countries of this platform, Asian News International (ANI) reported on Monday. As per a statement from the Reserve Bank of India (RBI), an agreement was signed by the BIS and the central banks of the founding countries -- Bank Negara Malaysia (BNM), Bank of Thailand (BOT), Bangko Sentral ng Pilipinas (BSP), Monetary Authority of Singapore (MAS), and the RBI on Sunday (30th June, 2024), in Basel, Switzerland.”

EUROPEAN UNION

The ECB President Christine Lagarde said that she doesn't yet have enough evidence that inflation threats have passed and may have to pause cutting rates for July.

The EU Commission is seeking one of the biggest transformations of the EU budget ever, with the goal to unify the bloc’s (The EU member nations) spending plans across more than 50 programs.

This is merely a goal to centralize control to the EU to be able to better manage individual nations of the EU. It is the goal of bureaucrats/socialist/communists to centralize financial control to better manage and dictate the direction of the European citizens.

Dutch Finance Minister Eelco Heinen says EU member states should respect the bloc’s new fiscal framework that aims to rein in public debt.

Germany and the commission warn France that they will have to abide by the EU budget rules.

ELECTRIFICATION

China tightens management of rare earths with new regulations

“Rare earths belong to the country and no organization or individual are allowed to claim them, the State Council said in a statement on its website. The state will take charge of protective mining of the resource, it said. The new rules take effect on Oct. 1. Government agencies will have control over the total amount of rare-earth mining and smelting, and will establish a product traceability system”

China has supposedly stopped publishing data that highlight the extent to which power from solar and wind plants are being wasted as the rapid renewable energy expansion runs up against constrained grids………

Philippines dependency on coal-fired power surpasses China with dependency on coal reaching 62% for 2023.

“Saudi Arabia Public Investment Fund (PIF) strengthens renewable energy localization in Saudi Arabia with three new joint ventures to localize in Saudi Arabia the manufacturing and assembly of equipment and components needed for solar and wind power.

These agreements have been entered into by the Renewable Energy Localization Company (RELC) – a fully owned PIF company. They are in line with the Saudi Ministry of Energy’s drive to localize production of renewable energy components. The three joint ventures (JVs) represent the latest in a series of investments by PIF in the utilities and renewables sector to support Saudi Arabia’s energy needs and consolidate its position in the field of clean power.

The first agreement involves a JV with the wind power technology company Envision Energy and the Saudi firm Vision Industries. It will involve manufacture and assembly of wind turbine components including blades with an estimated annual generation capacity of 4 gigawatts (GW). Under this agreement, RELC will hold 40% of the JV, with Envision holding 50% and Vision Industries holding 10%.

The second JV features the manufacturer Jinko Solar, which supplies photovoltaic energy technologies, and Vision Industries. This JV entails localizing the manufacture of photovoltaic cells and modules for high-efficiency solar generation. Under the agreement, which envisages annual production of 10 gigawatts (GW) generation capacity, RELC will hold 40% of the JV, with Jinko Solar holding 40% and Vision Industries holding 20%.

The third JV is with LUMETECH S.A. PTE. LTD, a subsidiary of TCL Zhonghuan Renewable Energy, along with Vision Industries. This deal will localize production of solar photovoltaic ingots and wafers with annual production sufficient to generate 20 GW of power. Under this agreement, RELC will hold 40% of the JV, with LUMETECH holding 40% and Vision Industries having 20%.”

Jannet Yellen, the Treasury Secretary said at a conference “the transition to a lower carbon global economy will require no less than $3 trillion USD per year until 2050.”

She called the financing need “the single greatest economic opportunity of the 21st century,” which could be used to promote sustainable and more inclusive growth, including for countries lacking investment.

COMMODITIES

Gold hits a new all time high in July. Gold surpassed $2,500 per ounce for the first time in history on Friday in the wake of rising geopolitical tensions and new data indicating a weakening US economy. Gold contracts for December delivery reached an all-time high of $2,522.50 in the early trading hours.

London Metals Exchange

Trading volume on the London Metal Exchange surged 27% in the second quarter to the highest in a decade. With a sharp increase in the LME/s nickel contract leading activity gains across its major metals.

The London Metals Exchange has approved the Red Sea Port City of Jeddah in Saudi Arabia as a warehouse delivery point for Copper & Zinc.

The Canadian Government is increasing its restrictions on foreign companies acquiring major mining companies involved in critical metals. Yet, China’s Zijin Mining is to take a 9.9% stake in Canadian Montage Gold.

Canadian Government Releases Ministerial Statement Governing Foreign Investment in Critical Minerals

BHP & Lundin Group made a joint bid for Filo Corp and it was accepted at $3.25 billion USD.

US & Indonisia

Indonesia launches nickel, tin online tracking system.

“Indonesia launched on Monday an online system to track movements of nickel and tin from mines to domestic processing facilities to improve accountability and government revenue, authorities said. The system, known as SIMBARA, was first implemented in 2022 to track coal, with a plan to widen its use to other minerals. Indonesia is the world’s biggest exporter of coal. It is the top global producer of nickel, and one of the largest producers of tin. Speaking at the launch, Finance Minister Sri Mulyani Indrawati said the system had improved governance in the coal sector, including by forcing companies to pay liabilities to the state, and she hoped to replicate this with nickel and tin….Improvement in compliance is expected to increase tin and nickel miners’ royalty payments by between 5 trillion to 10 trillion rupiah ($308 million-$616 million) in a year, Coordinating Minister of Maritime and Investment Affairs, Luhut Pandjaitan, said at the same event.” - mining.com

India cut its import tax on gold to support jewelry manufacturing to 6%, down from 15%. India is the second largest consumer of precious metals.

CANADA

Canada to now allow 30 year mortgages. The debt trap grows as they continue to expand the cost of living with inflation and directly with never ending growth in taxes.

Unemployment rises to 6.4% in June 2024. The unemployment rate for ages 15-24 rose to 13.5% in June, highest rate since 2014. Unemployment rate among university students looking for summer jobs is currently the lowest since 1998.

Source: Fraser Institute.

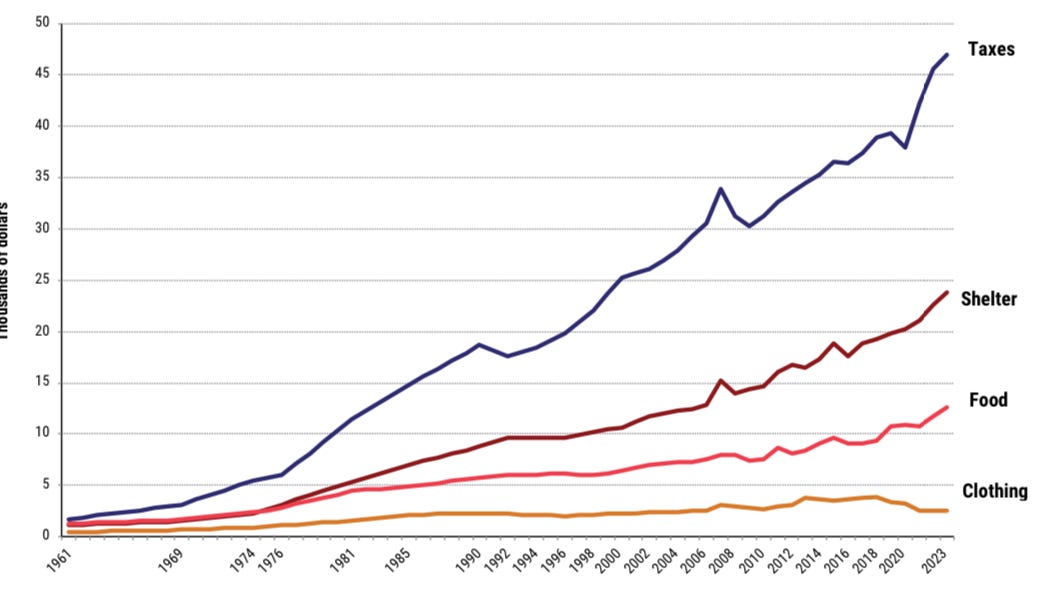

Taxes now make up more % of Canadian costs than Shelter, Food and Clothing combined.

"It's not only income taxes. It's also payroll taxes, sales taxes, fuel taxes when you're filling up at the pump. Property taxes as well," said Jake Fuss, fiscal studies director with Fraser Institute.

The amount people spent on taxes last year is more than they spent on housing, food and clothing combined. On average, shelter cost $23,809 while food was $12,607 and clothing cost $2,514.

“Lives for Canadians right now are so unaffordable," said Jay Goldberg, the interim Atlantic director for the Canadian Taxpayers Federation. "We have statistics that have come out quite recently saying that 50 per cent of Canadians are $200 away from not being able to pay their bills and this is a big reason why."

According to the study, since 1961 a family's total tax bill has increased by 2,705 per cent, while housing has increased 2,006 percent and food expenses have gone up 901 per cent. Goldberg said governments at all levels need to look at cutting taxes.” - Taxes largest household expense for Canadian families: study | CTV News

Full Fraser Institute REPORT - Taxes versus the Necessities of Life: The Canadian Consumer Tax Index, 2024 (fraserinstitute.org)

The Government of Canada has started a radio and television ad campaign to promote the newest resources on the “how to afford your mortgage” website.

Federal Government payroll hit $67 billion CAD for 2023. A 68% increase since 2016

IMF

The IMF hilariously claims that they believe Canada has attained what appears to be a soft landing……..

“The Canadian economy appears to have achieved a soft landing: inflation has come down almost to target, while a recession has been avoided, with GDP growth cushioned by surging immigration even as per capita income has shrunk. Housing affordability has reached its worst levels in a generation, with housing supply unable to fully meet growing demand. Meanwhile, the financial sector remains resilient, with banks well capitalized and liquid, although data gaps preclude a more definitive assessment of nonbank financial institutions.

Real GDP growth is expected to pick up slightly this year, supported by the recently initiated normalization of monetary policy, some easing of fiscal policy, continued (even if slowing) immigration, and the expansion of the Trans Mountain pipeline. Inflation is set to continue declining, reaching the 2-percent target by early 2025.

Risks around the baseline forecast are broadly balanced. An abrupt global slowdown could dampen Canadian growth and inflation alike, while tighter financial conditions could negatively affect the outlook. On the other hand, labor market resilience and stronger-than-anticipated US demand could lead to a stronger growth outlook.”

The IMF is planning to rally a Group of 20 nations to offer poor/emerging countries ways to lower their unsustainable debt burdens, avoid defaults and stabilize their economies due to nearly $400 billion USD in debt servicing payments.

Dollars and Sense - What We’re Buying

Written by Dan Kozel

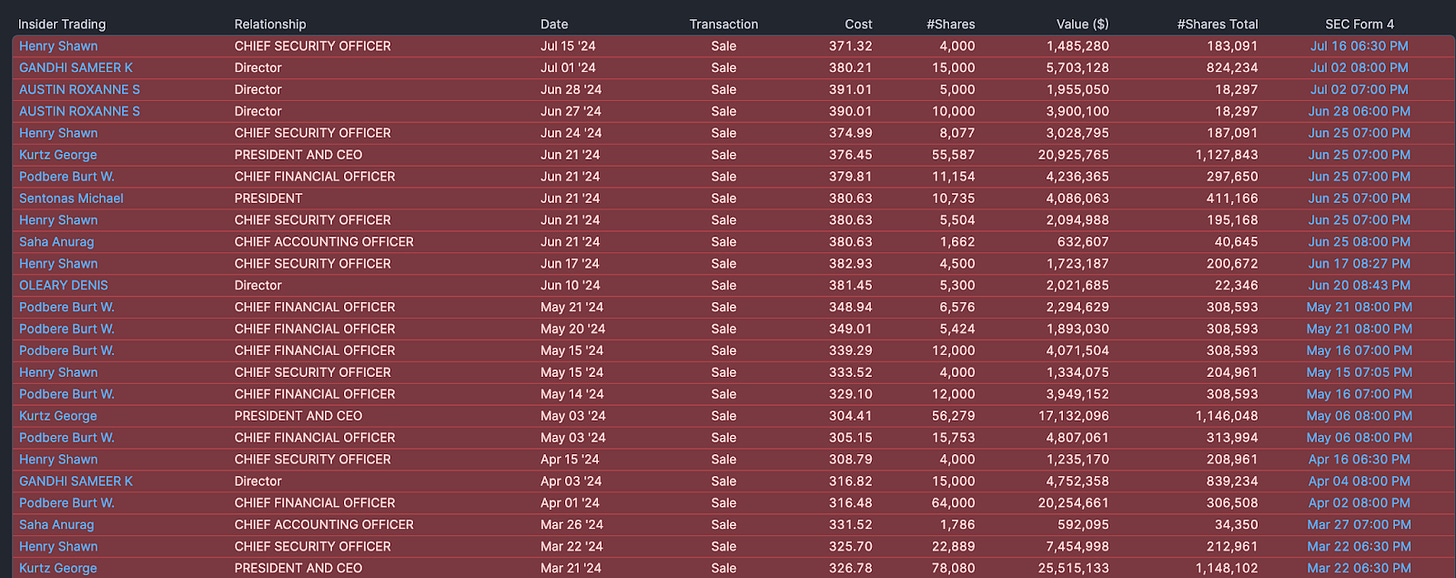

Insiders Keep Selling Stock - S&P 500 Chart tells you why

Every single major tech CEO has been selling stock for the last three+ months. I also found it quite interesting, when the Crowdstrike failure occurred, every single executive in that company was selling shares of CRWD months prior.

Source: Finviz - (there’s no way they didn’t know!)

As most of you know, many tech insiders have been selling stock for months - we spoke about this in our March Macro Chronicles. They know what's coming. Especially with inverted yield curve and a looming rate cut - more on that shortly.

The chart always tells the story - And the S&P is no exception - every single chart will always find a way to regress back to the mean. Right now I’m prepared to make a very bold prediction, which hopefully, wont have your heads spinning, but given the complete economic distortion of risk-on assets, and the way the market has behaved over the last few years, there’s a probability of this occurring within the next 25 months (over a prolonged period of time).

Bracing for impact ?

The above chart is a Monthly SPX (S&P 500 chart) showing an over-extended move to the upside. When the COVID crash occurred, the FED cut rates to 0% and we saw an insane move on stocks for a period of 8-10 months. A lot of money was made - but the silent killer of inflation had barely creeped up.

Fast forward to now, after a period of 11 consecutive rate hikes - the market is at a key inflection point. When looking at charts, the most important rule of thumb is the following - “When in doubt, zoom out”. The longer the time frame, the stronger the direction of price action will follow. Timing this is extremely difficult - I've studied companies where I’ve made the right thesis, but the execution of the trade was one or two months too early.

Welcome to the game…

Now when you look at the chart of the S&P 500 - like any chart - you need to understand what the support and resistance lines are. Others will argue that it's all about channels and wedges, and that's fine, but let's save that for another time.

When the indicator on the bottom - RSI - or relative strength index is trending lower, but the price action is moving higher, alarm bells should start ringing. You’ll notice a “bearish divergence” is occurring with the RSI relative to the SPX. So you need to ask yourself, what other variables would confirm this. Rates are currently at 5.5% in the US (more on yield distortion later) - this means borrowing costs are through the roof and unprofitable company valuations are plummeting. Tied that into weak economic data and a weak consumer, and you have a recipe for disaster.

Right now, based on the technicals - everything in the charts, and the bleak economic outlook on both the US and Canadian markets, it's kind of starting to feel like 2006 all over again.

The next rate cut from Jerome Powell, will likely trigger a sell-off, and I think we still have one more melt-up rally, before the entire thing collapses to at least 30% (soft landing). A hard landing scenario - or a 50% will be catastrophic for risk-on assets. Nobody will be safe in risk-on assets - at least in the short-term.

So while the media continues to push the narrative that the economy is fine, and politicians continue to push a narrative of hope. The chart is telling you the next two years are going to be very volatile.

And the insiders know this - hence a massive wave of insider selling since the start of 2024.

I remain pretty optimistic about the future - but the near term doesn’t look great for stocks. We’ve shown you the above chart to keep this in the back of your mind, so when a market sell-off ensues (or deepens), none of this should surprise you.

If a 30% drop in the market happens - this will weed out a lot of the zombie companies on the market and hopefully a complete reset can occur. The current market price action is quite frankly, not sustainable.

And if this does play out, it won’t happen over one day, but over a period of a few months. Recall the 2008 crisis, which really started in 2006 and the market did not recover until about 2011.

And top that with a US presidential election this year, the market could have its final melt-up, before people are wondering - “how could they let this happen”.

The chart tells the story and this is a developing one - so how do we want to play it.

Let’s keep reading…

Gold Hits a historic all-time high - Position Updates

The rise in Gold continues to be driven by increased geo-political tension and the threats of more civil wars breaking out.

A pullback in Gold is likely but not a deep one - too many BRICs nations are backing their currencies with Gold.

After Gold formed, the most bullish cup-and-handle formation, we finally broke above an important resistance line and I’m surprised that gold has not traded higher. This is likely due to the increased manipulation of the Gold derivatives squeezing the price down, when the true value, in my opinion, should be around $2,800. We will get there, but it wouldn’t be surprised to see a pullback to the $2,000-2,200 level. I continue to add to GLD and Sprott Physical Gold Trust, on weakness, and have about a 18.6% allocation to gold.

Source: Atrium Research

The major gold mining producers have done very well this year, and apart from any crypto related shitcoins, you are pretty pleased with the returns. And there’s a catch-up trade on the way - see the June macro report.

In the current market, and as we’ve mentioned before, its always great to have some physical gold - who knows, maybe the next Crowdstrike blackout could impact the power grid and banks wont let you withdraw you’re own money (just saying!). But we also want some more exposure to the main ETF’s and miners who have had some great results with good management.

We continue to remain long gold and silver in these volatile times - for security and price protection.

Below is a brief update on our current positions in the market, where we have been trimming some companies and been adding to others on weakness.

Lavras Gold LGC - continue to remain bullish on future drilling results. Mike Durose and his team have been hard at work drilling at both Fazenda Do Posto and their Butia project - with great drilling results. The potential for these projects in Brazil to be mines in the future is very optimistic.

Silver Tiger - SLVR - continues to have strong drilling results in Mexico and we are being told from management right now, that the recent victory for Claudia Schienbaum, is a positive turn of events. She plans to meet with the mining communities across Mexico later in the year.

Delta Resources - DLTA - this is still and continues to be our largest holding, amongst the junior miners. And the chart looks very nice - as we are currently in an accumulation zone near the bottom. They recently completed their till sample program at the Delta One Project in Thunder Bay, ON. We believe there’s even more upside potential, chatting to several geologists in the area - most believe there's a strong possibility of million-once-plus deposit at the Eureka zone. We continue to accumulate at these levels.

Emperor Metals - AUOZ - we’re in an accumulation period and much of the selling was due to the recent Capital Gains laws in Canada. The company will be announcing some important results towards the end of the year - I don’t think the stock will be this cheap in December.

Two names we’ve trimmed or sold off are NAU and TIG - NevGold and Triumph gold. The proceeds were then placed into names like DLTA, LGC and NEM - which we believe are strongest positioned for more growth in the already bullish gold market.

McEwen Mining - MUX was trimmed for liquidity purposes and thrown in Cash - but remains a holding due to its torque and leverage to copper prices - which we believe has a structural demand side challenge (ie: bullish - even after the aggressive correction).

Yields are Selling off - USDJPY is all that matters right now

After the FED's decision to hold rates and the complete dislocation between the 2-year note, it's quite clear that Jerome Powell is behind the 8-ball on this one.

Now, don't get me wrong—he has one of the hardest jobs on the planet right now. But given his track record of predicting inflation would be transitory back in 2021, the reliance on much of the economic data right now seems to be backfiring. On Wednesday, the spreads between the 10-year and 2-year US notes indicated an inversion, which is clearly recessionary. Yesterday, the market was a complete blood bath (thanks Japan!).

The problem with waiting until September for a rate cut is that the current market volatility is rising. When the July jobs numbers came out weaker than expected, the market experienced its worst day since March 2020. The 10-year note was trading at 3.8%, with the 2-year closing at 3.9%. My fear right now is that if these two rates keep dropping, there's a heightened probability that an emergency rate cut might be on the table—and Powell’s dream of 2% inflation will be completely gone.

Going into September's rate decision, the two charts I’ll be looking at are the USD/JPY and US 2-year Treasuries—their significance cannot be ignored.

Last week, the Bank of Japan announced a surprise rate hike of 0.25%. This means that anyone who held Japanese yen for the last few years was able to borrow money at 0%. This surprise decision has just made it more expensive to take on Japanese debt or currency, leading to a massive sell-off in the USD/JPY, which began at the beginning of the month.

Even from a technical standpoint, the top of the chart at 161.22 indicated a drop was inevitable. However, this decision accelerated the drop to 146. Right now, it seems selling has subsided, and we could see it go back to about 150.

Here's why: Japan is the largest holder of US Treasuries ($1.1 trillion), right before China (790 billion). If Japan panics to save the Yen, they have two options: raise rates aggressively or buy US dollars. The fear is that this could cause a massive treasury dislocation - as being seen right now

This will create some dislocation in the actual market, especially for Powell’s next rate decision come September. You can see above - the complete dislocation between the FED’ funds rate at 5.5% and the US02Y - at 3.88%.

Another concern, albeit speculative right now, is the carry trade on NVDA and the YEN - how many US investors have used the Yen to purchase big-name stocks like NVDA. This remains to be seen because when investors can borrow a currency at 0% and deploy it into risk-on assets, the ultimate effect of an aggressive move to the upside by the USD/JPY is uncertain.

Recall that everything in these markets is linked. When currencies move violently, it reverberates aggressively into other asset classes. While a weak currency should help exports, it presents a very delicate period - especially with everything going on right now globally.

If the Yen appreciates significantly, all the best mega-cap tech stocks could continue to see a another aggressive sell-off (hello Monday!)

Right now, this is the most important chart going into September's rate cut decision. I expect a 0.50% cut in September, assuming treasuries don't get out of control.

A big wild care scenario is if yields continue to drop even harder, Powell will be forced to make an emergency rate cut. I’ll put this probability at 10% right now.

How to play this: stack cash and hold a cash ETF that can pay a small percentage while you wait for the dust to settle.

People calling for rate cuts because they think debt will be cheaper don’t have a fundamental understanding of market cycles. This is a period where your patience will be tested. We are currently holding about a 15% cash position in the Horizons CASH ETF.

TLT can be another good alternative - rates are more than likely to go down. The TLT rose from 92 to close at around 98 last week. This should rise, the closer we get to September - remember, Bond prices rise, when rates go down. This should retest the 101 level shortly.

Waiting for a pullback here to reset the RSI - as it's currently overbought.

More volatility is coming up - and we expect a bumpy run these next few months.

Cash is king - at least for now.

Wrapping Up

As we head into the end of the summer - we want to caution our readers about many of the risks in the market right now. This is a game of PAY-tience coupled with an appetite to protect and build your wealth over the long-term.

We hope you enjoyed this report - for this in Montreal and around, we will be hosting our next Investor Gathering on Thursday, September 19 - stay tuned for updates.

We’ll see you next month.

*DISCLAIMER* - READ CAREFULLY

None of the information taken within this newsletter should be considered investment advice and should only be viewed for information purposes only. NewGenMindset is not a broker, or a licensed provider of financial services or securities. All claims made in this newsletter to any listener should not be viewed as offering personalized legal or investment counseling. Any investments made in any companies should be consulted with a licensed financial professional from here on.