Middle East Escalation, Cultural Divides, and Precious Metals Go Wild

September 2024 Edition: Issue 09 - Macro Chronicles: Unfiltered Insights

Hi there,

With the world on the edge of its seat due to increased escalations in various parts of the globe, we are entering a new phase of wars and inflation—and the precious metals market seems to agree.

After months of conflict, the Middle East appears to be on the verge of a regional war at a scale we haven't seen since the later stages of World War II. Over the past few months, we’ve been warning our readers about the ongoing instability, which has resulted in gold hitting new all-time highs multiple times. We expect this trend to continue.

In times like these, it’s crucial to stay ahead of the curve in geopolitics, culture, and economics.

In this month’s newsletter, chaos is the order of the day. With just under a month until the fate of the West is decided, the time to allocate cash into defensive sectors is now.

Let’s dive in.

Macro Headliners

written by Nic A. Tartaglia

POLITICAL

Middle East WAR?

The month of September on the geopolitical front has been heavily more dominant in the Middle East as this conflict has heavily escalated. We are seeing a collaborative front from 3 primary Israeli threats; Hamas, Hezbollah and Houthis getting more aggressive in their attacks against Israel as Israel seeks to eliminate the heads of their primary militant officials across other borders.

A breakdown of this month’s Middle East developments follow:

Terror Attack in Israel Tel Aviv killing multiple locals and were eliminated by Israeli Police

At the request of Israel, Binance has seized all Palestinian assets.

For the first time, Houthi’s missile reaches central Israel and Prime Minister Benjamin Netanyahu promised Israel would retaliate with powerful strikes. The Houthis apparently are using “new hypersonic ballistic” missiles.

Large Yemen forces were seen crossing Iraq to join Syria for ground operations against Israel.

After the UK Prime Minister Ken Starmer visited Washington, Washington accused Moscow of helping Iran with their nuclear program for nuclear weapons in exchange for ballistic missiles.

A secret operation by the Israeli forces appears to have been executed to everyone's surprise when Japanese made ICOM pagers began exploding across Lebanon, in an attempt to inflict damage to Hezbollah targets who are the ones meant to be the ones in possession of this equipment. The story circulating on how this was accomplished is…

Iphones were exploding in shops around Lebanon following the pagers explosion.

The Russian Foreign Minister said “The attack on communications devices in Lebanon is a comprehensive act of war and aims to provoke a major war in the region.”

Hezbollah launches more than 40 rockets towards Israel in response to the equipment attack.

Israel carried out another major attack on Hezbollah striking the Lebanese capital aimed at eliminating a senior Hezbollah militant, Ibrahim Aquil. This comes after having striked southern Lebanon earlier in the month aimed at eliminating other Hezbollah militant groups and the covert operation exploding electronic devices at the same time.

Iran and Burkina Faso have signed a nuclear cooperation agreement. Burkina Faso’s supposedly rich untapped uranium reserves is the key to this agreement.

Hezbollah fired missiles and hit the Ramat David Air Base in Israel. Meanwhile Israel escalates their bombing of Lebanon.

The Prime Minister of Lebanon stated

“We are now in an open War with Israel, and I hope things do not escalate.”

Israel raids the offices of Al Jazeera in Ramallah and mandates the end of broadcasting in the West bank for 45 days. This happened September 21st.

In the 3rd wave of attacks against Israel, Iraq launches one the largest drone strikes against Israel.

Iran announces they have dismantled a cell of Israeli spies and 12 collaborators who will be executed most likely.

President Erdogan of Turkey is calling out Israel for committing state terrorism and is extending a hand to Syria to work together. He states that Israel is dragging the whole region into an all-out war. As the expression goes, the enemy of my enemy is my friend. He calls for a Islamic Alliance to fight Israel.

China declares their support for Lebanon in safeguarding its security.

The US Pentagon informed that American troops were sent to the Middle East as this issue escalates.

Hezbollah then begins bombing Israel in the northern city of Safed. The Iron dome is not stopping all missiles. Some are now getting through.

Israel strikes a senior Hezbollah commander in Beirut as Hezbollah and Israel go at it.

Hezbollah lands a strike on a large Israeli weapons depot in Atlit al-Shatit.

An Israeli port of Eilat was struck by a drone by either Iraq or Yemen

A Houthi hypersonic missile hit Tel Aviv.

The Iraqi resistance has threatened the UAE that they are at risk for helping Israel in the Persian Gulf.

There was a terrorist attack in Tel Aviv at a bus station where a handful of Israelis were killed.

Israel begins to bombard Beirut → It is confirmed that its leader Hassan Nasrallah was killed in the Beirut Strikes

Russian Foreign Minister Lavrov says that Washington is just as culpable as Israel in attacks against Lebanon.

The US demands a ceasefire which includes the endorsement from many other nations:

And a massive strike on Tel Aviv happens, Hezbollah declares war officially against Israel and its allies.

Israel goes on offense in another country, striking Yemen’s port of Hodeidah. Including several power plants.

Then Hezbollah launches a barrage of rockets at Haifa with some direct hits.

Nearing the month of September, the mention of a possible Israeli ground offensive raid into Lebanon began. And indeed, Israeli forces stepped foot into Lebanon but were heavily pushed back by Hezbollah forces who apparently did a lot of deadly damage to the Israeli forces who attempted to enter.

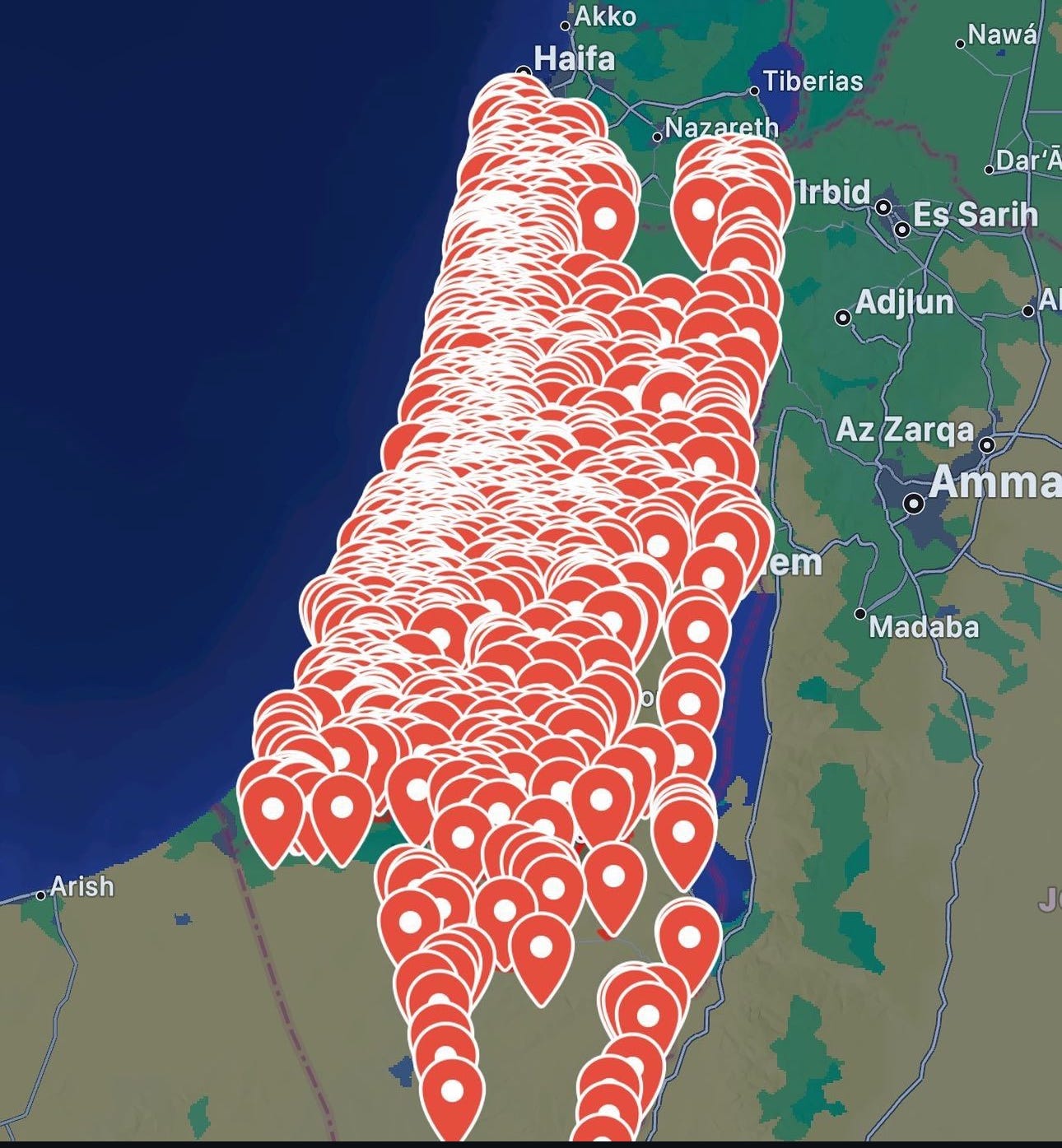

Image above of sirens going off across Israel as they get attacked with bombs at the end of the month of September.

The above image is to highlight the chain of command that has supposedly been eliminated by Israel to date with the last few weeks of engagement.

Really feels like this is not close to its top yet in terms of escalation. Something grandiose is coming.

Will the USA be pulled into this conflict more aggressively if the Middle East joins forces to levels unseen in history allowing their collaborative power to become a dangerous threat to Israel requiring American troops to truly become a necessary variable in Israeli defense and possibly offense.

Russia Ukraine Conflict

The Russian Foreign Minister says the US and UK will suffer consequences for allowing Ukraine to strike deep into Russian Territory. Part of Zelensky’s new “Victory Plan” includes deep strikes into Russia using Western missiles. The European Parliament passed a symbolic resolution approving Zelenky’s use of long-range weapons to attack the inside of Russia.

NATO’s Baltic states appear to be the most aggressive in their desire to confront Russia. Just recently, former Lithuanian Prime Minister Andrius Kubilius who is now the EU’s new Defence Commissioner stated that he has an expectation of inevitable conflict between NATO and Russia, and thus Europe needs to begin preparing for that day now. He has called for a large investment of $500 billion euros for the coming years to ramp-up military readiness.

“Defense Ministers and NATO Generals agree that Vladimir Putin could be ready for confrontation with NATO and the EU in 6-8 years… If we take these assessments seriously, then that is the time for us to properly prepare, and it is a short one. This means we have to take quick decisions, and ambitious decisions.”

And as always, Western nations announced a few more subsidy packages:

$375 million weapons package. The capabilities in the PDA package includes:

Air-to-ground munitions;

Ammunition for High Mobility Artillery Rocket Systems (HIMARS);

155mm and 105mm artillery ammunition;

Tube-launched, Optically tracked, Wire-guided (TOW) missiles;

Javelin and AT-4 anti-armor systems;

M1117 Armored Security Vehicles;

Mine Resistant Ambush Protected (MRAP) Vehicles;

Light tactical vehicles;

Armored bridging systems;

Small arms;

Patrol boats;

Demolitions equipment and munitions;

Spare parts, ancillary equipment, services, training, and transportation.

The UK government announced its supply of 650 lightweight multirole missiles to Ukraine to boost country’s air defenses

Defense Minister Bill Blair announced Canada’s plan to send 80,840 surplus small unarmed air-to-surface rockets to Ukraine and in coming months to send them 1300 warheads.

Back in the USA, when Zelensky visited the country to get more money/weapons as usual, he and the Governor of Pennsylvania visited a weapons factory where they sign bombs that will be sent to Ukraine for the conflict.

It's like when they make Hollywood superstars reproduce their hand print in the cement and sign it. It is all a show and games. His own people are dying in this conflict and he smiles in the face of destructive and deadly weapons. Twisted in my opinion. This is all a joke to them. They seem to enjoy being a part of the military industrial complex.

The following image with Zelensky and Trump shows an entirely different body language by Zelensky and you can see it in most of the pictures and videos of them together.

On the battle front of this issue, Russia made a frontal attack into Ukraine’s capital Kyiv with a barrage of drones, cruise and ballistic missiles.

Russian forces have taken control of an eastern town in Ukraine called Pokrovsk, claimed to be an important city for Ukraine’s defensive front lines.

In another major counter offensive move by Russia, they have reclaimed 10 settlements in Kursk previously held by Ukrainian forces.

Russia attacked the small mining town of Ugledar in Donetsk, supposedly capturing half the town and surrounding the Ukrainian army.

I think Russia is most absolutely the winning force in this conflict.

USA

Kamala VS Trump Debate

Trump did not appear to do so well in this debate, with the hosts of the debate from ABC appearing to favor Kamala and not giving much room for Trump to counter much. Granted, Trump was sluggish in this debate and often said things that were better off not being said, precisely because the playing field was not on his side. Silence and calm from Trump would have given him the edge against such an illiterate and confused competitor.

Perfect example is Kamala flip flopping on her stance around assault weapons. She is a 2 face poli-’tic’ who gives no clear indications into any of her plans other than how to remove rights from her fellow American citizens.

Trump on the side of the coin promises to create a “Department of Government Efficiency Agency” and states that Elon Musk would be at the head of this agency. More government to remove government? Let us see what happens here. If Elon does not take a salary for this position, at least we are starting the right way.

Failed Assassination Attempt

Another failed assassination attempt was made on Trump.

1st Amendment At Threat by US Government

Go listen John Kerry, a former presidential candidate and Secretary of State (2013-3017) for Obama says “the first amendment stands as a major block” to governing.

Another Russian Interference Claim

The Biden Administration accused Russia of sustained effort to influence the 2024 elections, with examples such as using X to promote Trump and the Republican Party. All this as we approach the elections and the momentum appears to favor Trump. On a side note to this, it is as if the forces are trying to find ways to intervene and get their paws on Musk’s X platform. The DOJ claims that allegedly, popular conservative and “right” leaning on social media platforms were tricked into an influence campaign runned by Russia.

They want to play high school games to create smoke and mirrors to distract from Kamala and Biden's little to no presence, and endless incompetencies. Don’t forget, politics does not and will never be the solution of socioeconomic problems. It is a waste of man’s potential to play such primitive games.

US NAVY READINESS REPORT

‘CHIEF OF NAVAL OPERATIONS NAVIGATION PLAN FOR AMERICA’S WARFIGHTING NAVY 2024’ report was published in the month of September.

Some Report Highlights:

“Executing the Navigation Plan: This Navigation Plan drives toward two strategic ends: readiness for the possibility of war with the People’s Republic of China by 2027 and enhancing the Navy’s long-term advantage. We will work towards these ends through two mutually reinforcing ways: implementing Project 33 and expanding the Navy’s contribution to the Joint warfighting ecosystem.”

“Why The Update: The Navy must address fundamental challenges to our force—ship, submarine, and aircraft construction, recruiting, munitions production, software acquisition, infrastructure, and platform maintenance—at the same time as we continue to outpace learning, adaptive adversaries.”

“Security Environment: The Chairman of the People’s Republic of China (PRC) has told his forces to be ready for war by 2027—we will be more ready. The challenge posed by the PRC to our Navy now goes well beyond just the size of the PLA Navy fleet. Ships matter greatly but gone are the days when we assessed threats based purely on the number of battle force ships or tonnage. Through operational concepts like multi-domain precision warfare, grey zone and economic campaigns, expansion of dual use infrastructure (e.g., airfields) and dual use forces (e.g., Chinese maritime militia), and a growing nuclear arsenal, the PRC presents a complex multi-domain and multi-axis threat. The PLA Navy, Rocket Force, Aerospace Force, Air Force, and Cyberspace Force are coalescing into an integrated warfighting ecosystem specifically designed to defeat ours, backed by a massive industrial base. The PRC’s defense industrial base is on a wartime footing, including the world’s largest shipbuilding capacity now at the hands of the PLAN. In response, we understand that deterring PRC threats to U.S. Allies, partners, and interests—and winning decisively if called upon—requires us to stay committed to a Navigation Plan that delivers integrated, all-domain sea control as part of a warfighting ecosystem.”

“Security Environment: On the battlefield, however, Russia has demonstrated operational learning, adapting technologically and tactically to Ukrainian innovations. Moscow, Beijing, Tehran, and Pyongyang have strengthened their linkages and are actively targeting the U.S., our Allies, and our partners in the information domain. Damage to undersea pipelines and cables underscored how seabed infrastructure has become targetable. Despite Black Sea losses, Russia’s fleets retain combat power in the High North and Atlantic, Mediterranean, Baltic, and North Pacific. The Kremlin also holds the world’s largest nuclear stockpile. We must continue to support credible deterrence alongside Allies and partners in the Euro-Atlantic area”

“Our Constraints: The Navy emphatically acknowledges the need for a larger, more lethal force. Beyond the 381 battle force ships and submarines last assessed in June 2023…”

“Our Constraints: We will not stand still as we work to secure long-term investments for the force. The 2022 Navigation Plan underscored the imperative of topline growth: “To simultaneously modernize and grow the capacity of our fleet, the Navy will require 3-5% sustained budget growth above actual inflation.” Without substantial growth in Navy resourcing now, we will eventually face deep strategic constraints on our ability to simultaneously address day-to-day crises while also modernizing the fleet to enhance readiness for war both today and in the future.”

What I conclude at face value from this report is:

The USA is operating under the proactive assumption that there will be conflict/war with China as global military and political dynamics evolve aggressively.

The US Naval force is smaller in size from personnel to # of ships than China and does not have a large enough lethal force in its own opinion.

The military industrial complex is growing and wants to continue to grow at the cost of the US taxpayer.

A US Admiral claimed that American ships could very much sail into the South China Sea in a standoff to shield an ally as tensions with China escalate.

The US House of Representatives Foreign Affairs Committee has subpoenaed Secretary of State Anthony Blinken due to the fact that he has refused to appear in front of the panel to testify on the US withdrawal from Afghanistan in August 2021.

CANADA

The agreement between Trudeau (Canadian PM) and Jagmeet (NDP leader) has ended. NDP Leader Jagmeet Singh has ended the Supply and Confidence Agreement signed with the Liberal government in 2022.

TRANSCRIPT OF SINGH'S VIDEO ADDRESS TO CANADIANS:

“Today I notified the prime minister that I have ripped up the Supply and Confidence Agreement. Canadians are fighting a battle. A battle for the future of the middle class. Justin Trudeau has proven again and again he will always cave to corporate greed. The Liberals have let people down. They don’t deserve another chance from Canadians.

There is another, even bigger battle ahead. The threat of Pierre Poilievre and Conservative Cuts. From workers, from retirees, from young people, from patients, from families—he will cut in order to give more to big corporations and wealthy CEOs.

The fact is, the Liberals are too weak, too selfish and too beholden to corporate interests to fight for people. They cannot be change, they cannot restore the hope, they cannot stop the Conservatives.

But we can. In the next federal election, Canadians will choose between Pierre Poilievre’s callous cuts or hope. Hope that when we stand united, we win. That Canada’s middle class will once again thrive together. In Canada, we take care of our neighbours. That’s who we are. I have embraced that value my whole life. I am running for Prime Minister because together, we can and will stop Conservative Cuts. We can deliver relief and restore hope. Fix health care. Build homes you can afford. Stop price gouging. It's always impossible until it isn't. It can't be done until someone does it. If we’re together, nothing is impossible. And we won’t let them tell us it can’t be done. Big corporations and wealthy CEOs have had their government. It’s the people’s time.”

Notice how Jagmeet seeks to use the word “hope” as though he can be our savior.

POLAND

Polish MEP Braun made comments in regards to Anthony Blinkin visiting Poland:

“Blinkin, go home as soon as possible. Get lost! We don’t want you here. We don’t want Polish people paying and dying for your wars.”

VENEZUELA

Opposition Presidential candidate has left the country to Spain where he has been granted political asylum after quitting the political chaos and to ensure his freedom from jail or death from his opposition who is in power and seeks to hold on to it.

They then approve the arrest warrant for the President of Argentina Milei, asking Interpol to also place an arrest warrant and enforce it after Argentina put forth that Maduro should be arrested for crimes against Humanity.

SUDAN

The government in Sudan has rejected a proposal for an independent peacekeeping force made by the UN. Sudan has been facing a civil war for the last 17 months.

What we also know is that the Sudanese military leader Abdel Fattah al-Burhan met Chinese President Xi Jinping in Beijing last week, and the two countries announced agreements in energy, manufacturing and port development. So while the west is trying to infiltrate the resource rich land, the Sudanese powers are making deals with the Chinese.

AL-QAEDA

Al-Qaeda group said it killed nearly 300 people, targeting militia members linked to the army in north central Burkina Faso. And just recently French Government Intelligence stated that they estimate closer to 600 people were killed.

“Up to 600 people were shot dead in a matter of hours by al Qaeda-linked militants in an August attack on a town in Burkina Faso, according to a French government security assessment that nearly doubles the death toll cited in earlier reports. The new figure would make the assault, in which civilians were shot dead as they dug trenches to defend the remote town of Barsalogho, one of the deadliest single attacks in Africa in recent decades.

Militants from Jama’at Nusrat al-Islam wal-Muslimin (JNIM), an al Qaeda affiliate based in Mali and active in Burkina Faso, opened fire methodically as they swept into the outskirts of Barsalogho on motorcycles and shot down villagers, who lay helpless in the freshly upturned dirt of the trench, according to several videos of the August 24 attack posted by pro-JNIM accounts on social media.”

Brazil

Brazilian Justice Alexandre de Moraes just seized millions from Starlink’s bank accounts. He stated that the seizure of funds from Starlinks will be used to pay X’s fines after the social network refused to comply with this judge's illegal censorship orders. These are 2 separate companies, yet the judge is acting as if there is no separation of entities.

CULTURAL

Massive port workers threaten to strike set to start Oct 1, 2024. From Maine to Texas, nearly 45,000 port workers. Head of ILA said “we will cripple you…..these people now-a-day don't know what a strike is.” They are seeking a pay raise greater than their offered 50%.

Large protests re-surged again in Israel against the sitting administration and a lot of that resistance is also aimed directly against Netanyahu. It escalates into a conflict between protestors and the police.

Massive protests by locals happen at the US Embassy in Iraq.

In Turkey, some sailors were assaulted and one was taken and bagged while yelling “yankee go home”. There were also protests in Turkey against the Presence of US Navy Warships and for them to leave.

Massive free speech protest in Brazil with no media coverage. As always.

Massive protests by thousands against the newly nominated Michael Barnier who is on the “right” as new Prime Minister.

Protestors in Mexico clash with police after storming Mexico’s Senate as lawmakers weighed a contentious plan to overhaul the country’s judiciary, forcing the body to take a temporary recess for the safety of the senators. The shut down came just hours after Mexico’s ruling party, Morena, wrangled the votes it needed to jam through the proposal after one member of an opposition party flipped to support it. This comes after week’s of protests by judicial employees and law students who were outraged by the plan championed by outgoing President Andrés Manuel López Obrador

ECONOMICS

Central Bank Decisions

CBOC (Central Bank of Canada)

Cut rates by 0.25 down to 4.25%

FED (Federal Reserve)

Cut by 50 basis points leaving the Fed Funds rate between a range of 4.75% and 5%

The S&P 500 ended at record highs near the end of September

ECB (European Central Bank)

Cut rates by 0.25 down to 3.75%

BOE (Bank of England)

Held rates at 5%

PBOC (People’s Bank of China)

Cut medium-term term lending by 0.30 down to 2%

Announced broad monetary stimulus and property market support to revive and stimulate the economy.

China will allow securities firms, funds and insurers to tap into the PBOC funds to buy equities.

It is planned for at least $500 billion Yuan to be available as liquidity support to stocks.

Cuts multiple rates and reserve ratio requirements needed by banks. Goes all in to prop up the market. Is this foreshadowing a similar move by the western nations in the near future?

The Chinese Government has decided to consider the injection of $142 billion Yen of capital into its biggest banks.

Stocks in China went on a run overnight.

Copper took a nice reversal on this decision.

USA ECONOMY

Janet Yellen says the US economy remains solid/healthy and on path to a soft landing with no meaningful layoffs. Truly a fascinating era with the blind leading the blind. Always using these keynesian illusions to create this narrative of “strength”. The US Treasury which Yellen runs, is set to place 15% minimum tax on the biggest most profitable companies. They claim everything is all good yet they keep seeking to justify taxing more and taking more for problems that shouldn’t exist if the economy was strong…

Remarks by Secretary of the Treasury Janet L. Yellen at the 2024 U.S. Treasury Market Conference found at this link → Remarks by Secretary of the Treasury Janet L. Yellen at the 2024 U.S. Treasury Market Conference | U.S. Department of the Treasury

Meanwhile in the United States, The US House passed a 3 month government funding extension avoiding a shutdown.

“The Senate approved the funding package just two hours after the House passed the bill on Wednesday afternoon, as lawmakers raced to return to their home districts six weeks before election day. The bill won significant bipartisan support in both chambers, with the Senate voting 78 to 18 in favor of its passage after the House approved the legislation in a vote of 341 to 82. Every vote against the bill, which will extend government funding until 20 December, came from Republicans.”

They are doing this every year and sometimes more than once because there is so much debt and problems.

The Interest payments on national debt tops $1 trillion USD, up 30% since the last period last year 2023, of a projected $1.158 trillion in payments for the full year. And there is no end in sight for this dilemma.

Jerome Powell’s speech on the Economic Outlook at the National Association for Business Economics Annual Meeting, Nashville, Tennessee

“I have some brief comments on the economy and monetary policy and look forward to our discussion. Our economy is strong overall and has made significant progress over the past two years toward achieving our dual-mandate goals of maximum employment and stable prices. Labor market conditions are solid, having cooled from their previously overheated state. Inflation has eased, and my Federal Open Market Committee colleagues and I have greater confidence that it is on a sustainable path to 2 percent. At our meeting earlier this month, we reduced the level of policy restraint by lowering the target range of the federal funds rate by 1/2 percentage point. That decision reflects our growing confidence that, with an appropriate recalibration of our policy stance, strength in the labor market can be maintained in an environment of moderate economic growth and inflation moving sustainably down to our objective.

Recent Economic Data

The labor market

Many indicators show the labor market is solid. To mention just a few, the unemployment rate is well within the range of estimates of its natural rate. Layoffs are low. The labor force participation rate of individuals aged 25 to 54 (so-called prime age) is near its historic high, and the prime-age women's participation rate has continued to reach new all-time highs. Real wages are increasing at a solid pace, broadly in line with gains in productivity. The ratio of job openings to unemployed workers has moved down steadily but remains just above 1—so that there are still more open positions than there are people seeking work. Prior to 2019, that was rarely the case.

Still, labor market conditions have clearly cooled over the past year. Workers now view jobs as somewhat less available than they were in 2019. The moderation in job growth and the increase in labor supply have led the unemployment rate to increase to 4.2 percent, still low by historical standards. We do not believe that we need to see further cooling in labor market conditions to achieve 2 percent inflation.

Inflation:

Over the most recent 12 months, headline and core inflation were 2.2 percent and 2.7 percent, respectively. Disinflation has been broad based, and recent data indicate further progress toward a sustained return to 2 percent. Core goods prices have fallen 0.5 percent over the past year, close to their pre-pandemic pace, as supply bottlenecks have eased. Outside of housing, core services inflation is also close to its pre-pandemic pace. Housing services inflation continues to decline, but sluggishly. The growth rate in rents charged to new tenants remains low. As long as that remains the case, housing services inflation will continue to decline. Broader economic conditions also set the table for further disinflation. The labor market is now roughly in balance. Longer-run inflation expectations remain well anchored.

Monetary Policy:

Over the past year, we have continued to see solid growth and healthy gains in the labor force and productivity. Our goal all along has been to restore price stability without the kind of painful rise in unemployment that has frequently accompanied efforts to bring down high inflation. That would be a highly desirable result for the communities, families, and businesses we serve. While the task is not complete, we have made a good deal of progress toward that outcome.

For much of the past three years, inflation ran well above our goal, and the labor market was extremely tight. Appropriately, our focus was on bringing down inflation. By keeping monetary policy restrictive, we helped restore the balance between overall supply and demand in the economy. That patient approach has paid dividends: Inflation is now much closer to our 2 percent objective. Today, we see the risks to achieving our employment and inflation goals as roughly in balance.

Our policy rate had been at a two-decade high since the July 2023 meeting. At the time of that meeting, core inflation was above 4 percent, well above our target, and unemployment was 3.5 percent, near a 50-year low. In the 14 months since, inflation has moved down, and unemployment has moved up, in both cases significantly. It was time for a recalibration of our policy stance to reflect progress toward our goals as well as the changed balance of risks.

As I mentioned, our decision to reduce our policy rate by 50 basis points reflects our growing confidence that, with an appropriate recalibration of our policy stance, strength in the labor market can be maintained in a context of moderate economic growth and inflation moving sustainably down to 2 percent.

Looking forward, if the economy evolves broadly as expected, policy will move over time toward a more neutral stance. But we are not on any preset course. The risks are two-sided, and we will continue to make our decisions meeting by meeting. As we consider additional policy adjustments, we will carefully assess incoming data, the evolving outlook, and the balance of risks. Overall, the economy is in solid shape; we intend to use our tools to keep it there.

We remain resolute in our commitment to our maximum-employment and price-stability mandates. Everything we do is in service to our public mission.

Thank you. I look forward to our conversation.”

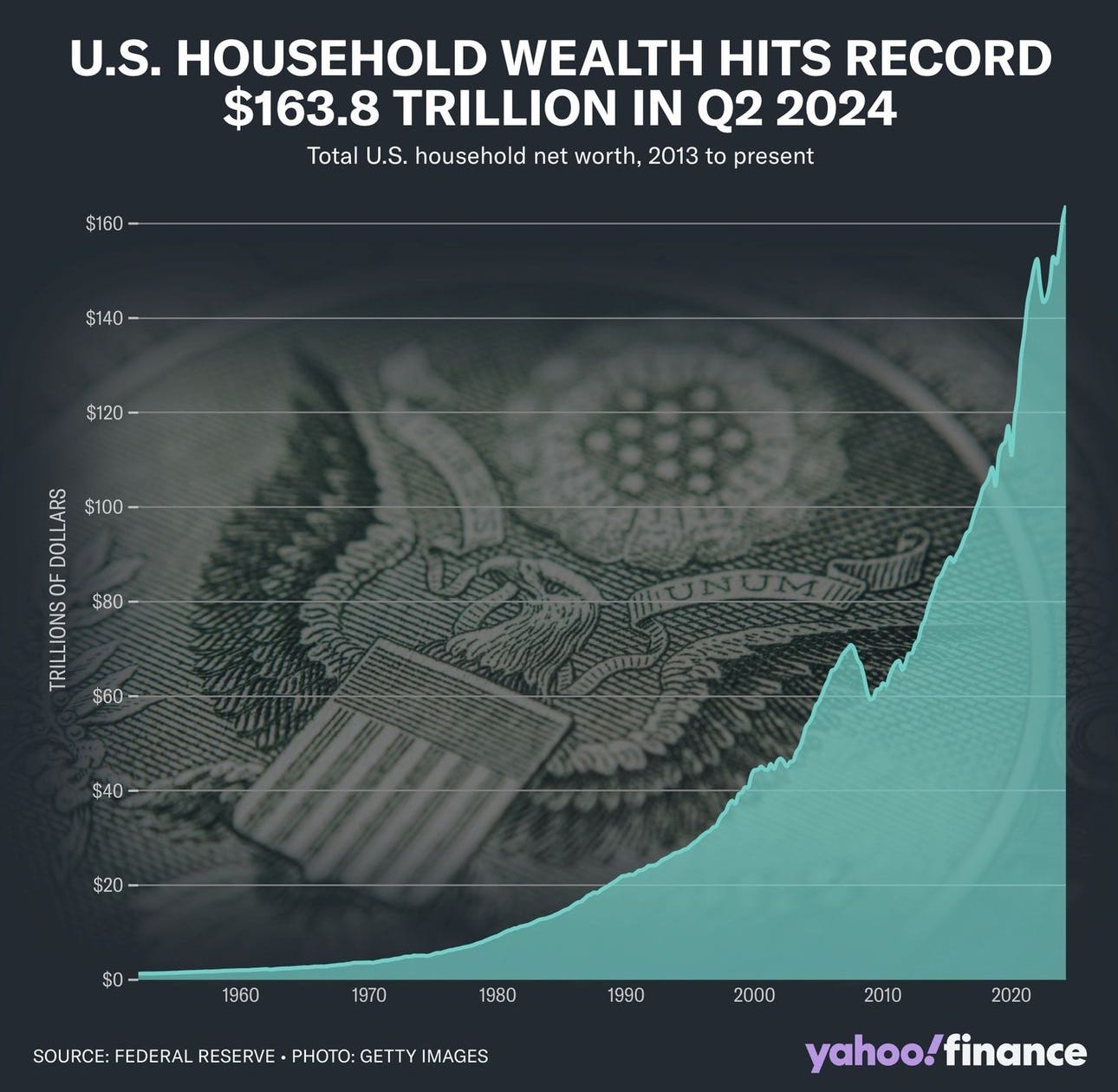

The household wealth in the US hit a fresh record driven by real estate and stock market gains.

Sanctions/Bans

The US Commerce Department is planning to reveal rules that would ban Chinese and Russian- made hardware and software for connected vehicles on the road. This basically makes all cars imported from these nations ineligible to be on the road.

The Biden Administration implements significant tariff increases on Chinese imports, hitting primarily EVs with a 100% duty placed on them. The White House says they need to protect their domestic industry from China’s overproduction.

CHINA

China offers billions in fresh financing to Africa to create jobs.

“China pledged $51 billion in fresh financing to Africa, support for 30 infrastructure projects across the resource-rich continent, and promised to create at least one million jobs.

In a speech at a major China-Africa cooperation summit, President Xi promised delegates from more than 50 African nations that the $19 trillion Chinese economy will unilaterally improve access to its market for African trade. The Forum on China-Africa Cooperation Summit, held in Beijing this year, sets a three-year agenda for ties between the world's second-largest economy and the world's fastest-growing continent.”

Commodities, commodities, commodities……

JAPAN

Japan CPI inflation data hit a 10 month high. The inflation cycle appears to be initiating a comeback. There could be a panic move from Japan on rate hikes later this year.

With all the central banks showing a reversal in their rates, it does not appear this inflationary cycle has actually ended and its second phase is in its early phases.

CANADA

Unemployment rose to 6.6% and youth unemployment hit its highest levels in years reaching 14.5%.

Evolution of the Global Financial System

Global money supply rises by 7.3 trillion, a level last seen in 2021.

40 of the world’s leading commercial banks have joined a G7-led pilot scheme with the New York FED and leading central banks from Europe, South Korea and Japan for a new digital currency platform. CBDCs…………… another centralized big government threat we must be wary of.

Top Saudi Arabian official stated the country is open to new ideas, including the use of Yuan for crude settlements.

On the BRICs front

Turkey has officially asked to join the BRICs group.

In a speech, Putin stated that there are more than 30 countries expressing a desire to join the BRICs cooperation.

Central Banks & GOLD

Hungary raises their gold reserves to 110 Tons. According to a statement from the National Bank of Hungary;

“In times of heightened financial and geopolitical uncertainty, in extreme market environments, gold’s role as a safe haven and store of value is of particular importance. It can strengthen confidence in the country and support financial stability.”

Gold holdings for Russia are now at record highs of $188.8 billion. First time in 25 years that gold accounts for 30%+ of their international reserves. Russian central banks are now buying Silver, palladium and platinum as reserves.

Tanzania orders gold dealers to reserve 20% for purchase by the central bank to bolster foreign reserves.

Ghana launches a new gold coin to help it manage money market liquidity and boost savings.

Burkina Faso has regained control of its gold mine from a British company, supposedly a large mining company. President Ibrahim Traore then nationalized the gold mine. They have now shown the clear desire to strengthen their control over their own resources and have them become nationalized with state control and oversight, A trend we are seeing more and more across Africa. This move marks their second mine getting nationalized.

On the front of CBDC/government control over the money supply, Israel decides to consider limiting ownership of precious metals and limiting cash in their economy. They want more oversight on the flow of liquidity and use the illegal players as their justification. For your “safety” and well being.

“Prime Minister Benjamin Netanyahu has asked officials to begin discussing measures to limit the circulation of black market currency to curb illegal activity in Israel.

According to Ynetnews.com, a meeting will be held with Finance Minister Bazalel Smothrich, Bank of Israel Governor Prof. Amir Yaron, Prime Minister’s Office Director-General Yossi Shelley and top officials from the Tax Authority and Task Force for Combating Crime in the Arab Community. Part of the proposal suggests limiting private ownership of large amounts of cash alternatives such as gold, silver, and coins….As a medium-term goal, the proposal would seek to reduce cash use in Israel drastically and instead encourage bank transfers or credit cards, allowing the government to track illicit transactions better.”

GOLD Chart

Gold is telling you the truth, sending a massive warning.

Hit multiple all time highs in September. From $2500 USD to an all time high of nearly $2686 USD

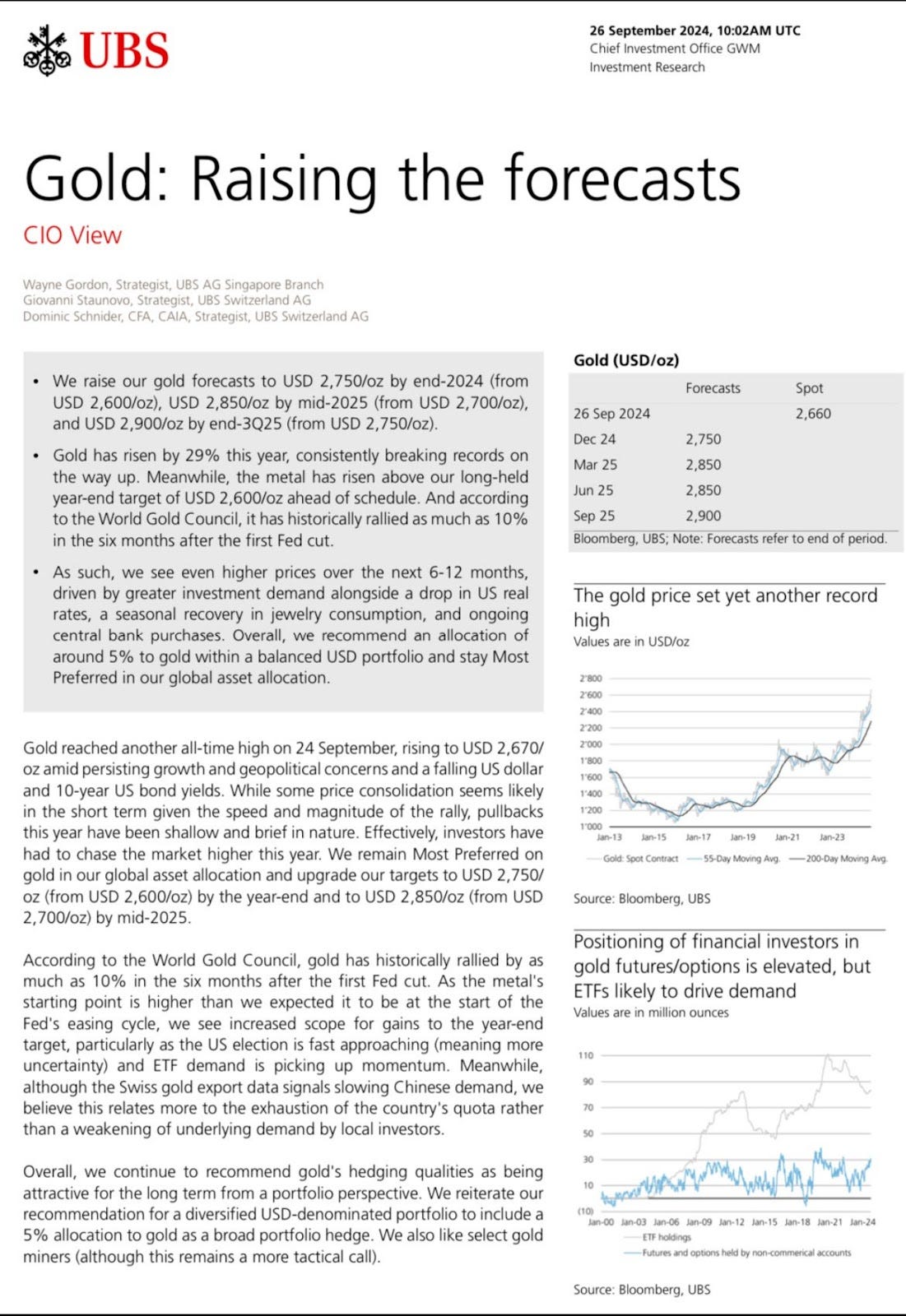

UBS raises its price target on gold to $2,900 for Sept 2025.

SILVER

Silver had a great month in September reaching a range between $31 USD and a 12 year high of $32.75 USD. It may appear that Silver’s time to shine is just about to begin, finally following Gold’s incredible rise.

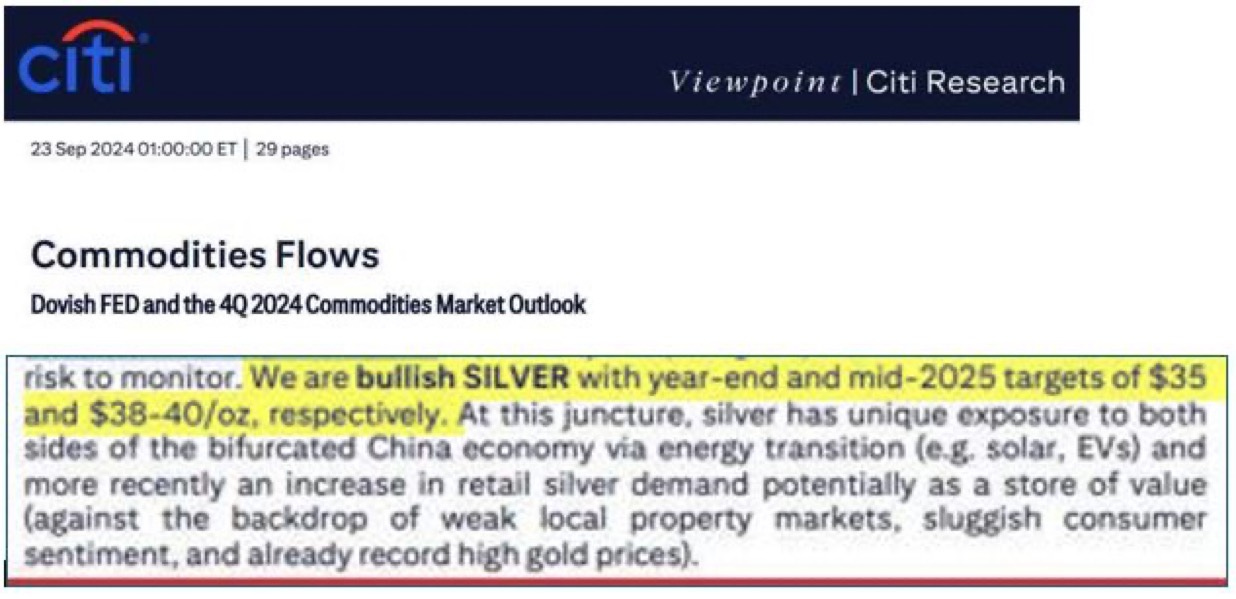

CITI Bullish Silver Statement:

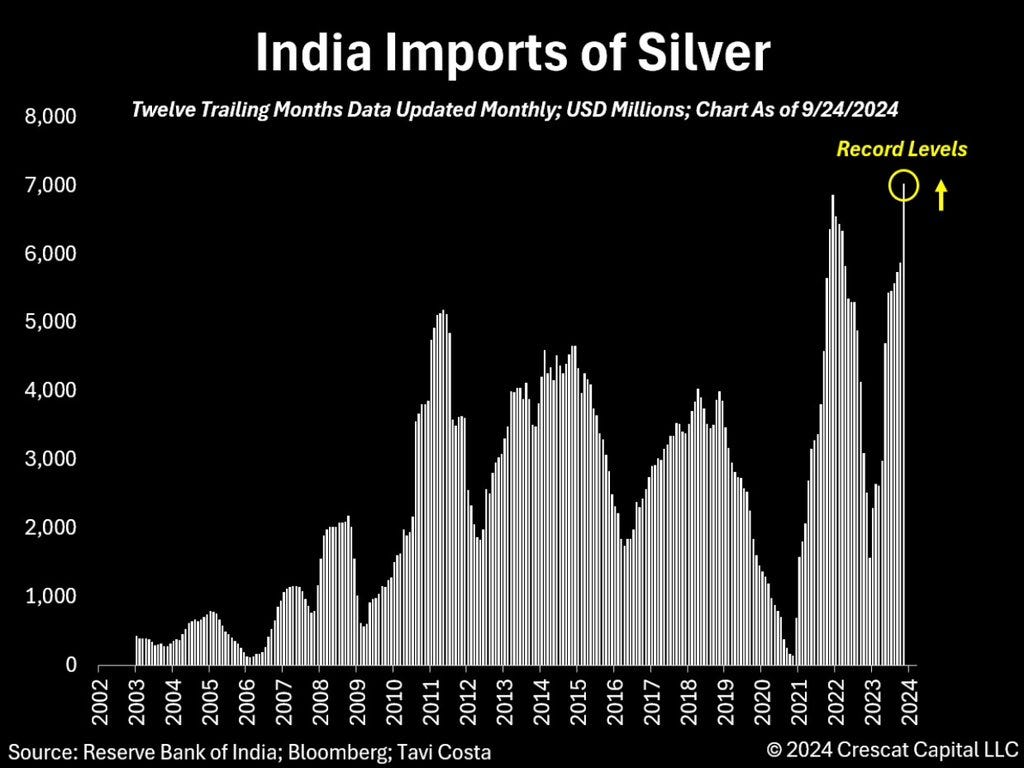

In India, they imported 45 million ounces of silver in the month of August….. On an annualized basis, that's 540 million ounces. This would represent 65% of all the silver mining supply which stands at 830 million ounces.

NATURAL GAS

OIL

I wanted to show these energy commodities charts in order to highlight some possibilities around a 2nd leg of the inflationary cycle:

Both Oil and natural gas have appeared to bottom. With governments seeking to stimulate the economy and hide from any possible recession, this will add upward pressure, as well as the summer coming to an end and winter approaching. A very cold winter can add a lot of pressure on prices, especially on natural gas. Last 2 winters have been relatively calm.

The escalating conflict in the middle east may very well bring about much more upward price pressure on oil.

If oil goes back into the range of $80 - $90 USD and natural gas breaks out back to the gap above $4 USD, and possibly back to the $6 range where there is strong support, we may very well see added pressure to prices as the inflationary cycle reignites.

Think about this, we are also seeking central banks of the major economies reverse their fund rates while global money supply rose by over 7.3 trillion USD. Major economies and governments are acting like inflation has bottomed and is under control, but when looking at all these variables together, it appears their claims are mere temporary illusions and are setting the general populace up for failure with short term expectations that don’t match long term cycle moves.

BATTLE OVER CRITICAL METALS

Russia is preparing to ban exports of essential raw materials to unfriendly countries, such as limiting the exports of certain commodities such as nickel, titanium and uranium.

Western Nations are going to become more aggressively focused on securing resources as the West is far behind the East and their access to critical metals.

Electrification/Infrastructure

The US International Development Finance will consider more deals to accelerate India’s adoption of clean energy after making loans to solar equipment makers.

US and India reach an agreement to work together on setting up a semiconductor fabrication plant in India.

Jersey Shore WInd Power Project stalled because of a hard time finding manufacturers for the turbine blades.

Netherlands Government cement timeline and budget confirming the build of 4 new nuclear reactors with an initial $15.4 billion with the first 2 set to come online by 2035.

Canada to invest $42 million in Yukon, Northern BC for the development of mining infrastructure

Turkey is seeking deeper ties with Egypt for the purpose of developing their relationship over natural gas and nuclear energy.

Intel was awarded up to $3 billion by the US Federal government in the name of National Security related to chip production.

Under the new Microsoft deal, Three Mile Island nuclear reactor will be restarted.

Remember this truth, no matter what, Governments around the world will become increasingly fixated on infrastructure, energy and commodities as they use these programs to ignite market activity to “stimulate” which will serve as a way to subsidize the regression in the private sector. No short term noise can take away from this truth as we see it in their actions, policies and intentions across the globe.

Commodities will be recipients of these massive spending programs.

Dollars & Sense - What We’re Buying.

Written by Dan Kozel

For all of you who have been following us since the early days of the year - we’ve been harping on two important sectors that will continue to provide substantial returns for investors over the next few years.

It’s funny - I had a broker reach out to me and say “everyones a genius in a bull market”. And while this statement may be correct, for the majority of sectors - the precious metals space is about to embark on what we believe will be a generational wealth creating opportunity that cannot be ignored.

This month - we will focus on the following - our core mining portfolio, bitcoin/crypto and natural gas. I would like to point out that there are some special situation names to be put on your watchlist, because the small caps who have strong revenue growth and low cash burn, are going to provide some investors with attractive alpha, in a chaotic market.

Mining Portfolio Update - Adding More Juniors

Since our trip to Beaver Creek, the mining space is ripe for opportunities. And having met with more than 27 companies during our trip, we’ve initiated positions in two names as part of our core mining portfolio.

CDPR - Cerro de Pasco Resources

I had a great meeting with the current CEO, Guy Goulet, and after hearing the story directly from him and sharing some important information about the current share structure and project, here's the takeaway: The company sits on one of the largest untapped mineral resources in the world, located in Peru, above sea level. If they revive this project, it's going to generate so much g–d damn money that it might be too late to get in. That's a big "if," but I'm happy to speculate.

A brief history of the mine:

In 1906, JP Morgan made a major investment into the Cerro de Pasco Resource mine. At the time, it was the largest gold and copper producer in the world, and it went public on the NYSE in 1916

Today, the company owns the mineral rights on the stock piles on the largest mineral resource on the planet. 300M of material were found over the course of the early 20th century, and the current management team, along with an important strategic investor are looking to turn this project into a multi-billion dollar produce - see below for an economic understanding of the business.

Profit on 75M tonnes is close to $3B USD - I’m happy to buy a company trading at $70M market cap.

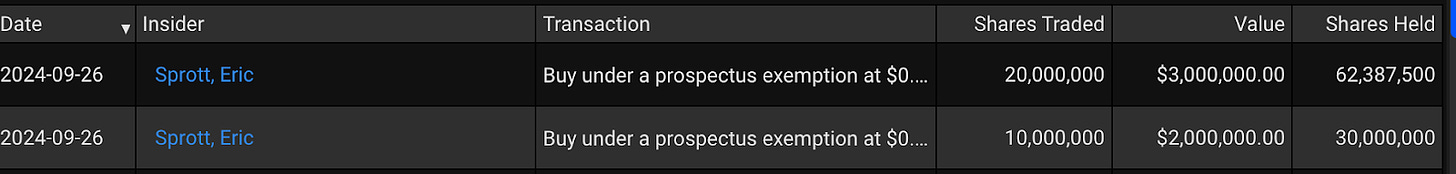

The other important thing to point out is that one of the world’s most successful mining entrepreneurs is actually accumulating the stock at an incredible rate. Eric Sprott has been accumulating shares of CDPR since the middle of this summer - and currently has close to 63M shares in his portfolio companies. We typically steer away from mining companies who have north of 200M shares outstanding, but given how aggressively Mr. Sprott has been accumulating stock, there’s something very valuable going on here.

We’re in it for the long haul and bought shares on the Monday, following our return from the Beaver Creek Conference.

VIO - Vior Inc.

We met with VIOR back in Quebec City in June and kept this name on our radar for a little bit. And while the company did take some time to announce they have commenced their 60,000 ft drilling program. Leading up to this announcement, shares were trading down as low as $0.10 through the door days of summer - this was an opportunity to purchase a company who has $16M on the books for peanuts. Not to mention, their second largest shareholder is Osisko metals, which was just recently acquired by Gold Fields for $2.1B cash.

With the above information in place - the Belletare project is the company's main focus, as they will be drilling almost 24 hours, 7 days a week for the next several months.

We’ll be hosting Mark Fedoswich to our entire Montreal Investor Gathering - so stay tuned for an update as we bought shares earlier in September.

Adding - Another Bid on DLTA - Delta Resources

The bigger the base the bigger the space ? - I think so.

We continue to believe the current land package, along with recent drill discoveries in the Eureka zone, along with its proximity to the TransCanada Highway, that Delta Resource is likely to be a very attractive takeover target, over these next few months.

Delta has defined mineralization for 2.5km along strike and 300M in depth, in their Eureka zone. This was their biggest discovery, which happened two years ago - and word is getting out that the Delta-1 project see’s similarities to Agnico-Eagles, Canadian Malartic Complex in Northwestern Quebec.

Again - this is a game of patience, but our recent discussions with Andre Tessier are quite promising - not to mention, there is a possibility to have some nickel mineralization just West in the Delta 1 Project.

Complete Summary of Existing Holdings

Newest Additions

Bitcoin and Crypto Update

The M2 Money Supply chart relative to bitcoin tells an important story - where is all this liquidity going in the next few months. I like to speculate using a bit of logic here. It’s quite simple…

Source: Joe Consorti - Twitter

As stated numerous times in this newsletter - many people are beginning to lose trust in the federal governments. The entire monetary system is hanging by a thread with debt ridden holes across the ecosystem, where the taxpayers will continue to foot the bill for generations to come.

Bitcoin is an inflection point this month, as geo political chaos roils through the markets (just look at gold !). So it begs the questions, and I’ll keep asking it until this does happen.

When will bitcoin decouple from being a risk-on asset ? - time will tell.

The important thing to realize - is the biggest Whale on the block is buying Bitcoin.

With the FED cutting rates this month, it’s quite likely that much of the liquidity will funnel into this space once again. Therefore, we continue to stand by our price prediction from earlier this year, where we believe Bitcoin will hit $80,000 USD by the end of this year.

Along with it, many altcoins and portfolio companies are expected to follow suit. I’m sharing one name we’ve held since March and a meme coin we mentioned in our April Macro Chronicles newsletter, which is up nearly 6000% since February 2024.

POPCAT – Please refer to the April newsletter for more details. This coin has been on an absolute tear since being listed on Binance.

DEFI – This is a public company that, in my view, is still tremendously undervalued. When we met with one of the Executive Directors in February, the stock was trading at $0.62. Since then, you can do the math. This is the first published analyst report we’ve seen for the company. There’s considerable upside here, and we encourage you to read the report here.

Natural Gas

I will keep this section brief, but please read last month's Dollars & Sense Piece on PineCliff Energy. Nic posted some great charts showcasing that Natural Gas seems to have bottomed and we expect this momentum to pick-up in the winter season.

This story is tremendously underrated and has been catching a bid since we spoke about it last month. Will be adding more on weaknesses going into the winter season.

See the chart below

Wrapping Up

That’s all for this month! If you found any of this helpful on your investment journey, feel free to share it with your friends—or even your frenemies.

We’ll catch you next month as the world continues its chaotic spiral. Just remember: where there's mayhem, there are always new opportunities waiting to be seized.

Until next month.

*DISCLAIMER* - READ CAREFULLY

None of the information taken within this newsletter should be considered investment advice and should only be viewed for information purposes only. NewGen Mindset is not a broker, or a licensed provider of financial services. All claims made in this newsletter to any listener should not be viewed as offering personalized legal or investment counseling. Any investments made in any companies should be consulted with a licensed financial professional from here on.