Chaos & Momentum - Your Best Friend or Greatest Enemy

April's aggressive selloff has left many investors wondering about the FED's next move, as gold and copper gains accelerate.

Hi there,

We're just two months away from what appears to be a ridiculous summer of madness. Most investors are still left wondering where to turn for a flight to safety, while central banks on the other side of the world continue hoarding gold at record amounts.

Everything we are witnessing unfold domestically and globally seems to be teetering on the expectation that "everything is okay." It's only okay if you've been paying attention.

Those who continue to ignore the signs are heading into the next cycle with a rude awakening. Our goal here is to keep you informed about global events and how they relate to the markets, and ultimately, your ability and willingness to seize incredible investment opportunities.

We're just six months away from what is likely to be the most insane and pivotal election in the United States in modern history. Market signals point towards more uncertainty. So let's dissect this and have fun doing it.

Remember, those worried about what's happening should already have been preparing. Unfortunately, those who continue to ignore these signals will be left behind.

Before we jump in - here’s our most recent episode with Lynette Zang.

Lets Dive in.

Macro Headliners

written by Nic A. Tartaglia

POLITICAL

Geopolitical Conflict & Funding

Global Military Spending hits an all time record of $2.4 trillion USD for the year of 2023, up 6.8% from the year 2022, reported by the Stockholm International Peace Research Institute. Military expenditure has risen for the 9th consecutive year, and for the first time since 2009, military expenditure has risen in all geographical regions, led by The United States, China and Russia.

Let’s get into some of the developments that occurred during April.

Middle East

This month, the conflict at the forefront to be wary of revolves around Israel & Iran.

At the beginning of the month of April, Israel launched an airstrike in Syria, at an Iranian diplomatic building killing 2 Iranian Generals and 5 officers. There has been a growing conflict between Israel, Hezbollah and the Houthis, who are both backed and funded by Iran. So it is not hard to make sense of this strike by Israel. Iran naturally vowed to retaliate and for nearly 2 weeks they went quiet. On April 13th, Iran launched over 300 attack drones, ballistic and cruise missiles towards Israel. UK and US ships moved in to help defend, with the Israeli Defense Forces saying that 99% were intercepted and were taken out.

This event put the whole world on alert wondering what would come next or how this would begin to further escalate the conflict in the Middle East, and if this would further drag Western Forces into the mix. IRFC (Islamic Revolutionary Guard Corps) Commander warned on Press TV that if Israel attacks again, Iran will respond with a greater force. What we do know for now at least is that Israel's War Cabinet do appear to want to respond to Iran, but are split over when and how. Will Israel respond, and how so?

Following this significant moment in April between Iran and Israel, activity by the Iranians and their other militant groups they back have picked up again. A week after the strike on Israel, Iranian forces seized a cargo ship operated by MSC, one the world's largest shipping companies. The MSC Aries, which is registered in Portugal, had been boarded by Iranian authorities via helicopter as it passed the Strait of Hormuz. Yemen’s Iran-backed Houthis launched an attack on US, Israel vessels and Navy ships after being silent for nearly 2 weeks. They launched an anti-ship ballistic missile from their territory hitting the Maersk Yorktown cargo ship in the Gulf of Aden. Also, the UK said the Royal Navy warship HMS Diamond shot down a missile fired by Houthis targeting a merchant vessel.

The tension in the middle east is clearly seeing no regression, and the expectation of escalation is clear at the forefront of many geo political analysis. We must do the same and keep a clear eye on the development in the region.

Turkey Sanctions

Turkey has imposed export restrictions on Israel until there is a ceasefire in Gaza, so they say. From 54 different categories, including iron, marble, steel, cement, aluminum, brick, fertilizer, construction equipment and products, aviation fuel, and more.

France

In terms of the Ukrainian and Russian conflict impacting European decisions, we are seeing a lot of escalation in fear by military officials and politicians in relation to further fund and potential involvement. Macron himself has made it clear in his position to keep all military options open including sending western troops in Ukraine.

Ukraine’s Zelensky

Zelensky condemns the attack by Iran on Israel and then proceeds to use the opportunity to ask for more money. The military industrial complex and government officials around the West associated with these decisions sure keep getting richer. What a fantastic mechanism for transferring wealth from western citizens to governments and the military industrial complex.

Nato - The Western War Machine

NATO’s Secretary General Jens Stoltenberg said in early April that the proposed $100 billion Ukrainian Fund would ensure “fair burden sharing” between western allies. The collectivist western bureaucrats and global institutions always want the citizens to burden the financial costs of all these western globalist games outside their territories. And they will use fear to really drive this spending.

Later on in April, NATO Secretary General Jens Stoltenberg chaired a virtual meeting of the NATO-Ukraine Council at the level of defense ministers on Friday (19 April 2024), to address Ukraine’s urgent need for air defenses and other military aid. “Mr Stoltenberg welcomed the recent additional support from Allies to Ukraine, including Germany’s decision to deliver an additional Patriot to Ukraine; an additional 4 billion euros in military support from the Netherlands; Czechia’s ammunition initiative; and new pledges from Denmark and Norway. The Secretary General also welcomed plans by the US House of Representatives to schedule a vote on a critical aid package for Ukraine. “I count on the bill to pass without further delay,” he said. He underscored that all Allies must “dig deep into their inventories and speed up the delivery of missiles, artillery and ammunition.” Mr Stoltenberg underlined that “Ukraine is using the weapons we provide to destroy Russian combat capabilities. This makes us all safer. So support for Ukraine is not charity. It is an investment in our security.”

Lithuania’s defense chief also stated that NATO has no time to lose as Europe’s military industry ramps up production to keep pace with Russia’s war economy.

But to what end? How much can they spend before citizens have had enough? How much financial consequences do western citizens need to burden for this conflict? A society cannot sustain a regression economy being inflated by military economic activity to boost GDP and employment. What productive outcome will come off all this spending which produces no productive input from an economic standpoint, beyond the stimulation of war spending.

United States

CIA director Bill Burns issued a warning that there is a very real risk that the Ukrainians could lose on the battlefield by the end of 2024 unless more money and support is given to Ukraine by the US.

The State Department approved an emergency sale of $138 million in air-defense equipment for Ukraine. This included equipment, services and training for the Hawk Phase III missile system from RTX Corp. Even though they call this a sale, it doesn't take a genius to figure out that this money from Ukraine is actually the $ from western citizens. May as well call a spade a spade, and so in actuality, western citizens are paying for this.

After the plea of Nato, the cries from Zelensky for infinite money and military goods, The US House of Representative comes to the rescue, as always. Who cares how much their own citizens are experiencing socioeconomic regression by nearly every metric, they will be tax cattle for the war hungry boomers and elderly who won't be here in 10 years to rebuild and undue all the damage they will left the next generations.

The US House of Representative passed a $95.3 billion USD bill with heavy support from both parties, even 101 republicans voted in favor to provide aid and military weapons, with the aim to provide support to Israel, Ukraine, and Taiwan. Biden said the foreign aid package would strengthen national security: “It’s going to make the world safer.”

Ukraine $60.8 billion USD

Israel $26.4 billion USD

Taiwan $8.1 billion USD

This bill also included the nationwide ban of TikTok and sanctions against Iranian and Russian officials.

"Of all tyrannies, a tyranny sincerely exercised for the good of its victim may be the most oppressive." C. S. Lewis

Time will tell the truth of this wisdom.

The industrial military complex is clearly in control of the people’s purse.

England

The U.K. had just announced prior to the passing of the $95.3 billion bill, a pledge for an additional $620 million in new military supplies for Ukraine, including long-range missiles and 4 million rounds of ammunition.

Russia

This has yet again led to a threat of escalation by Russia to step up strikes on Ukraine as a result of new US military aid to Kyiv. Russian Defence Minister Sergei Shoigu said “We will increase the intensity of attacks on logistic centers and storage bases for western weapons.”

Russian court orders the seizure of JPMorgan Chase funds totalling $439.5 million USD to recoup the capital that the US lender froze after the Ukraine conflict began.

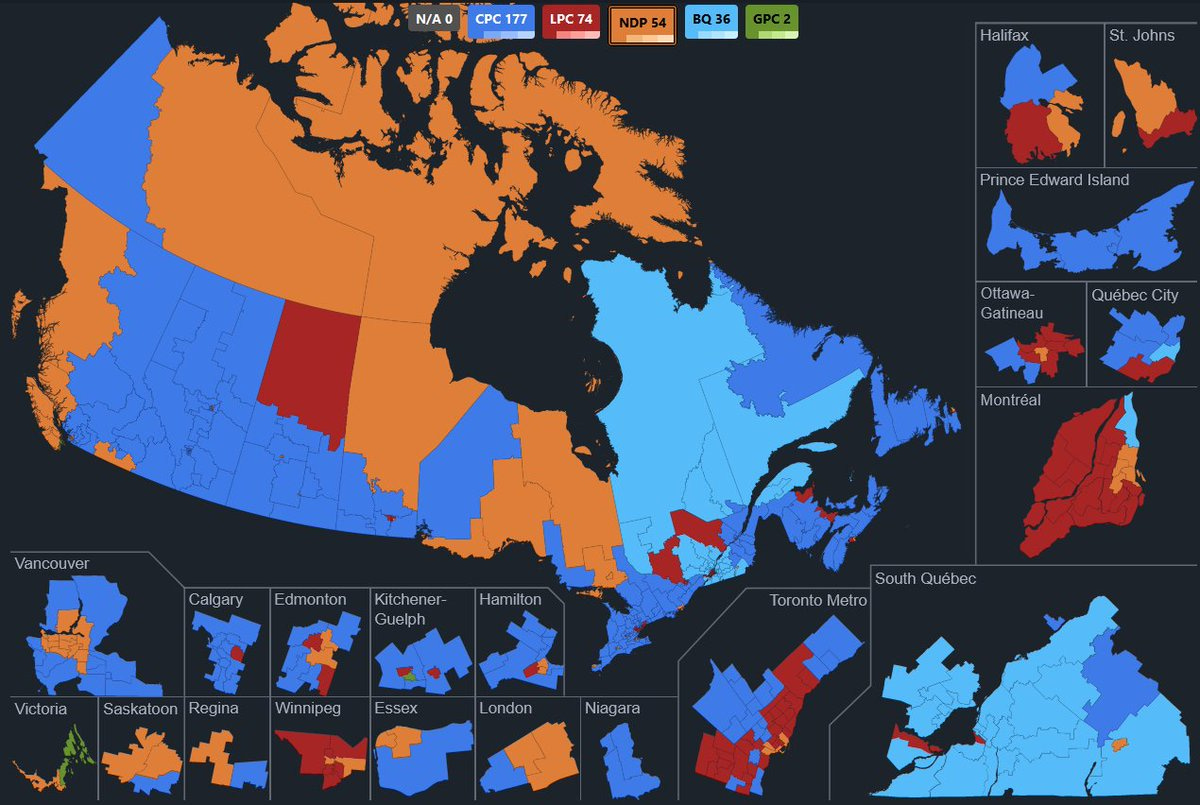

Canada

In Canada, The Prime Minister, Justin Trudeau, and the Minister of National Defence, Bill Blair, released “Our North, Strong and Free: A Renewed Vision for Canada’s Defence”, announcing a boost to the defense budget by 8.1 billion over 5 years, with $73 billion in defense spending over 20 years. For a breakdown of the spending plan and more details on this matter, click here → Our North, Strong and Free: A Renewed Vision for Canada’s Defence | Prime Minister of Canada (pm.gc.ca)

Minister Blair announced that Canada is donating $3 million to Ukraine for the production of drones by Ukraine’s domestic defense industry. This marks the first time that Canada is contributing directly to the production of military drones in Ukraine, and this donation will be made in collaboration with the United Kingdom.

Minister Blair also confirmed that Canada is providing an additional contribution of approximately $13 million to Czechia’s initiative to procure and deliver large-caliber ammunition for Ukraine. This contribution comes in addition to last month’s announcement of $40 million and brings Canada’s total contribution to the Czech initiative to over $53 million.

North Korea and Iran

North Korea and Iran eye historic deal, seeing a rare delegation from North Korea being sent to Iran.

Government Intervention and Insanities

The issue of Climate Emergency is a serious one. Not because the government is telling me it is, but rather because of the so-called behaviors of governments proclaiming an emergency around this issue. These motives of the State to always intervene in the marketplace comes with control because only by applying control can they seek to force a shift away from the so-called crises they are claiming. We heard this month that the White House has renewed internal talks on invoking “Climate Emergency”. White House spokesperson Angelo Fernandez Hernandez said in an email statement “President Biden has treated the climate crisis as an emergency since day one and will continue to build a clean energy future that lowers utility bills, creates good-paying union jobs, makes our economy the envy of the world and prioritizes communities that for too long have been left behind.”

The US Trade Representative Katherine Tai calls for ‘decisive’ action to shield the EV sector in the US from China. Soon after, Biden calls for raising tariffs by 25% on Chinese metals because as he claims, China is able to win market share due to cheaper prices from overproducing. This is protectionism at its best, and never really plays out as intended.

At the same time, even the globalist institution of the UN is helping drive this emergency narrative with statements being made by the UN’s Climate Chief that we have just 2 years to save the planet. These drastic and hysterical claims which have been made for decades, and have always turned out false. Have we not yet learned our lesson about governments and emergencies? Clearly not, and that worries me. Manipulating and forcing the market will become a growing by-product of these government proclamations. So keep watching how they go about “preventing” the so-called emergency and how much it will cost citizens. They will even blame “climate change” as the cause of energy prices rising……… As if none of their actions in the marketplace disguised by some delusional sense of moral superiority has had any impact. It is as though they are some sort of Gods who produce no consequences, as if they exist beyond economic realities.

At an event in Calgary, The Prime Minister of Canada Trudeau said that it is the role of the Government to “make it more expensive for people who don’t care about the future.” Here we go with this patternal welfare collective insanity whereby those who hold the government’s ‘democratic’ power where they think punishing and manipulating citizens solve market problems. Who knew penalizing people financially equated to productive outcomes. Politicians are Gods right? They know best and can do anything they want to make us fall in line? Our servants do not serve, but rather dictate and direct like Tyrants. Climate change and pandemics are merely the means to justify the immoral and primal behaviors they inflict upon mankind.

On another note related to this issue, it makes me think of some wise words:

“Emergencies have always been the pretext on which the safeguards of individual liberty have been eroded.” - Friedrich Von Hayek

“When plunder becomes a way of life for a group of men in a society, over the course of time they create for themselves a legal system that authorizes it and a moral code that glorifies it.” - Frederic Bastiat

The Democrat Senator Sherrod Brown of Ohio came out this month calling for a total banning of Chinese Vehicles, proclaiming that the Chinese Government is illegally subsidizing its car manufacturers to flood the American Economy. An odd statement by a politician whose party also subsidizes companies, creating unfair advantages for their own special interest companies………. “Chinese electric vehicles are an existential threat to the American auto industry. Ohio knows all too well how China illegally subsidizes its companies, putting our workers out of jobs and undermining entire industries, from steel to solar manufacturing. We cannot allow China to bring its government-backed cheating to the American auto industry. The U.S. must ban Chinese electric vehicles now, and stop a flood of Chinese government-subsidized cars that threaten Ohio auto jobs, and our national and economic security” said Brown.

On the note of the expansion of the Welfare State expanding in America, this month Texas AG sued the county over the Houston-area’s guaranteed income program giving 1928 participants $500 a month to strings attache, a program funded by $20.5 million from the American Rescue Plan, which was the pandemic relief law signed by Biden in 2021. Federal pandemic funding has prompted dozens of cities and counties across the country to implement guaranteed income programs as ways to reduce poverty, lessen inequality and get people working. These are all wishful dreams of politicians and academics who clearly don't understand basic economics.

At the same time, relative to the subject of the Welfare State, 18 states sued Biden to block the student loan forgiveness and repayment plans.

As Ludwig Von Mises said, “The Welfare State is merely a method for transforming the market economy step by step into socialism.” America needs to bring an end to these insane political actions before the essence of what America used to stand for vanishes.

In Europe, there was a planned conservative conference being staged in Brussels with the support of Hungarian groups backed by Prime Minister Viktor Orban. The city authorities cited public safety concerns as justification for their actions of shutting down the event, with Emir Kir, the mayor of Brussels municipality of Saint-Josse stating “In Etterbeek, Brussels City and Saint-Josse, the far right is not welcome.” Even the Former Polish Minister Mateusz Morawiecki was scheduled to speak alongside Oban. The Belgian Prime Minister Alexander De Croo criticized officials in Brussels for these actions. Don’t forget, Brussels is the home of the EU (European Union), a globalist socialist entity.

CULTURAL

Protests Across The Globe

We are seeing protests grow across the world for a variety of reasons. A hunch I have from spending time observing the world change culturally, tells me that this is just the beginning. The fired spirit of collectives and tribes will only grow from here. Be it for good or bad intentions, we are seeing humanity begin to boil. It is no longer simply international conflict between governments, it is now truly beginning to show at a local and civil level the division/tension. Societies more than not peril when a culture becomes fractured and is unable to find back that balance in their differences.

Across The West

Significant escalation of violent pro-hamas and or pro-palestine protests in America and Canada disrupting infrastructure and education, with examples like:

Columbus University Campus

Cal State University

McGill University

Deltaport in BC (Canada’s largest container terminal)

Scotia Bank in Montreal saw one of their branches be taken over.

In New York protests we can see American flags being lit on fire and chants saying “death to America”.

The Golden Gate bridge in San Francisco

Chicago’s O’Hare International Airport

Major highway in Eugene, OR

They are acting like terrorists seeking to totally disrupt and produce chaos at home for their own fellow citizens. Destroying and impeding the lives of others with clear intention to do so, is not moral nor just. Nothing honorable nor respectable about these behaviors.

Do not allow external conflict to bring chaos home. We do our society no good.

Within Israel

Protests within Israel are growing against Netanyahu, something that was already present before the Israel war. Then there is the issue of the government of Israel seeking to force conscription of the traditional/orthodox jews in Israel who have been pardoned from service due to their devotion to studies and the faith. But the Israeli politicians, like all politicians, seem to believe that forcing military service is morally justified because they need to play their part to be “fair” (the words said by all tyrants in collectivist societies) and that serving in the army is the moral thing to do. The exemption for the ultra orthodox jews of Israel has expired which exposes them to forced conscription, and this has angered them. There is escalating tension and conflict internally between them and the other jewish class within Israel, primarily aiming their attention at politicians and the ADF. The Israeli government had until the end of April to agree on a new conscription plan, they decided to extend the date of decision to May 16th.

In America

Man sets himself on fire in protest of Trump, think about the passion and distorted hate to want to martyr yourself over that man. The media sure has done a job in the minds of people and how they view Trump as a threat. Other than the escalating protests related to Israel and Palestine which was talked about prior.

In Canada

“Axe the Tax” protests in retaliation to the carbon taxes rising which Trudeau says does us more good than bad, but says this while being unable to quantify those words with anything.

Farmers in tractors protest government overreach in farming in general which also ties to the “axe the tax” protests also.

Protests against Trudeau himself in some cities where he goes to visit are enraged and do not hide it - happened in Ontario as an example. Political culture in Canada is shifting and people are angry. Will any of the Canadian options really be able to bring balance back to their culture?

In Spain

An estimated +50,000 people joined the protests, hitting the streets of Spain’s Canary Islands to demand changes to the model of mass tourism they say is overwhelming the Atlantic archipelago. “The Canary Islands are not up for sale!”; “A moratorium on tourism”; and “Respect my home” - they shout. It seems the government's tourism model seems to be designed to benefit their needs, and not around local communities and their capacities.

In Brazil

Massive freedom rally in Brazil, where Brazil’s former ex-president Bolsonaro hailed Musk’s courage over Freedom of speech. Many believe their freedom of speech is at risk, especially after the escalation of the Brazilian Government's actions against Musk.

The Cultural Chaos of Illegal Migration & a Welfare State

Germany’s violent crime rate in 2023 has been published and determined the rate has reached a 15 year high. Migration as a result of global conflict and welfare systems brings about anyone who does not necessarily care to adapt to the environment they move to since they are provided care for simply being there.

What effort do they have to put to survive in a new environment if the Welfare State provides regardless of behavior?

Democratic Mayor of Denver has decided to divert $90 million of the city’s budget (taxpayers fund this) to service ‘newcomers’ as he worded it. These types of actions demonstrate the unwillingness to prevent the burden on their citizens. Illegal immigrants who have flooded America are becoming a very costly burden to American citizens, and this Mayor has the capacity to mislead the media saying it is the republicans fault. This comes after this same political party for 3 years rejected that the border wasn’t secured and that there was no migrant crisis. Their actions tell another story.

Chicago residents launch a petition to recall Democrat Mayor Brandon Johnson, because they are angry with their so called “elected officials' ' who are meant to represent their best interest have prioritized resources and effort to the illegals over the citizens of Chicago. This effort has even gotten the support of the police union.

Militia created in Michigan, with the purpose to preserve the 2nd amendment. The Holton Township Board passed a resolution that aimed to accomplish 2 things:

Declaring the township is a 2nd amendment sanctuary where unconstitutional laws will not be enforced

The creation of an enforcement mechanism using a voluntary community militia to protect these natural rights

Big Brother: Begging To Be Watched

A New York Times Opinion Guest Essay was written by on April 21st titled “Government Surveillance Keeps Us Safe”. As chaos domestically and internationally expands, the government's so called “good intentions” will give rise to what George Orwell calls “Big Brother”, a Police State always watching you. Opinion | Surveillance Law Section 702 Keeps Us Safe - The New York Times (nytimes.com)

Economic

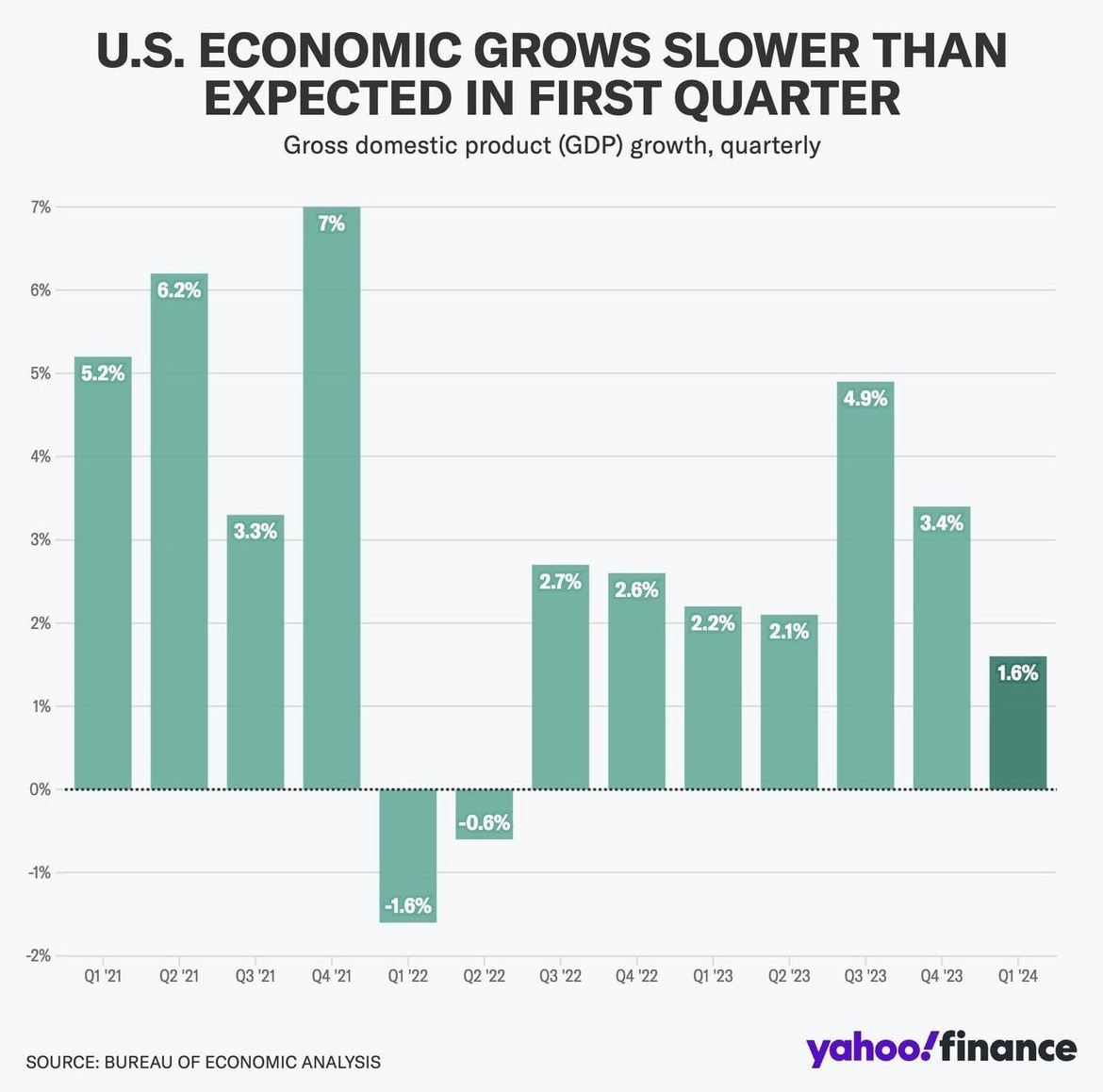

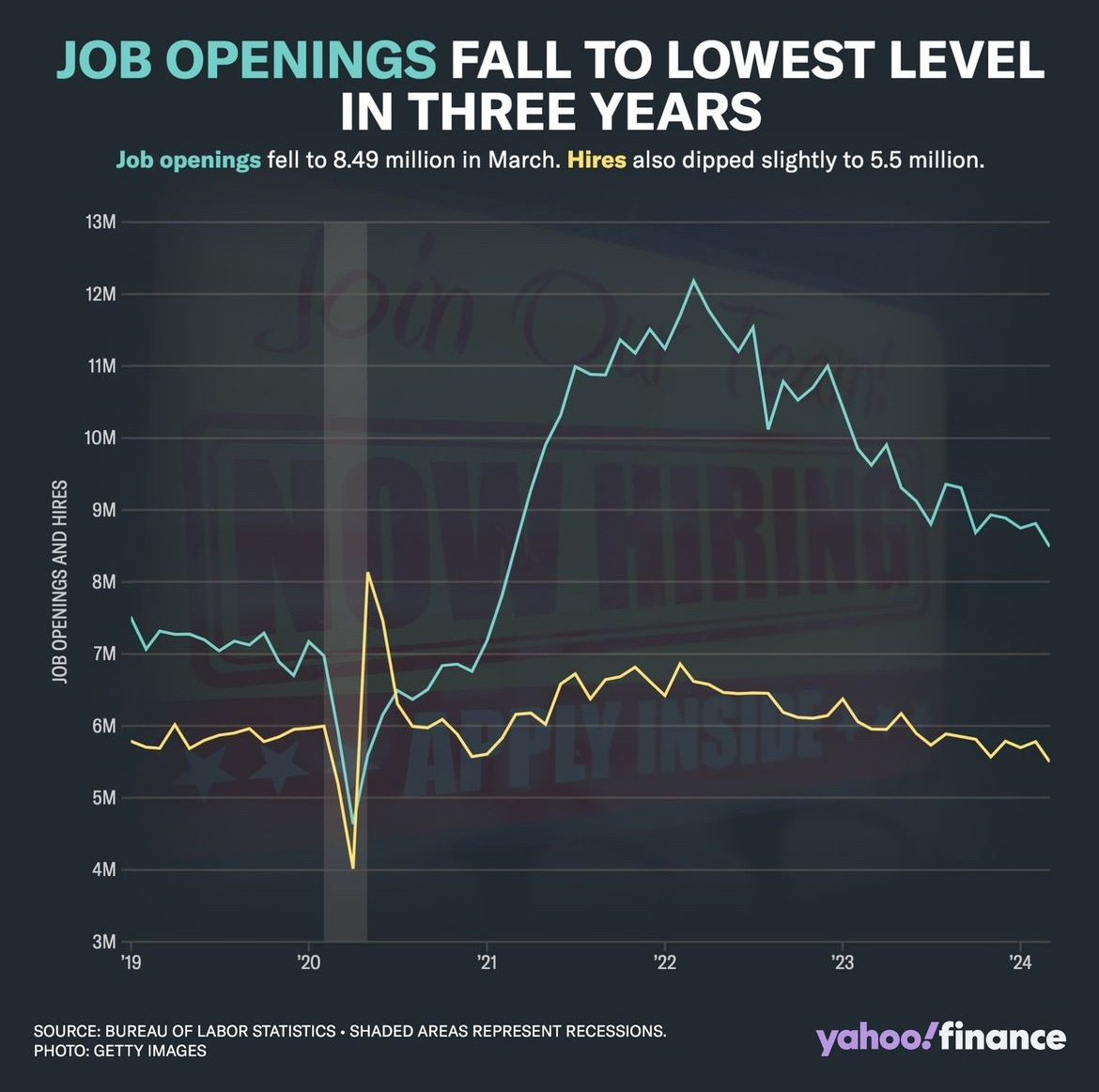

Let us begin the Economic section with some development in the global economy that solidifies the stagflation thesis that people are all of a sudden talking about. By the way, we’ve been warning these bells of stagflation since 2022 since we knew that raising rates would become the necessary course of action to fight inflation after collapsing rates to near 0 and flooding the market with debt. It was obvious that raising rates had its limits, clearly we have now seen central banks show that the limit has been reached. Stuck between a hard place and a rock is the situation facing central banks and governments. It is especially in the West where all eyes are paying attention. This is the cliffhanger moment where major economies will go sideways until their keynesian metrics turn on them moving against their duo mandate of inflation and employment. In my personal opinion, I think employment is more important than inflation for their focus, and as long as employment remains “strong”, inflation will be accepted as a cost. As Janet Yellen stated, inflation does not have to come down if wages rise. Because if employment begins to regress, naturally inflation will slow and potential reverse into deflation if employment collapses enough. The labor market is the great distortion and illusionary effect. So as long as they can keep claiming the labor market is strong, the illusion of economic strength can be maintained. Also, government and central banks can't afford deflation with all the debt and liabilities they hold. So observe these metrics and developments carefully.

Central Banks April rate decisions:

BOC holds rates

FED holds rates

ECB holds rates

BOJ holds rates

BOE holds rates

IMF

The IMF has sounded the warning bells that countries need to rebuild their rainy day funds and get debt down and that the medium-term prospects for global growth were at their lowest in decades.

American Economic Data Points

Jamie Dimon, CEO of JP Morgan Chase in his published annual shareholder report for 2023 said: “All of the following factors appear to be inflationary: ongoing fiscal spending, remilitarization of the world, restructuring of global trade, capital needs of the green economy and possibly higher energy costs due to a lack of needed investments.”

FED narratives

Federal Reserve Bank of Atlanta President Raphael Bostic reiterated his expectations for one interest rate cut in 2024, but added he's open to changing his view based on inflation and employment data.

Federal Reserve Bank of Boston President Susan Collins reiterated she sees no urgency to cut interest rates in the near term.

Powell said that it will take longer for confidence on inflation before taking any actions.

Meanwhile, the US 10 year is inching closer to 5% - and the 2-Year note alone is already at 5%. March CPI came in at 3.5% after rising 0.4% (hotter than expected). US GDP came in slower than expected at 1.6%, making this the 3rd consecutive month of decline since Q3 2023.

Mortgage rates top 7% for the first time in 2024 and credit card delinquency rates are on the rise climbing over decade highs in FED study.

Roughly 3.5% of credit card balances were at least 30 days past due

Roughly 2.5% of card balances were at least 60 days past due

Roughly 1.75% of card balances were at least 90 days past due

US regulators seized troubled lender Republic First Bancorp to sell to Fulton Bank. Republic Bank had about $6 billion in total assets and $4 billion in total deposits, as of Jan. 31, 2024. The FDIC estimated the cost of the failure to its fund will be $667 million. This is the latest regional bank failure since 3 collapsed in 2023 with Silicon Valley, Signature and First Republic.

Labor and Employment

Bankruptcy filings rose 16 percent during the 12-month period ending March 31, 2024 compared to previous year.

US corporate bankruptcy filings reached a new high in March as companies continue to battle high interest rates and lingering operational challenges.

US layoffs reach 14-month high, rising 7% since January 2023. Led by technology and government sector job eliminations. “The technology industry continued to outpace other sectors in jobs cuts through the first quarter of this year, announcing 14,224 in March and 42,442 since the year began. The U.S. government was the top job cutter last month, accounting for 36,044 announced layoffs, the highest since September 2011 and occurring largely within Veterans Affairs and the United States Army.”

US job openings in March fell to lowest levels in 3 years.

California initiates the $20 minimum wages. Let us now watch the ripple effect of this Keynesian insanity that somehow raising minimum wages will just solve the issue of rising cost of living. Lets see how many entities with small margins survive the consequences on the labor market as a result. Especially in the fast food and restaurant industry where cost pressure is always on their mind.

Tesla to lay off more than 10% of its global workforce, seeing that start with 2700 layoffs at Texas Factory.

Europe

Germany’s Finance Minister Christian Lindner lectures the US on spending at a Washington event and warns his coalition partners against emulating the country’s inflation reduction act.

The Bank of England's Deputy Governor John Cunliffe signed a growing support for a digital pound, and justifying this intention with articulating a need to maintain ‘grip’ on money. “On current trends, the Digital Pound in the form we have proposed is likely to be needed by the end of the decade,” Cunliffe Said.

In other words, they need control over the money supply in order to manipulate the marketplace according to their central whims, and they will use your safety and financial security as justification. Control is what all governments seek to ensure how outcomes occur as they want them to, with their self interest as the first priority. This trend is important to watch as it will have detrimental consequences on the freedoms of individuals. And many other economies are having similar conversations or already running pilot projects

UBS has been told by the Swiss Government it needs to find as much as $27 billion USD to absorb potential losses and protect taxpayers from having to bail them out.

Canadian Economic Data Points

Former Bank of Canada Governor David Dodge predicts that the Trudeau liberals budget will be the worst in 42 years. According to Statistics Canada, roughly 23% of Canadians are experiencing food insecurity, driving an increase in food bank usage, meanwhile Canada’s per capita output dropped 7%.

Canadian March unemployment rose to 6.1%.

Interest on Canadian Federal debt will reach $54.1 billion by end of year, up 14.6% over 2023.

Condo Sales in Toronto hit 15 year low.

Canada introduced a new housing plan in budget 2024 to “build homes by the millions, Solving the Housing Crisis: Canada's Housing Plan”:

“It includes our plan to make it easier to afford rent and buy a home, and makes sure that the most vulnerable Canadians have support, too. At the heart of our plan is a commitment that no hard-working Canadian should spend more than 30 per cent of their income on housing costs.”

Budget 2024 and Canada's Housing Plan lay out the government's bold strategy to unlock 3.87 million new homes by 2031

Announced that the government will consider introducing a new tax on residentially zoned vacant land. The government will launch consultations later this year.

Budget 2024 announces Canada Builds, the federal government's intention to leverage its $55 billion Apartment Construction Loan Program to partner with provinces and territories to build more rental housing across the country.

Canada introduces a 30 year amortization for new home buyers.

Canada raising capital gains tax on individuals making over $250K to 67% from 50%. The former Finance Minister for Trudeau said he rejected the raise on capital gains tax while he was in office, indicating concerns it would further impede Canada’s economic growth and drive many investors to question their place in Canada - causing a momentum of desired exodus of business owners from Canada.

CBC will receive another $42 million in funding from Liberal government of Canada. The propaganda machine of Canada is still being kept alive with taxpayer resources even though they are one of the least successful media outlets in Canada as of today and could not survive without the Liberal Government.

Japan

Japanese Yen at a 34 year low after BOJ holds rates at near 0.

BRICS Development

After Zimbabwe applied to join BRICS, they have really initiated the accumulation of gold, with a recent passing of a law that forces mining companies to pay part of their royalties using gold.

In addition, Zimbabwe introduced its first gold back note called ZiG to replace the collapsing currency. They have 2.5 tons of gold to back it, which also includes a basket of foreign currencies worth $100 million.

On the subject of gold back notes, check out Valaurum Inc who is revolutionizing the utility of gold through real gold back notes with real gold imprinted on them. Check out our episode with Adam Trexler who is the founder and CEO.

→

The major players of BRICs China and Russia make a united stand in strategic coordination to reform the West-led global system. "China has always attached great importance to the development of Sino-Russian relations and is willing to work with Russia to intensify bilateral communication, strengthen multilateral strategic coordination in the BRICs group and the Shanghai Cooperation Organisation, demonstrate greater responsibility, unite the 'Global South' countries ... and promote reform of the global governance system," state broadcaster CCTV quoted Xi as saying. Lavroz, the Foreign Minister said that China and Russia have almost de-dollarized their trades. This feeds into the supposed talk whereby BRICs nations are considering the launch of a stablecoin for international trade settlement, backed by gold and potentially other accepted foreign currencies. Let us not forget how active BRICs members have become with gold purchases, representing the majority of the largest purchases. This wouldn’t be a surprise after the US announced they are drafting sanctions that threaten to cut some Chinese banks off from the global financial system, claiming it as retaliation for facilitating trade with Russia.

Talk about the financial system beginning to really show signs of fracturing and the intent to remove/mitigate the power of the US dollar.

Precious Metals

In April, gold prices kept breaking All Time Highs week after week, hitting ATH over $2400.

Institutional Gold Price outlooks:

UBS says gold could double from here, giving it an outlook over $4000 USD

Goldman raises Gold price target to $2700 USD.

Bank of America’s most preferred commodity is Gold with a target of $3000 USD by 2025

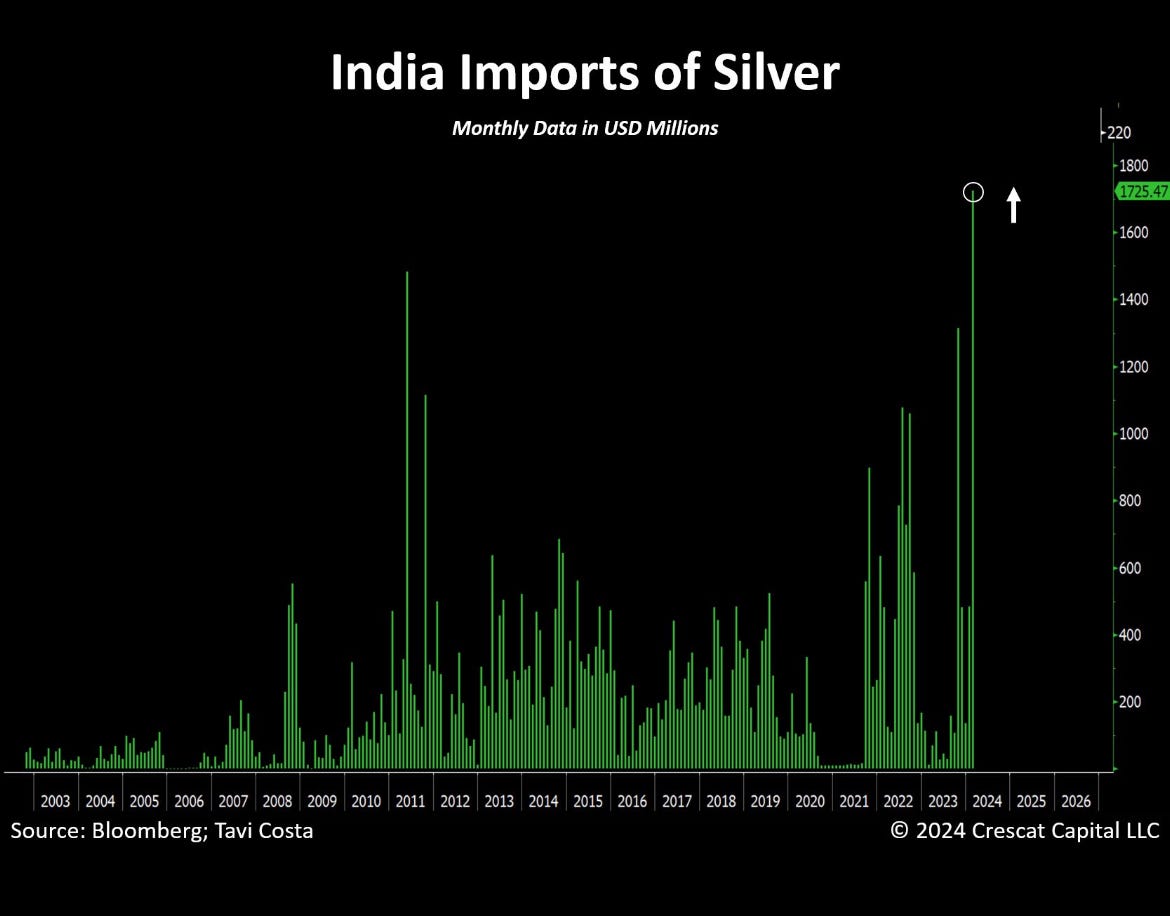

Silver

Silver on a quarterly basis broke out with the junior minors.

Silver hits its highest price levels since January 2021, recrossing the $28 price level.

India reported record monthly imports of silver.

Commodities

Commentaries

Trafigura, one of the largest commodities Private firms, stated that AI growth alone could add 1 million tons to copper demand by 2030. At the same time, Blackrock, the world’s largest asset manager, warns that $12,000/ton USD in copper is needed to incentivize large-scale investments in new mines.

As a whole for commodities, Rio Tinto Chairman has warned that global mining investments are too low to support energy transition demands.

This narrative will continue to highlight the supply gaps as world governments keep pushing for energy transition. The battle of commodities is just beginning.

The United States and UK announced new restrictions on trading Russian aluminum, copper and nickel.The LME (London Metals Exchange) banned deliveries of any Russian supplies of these metals. Russia represents of the total global supply:

Nickel 6%, aluminum 5%, Copper 4%

Oil prices are showing upward pressure. This will only add to the problem of rising prices as we are seeing inflation begging to creep back up. Next OPEC meeting is scheduled for June 1, 2024. Also, Iranian oil exports have reached their highest level in 6 years despite the sanctions of US and EU to impede Iran and punish them. But clearly it is not working, with the majority of their sales going to China.

M&A Activity

BHP offers a full buyout of $39 billion USD to acquire Anglo-America, a 107 year old mining company, which would make this merger the world’s largest copper producer. Is this a sign of M&A life awakening in the mining and commodities space? Anglo rejects buyout offer stating that the offer “significantly undervalues” the company and its future prospects. It was a quick response. BHP is supposedly going back to the drawing board to reassess a new offer buyout.

Electrification

Incredible global solar record coming out of India, where Adani Green Energy LTD, has completed and commenced the largest clean energy park with 30 GW capacity in Gujarat. This required the installation of approximately 2.4 million solar modules. The solar park's land mass is 5x that of Paris, 538 sq km. it will provide energy to roughly 16 million homes annually.

On a side note about these solar farms, how truly sustainable and environmentally friendly are these? Look at all that dead land that cannot be used for infrastructure, homes, farming/agriculture. And the fact that no animals can survive or benefit from this in any shape or form. Are we fundamentally solving an environmental problem doing this?

Ford delays EV production due to low demand for EV Vehicles in North America until 2027.

The Biden Administration has pledged $6.6 billion USD U.S. chips grants to Taiwan Semiconductors (TSMC) to build in America, using funding from the CHIPS and Science Act. They pledge to build their third Arizona plant.

Honda is to get up to $5 billion CAD in government support to build EV batteries, assembly plants in Ontario as part of a $15 billion CAD project

Japan approves $3.9 billion in subsidies for chipmaker Rapidus. They plan to mass produce 2-nanometer chips from 2027, competing with industry leaders TSMC and Samsung Electronics.

Equities

The New York Stock Exchange is considering 24/7 trading for markets.

Mag 7 earnings is what is keeping the S&P moving. Without them, growth would be negative.

Cybersecurity and Privacy

This subject is more related to caution and risks in order to be wary of how the internet is becoming a disruptive mechanism to steal and manipulate data. Be it our personal data, our financial information or bank accounts, we need to understand the risks and the consequences they pose to our financial wellbeing. DO NOT get too exposed to these online threats.

New laws by the EU prohibits anonymous hosted crypto wallets and cash transactions over 10K euros. Prohibits anonymous cash payments over 3000 euros.

Bitcoin

Bitcoin Halving occurred April 20, 2024. Since then we’ve only seen a pullback in price as we write this report.

Founders & CEO of Samurai, a service for anonymizing Bitcoin Transactions have been arrested with the claim that “Keonne Rodriguez and William Lonergan Hill Are Charged with Operating Samourai Wallet, an Unlicensed Money Transmitting Business That Executed Over $2 Billion in Unlawful Transactions and Laundered Over $100 Million in Criminal Proceeds''. In coordination with law enforcement authorities in Iceland, Samourai’s web servers and domain (https://samourai.io/) were seized. Additionally, a seizure warrant for Samourai’s mobile application was served on the Google Play Store. As a result, the application will no longer be available to be downloaded from the Google Play Store in the United States.

Dollars and Sense - What We’re Buying

Written by Dan Kozel

As many of you are likely recovering from tax season, it will be important to put some capital to work in the coming months. It's evident that there will be no slowdown in global geopolitical tensions - as previously mentioned in newsletters, we are already in World War III - and conflicts are typically fought over resources. Here's a brief update on the current status of some of our core holdings.

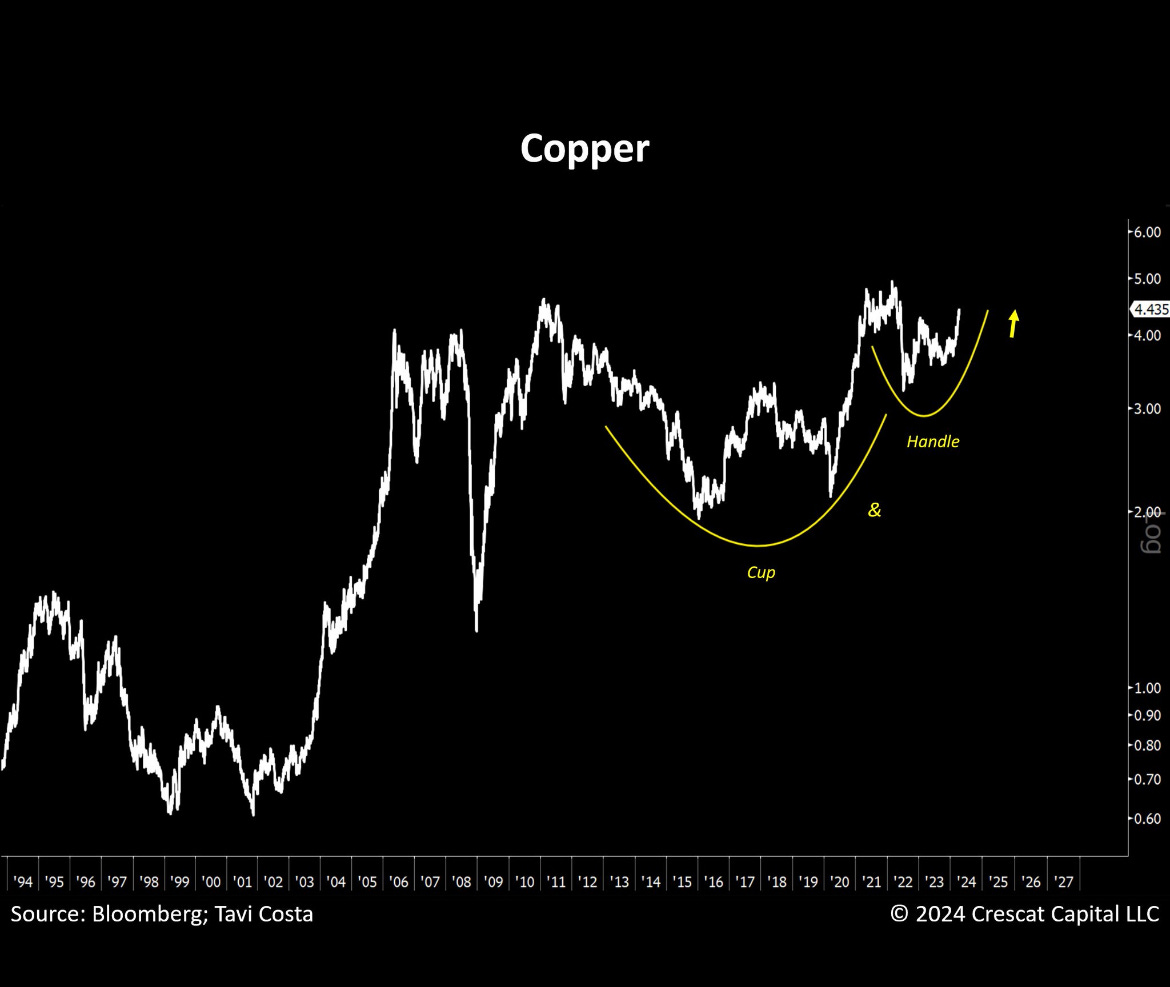

Copper:

We have consistently emphasized the continued significance of copper in the world. Since the end of February, we have witnessed a steady increase in copper prices, as we had predicted. With most institutions gradually acknowledging the new reality of global copper shortages, we anticipate this trend to persist throughout this month and the remainder of the year.

In a previous discussion, I addressed the political ramifications of governments intervening in the global supply chain, with China remaining prominently involved in this dynamic.

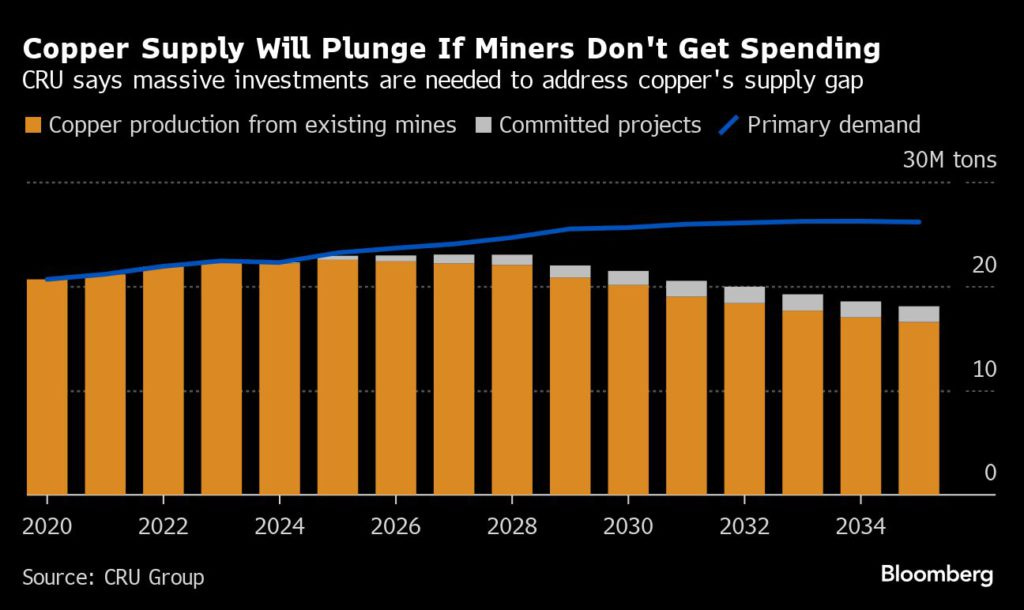

Moreover, the amount of capital required for additional copper mining operations continues to escalate each month. The substantial supply shortages are forecasted to become even more pronounced - as indicated by the chart below.

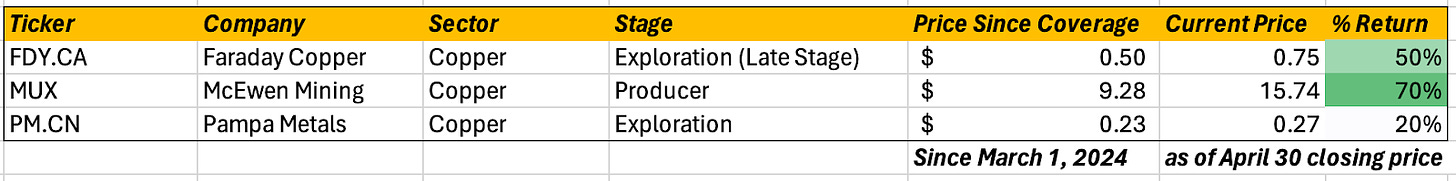

A brief update on some of our copper positions reveals significant momentum among many large caps. While there has been some delay in the world of small caps, this presents an opportunity to position accordingly.

.

MUX - Since our initial discussion last month, it has surged by almost 55%. This large-cap company continues to exert significant influence on the price of copper. Based on technical indicators, I anticipate a deeper pullback, as this stock has more than doubled since hitting a bottom at the end of February.

FDY - The small-cap juggernaut continues to attract more interest. The current CEO of FDY sold his previous company to Newmont - please refer back to summary in the previous newsletter.

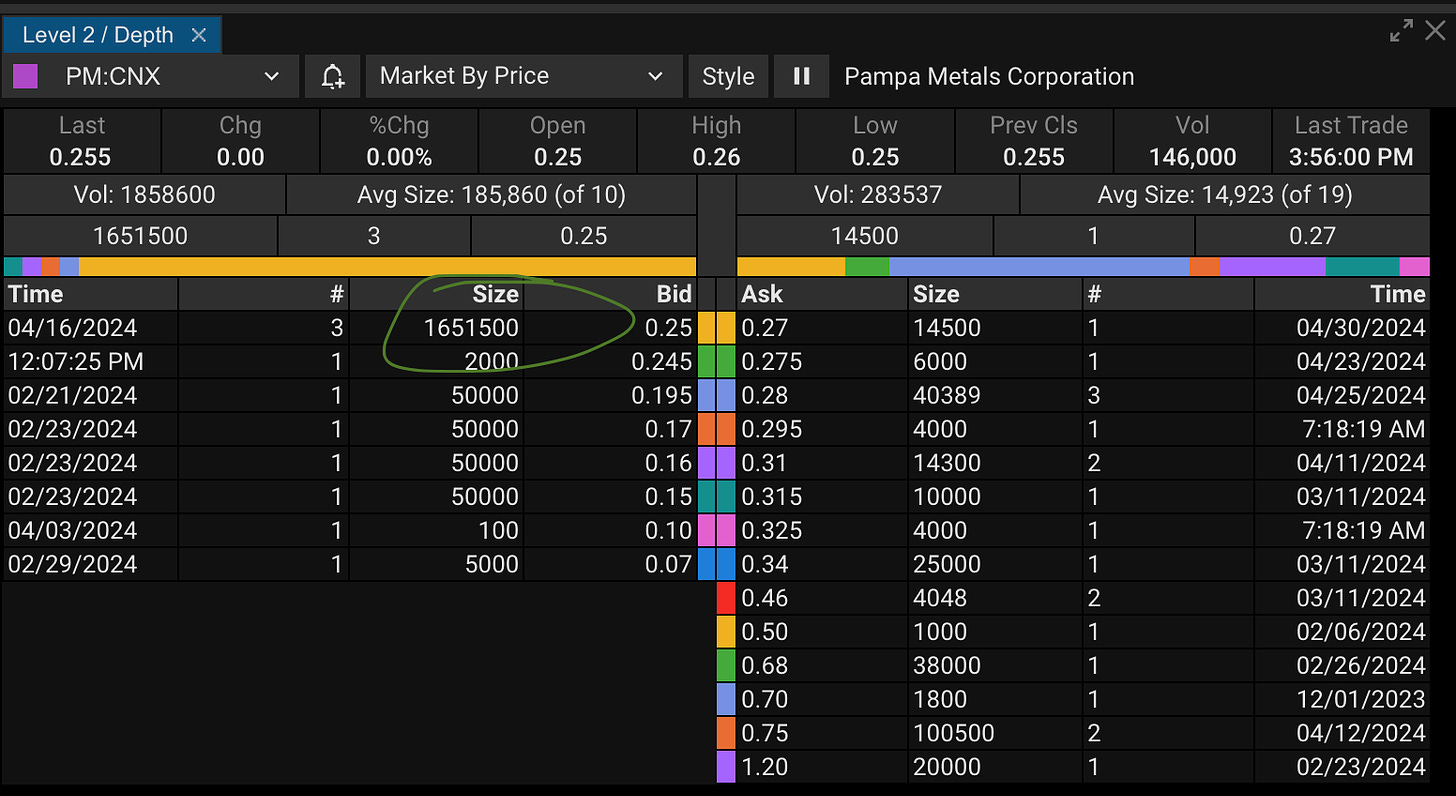

PM - Pampa Metals reached $0.28 this month before retracing to $0.26. I anticipate a significant increase above $0.30 following their next drilling results, provided they are of high grade. As mentioned previously, there has been substantial accumulation of stock from Canaccord Genuity - they also participated in the recent private placement. I am highly bullish on this junior copper story since the "smart money" has begun following PDAC. See the Bid - left side of the market depth and you’ll notice heavy bid support (bullish)

If you needed another piece of information on why copper will likely continue making new highs, it is due to the lack of investments in capex to develop more copper mines. This chart alone, tells the big story of the challenges ahead.

https://www.mining.com/web/blackrock-says-12000-copper-is-needed-to-incentivize-new-mines/

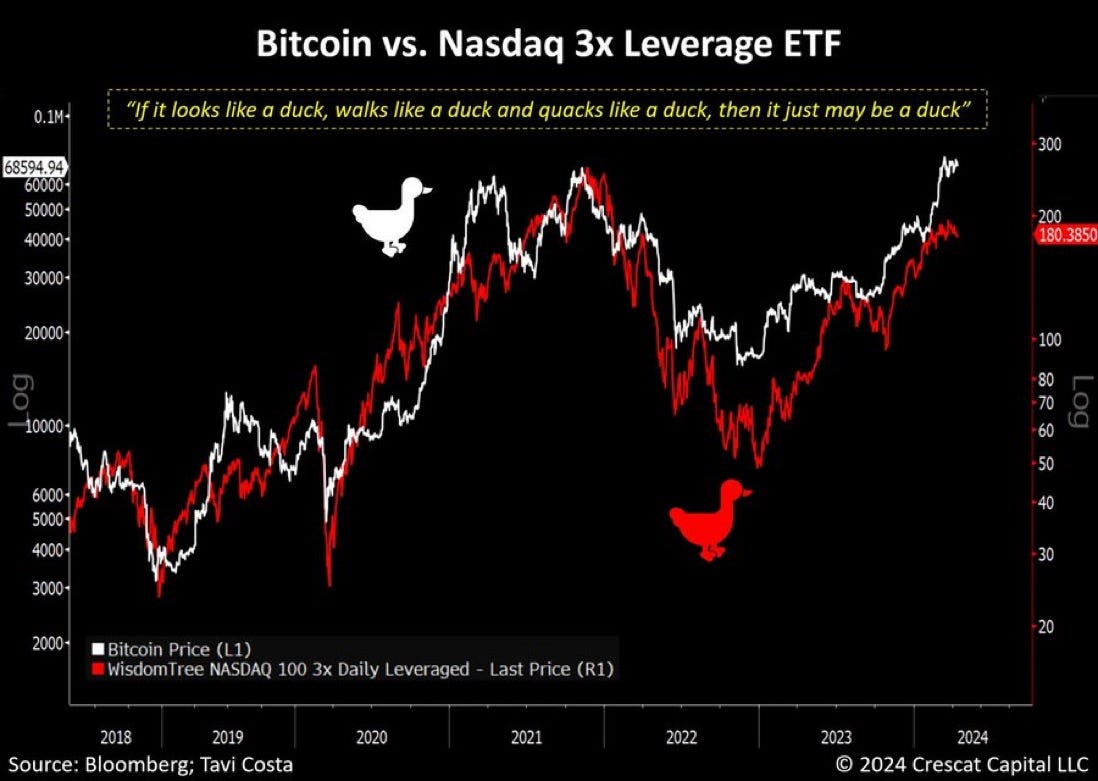

Bitcoin/Crypto/MemeCoins

I expect to see some short-term weakness in the price of bitcoin, and still, to this day, I do not understand why buyer psychology is so broken.

However, as Blackrock continues to hoard all the bitcoin in preparation for what seems to be an intentional rug pull before we see a break to new highs, I’m pretty sure we’re going to see $88K USD this year. I don’t know when exactly, but the charts are signaling that this level is needed to maintain the momentum we’ve been seeing since the start of December. Any weakness is another opportunity to add, and when the entire crypto community starts contemplating selling all their bitcoin, you will know this is a fantastic time to add some exposure.

The MemeCoins have been fun to watch. Although I am not recommending you throw your entire basket into this ecosystem, I’ve decided to throw $2,000 into the mix and sprinkle it across some names just for the sake of having fun. Again, this decision was purely based on looking at the charts and continuing to apply the same strategies as when looking at the regular market for new opportunities.

And now, Hedge Funds are rolling into the party.

Here are two Alt-Coins I’ve been playing around with that I think could be a fun experiment. But remember, only risk what you can afford to lose.

PepeCoin - I bought this back in December and have already 4.5x my money - it’s pure speculation. The only thing moving this is a giant group of Twitter crypto heads, but the technicals continue to be very attractive. And quite frankly - any move from Bitcoin to newer highs, usually follows an aggressive move higher from many of the shitcoins.

If you can read a chart, you can understand where this is potentially going. Trade responsibility and don’t even dare over leveraging yourself, unless you’re actually a complete moron.

PopCat - a close friend of mine mentioned something hilarious, which stood out to me and for anyone looking to have some fun, this might may sense to you. He mentioned the last MemeCoin run was all run by Coins with Dogs in them (ie: DodgeCoin). He then paused and mentioned this next MemeCoin run will be run by CatCoins. “Just keep it simple, Dan - Cats and Dogs - that’s all you need to know about Shitcoins”

So I bought some PopCat through my phantom wallet on a platform called Jupiter. This entire process is a bit complicated if you’re new to crypto, however it ensured that I had complete access to my own crypto, rather than holding it on an exchange.

Since that purchase, PopCat has near 3.5x - from a technical standpoint, a pullback is healthy, but if this thing goes to zero, which is very possible in the Wild West, you should manage your risk accordingly.

I’m prepared to lose all of my money in meme coins - so don’t throw your life savings into this, trying to hit $1M home runs, unless you can afford to do this. Quite frankly, I’m only doing this because it’s fun and I have a technical edge over a lot of other market participants who have no fundamental understanding of fundamentals or market cycles.

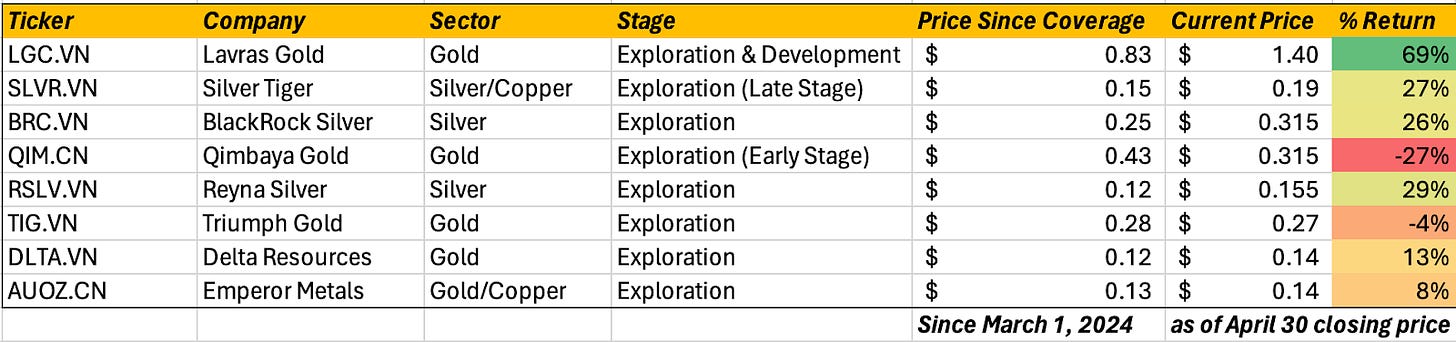

Gold/Silver Update.

For those who have been following us for a while, there’s not much to update here on Gold and Silver - other than the fact that we still continue to believe a $2,500/oz Gold price and a +$34/oz Silver price are going to occur at some point in the next 8-12 months. And gold silver miners continue to be the cheapest on the entire planet - in fact, the big basket of these stocks is the cheapest in nearly 40 years.

And like its copper cousin - many of the large caps have begun to move significantly to the upside as well. Last week, Newmont absolutely smashed earnings and saw a single day move of an 11% gain. This is not retail - but once again, smart money (institutions) coming in because they know the writing is on the wall. Stanley Drunkenmiller is sitting on a 39% gain since he bought Newmont - and there’s still more upside. We expect to see a move to higher highs, once NEM can sustain the $42 levels.

Meanwhile, in small-cap land - the same lag is occurring. There’s still massive opportunity in many of these names, which we continue to hold because these moves have yet to occur. One of the main advantages of investing in these names, is you’re really not left chasing them, as you’re able to buy yourself some time to position accordingly.

A brief monthly overview of our current holdings is below

Important Updates from our core holdings.

Wrapping Up

That’s all for this month - have an incredible weekend and feel free to give us a thumbs up if you enjoyed this month’s report. We’re likely going to see more momentum in the metals as global chaos accelerates.

Until next month.

*DISCLAIMER* - READ CAREFULLY

None of the information taken within this newsletter should be considered investment advice and should only be viewed for information purposes only. NewGenMindset is not a broker, or a licensed provider of financial services. All claims made in this newsletter to any listener should not be viewed as offering personalized legal or investment counseling. Any investments made in any companies should be consulted with a licensed financial professional from here on.