Hi there,

Welcome back to another issue of the Macro Chronicles Report.

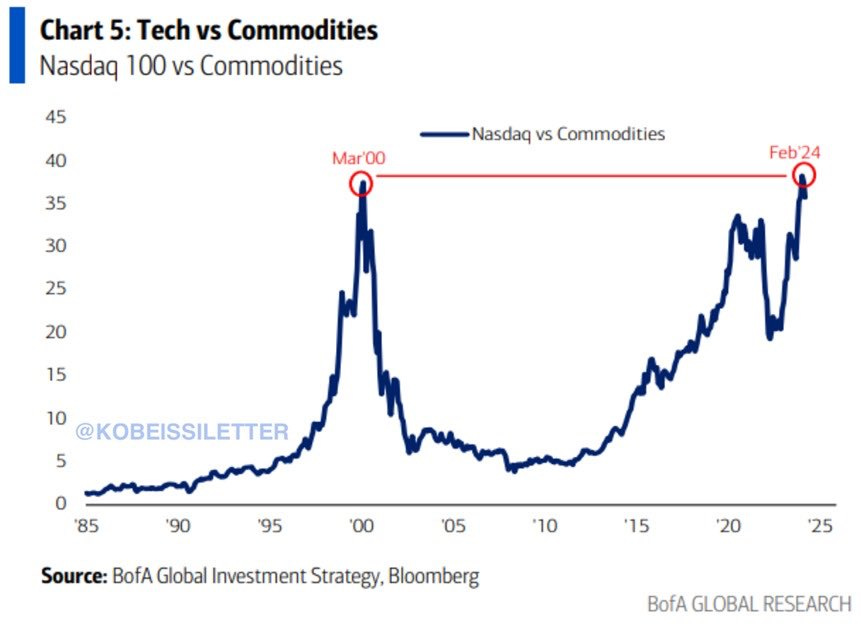

It has been remarkable to see the entire commodities sector rise alongside the general market, with new highs in the NASDAQ and Dow Jones. There is a strong correlation between these outcomes and the political policies introduced over the past years.

Now more than ever, the race is on to find enough raw materials to plan for the next phase of industrial growth. However, many people still believe the “Green New Deal” is achievable, given the current infrastructure relative to its desired state. The amount of time and money required is vast, but this seems to be underestimated.

While these “experts” continue to pedal this nonsense and treat our economies as their playground, the opportunities to make money continue to grow. We're here to provide you with more insight into the world and how we’re allocating capital in the current cycle.

If this is your first time reading this, welcome. We’ll be discussing geopolitical, cultural, and economic events and developments before tying it all to our market investments.

If you’re a regular reader - you know the drill and we appreciate your on-going support.

Let’s dive into the rabbit hole, shall we?

Macro Headliners

written by Nic A. Tartaglia

POLITICAL

China & Taiwan

The US and Taiwan navies conducted joint drills in the Pacific in late April that officially did not take place supposedly. This has led to a joint military action by China holding a series of military drills supposedly codenamed “Joint Sword-2024A,” around Taiwan. These will continue to occur more aggressively as Lai Ching-te was sworn in as President of the democratic island of Taiwan in later part of May.

China sanctions Boeing and two US defense contractors for Taiwan arms sale. This doesn’t happen without White House approval. The China and Taiwan story is likely going to turn into something sooner than later. Watch what is being done, not what is being said.

Even the Singapore Deputy PM said “Taiwan has become one of the most dangerous flashpoints” as US-China tension escalates. All this while the White House narrative is that the US-China relations have “improved”…… What a joke.

President of China Xi and President of Serbia Aleksandar Vucic signed a joint statement on raising partnership relations stating this to be a new era of partnerships between the 2 countries. China-Serbia Free Trade Agreement will begin July 1st of this year,

North Korea

North Korea sent balloons to be dropped in South Korea filled with feces and trash in response to South Korea’s distribution of anit-Northern leaflets by activists from South Korea.

Middle East

Al Jazeera’s 2 offices were shut down in Israel and raided by Police. Confiscated broadcasting equipment and blocked Israeli IP addresses from accessing the website.

The Israeli parliament outlawed the media outlet. Israel Communications Minister Shlomo Karhi signed an order instructing Israeli television providers to cease broadcasting the Al Jazeera news channel.

The Biden administration warned that if Israel forces launch a major invasion of Rafah, the US would stop supplying Israel with weapons. The month of May started with this little dilemma.

US Defence Secretary Lloyd Austin goes on record saying to the Senate that Washington had paused a shipment of weapons to Israel over that Government’s plans to carry out an operation in the city of Rafah in the Gaza Strip worried of civilian risks. Israel then sends tanks into eastern Jabalia in the northern Gaza Strip after a night of aerial and ground bombardments, upping pressure on Rafah.

And of course, Israeli and Egyptian armies clash at the Rafah border, leaving one dead. Israel then bombed the displacement camp in Rafah leaving 45 dead.

Later on in the month, Israel launches air strikes deep into Syria incurring civilian casualties and killing some Hezbollah members.

Another interesting development was May 19th, the helicopter of the Iranian President Ebrahim Raisi crashed in Northern Iran, killing him. Was this an accident? Or a special op? I have no clue, but one wonders when thinking of these subject matters.

The ICC issued arrest warrants against Israeli Cabinet members and members of Hamas.

“Yahya SINWAR (Head of the Islamic Resistance Movement (“Hamas”) in the Gaza Strip), Mohammed Diab Ibrahim AL-MASRI, more commonly known as DEIF (Commander-in-Chief of the military wing of Hamas, known as the Al-Qassam Brigades), and Ismail HANIYEH (Head of Hamas Political Bureau) bear criminal responsibility for the following war crimes and crimes against humanity committed on the territory of Israel and the State of Palestine (in the Gaza strip) from at least 7 October 2023”

“I have reasonable grounds to believe that Benjamin NETANYAHU, the Prime Minister of Israel, and Yoav GALLANT, the Minister of Defence of Israel, bear criminal responsibility for the following war crimes and crimes against humanity committed on the territory of the State of Palestine (in the Gaza strip) from at least 8 October 2023”

The White House officially disagrees with the arrest warrant. This begins to create some buzz and heats up the anti-Israel movements.

Israel’s UN Ambassador takes out a mini-shredder at the General Assembly podium to shred pages of a pocket-size UN Charter in protest to the UN he claims have turned their backs on Israel.

Was this arrest warrant all theatrics? I have no idea. Does something bigger come of this? That is to be determined.

The United Nations General Assembly has endorsed a revival of Palestine’s quest for full UN membership, urging the Security Council to reconsider Palestine's bid to join as the 194th member. The resolution was overwhelmingly passed by 143 countries and 9 voting against, 25 withheld their vote.

Spain, Ireland and Norway officially recognize the Palestine State despite Israel’s reaction and rejection of the claim. To date - there still is no official country known as Palestine, hence the emergence of nation blocs creating their own recognition.

Russia & Ukraine

Ukraine claims a record 932 mile (1500 kms) strike on a Russian oil plant in the Bashkiria region intended to disrupt critical infrastructure. Later, Russian forces launched an armored ground attack near Ukraines second city of Kharkiv in the northeast of the country.

Then Putin decides to initiate a replacement of the Defense Minister Sergei Shoigu with Deputy Minister Andrei Belousov who is an economist. Shoigu will now be serving as the Secretary of the Security Council. Russia this month seizes 700 million Euros in assets from 3 Western Banks : UniCredit, Deutsche Bank and Commerzbank.

NATO Secretary General Jens Stoltenberg at the Verkhovna Rada in Ukraine Claimed in a speech that arming Ukraine to the teeth is saving taxpayers money. He also said: “But in recent months, NATO Allies did not provide the support we promised. For months, the United States was unable to agree on a package of support. And European Allies delivered far less ammunition than we said we would. These delays have had consequences. And you know that better than anyone else. Ukraine has been outgunned, so Russia has pushed forward on the front lines. Ukraine has lacked air defense, so more Russian missiles and drones have hit their targets. Ukraine has lacked deep precision strike, so Russia has been able to concentrate more forces. But it’s not too late for Ukraine to prevail. More support is on the way.”

We even have France’s Macro on TV giving the go ahead to Kiev to bomb targets inside Russia. Which are funded and provided by the West. Six Nato countries set to build a ‘drone wall’ to deter Russia. They are Lithuania, Latvia, Estonia, Poland, Finland and Norway.

Let us not forget the truth of Ukraine’s democracy that Zelenski’s term has officially ended close to the end of May, yet with the use of Martial Law, he gets to remain in power.

United States

For commodities, we are seeing an ever growing push to support the industry from the Government, as seen above with the move by the Biden-Harris administration. This East versus West game in the short is not to our advantage as we are too far behind in our own domestic capabilities for necessary metals. They always take so much time to realize what is needed and to then put a plan, into action, that never seems to provide any sustainable solutions.

Immigration Conflict

Now this issue is just getting more and more insane. Western countries are playing with their culture and society like a damn yo-yo…

As Milton Friedman said “Because it is one thing to have free immigration to jobs. It is another thing to have free immigration to welfare. And you cannot have both. If you have a welfare state, if you have a state in which every resident is promised a certain minimal level of income, or a minimum level of subsistence, regardless of whether he works or not, produces it or not. Then it really is an impossible thing.”

This defines the modern day dilemma of free immigration as it stands. And it is destructive. There is no room for synergy and effective collaboration when energies from domestic versus foreign cannot synergies. Let's look at the glorified The United States of America:

The Illinois House just passed a $53 billion budget which includes spending over $600 million on free services and healthcare for illegals… (wtf !)

Talk about the Welfare fueling the cultural clash and financial cost being burdened from this. Now if we believe in the intention of the Left, is to convert these individuals into legal citizens, who may also be able to vote. Well who do you think would be the default party these tens of millions of illegals, would now “legally” vote for? I’d assume the ones giving them free things are the ones who will win their political vote…

After all, a DC judge upholds DC law allowing non-citizens to vote in local elections. It’s happening because we think politics will end these insane behaviors by politicians in their ivory tower.

And so the Left is manufacturing problems, to which they play the hero all to remain in power and fuel their God-Complex.

Chuck Schumer, the New York Senator for Democrats at a conference said “now more than ever, we’re short of workers, we have a population that is not reproducing on its own, with the same level it used to. The only way we're going to have a great future in America, is if we embrace immigrants. The dreamers and all of them because our ultimate goal is to help the dreamers but get a path to citizenship for all 11 million or however many undocumented there are here.”

“The difference between a welfare state and a totalitarian state is a matter of time.”

- Ayn Rand

Wow, so shocking he would say this. This was the most conclusive outcome since the immigration issue began with the welfare statism that now defines America.

Crazy Laws Never End

In the face of social decay, naturally the environment incurs more primal economic dynamics which comes with more crime and theft.

“The closer the collapse of an Empire, the crazier its laws.”

- Marcus Tullius Cicero

California lawmakers have made a new proposal to combat retail theft and shoplifting by limiting self-checkout lanes if these conditions are met (Bill 1446):

Checkouts limited to 10 items or less

One manual checkout station

Certain items prohibited

2 stations per employee.

Gavin Newson announces a new hate hotline whereby of course the welfare state will use the weakness and sensitivity of the culture to further regulate and punish its society. Hate, most often time is a concept that exists mostly in the realm of ambiguity and emotions, void of logic and intellectual foundation. But hey, we know what the west values more than strength, and that's weakness.

California Senate Democrats pass SB 961 requiring an alert system in all car systems to warn drivers when speeding. California is also considering a new $0.30 tax/mile driven. This would require a tracker in cars, a sort of government black box in your car to feed them that tax data.

Teachers Union for Chicago schools demand $50 billion, meanwhile Chicago state tax revenues are only $38 billion……. These bureaucrats and economically illiterate people love to throw numbers out there and hope it sticks. They have no comprehension of what they are asking for. It's always a game of, spend more money and things will get better. Spending money does not equate to a better outcome.

Housing program in Vermont meanwhile have just kicked-off; $25k forgivable loan for buyers who are black, indigenous or other people of color. It is legal now and part of “anti-racism” to do this so long as only whites are excluded based on their skin. Otherwise, this behavior with any other skin race, is considered racism. Who knew this word had 2 definitions…

The Political Arena

On the subject matter of current and former Presidents, Trump has been found guilty on all charges of 34 counts, in this hush money case being held in New York’s backyard. Hopefully June’s report will have more feedback to get a clearer sense of the results of this conclusion.

Now in terms of Trump versus Biden, the former versus the current will be facing off in a CNN hosted platform June 27th.

The House Judiciary Committee voted to hold AG Merrick Garland in contempt of Congress for failing to provide the subpoenaed audio tapes of Special Counsel Robert Hur’s interview with Joe Biden, after only providing the transcripts. It appears they want to hide the mental dysfunction of Biden by only focusing on transcripts. The other question is, how can the AG decide what to provide or not? How can he reject transparency like that?

AG Merrick at a press hearing claims that they should have trust in the DOJ because it is “a fundamental institution of our democracy.”........ Let us not forget America is is supposed to be a beacon of Democracy.

Republicans passed Congressman Tom Emmer bill banning the FED from creating a CBDC. But does this stop the White House from creating a CBDC?

Canada

Curbing Emigration

Canada saw the greatest emigration trend in 10 years to the US in 2022, 70% increase from a decade ago. Liberal Government under Trudeau proposed a $25K departure penalty and an increase in departure tax to curb emigration — this in the face of rising capital gains taxes to nearly 67%. The welfare state needs to keep their economic slaves to sustain their expansion and control.

Then Chrystia Freeland, the most incompetent Minister of Finance in history claimed that investors want to come to Canada to pay carbon taxes……. Who makes decisions about investing and living locations to participate in higher taxes….? Meanwhile foreigners withdraw $6.2 billion from Canada in Q1 2024.

Manufacturing New Voters

Liberal Government of Canada wants to lower the voting age to 16 and Calgary City Council (liberals) voted to allow foreigners to vote in Calgary Elections, but the Government of Alberta rejected the motion.

Equity & Diversity

The Canadian military has spent $9.5 million since 2015 promoting “equity and inclusion” programs such as a “workshop on the gendered nature of security”. Construction began on an $8 million LGBTQ2S+ national monument in Ottawa.

Why any of these things is necessary or justifiable when we are seeing socioeconomic regression is baffling.

Australia

Australia plans to wipe out $3 billion AU of student loans and then Parliament officially passes a Digital ID bill.

Slovakia

May 15th, Prime Minister of Slovakia Robert Fico was shot while meeting with supporters in the open outside, and was brought to hospital in serious condition. This comes a few weeks after he and his party rejected WHO and their proposed Pandemic Accord.

England

British PM Rishi Sunak announces snap elections taking place on July 4th. All this is nothing more than a game to attempt at having a head start on your political component in order to attempt a more beneficial political outcome.

El Savador

El Salvador arrested bankers and administrators for Money and Asset Laundering, Defrauding the Public Economy, Cover-up, Illegal Groups, among others.

Africa

According to the DRC military, 3 Americans were stopped attempting a coup near the Presidential palace.

CULTURE

Pro-Palestine/Pro-Hamas protests continue

NYPD declare protest at Columbia University a riot and initiate to remove them - of the 300 arrested, majority were not students

UCLA sees violent protests and rioting with police clash

Burning of flags of their residing country - we are seeing this in places like France and the USA in these protests.

Dutch police use Bulldozer to raze Hamas supporters camp in Amsterdam University

Princeton ‘hunger strikers’ complain University isn't monitoring their vital signs. Even in their protesting chaos, they spew socialism. We have to feed them while they pursue their selfless “moral” causes

Drone footage at Emory College shows students being trained and practicing for violent protests with the police.

Pro-Palestine rioters set fire to the Israeli embassy in Mexico City.

Other Protests

Thousands of people take to the streets of Poland to protest against the EU climate agenda.

Farmers all over Europe are heading to Brussels for June 4th to priests against the EU climate agenda.

Austrians protests in the streets asking for remigration

In New Caledonia, an island part of France since 1853 located east of Australia has seen growing escalation of violent anti-France protests. They have been received with riot police.

Firefighters across France are protesting in the streets clashing with police.

Anti-immigration protests keep happening across Europe.

Antifa Mob vandalize and destroy property in Montreal and violent protests erupt with police intervention

Massive protest in Tel Aviv demanding Netanyahu’s resignation

Communist protest takes place in Montreal

A radical left anti-tesla mob attempts to storm the premises of the electric factory in Grunheide near Berlin, Germany.

French government shut down certain areas to youth and teenagers and only allow adults due to “protests”

Youtube blocked videos of Hong Kong protest songs in the city, days after a local court approved an injunction order to ban it.

Social and Intellectual Decay in America

Chicago city saw a 80 man brawl comprised of illegal immigrants

Chicago residents in anger with new migrant housing

A segregated mental health clinic just opened in Washington for black or brown people.

Slavery reparations meeting was held in Boston for Black residents from white churches.

Chase bank branch in Youngstown Ohio was blown up.

New Jersey Marine arrested after allegedly making death threats to kill white people with a mass shooting “plan”

Maine Governor Janet Mills has signed an executive order designed to incentivize hiring of more women in construction. Special privileges will be granted to companies who partake in these games and prioritize women over men because apparently the outcome of mostly males in construction is the by-product of sexism…….

New York Governor said “Young black kids growing up in the Bronx who don't even know what the word computer is.” My god do these bureaucrats live in a fantasy world while pretending to know what's best for everyone else.

**No wonder the Trump rally in the Bronx is received by a massive diverse crowd of people from all backgrounds.

State vs Gang

In Apopa, El Savadro, President Bukele sent 2,000 soldiers and 1,000 police officers after gang members were spotted to hunt them down. .

These are some wild times. Cultures are changing fast. Where we will be culturally in 5 years is going to be chaotic, most definitely. Humanity by the year is experiencing ever growing clashes that are getting bigger, dragging down further and further the rest. How far will we have fallen as an outcome of this decay.

Covid Related News

AstraZeneca withdrew Covid-19 vaccines globally after reporting they now accept the risks of Blood Clots, which they denied in the past.

Ottawa injects another $36 million into vaccine injury compensation fund.

ECONOMICS

Central Bank Rate Decision

FED: rate unchanged

BOC: rate unchanged

ECB: rate unchanged

BOJ: rate unchanged

Bank of China: rate unchanged

Economic Warfare is only achievable through control of the marketplace

US to revoke license allowing China’s Huawei to buy semiconductors from Qualcomm and Intel.

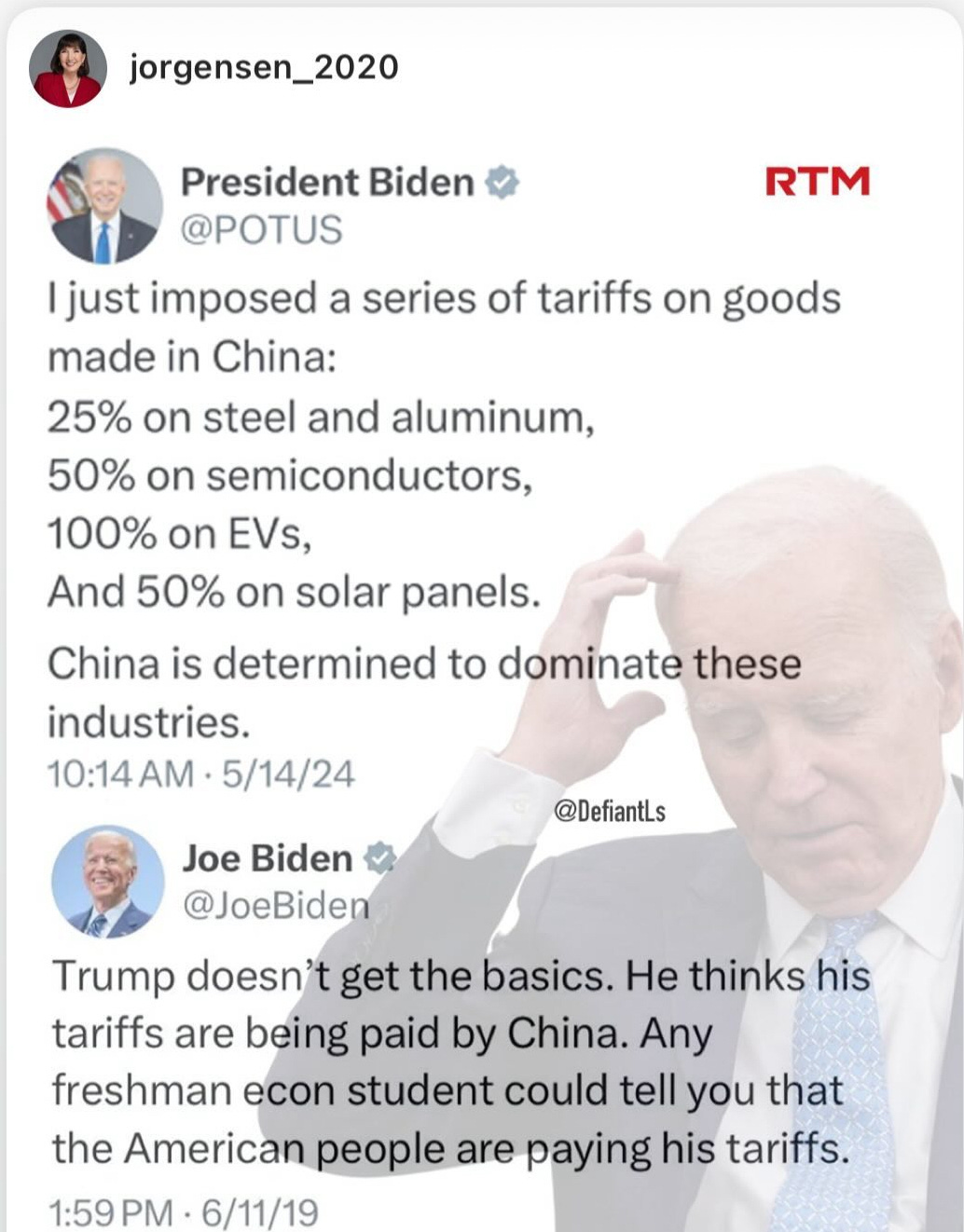

Biden hikes US tariffs on Chinese Imports. Who pays more? American taxpayers. Politicians are brilliant humans who are totally solving problems……

China is likely to hit back against US tariffs on EV, Wedbush’s Dan Ives argues.

No shit they will retaliate somehow or another. This is economic warfare.

Canada is looking into whether it needs to raise tariffs on Chinese made EVs after the white announced major new levies on them. This is what economic warfare looks like. This is anti-collaborative. What I call primal economic games which produce a regression is progress. This fuels the de-globalization thesis, creation of global Blocs and citizens as always burdening the costs of these destructive behaviors.

United States of America

Statements made by US officials around the economy that are quite delusional.

Jerome Powell “I don’t see ‘stag’ or the ‘flation’”

Biden Economic advisor in an interview says “The US government can't go bankrupt because we can print our own money”

Janet Yellen says the US Economy is doing fantastic

Biden CNN Interview claims inflation was at 9% when he came into office and continues to spew the whole corporate greed is responsible for inflation. The New York Times reported that in the CNN interview which lasted 17 minutes, Biden told 15 conformable lies.

Government and bureaucrats are always trying to distort truth and history to fit their narrative.

Now Let’s take a look at some data

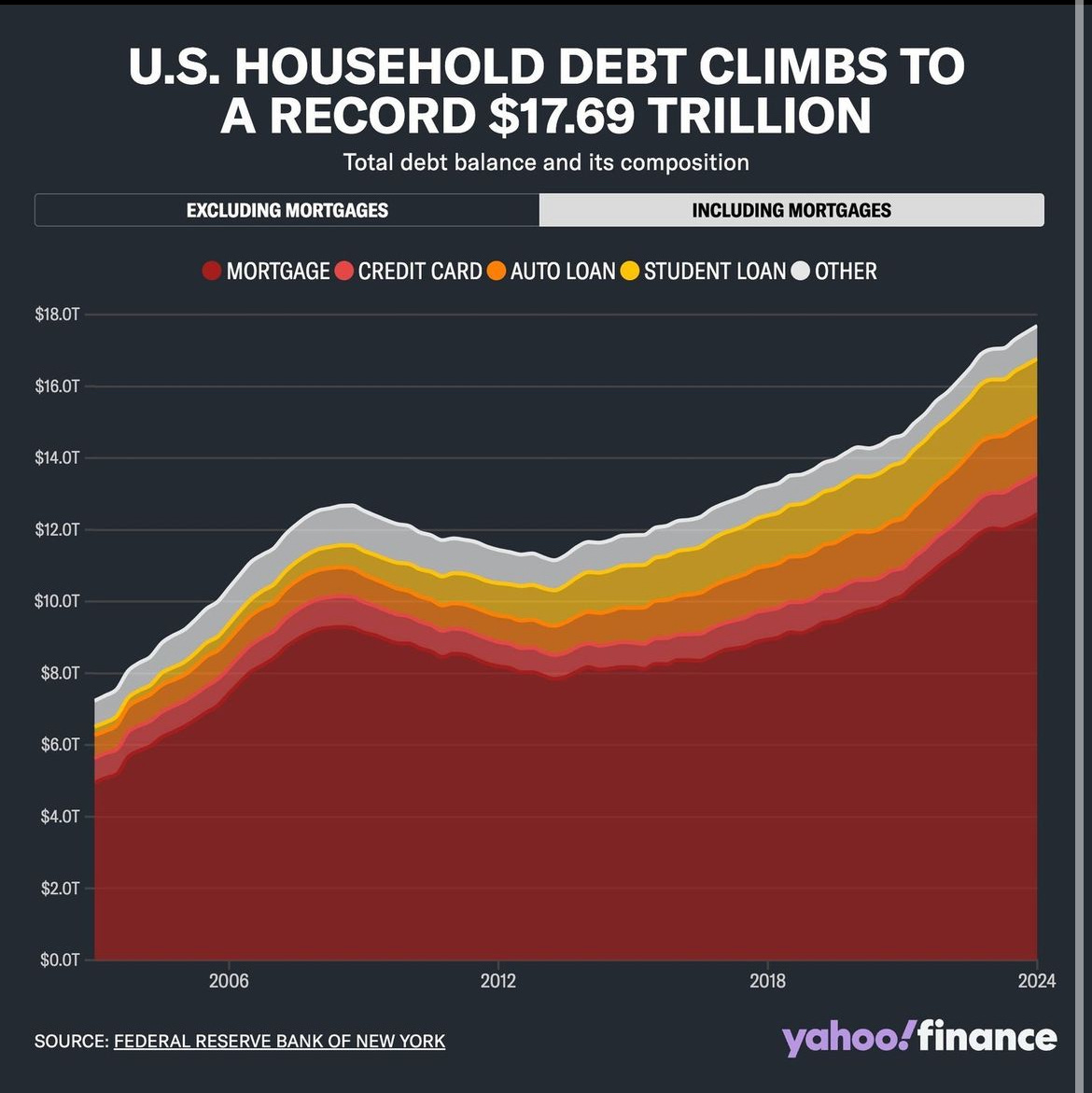

US household debt climbs to a record $17.69 USD Trillion

Credit card debt still holding over $1 trillion with APRs still over 20% for the average CC

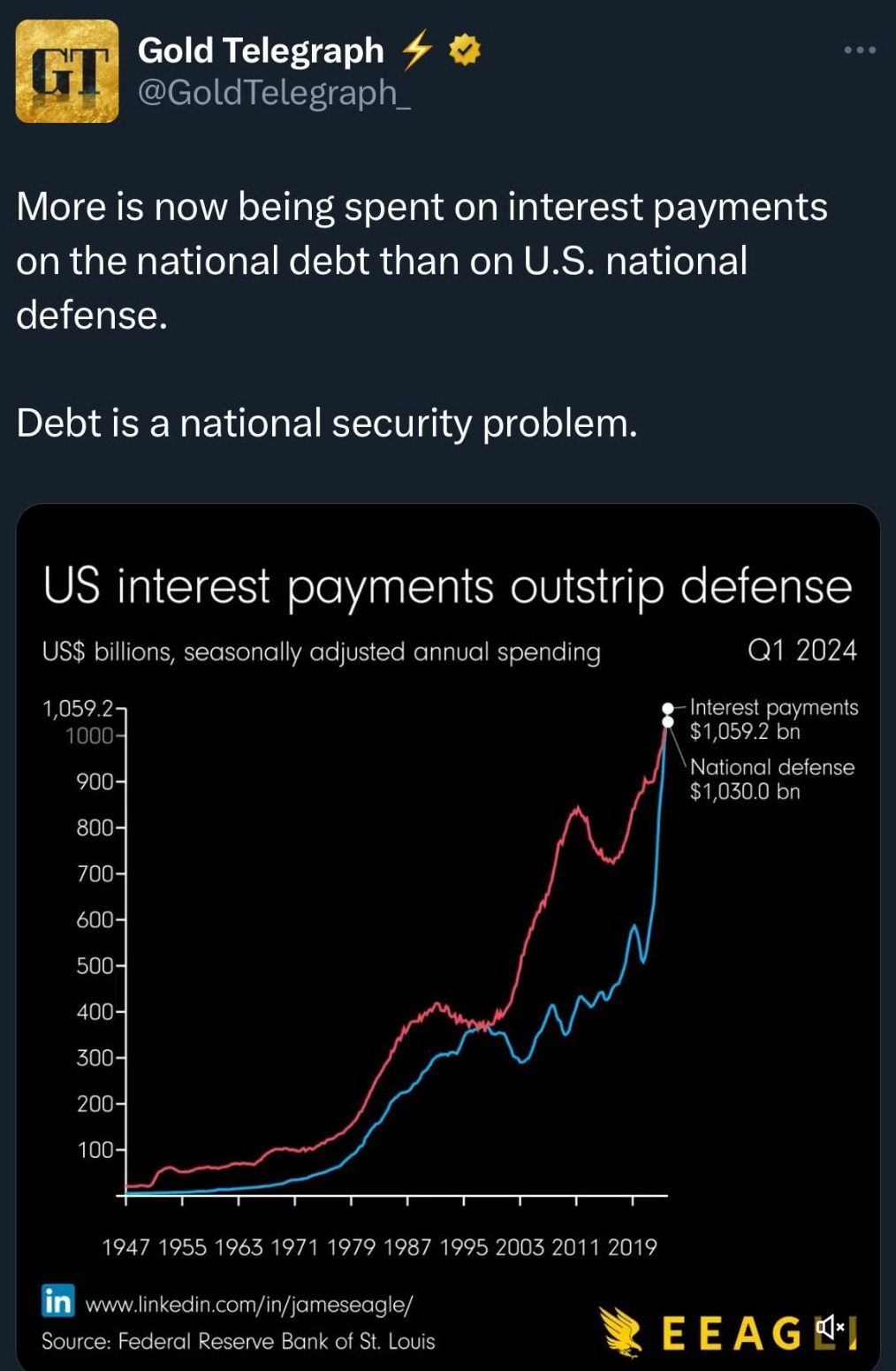

Here's a graph on US interest payments striping defense:

Debt is the only illusion keeping things going. And only deflation can bring a collapse to debt. But we all know the government doesn't want that, nor does the Central Banks, and nor do those with assets because they want to protect their wealth at the cost of the future economy. Remember, protectionism is a negative and destructive force to an economy that deviates an economy from healthy natural cycles of boom and bust. This is like an ego using debt to hide from their incompetence and insecurities by creating a false sense of truth.

Just look at the “Buy now. Pay later” phantom debt trend whereby Americans are racking up debt. Just look at those record breaking debt levels.

Reality always wins. It is a matter of ‘WHEN’, not ‘IF”.

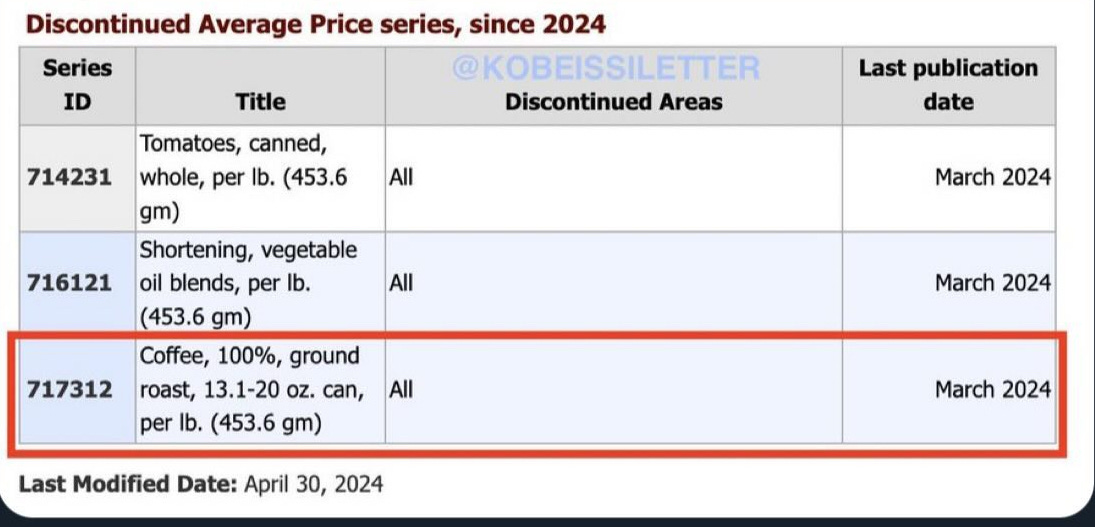

The April and onward CPI inflation reports will not include the following food items in their calculations. Talk about manipulating data to suit their narrative.

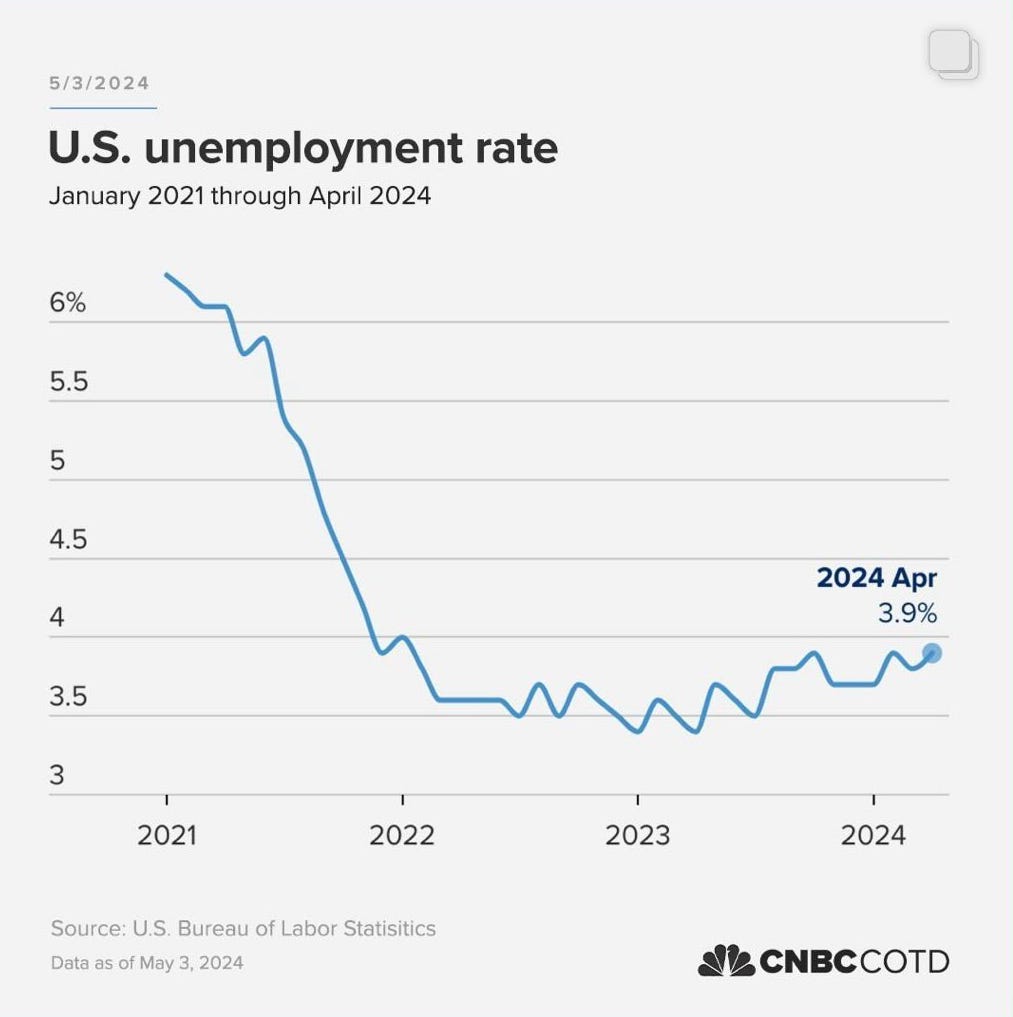

US Job growth slowed in April and unemployment rises to 3.9%

Crypto

On the crypto related front in the USA, California Democrat Congressman Brad Sherman said “cryptocurrency literally means hidden money and if it ever becomes a currency, it means we will never be able to enforce our tax laws.” We need to be wary of this very centralized POV that politicians have. And this POV will negatively fuel the utility of the crypto space relative to its initial intentions of being free market tools.

Canada

Canadian Liberal Government seeks $295 billion increase in borrowing limit. Hiking debt ceiling to $2.16 trillion, second debt ceiling hike in 3 years.

Calgary unemployment rises to 7.7%

Edmonton City is raising property taxes by 8.9%

"We do see renewed downward momentum in underlying inflation. The message to Canadians is, we are getting closer. We are seeing what we need to see and we just need to be confident that it will be sustained"

"Canadians should not be expecting a rapid decline in interest rates"

"Interest rates are certainly not going to the emergency low levels we had during COVID. They're unlikely to even get back to the pre-COVID levels”

"If we move lower than the Fed, that will tend to depreciate the Canadian dollar,"

He also made a speech later in the month saying:

“That while risks of recession at home and globally have diminished, inflation in most countries have come down, and inflation targets are in sight. However there could be volatility in the market as expectations shift as to when and by how much central banks will lower their policy rates and there continue to be important geo-political and economic risks on the horizon, against this backdrop, households and businesses continue to adjust to past interest increases. Some indicators of financial stress have risen, at the same time the evaluation of some financial assets appear to have become stretched. This could increase the risk of a sharp correction that could generate system wide stress. The recent rise in the use of leverage in the non-bank financial institution could amplify the effects of such a correction. What is most important to properly manage risks, financial system participants need to remain proactive and financial authorities need to remain vigilant.”

Poverty

Daily Bread Food Bank numbers show that food bank usage in Toronto has skyrocketed 350% since Trudeau entered office.

Food Banks Canada’s 2024 Poverty Report Card stated that “Canada has reached a critical turning point as poverty and food insecurity worsen in every corner of the country..”

China

China will soon cease displaying real-time data for flows into the world’s second-largest stock market through Hong Kong, cloaking a closely-watched indicator of foreign sentiment.

Apparently, according to a Bloomberg report, China is considering government purchases of unsold homes. Print money and manufacture your own demand. Talk about not inflating your economy…..

China to cut mortgage interest rates, home down payment ratio to boost demand.

EU

European Central Bank President Christine Lagarde has announced the launch of the EU’s new CBDC - the digital euro.

On the inflation front, she is also “really confident” inflation is under control. This goes along the statements made:

ECB will be on a monetary-easing path for a while, says Governing Council member Mario Centeno

ECB’s Lane says they are ready to start cutting interest rates.

Germany’s Central Bank says central bank business models are being forced to change as the economy digitalises. This fuels the reset narrative. German Chancellor Olaf Scholz says a planned reform to the nation’s pensions system will be approved in the cabinet. But of course, the entire first world nations of the west are facing a pension crunch with aging populations, expanding healthcare costs and endless deficit spending of money they don't have. France already went through early last year raising their age of retirement.

IMF

First Deputy Managing Director Gita Gopinath wrote a piece titled “Geopolitics and its Impact on Global Trade and the Dollar” where she says:

“Global economic ties are changing in ways we have not seen since the end of the Cold War.”

“Some countries are re-evaluating their heavy reliance on the dollar in their international transactions and reserve holdings.

“Consider a world divided into three blocs: a U.S. leaning bloc, a China leaning bloc, and a bloc of nonaligned countries.”

Look at what was said by the Russian IMF representative, that BRICs could offer an alternative currency in the event of a collapse of the dollar and the international monetary system.

The intention to move aside USD dominion is clear as day.

THE IMF is warning that widening geopolitical divides are disrupting global trade flows, creating spillover effects that are dividing the world’s economies into competing blocs. Thanks Sherlock, like that has been obvious for years now.

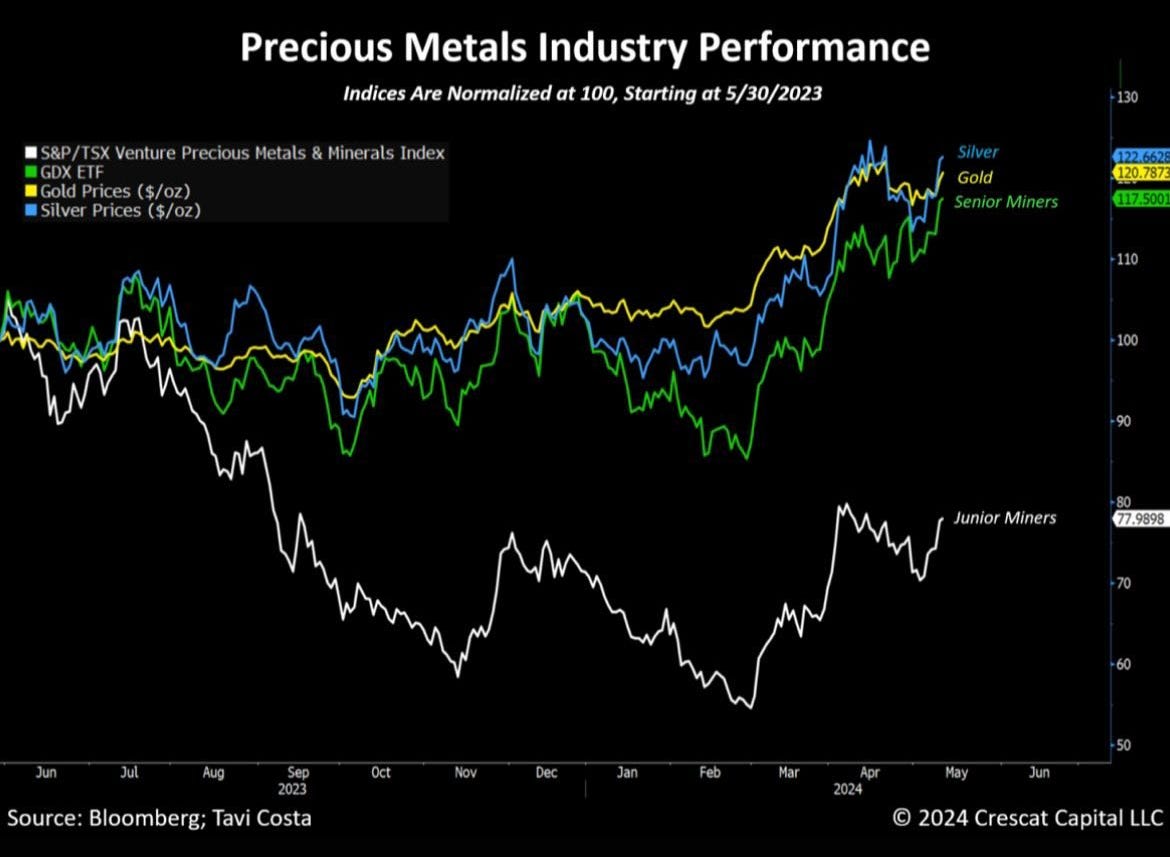

Gold & Silver Market Development

Global Gold Demand hits 8 year high in Q1 of 2024. This was fueled by the fact that in Q1 2024, China’s demand for gold bars and coins surged 68% year on year to 110.5 tonnes. China is most definitely experiencing a gold rush while the west sleeps. Meanwhile, China dumps the largest amount of US Treasuries in history to a tune of $53.3 billion.

Frank Guistra at Canaccord Genuity’s 3rd Annual Global Metals & Mining Conference in La Quinta, CA said:

“the price of gold is no longer controlled by the West. For the longest time we had a situation where the gold markets were consumed in the East but priced in the West. That’s changed, and changed very recently. China now controls the price of Gold. The reason they control the price of gold, and the reason they control the price of gold is because they have a lot of it, much more than they declared officially. They're the world’s largest gold producer, they're the world's largest gold importers, they don't allow any export of gold mined in China.”

We had India’s Central Bank claiming back into their own vaults around 100 tonnes of gold from the UK’s vaults.

Sudan and Qatar have agreed to establish a gold refinery in Doha to process gold experts from Sudan.

Silver broke $30 and then $32. Now we need to see a quarterly close above $30 and then this could really be off to the races.

Electrification & Mining Development

South Korea has unveiled a $19 billion package of incentives to bolster its chip sector. Samsung and SK Hynix may very much benefit from this. This is clearly coming from the funding from US foreign package bills.

Japan unveils first ever wireless 6G device - supposedly 20x faster than 5G.

Europe’s biggest pension fund Stichting Pensioenfonds, has exited all liquid assets in oil, gas and coal worth roughly $10.8 billion USD to redirect towards greener initiatives.

Anglo America rejects BHP’s revised US $43B proposal. With this rejection, BHP now says they no longer have any plans to further offer higher bid offers to buy Anglo.

MSFT commits to invest $3.3 billion to build Ai infrastructure. This is all dependent on more commodities and thus more mining. And there a lot of these projects happening.

Commodities

Legendary oil trader Pierre Andurand said “Copper prices to quadruple on surging green demand”

Goldman Sachs warns copper market moving into extreme tightness

Aluminum prices hit 2 year high

Equities

NVIDIA shares surge to another new record close of $1,100.

NASDAQ crossed 17,000 for the first time.

Nice graph showing an opportunity for commodities relative to the NASDAQ

DOW JONES industrial average touches 40,000 for the first time

Gamestop, AMC shares soar with return of meme stock era icon Roaring Kitty

The Office Market

Billionaire Barry Sterlich says remote work will lead to $1 Trillion in real estate losses “The office market has an existential crisis.” We’re seeing this in action, as many commercial properties are being sold down to 80% of their market value and/or purchase price from just 8 years ago…

Dollars and Sense - What We’re Buying

Written by Dan Kozel

Perhaps the most common themes this month were controlled chaos, legalization buzz, and Silver reaching a high we haven't seen since 2020.

A lot has happened in the last 31 days, and it’s quite clear that momentum can carry a tailwind of opportunities, even when you least expect it.

It’s been a rather slow month for us moving around our positions. However, one dormant holding finally woke up, after holding it for 2 years.

Polymetallic Mines - Powering Nickel Forward

I’d like to apologize for not mentioning a name that has been sitting in my portfolio for over two years. Quite frankly, I wasn’t sure about the recent developments, but my goodness, it’s been the most pleasant of surprises, and it may just have some potential.

Power Nickel - PNPN.VN has been sitting idle in my portfolio for about 482 days now. In the resource space, your patience is greatly tested, and this one was no exception. Perhaps a quick update is needed here so you can understand how remarkable the returns could be if you stick with it.

The company is run by Terry Lynch, a gentleman I’ve gotten to know somewhat well over the past two years while helping him find more investors. Terry’s asset is based in Quebec and was recently purchased from another Quebec company called Critical Elements. The Nisk asset had significant deposit potential and Terry kept telling the market just how significant the potential of it was - and he’s been right all along. However, the market grew tired when Power Nickel kept announcing funding rounds, which created significant dilution for existing shareholders and tended to attract more sellers than buyers - not to mention those damn blackbox algos, who short stock on the up-tick with one second to go in the trading day - more on that here.

Fast forward to this month and PNPN had hit something incredible…

In late April, Power Nickel’s Nisk ownership grew to 80%, after they closed the acquisition. Fast forward to a few weeks later and the discovery of a possible Polymetallic mine was just 5 km north of the Nisk project. Just to give you some context - the world’s largest and most valuable mines are in fact polymetallic - which is just a fancy way of saying the land package has access to multiple types of metals. In this case - Copper, Nickel, Gold and Silver were all found at surface.

A year ago, they released results showing some copper and gold at 60m on the surface. It was a winter target, and they started drilling in January. They made an important new discovery of a high-grade copper/PGM gold complex with some nickel as well.

Terry and his team were actively looking for nickel, and this particular section of mineralization showed an unusual combination of high-grade materials. This is very exciting. They’ve also drilled 15 holes and missed only one, indicating strong mineralization at this core project.

Summer is drilling season and I expect to see more results coming out here shortly.

I’ll be meeting with Terry and his team this week in Quebec City, at the Mining Investment Conference of the North, to gather more intel on their next planned drill holes and their plan for the remainder of the year.

Stay Tuned…. As we believe the next move up could be explosive…

Silver Update - Best Month since 2020.

Two names mentioned since our January newsletters were Silver Tiger Mining and Blackrock Silver - both exploration and early-stage producer mines located in some of the world’s friendliest mining jurisdictions (Mexico and Nevada).

These two names have seen significant growth since the beginning of Q1 this year, with our portfolio returns of 67% and 26%, respectively. This surge is not only due to rising silver prices but also because both companies have hit significant drill targets, exciting investors about their potential - these are real companies.

Blackrock Silver recently announced a bought deal financing of $10.35 million, led by Eric Sprott. Getting into a company before Sprott deploys his own capital, is often a good sign of entering the right investment. The company operates a production mine in Nevada.

Meanwhile, Silver Tiger received initiating coverage from two analysts this past month. You can read both reports in the links below. The company, led by Glenn Jessome, is expected to see even more growth this month, especially after gaining a clearer understanding of the Mexican presidential election. The leading candidate is a pro-mining enthusiast, and with Silver Tiger’s recent drill discoveries, this name is poised for further upside.

In addition , they intersected 875.6 G/T equivalent of Silver, at their core “El Tiger Mine.

Echelon Price Target - $0.75/share - Full Report Here

Either Capital Price Target - $0.75/share - Full Report Here

Any future weakness will be seen as an opportunity to add to our position.

And we do have good relationships with these companies - will keep you posted on their developments.

Other Portfolio Updates

We’ve trimmed a bit of NevGold this past month but remain bullish on the project - see previous letter here on why we owned it.

Faraday Copper - Had some incredible news this past month, as they also received a lead order financing from Pierre Lassonde, the Lundin Family and Murray Edwards. Further to an additional surface level discoveries.

We’re not bragging here, but if you, as an investor can buy into a story before these legendary mining investors, there’s almost a 90% chance the stock is going to move higher, to the upside.

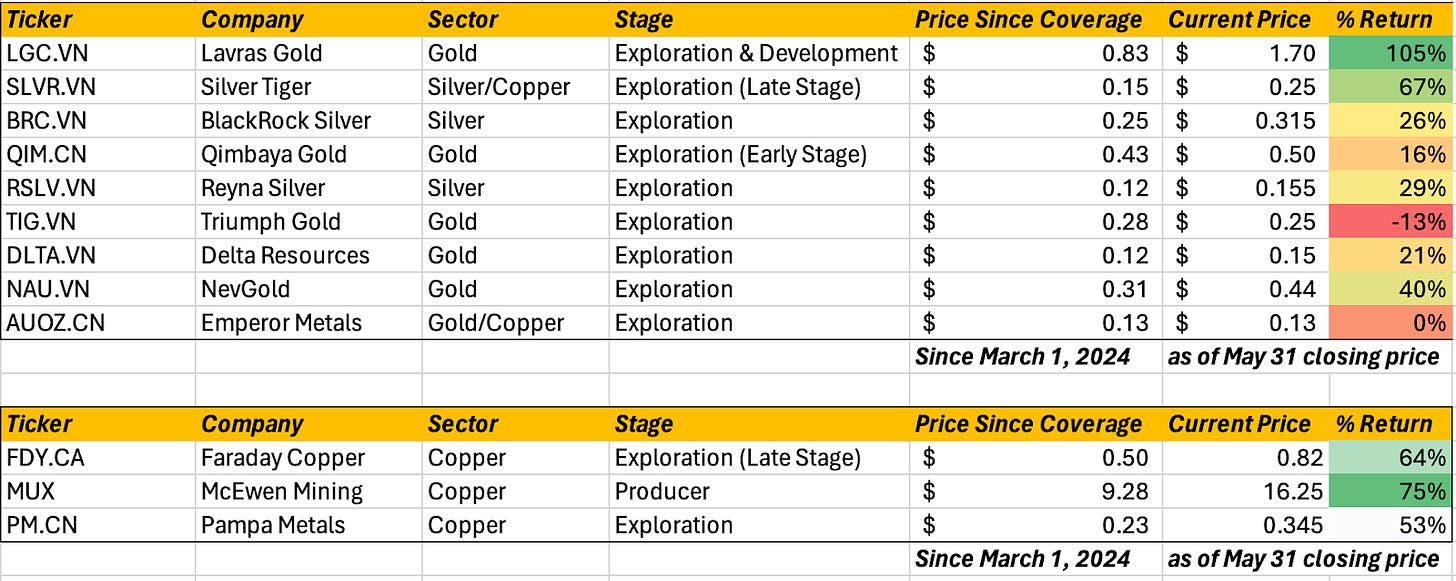

See below for current holdings.

Cannabis Train is Back

Find Names with Cash Flow and Profitability

It’s no secret that speculation in the cannabis sector ran out of steam in 2021. The focus had shifted primarily to the size of a company's facility. Those boasting large operations performed exceptionally well between 2017 and 2021, yielding returns of 1000-1500% for early investors.

However, this has recently changed, at least in Canada. The days of rampant speculation in the sector seem to have ended. Many producers were significantly impacted when the CRA announced that approximately $300 million in excise taxes were owed by several cannabis companies, leading many to face potential bankruptcy.

The future of this sector will be driven by companies that can manage cash flow and maintain profitability, while growing revenue and margins at a steady pac.

One company we've been accumulating shares in over the last several months is, The Good Shroom Co. - MUSH.VN. Many of you who attended our investor gathering in Montreal on May 23 are already familiar with the company and its story. Full disclosure, we own about 67,000 shares of this company and want to provide a better understanding of why we believe in its potential.

The company started in 2021 with a cultivation license but soon realized the difficulty of competing with other licensed producers. This led them to acquire a processing license instead, allowing them to focus exclusively on branding and producing specialized products for consumers.

A significant turning point for MUSH was when they began experimenting with different edibles, leading to the creation of brands like OG Jerk and Le P’tit Snak, which have become popular in Quebec. Over the past year, they’ve seen solid revenue growth and had their first profitable quarter as a public company.

While the stock currently trades at $0.15 per share, it seems the market has fully valued the company's current status. However, we will be watching the next few quarters closely as Eric and his team launch a new product, which may attract consumers from another category. Any increase in revenue growth and profitability should provide a boost to the stock. If the product launch goes as planned and translates well into earnings, we see no reason why the stock should trade below $0.20 per share.

If you’d like to hear from Eric Ronsse, CEO, take a look at our Capital Market Series episode with him or reach out to us directly. We’d be happy to arrange a meeting between you and the company.

Uranium Update - Good Time to Go Long, Again

Since Uranium has pulled back significantly, and the structural supply still contains a massive gap (which will take a few years to close), we’re going to be looking closely at the next 30-60 days in the commodity. The chart below is a clear indication of where prices are going, even after the total capitulation we’ve seen these past several months.

Will be going long the Uranium Index and keep adding to the Sprott Uranium Index as prices recover - this is a long-term play until companies figure out a way to adapt to the new market dynamics. Here are some other names we spoke about previously in our other reports.

This is looking identical to the Silver breakout we saw a few ago - all signs point to a higher Uranium price here. Be patient :)

Wrapping Up

Thats all for this month - if you have any questions, please email or contact us directly. And if you’d like to chat with any of the CEO’s we’re in contact with, we’ll be happy to coordinate.

Enjoy the early days of summer.

Cheers,

*DISCLAIMER* - READ CAREFULLY

None of the information taken within this newsletter should be considered investment advice and should only be viewed for information purposes only. NewGenMindset is not a broker, or a licensed provider of financial services. All claims made in this newsletter to any listener should not be viewed as offering personalized legal or investment counseling. Any investments made in any companies should be consulted with a licensed financial professional from here on.