March Madness isn't over...

Russia and the FED continue to provide some insights into the market's next move, while China sends copper to a new highs.

Hi There,

We hope you had a great Easter Weekend.

It seems the FED is just dragging its feet on those rate cuts, because why make things easy, right? As the world keeps on turning, we're all left scratching our heads wondering what kind of rollercoaster ride the next 8 months will be.

And oh boy, Q1 ending with the markets on a bull run - surprise, surprise! Is it just me, or are we all waiting for the other shoe to drop?

So, picture this: last night, I'm strolling through my neighborhood and what do I see? A taxi driver delivering food to a house... in a Tesla. I mean, is that the new normal now, or have we officially hit the bottom?

And let's talk about gold hitting those all-time highs. Is it because everyone's suddenly investing in shiny rocks, or is it just the good ol' US Dollar playing hide-and-seek with its value?

March Madness - for your portfolio.

Global pandemonium? Check.

Domestic madness? Double check.

But hey, who needs stability anyway, right?

And in the 3rd Edition of Macro Chronicles, we're not holding back. Nope, we're diving headfirst into the mess and embracing it.

Buckle up, folks. It's about to get real interesting. Let's dive right into this circus.

Macro Headliners

written by Nic A. Tartaglia

Political

Moscow Attacks

This was a surprise to many and primarily left out of the mainstream media. There was a massive attack in Moscow where officials claimed there were at least 4 gunmen attacking Russians at Moscow’s largest concert hall. Close to 150 people were killed and dozens more injured. The Terrorists were apprehended attempting to flee to Ukraine, with some of them being identified as having Ukrainian identifications, according Russian Officials. The Western narrative is that ISIS is responsible, claiming they took responsibility. But that narrative is an odd one, since there is very little history of conflict between Russia and ISIS, and no motive has been established as to why ISIS would have wanted to do this. The Russians on the other hand believe this was a consequence of US, UK and Ukrainian influence. One of the soldiers allegedly admitted to being offered a few thousand dollars, as a sort of hired hitman.

In what appears to be escalation, Russia resumes drone and missile attacks, targeting energy infrastructure in Ukraine. Clearly with such an attack at the heart of Russia, they are more motivated to increase their retaliative force.

Which narrative is most plausible? ISIS did it? Or the West did?

Continued Support for Ukraine

As the conflict between Russia and Ukraine persists, the notion of Russia's demise seems increasingly like a fairy tale that Western forces had many believing in early on. We can see it in the desire for escalation, with French President Macron being a perfect example of seeking approval to send troops to Ukraine. At the same time, Germany and France joining 12 other EU countries in calling for the European Investment Bank to enhance its financing for defense as it means to boost its bloc’s security in what they claim is due to growing Russian aggression.

On the American front of support with $, National Security Advisor Jake Sullivan made a visit to Ukraine and vowed that the US house will approve a $60 billion aid package. Far greater of a promise than Biden’s National Security Advisor announcing an emergency package of security assistance of $300 million worth of weapons and equipment to Ukraine. So the support here will keep draining the pockets of Western citizens.

Eastern Conflict

North Korea is still in full preparation mode, and their activities are validating this. North Korea’s Kim visits the Tank Unit and calls for airtight combat readiness. Kim guided military drills that included fire from an artillery unit capable of hitting Seoul. With the escalating presence of western forces in the east, I see why North Korea would be getting prepared.

Meanwhile, the US and Philippines plan military drills near the disputed sea near Taiwan. “The PRC (People’s Republic of China) portrayed the Philippines as a provocateur rather than a partner for managing disputes in the South China Sea while the Chinese Coast Guard drives heightened tensions in the South China Sea.” Taiwan is at the center of this tug of war between China and the West. “Taiwan’s Ministry of National Defense announced that it redefined its criteria for a “first strike” against PRC military assets, which now include a “first move” by PLA aircraft and vessels across Taiwan’s territorial boundaries. Meanwhile, “the PRC’s Taiwan Affairs Office (TAO) spokesperson Chen Binhua stated that “peaceful reunification” with Taiwan remains the PRC’s policy despite the omission of the term “peaceful” from the Two Sessions government work report.”

At the same time, presently, the US is spending hundreds of millions of dollars to develop maritime capabilities in Southeast Asia as nations face growing pressure from Beijing in the disputed South China Sea, a senior US official said. “We spend a great deal of time, effort and money investing in building the maritime capacity of our partners,” Assistant Secretary of State for East Asian and Pacific Affairs Daniel Kritenbrink said.

Joe Biden’s administration proposed a $850 billion pentagon budget for fiscal 2025 - with an aim to tap US stockpiles to arm Taiwan, providing major funding increases for long-range, air-launched and anti-ship missiles.

China announced defense spending will grow by 7.2% in 2024.

Governments around the world are militarizing at a pace unseen in decades.

Middle East Continuation

The PRC, Russia, and Iran held the joint Maritime Security Belt – 2024 naval exercise in the Gulf of Oman from March 11 to 15 located between Iran and Oman. Alliances are continuing to be strengthened and the division between East and West is growing clearer.

The Houthi conflict in the Red Sea is still a continuing conflict to watch. Attacks are still occuring in this area. The US is still sharing moments of conflicts in Yemen.

President Biden seeks a ceasefire between Israel and Palestine. This conflict is really splitting as a military issue, going as far as dividing political groups even within themselves, especially within the Democrats and the Liberals.

US approves possible javelin missiles and related equipment sale to Morocco for an estimated cost of $260 million.

US sanctions on Iranian natural gas exports are failing, with surging exports of liquid petroleum gas. In 2023, Iran became the middle Middle Eastern supplier for the fuel. The USA attempted to dent energy sales. As they did with Russia, with no real success.

Don’t let any politician or daydreamer tell you the whole world is all fine and dandy. Use that truth to hedge and understand how to be malleable to what is happening around the world, so you do not get blind sided. To maintain one's sovereignty, macro awareness is crucial.

New Regulations to be Wary off

In Canada, Bill C-63, the Online Harm Act “seeks to introduce harsher penalties for existing offenses. It would allow sentences of up to five years behind bars for hate propaganda, up from the current two years. It would also allow a judge to impose lifetime imprisonment for advocating genocide.” The Canadian Civil Liberties Associated warned against this. The mixing of government and social media for digital control will continue growing as a problem. Speech is at risk.

In the US, Senator Bob Casey, Pennsylvania Democrat introduced a bill called Shrinkflation Prevention Act of 2024. These politicians act as though inflation itself is an act of the free market. They forget to look inwards rather at the marketplace. Businesses do have the option to reduce the quantity of their products rather than push prices up, hence the concept of shrinkflation. But this is the choice of a business. Who is the government to dictate any of these market dynamics? Oh right the Welfare State can’t stay away from pretending to be some hero who will solve economic problems with more control and regulations. Precisely the behaviors that drive us into these market problems.

California moves to expand zero-down interest free home loan programs to illegal migrants. Assemblymember Joaquin Arambula, D-Fresno, introduced legislation, Assembly Bill 1840, in February to expand eligibility for the California Dream for All program, which uses a “shared appreciation” lending model. No wonder people in California are paying the highest costs in America, the state has become a heavy socialist welfare state and the citizens are footing the entire bill.

In the same realm of socialism insanity, Bernie Sanders introduced legislation that could make a 32 hour work week a new U.S. standard. Let’s not forget, these are the same people who cause the inflationary problems that regress the standard of living, while taxing people for what they work hard for. Now the solution, one that is from a POV of privilege since most of mankind now and in the past have no concept of ‘days offs’. All while productivity is becoming a growing problem, and in Canada alarms are being sounded on the collapse of productivity. Yet here we have politicians day dreaming of a fantasy world all so they can appeal to the ignorant for votes.

The Biden administration has proposed a 30% tax on bitcoin mining in a new budget proposal. In a U.S. Department of the Treasury document titled “General Explanations of the Administration’s Fiscal Year 2025 Revenue Proposals,” the administration stated that current laws do not address digital assets apart from broker and cash transaction reporting. Because of this, the administration wants to impose an excise tax, taxes levied on goods like fuel, on digital asset mining. The Treasury wrote: “Any firm using computing resources, whether owned by the firm or leased from others, to mine digital assets would be subject to an excise tax equal to 30 percent of the costs of electricity used in digital asset mining.” The administration suggests it could generate nearly $10 billion in 2025, and north of $42 billion over the next decade.

On the Social media front, the US House passed a by-partisan bill - bill HR7521 that could force TikTok to cut ties with Chinese parent company Bytedance or face nationwide ban.

The UN stalls bid to examine sun-blocking ‘climate change’ tech. Switzerland’s attempt to explore the possibility of dimming the sun has been dismissed by a United Nations summit in March. Solar geoengineering will go no further for now. A debate at the UN Environment Assembly (UNEA) in Kenya failed to reach a consensus on the issue. Switzerland had suggested creating a UN expert group to study the “risks and opportunities” of solar radiation modification (SRM), a controversial set of technologies aimed at cooling the Earth but the EU canceled its draft resolution in the face of strong opposition from other nations. Thankfully for now this is not a problem, but it seems to be a ‘solution’ some academics in a lab believe. Honestly, it seems dangerous to be playing God with nature like this. So stay aware of the developing insanities for ‘climate change’.

Government Spending

The US House approved a $460 Billion spending bill, moving to the Senate where they hope it'll pass in time to avert a partial government shutdown. This is becoming a never ending recurring problem, waiting to get near shutdown of government to then justify more spending. Cutting their spending seems to be a non existent solution to those who love spending other people’s money.

Congress released a +1000 page spending bill with a nearly $1.2 trillion price tag, featuring money for the departments of State, Homeland Security, Defense, Labor and Health and Human Services, as well as funds for foreign operations, financial services and the legislative branch.

Democrats of course put in spending commitments such as:

$850K for a gay senior Citizens home

$15 million to pay for Egyptians college tuitions

$500K for a DEI Zoo

$400k for a gay activist group to teach elementary kids about being trans

400k for a group to gives clothes to teens to help them hide their gender

Money truly has no meaning but to fuel the fantasies of these political ideologues.

The Battle Versus Dems and Republicans

The U.S Supreme Court has restored Donald Trump to this year's presidential primary ballots. Former President Donald Trump will not be disqualified from Colorado’s presidential ballot under the 14th Amendment, the Supreme Court ruled. “Colorado was the first state to kick Trump off the ballot as lawsuits have proliferated across the country challenging his candidacy, with Maine and Illinois following, but the court’s ruling Monday kills those cases, as justices unilaterally found that states cannot remove federal candidates from the ballot.”

2 days later, Nikki Haley officially drops out of the Race for Presidency, leaving Trump as the clear primary candidate for the Conservatives. Nikki although seemed to appeal far more to Democrats than republicans.

Special Counsel Robert Hur led the investigation into President Joe Biden's handling of classified documents. He faced heavy fire from both Republicans and Democrats in congressional testimony. After Trump had his Mar-O-Lago home raided for “abuse” of classified documents, it now became Biden’s turn to be on the spot. The Republicans wanted to know why Mr Hur had decided not to prosecute President Biden for having classified documents that were from before his presidency and found in many different locations belonging to Biden.

Democrats attacked Mr Hur's remarks in his explosive report on Mr Biden's mental acuity. Democrats are fixated on keeping the illusion of Biden being sharp, aware and capable going for as long as possible. They take citizens for complete imbeciles.

Government ‘investments’

Let’s begin with the incredible yet insane Trudeau speaking on “climate change”, seeking to “invest” $8.4 million on research across the global south to better understand how climate change interacts with democratic decline. According to proponents of the climate fears, there is an attempt to establish a link of causality between the ramifications of a fractured culture and oppressive governance with the phenomenon of climate change..In their fractured logic, the consequences of a regressing culture, with abusive and manipulative government that produces social decay is actually the by product of climate………. Scapegoating and misleading citizens has become too much of an easy thing to do. We need to end it before they spend us into oblivion while pretending to solve climate change.

The EU pledges to bolster ties with Egypt with a $8 billion funding. The so-called purpose is to curb migration. Spending around migration across Europe and North America is rising. And again, more burden on citizens while governments spend more and more.

Cultural

Haiti’s Societal Collapse

Haiti's political system collapsed, with a state of emergency declared because the Haitian Gang led by Jimmy Cherizier, “aka barbecue” , has led an escalation of violence against the Haiti government, saying it was a bloody revolution and not a peaceful one. President Ariel Henry fled Haiti as Haiti fell to the gangs. The 2 largest prisons in Haiti were stormed, giving the chance to 1000’s of violent prison inmates to escape. The US, Canada, Germany and the EU have had their embassies begin to evacuate. About a week before this developed in Haiti, the Trudeau government of Canada promised a funding of $123 million of taxpayer resources to “improve security” in Haiti. Great to know the Western government has had so much successful influence in Haiti while spending citizen’s money.

Protests & Revolt Continue

In Cuba, thousands took to the streets to protest wanting an end to the 64 year communist Castro regime. This comes after power cuts and food shortages plague cubans. Centralized economies over a long enough time period will experience decay. This tyrannical government has been in control of the market for decades, and the compounding effect of that horrible combination is beginning to show signs of reaching boiling points. Government, a negative economic force, cannot remain the foundation of economic continuity for a society. Only the marketplace can accomplish this. Decay is observable around the world. Plan and hedge accordingly.

Spanish farmers and police clash as roads are blocked in northwestern Spain by farmers pushing forth waves of protests over Government actions in the agricultural sector. They are angered by excessive environmental demands in the EU's Common Agricultural Policy (CAP) and its forthcoming "Green Deal". Farmer conflict still in full effect, seeing growing conflict in Brussels (EU headquarters), Poland, Czech and Germany. We are seeing farmers rise in Rimouski Quebec also, following the footsteps of their European neighbors against government overreach, wanting to remind people that farmers are important to have food on their plates.

Activists claim responsibility for an attack on the Tesla GigaFactory in Berlin where a power outage was induced. The activist group is called “Volcano Group” and their actions weren't isolated only to Tesla’s factory, impacting thousands of homes around. These climate activists are acting like terror groups and they are becoming a threat. Disruptive forces from within were as destructive to Rome as the external problems.

Social Decay Acceleration in Canada & USA

With a combination of social decay from a weakening and politicized culture, and uncontrolled migration is showing to be destructive, giving opportunity for the Government to exert more power and control.

What has been occurring in New York City is a perfect example of the rising police State. Governor Kathy Hochul, deploys close to 1000 National Guard and State Police to the NYC transit system, checking bags and patrolling. She even admitted that a refusal to have your bags checked if requested would mean a refusal to enter the transit. Safety has been used for this expansion of power. The rise of the police state as conflict rises. Philly transit boss takes a lesson from New York and calls for National Guard help as Philly experiences rising violent crimes. NYC mayor Adams meanwhile came out a few weeks before saying New York is the safest big city in America and not to fear. Talk about trying to create a distorted reality, an illusion. What they fail to understand is that this will resolve nothing when the problem is social decay.

LAPD established a new Unit to combat the rise in residential burglaries orchestrated by foreign gangs. Chaos from within is plaguing America, undoubtedly.

There is a trend in American cities where mayors and their politicians who supported open borders and advocated being sanctuary cities are now asking their citizens to open their homes to illegal migrants who are flooding their communities as we have witnessed in Denver Colorado.

The Biden Administration supposedly flew as many as 320,000 illegal immigrants on secret flights into the U.S., in an effort to decrease the number of illegal immigrant encounters at the Southern Border. Use of a cell phone app has allowed for the near undetected arrival by air of 320,000 aliens with no legal rights to enter the United States.

The migration problem mixed with defected laws in some states such as squatter rights is becoming a problem, so much so Governor Desantis signed a law squashing squatter rights. There was an illegal migrant with a TikTok who was spreading this flaw in the US encouraging others to come to America where the border is indeed open and take over a home in some places that have squatter rights to be taken advantage of.

On the other extreme of the social decay, armed citizens in Hartford Conn have begun patrolling the streets day and night in their neighborhood, while cleaning up the community. Time to take back the community and protect it themselves is their conclusion. Safe communities are becoming a distant reality. Families and businesses cannot function and plan when violence becomes a predominant issue in an ecosystem.

Look at Toronto where police advised people to leave car keys at the front door to prevent escalation with possible thieves since the violent crimes and thefts are escalating at a rapid pace. An estimated 12,000 cars were stolen in 2023 with a rough value of $800 million.

Economic

Energy Sector Development

Britain’s National Grid proposes a $74 billion energy system upgrade. Infrastructure spending is how Governments will prioritize economic “stimulation” and create employment. This is becoming noticeable as a means to push GDP and employment up by governments around the world.

Another Government initiative is the Biden Administration announces plans to lend more than $2.26 billion to Lithium Americas Corp, who is developing the largest lithium deposit in the country in Nevada. Talk about governments fueling monopolies and playing special interest games.

Yellen visits US lithium producer Albemarle in northern Chile for green transition as the US sees a big jump in imports from Chile. While there, she stated that rising demand for clean energy could generate some $3 trillion in global investment opportunities through 2050. Governments will be spending trillions clearly to make this happen.

This clearly creates a commodities opportunity since the demand is greatly above the capable supply as we speak.

How much debt and burden will citizens incur to make this fantasy a reality?

How secure will their access to energy be as this forced transition occurs?

Biden Admin awards Intel $8.5 billion chipmaking grant in direct funding under the CHIPS Act. This would help Intel advance American semiconductor manufacturing and technology leadership in the AI era. More special interest and fueling of big companies, and then they complain they are too big. The irony and hypocrisy of bureaucrats.

Growing Problems In Renewables Sector

Swiss Solar panel maker Meyer Burger wants to start operations in the US in 2024 after a flood of products from China forced it to close one of Europe's largest solar factories.

Saudi Aramco CEO says energy transition is failing, world should abandon fantasy of phasing out oil. This one seems to be an obvious statement but to the climate hysteric people and the government alongside their so called ‘experts’, don't seem to understand how you can't just phase out an energy source that is fundamentally intertwined with the global economy and infrastructures. Oil, and alot more of it will be needed to get all the commodities out of the ground to make this transition. Plus, nations outside the Western bubble do not have the same incentive to put their economies at a disadvantage, putting their infrastructure and energy grids at risk.

We have a perfect example of the lack of understanding from the government and their experts that the Biden Administration slashed its target for US electric Vehicle adoption by 2030-2032 from 67% to as little as 35%. The Fraser Institute came out saying that Ottawa’s EV mandate is so unrealistic, it would require an equivalent of 10 new mega hydro dams or 13 large natural gas plants nationwide within 11 years. The marketplace will suffer the consequences of misplaced and ignorant intentions.

The other issue arising is the true sustainability of some renewable projects like solar panel farms. Why? A perfect example is a weather occurrence in Texas that experienced a strong hail storm that damaged thousands of solar panels at a 350 MW farm. Apparently, the solar industry is losing $2.5 billion annually from equipment underperformance, likely caused by equipment malfunctions and weather conditions, according to an article in kWh Analytics’ 2023 Solar Risk Assessment.

How sustainable is this source of energy when it is at risk from nature to this extent?

The issue of licensing/permitting processes in the mining industry is crucial to solve if we want to tap into USA’s and Canada’s vast resources. This issue ensures American companies are at a disadvantage in terms of competitiveness against international mining companies and jurisdictions. Freeport CEO, Richard Adkerson voiced his concerns that the US must improve the copper mine permitting process if it hopes to boost domestic supplies. He said "the question is, given our political system that we have today and the dysfunctionality of it, how do you go from getting a project verbally accepted to getting actions done?"

Meanwhile, U.S. Energy Secretary Jennifer Granholm told the conference that she supported efforts in the U.S. Congress to reform the country's mining laws, some of which were first approved in the 19th Century. We shall see how quick and effective these politicians can be with this issue in the coming years.

Debt, Inflation & Interest Rates

Global Government Debt has reached $82 trillion. Global debt levels hit a new record high of $313 trillion by year end of 2023, with developing economies scaling a fresh peak for the ratio of debt to their gross domestic product, a study showed. The Institute of International Finance (IIF), a financial services trade group, said that global debt surged by over $15 trillion in the last quarter of 2023 year-on-year. The figure stood at around $210 trillion almost a decade ago, according to the data.

US Federal debt has surpassed $34.5 trillion, with a pace of nearly $1 trillion every 3 months. The U.S. unemployment rate rose to 3.9%, higher than the estimate of 3.7% and highest since Jan 2022. US producer price index (PPI) comes in hotter than what they expected for February, rising 0.6% from January.

FED holds rates in March. But Jerome indicates a potential for 3 rate cuts in 2024. This does not appear to be an outlook he alone holds. “Strong job growth is not a reason for us to be concerned about inflation” - Jerome Powel. He also said inflation data released is pretty much in line with their expectations, but restates that it won't be appropriate to lower rates until inflation is on track toward the 2% goal. This reinforces the stagflation thesis, assuming inflation does hold persistent and reignites another wave. But raising rates is not what they want to do either. The Central bank is reaching a climax where it will become clear that they are stuck between a rock and a hard place. They don’t want deflation as debt is hitting record levels on a weekly basis.

Treasury Secretary Yellen insists that American households are better off under Biden and that 2024 will be a very good economic year for Americans. This is the same Keynesian economic expert who just recently in an interview, Janet Yellen says she regrets saying in 2021-2022 that inflation was transitory. So take her words and economic outlook with a grain of salt.

Other Central Bank moves:

Canada holds rates

The Bank of Japan raised its interest rates for the first time in 17 years, ending its negative rate policy.

Argentina’s central bank cuts interest rates to 80% from 100% as the Peso has been strengthening.

The Chinese Central bank has room to cut bank reserves ratio further, the Deputy Governor says.

The ECB decided to keep rates unchanged also. But their outlook for rates is similar to that of the FED. ECB Governing Council members Pierre Wunsch & Pablo Hernandez De Cos said policymakers will have to lower the rates, with June being an expected starting point. We even have Italy’s Bank Governor Fabio Panetta saying a rate cut is expected.

Bankruptcies & Employment Trends

The Body Shop Canada files for bankruptcy closing 33 stores

Dollar Tree to close nearly 1000 stores after a Q4 loss

The S7P global ratings released a report showing that the number of corporations defaulting on their debt has hit its fastest pace since the great recession of 2008-2009.

As this trend continues, it will absolutely put downward pressure on employment.

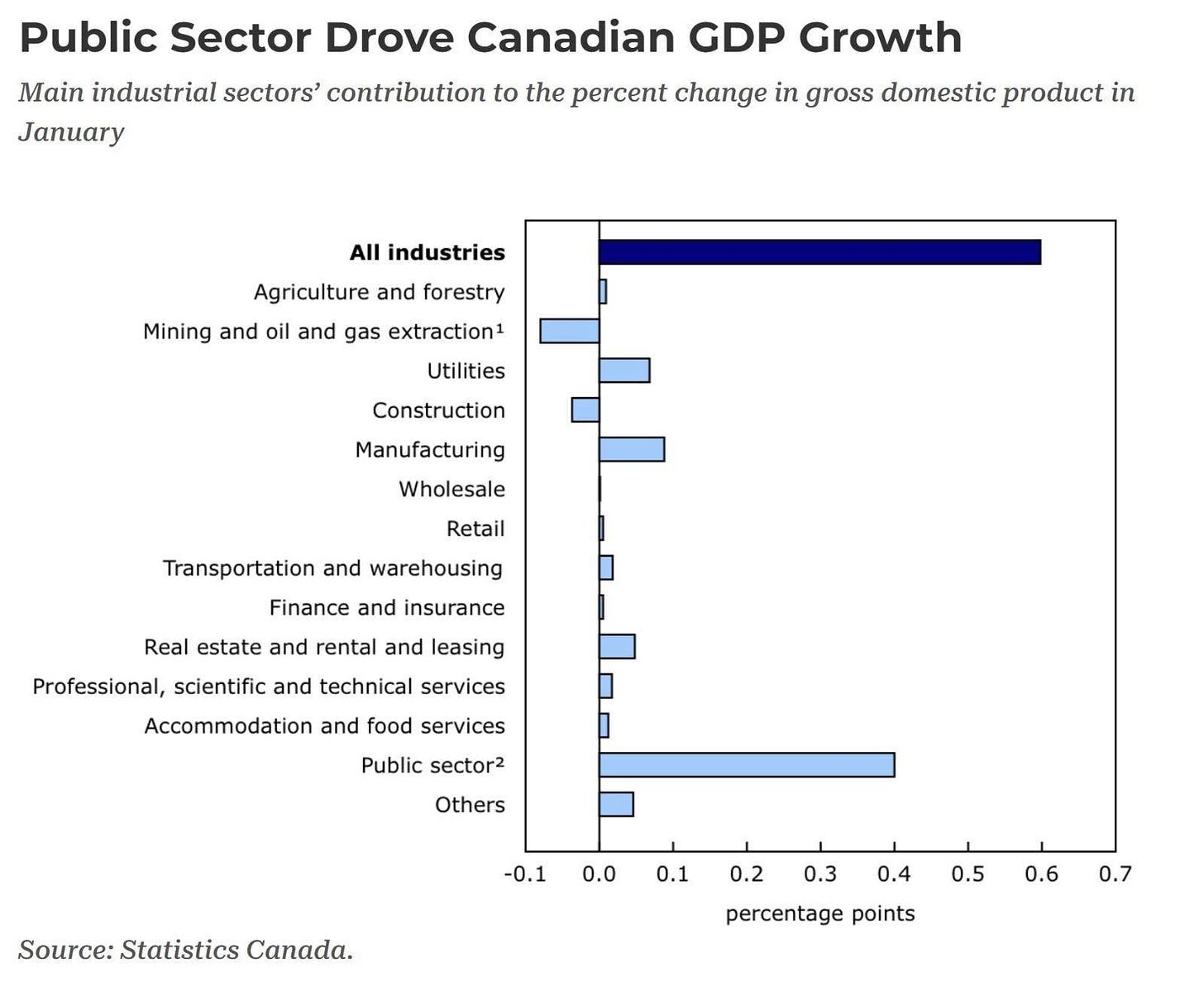

It seems that as the private market place regresses, the public sector will grow to offset this, be it directly with public jobs or indirectly with government subsidies to private companies.

Bell Canada lays off 400 employees.

Ericsson to lay off 1200 employees as 5G demand slows down.

Touching on the subject of employment, the graph above provides a window into how the Government has distorted the reality of the market “strength” by subsidizing the labor market and fueling the increase in GDP through spending programs and debt. Sustainable economic strength cannot come from what the government does, as it depends on taking/controlling the market place.

Can we truly call these distortions strength? I believe not. In time, the truth shall be revealed.

Canadian Real Estate is Boiling

One must begin to watch real estate in Canada with some important developments:

Canada’s Superintendent of Financial Institutions has directed banks to begin assessing risky mortgages and estimating potential losses immediately as mortgage defaults begin to skyrocket. They have also told lenders they will have to limit loans to borrowers with mortgages greater than 4.5x times their annual income.

Equifax has informed that in Q4 2023, there is a noticeable increase in missed payments by mortgage holders in BC and Ontario. See this lagging data, watch how it will continue to creep up on us.

RBC economics estimates that half of all the wealth generated in Canada in the last 3 decades has come from homeownership. This only validates that the Government and Central bank want to absolutely avoid a deflation in the real estate market as much as possible as the market’s wealth effect which encourages spending is tied to this asset.

Commodities development

Jiangxi Copper buys $212 million worth of Canadian First Quantum Mineral located in Panama.

JP Morgan names gold as their #1 commodities pick with a price target of $2500 in 2024.

Gold hit an all time high 4x in March closing the month close to $2240 USD. Bitcoin, SP and Nasdaq also hit an all time high in the month of March. Is gold foreshadowing something the market is ignoring?

Silver poked its head above a 15 year resistance on the quarterly chart.

Cocoa prices spike to record high

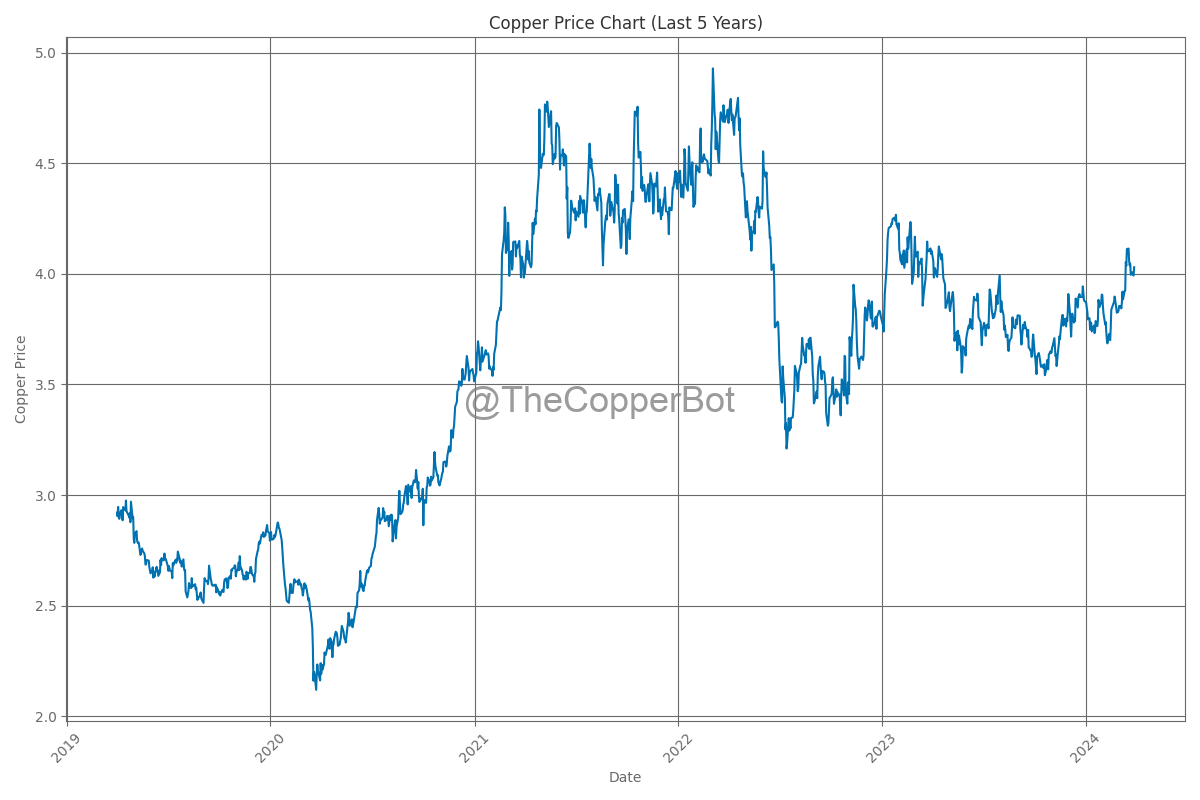

Copper prices spike breaking a 52 week high.

Financial Markets

US bank profits dropped 44% in Q4 2023

Delinquency rate among large banks hits an 11 year high at 3%

Delinquency rate among small banks hits 7.8%, a record.

New all time high for S&P’s tech sector’s price/sales ratio

Millions of Google, Whatsapp, Facebook 2FA security codes leak online as social media platforms in America experienced a cyber attack.

Costco starts selling silver coins.

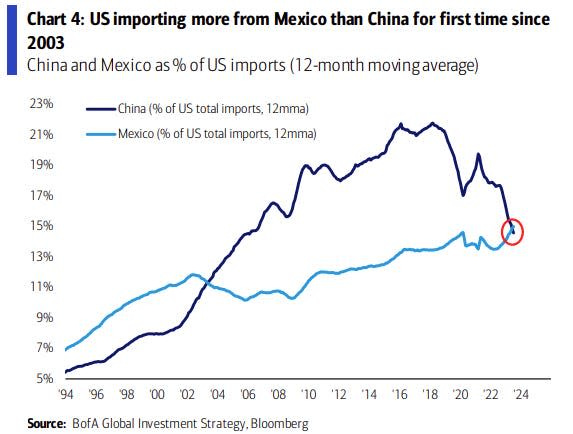

Mexico overtook China as the #1 source of Imports into the US

Dollars and Sense - What We’re Buying

Written by Dan Kozel

Copper hitting a 52 week high - Miners ready to go?

For many following the commodities space, we’ve been waiting to see some kind of a breakout on the Copper for just over 18 months. China’s real estate bubble burst towards the end of 2023 and copper went down with it. However, fast forward to March 2024 and the narrative has confirmed what many technical traders have been looking at on the charts - the catalyst to push copper to new highs.

Copper prices are determined by two things - China’s economy and US Interest rates - although there are other factors, it’s better to keep it simple when trying to allocate some capital. China’s economy has the largest refined copper producers and consumers globally.

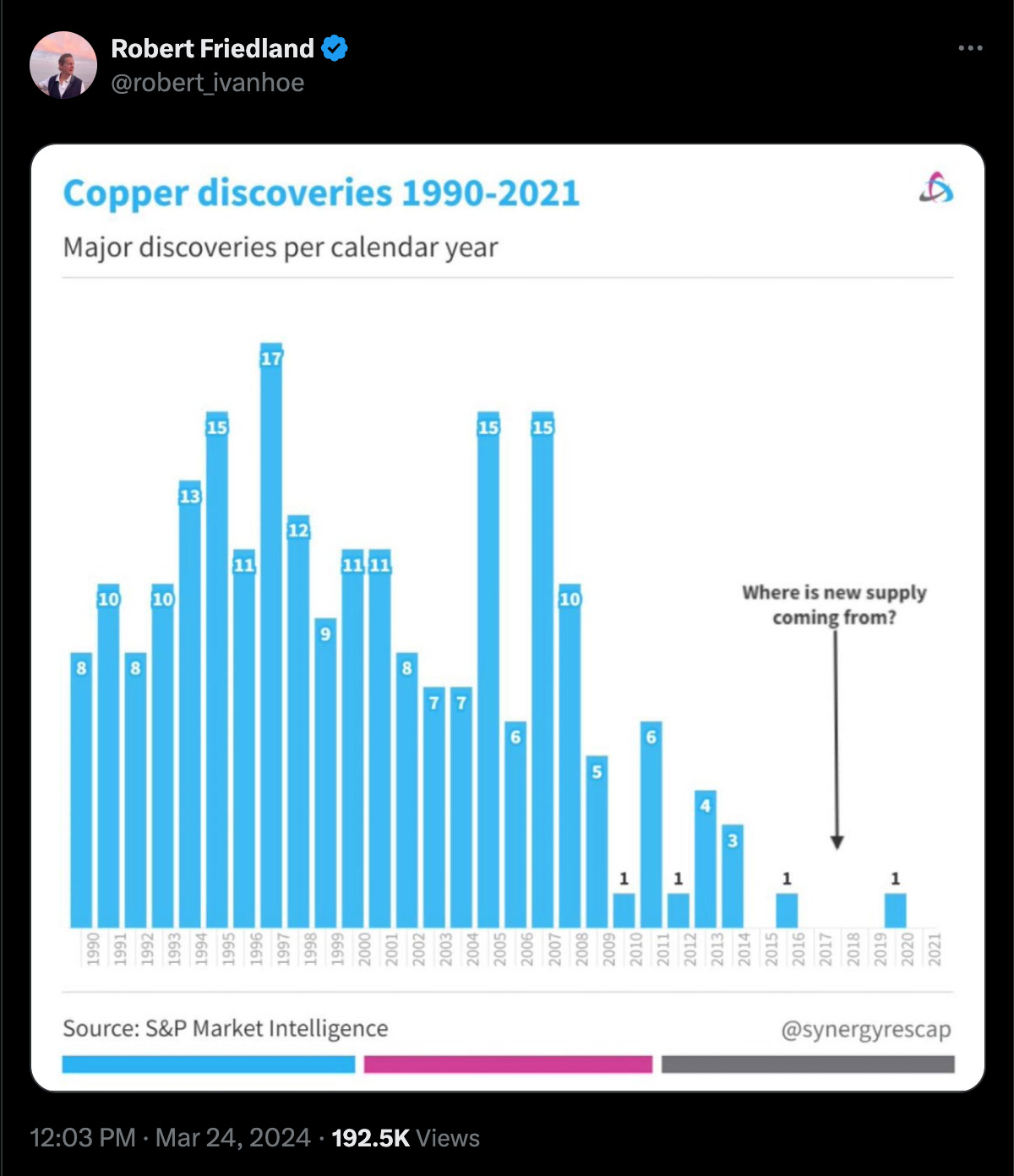

The supply side of the equation can’t be overlooked either - Mining Mogul Robert Friedland recently Tweeted that the gap in the global supply of copper is, in fact, astronomical and almost non-existent - (full tweet here).

When China announced a supply cut in production, this led to a complete slash in smelter fees to single digits - it shook the entire global market, pushing the price of copper to a 52-week high of $4.13/lbs USD, before retracting back to the lower $4/lbs range.

What you need to understand about the production of copper, is there is a smelting process which takes the raw materials, and turns it into concentrate, which turns into the metal.

From a technical standpoint, we continue to make higher lows and higher highs, so any form of weakness in copper, in my view, continues to be a buying opportunity. A break above $4.30/lbs USD, could see push to $4.50lbs.

If we can look even further then that, $4.90/lbs resistance break could see a push above $5/lbs. Still a long-ways to go, but the supply gap globally could see it there sooner, rather than later.

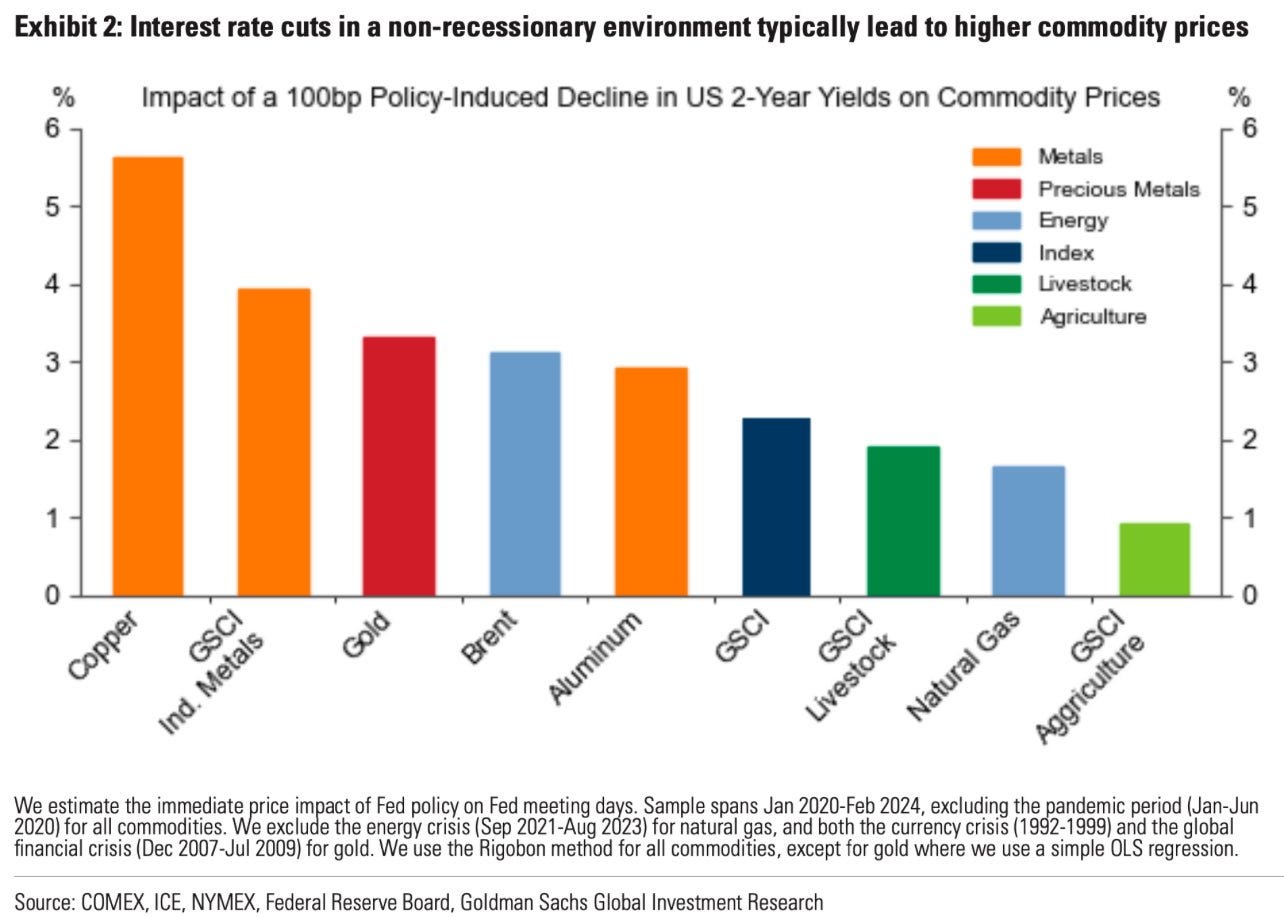

Now a simple peek at what happens to the prices of various metals and commodities, relative to US interest rates, confirms exactly how Copper will react if the 2-year note begins dropping 100 bpts (or 1%).

We remain bullish on copper over the next 3 years at a minimum - this is a long-term trade which will have ramifications on everything around society, particularly construction projects and real-estate costs.

There’s simply not enough copper in the world right now, at all. And many of the industry leaders are sounding the alarm on the amount of investment required to get copper mines into production as quickly as possible.

How we’re playing the copper shortage - hint - this will require significant patience

MUX - McEwen Mining

In March, we were fortunate enough to attend PDAC in Toronto and really immersed ourselves into the mining ecosystem. After speaking on a panel on the Sunday, we got an introduction to one of the greatest mining pioneers in the space, who brought one of his companies from a $50M market cap to an $8 Billion market cap, under a company called Goldcorp.

Here’s a picture of Rob McEwen and I on Day 2 of PDAC.

After meeting with Rob, we spent a good chunk of the next two days doing some due diligence on his main company. He's personally invested $220M into MUX - which is listed on both the Toronto and New York Stock Exchange. And what a pop to capital is has been so far, since we entered on March 5.

McEwen Mining provides investors with two types of exposure - wealth protection and growth toward the fundamental infrastructures to society. In other words, MUX has exposure to Gold and Silver as well as Copper.

As mentioned in many keynote presentations from Rob, the stock had quite the “road to hell” from 2018, up until the end of 2022. This was purely a result of missing guidance quarter after quarter, at which point the market punishes those companies appropriately.

But the thing that caught our attention was where MUX’s copper projects were located - in particular, the most attractive copper jurisdictions in the world, that being South America. Yes, there’s a lot of copper in this region - something most generalists aren’t even aware of.

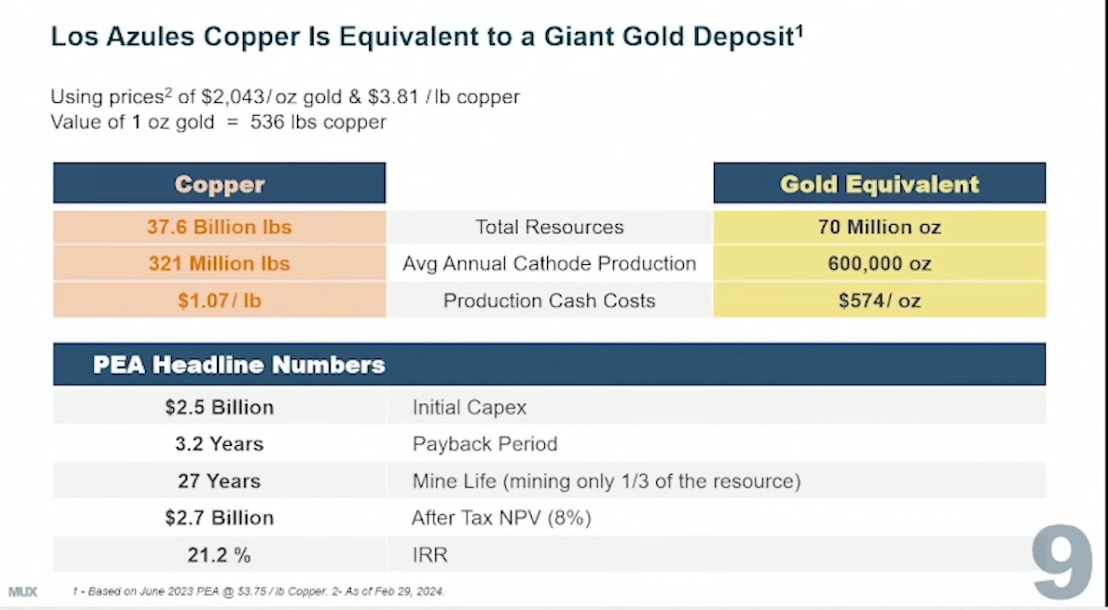

The Los Azules Copper project in Argentina, sits on the border of Chile, which is also known to host some of the worlds largest copper mines. In one of the keynotes, Rob does an excellent job of explaining the cost equivalent of gold to copper on the project.

Production cash costs was the key metric we took a look, along with the expected NPV of the project being $2.7 Billion (8%).

A deeper dive into the projects and you start realizing two important strategic investors are in this deal - Rio Tinto, the 2nd largest mining company in the world and Stellantis, the 4th largest car manufacturer globally. In addition, MUX was able to raise $400M privately over the last 18 months - Rob has also put his money where his mouth is, investing $40M into the company’s earlier financings.

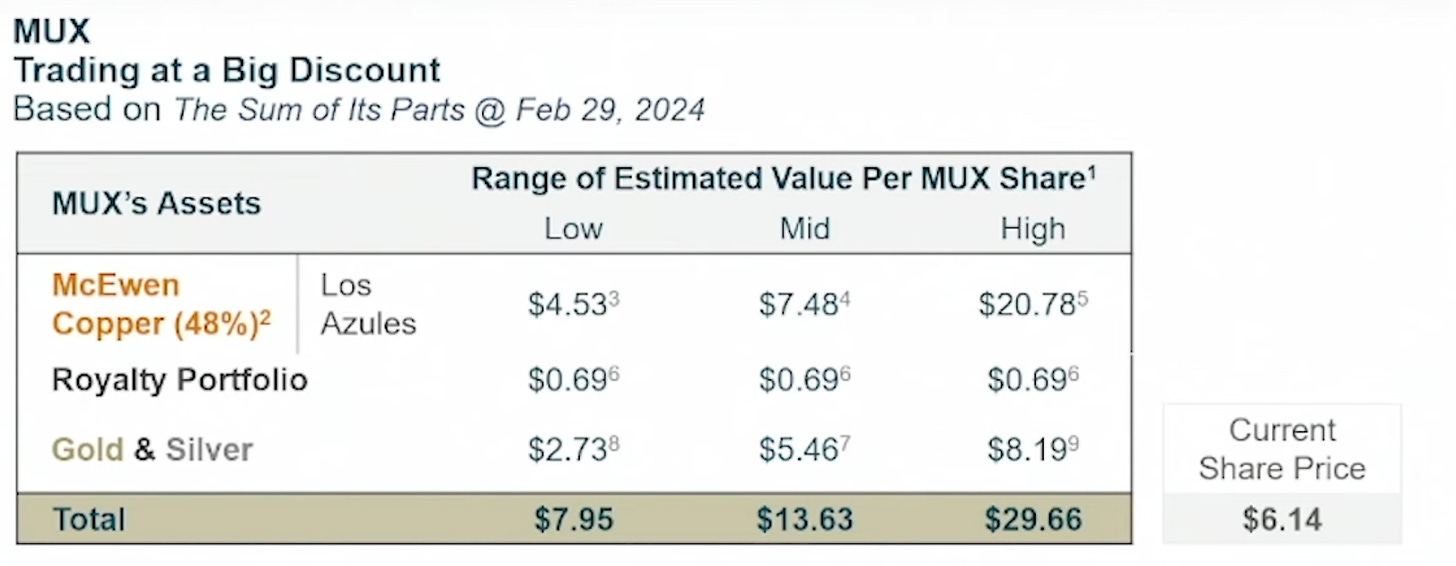

The last component for us which we saw as a great company was the share structure. MUX only has about 53.4M shares outstanding. With this in mind, we initiated a buy for 520 shares at around $10.11-$10.33 on MUX.TO.

Note the table below is based on USD, where it combines the three core assets of the business.

Since acquiring the stock - we’ve already seen an unrealized return of about 25% and we’re convinced there’s still more upside to go. Assuming MUX executes on the production numbers, the stock has some strong torque relative to the price of Gold/Silver and Copper - with higher prices in these commodities, we’re likely to have a strong upside over the next several quarters. And any weakness in the name is another opportunity to potentially add.

At $20/share, we’ll begin trimming our cost to create a risk-free trade, but for the time being, the key is patience. We’re fully behind the jockey (Rob McEwan) and the horse (price appreciation on gold/silver/copper)

Some Other Copper Names we are holding - Also Super High Risk.

FDY.TO - Faraday Copper - $0.17 CAD entry (old ticker CBK - Copperbank Resources)

$45M USD raised last year, projects are all in Arizona, with a new management team that took over when what use to be called CopperBank was ready to go into offensive mode with the assets. Their strategy at the beginning was centered around acquiring distressed copper assets when copper prices had collapsed after the last commodities cycles. Their main asset Copper Creek, 100% owned is in a top mining district in Arizona with great infrastructure, labor and smelters close by. They currently have 4.2 billion lbs of contained copper M&I Mineral Resources at Copper Creek at 0.45% Cu grade, and still have close $15 million in cash in the bank. Their have top strategic investors are Lundin Family, Pierre Lassonde and Murray Edwards.

PM.CN - Pampa Metals - $0.10 CAD entry

Chile project - super high grade copper and high risk. Recent drill hole discovery back in December found 1.31% CuEq (Copper) with another border interval of 0.73% CuEq (copper). Just to give you some context, any drill result above 0.4% Copper is considered high grade (market went bananas). PM has seen a high of $0.30/share and I believe still has some great exploration upside, given the recent grades they’ve found in the region - manage your risk accordingly.

Gold and Silver - position updates

Last month we talked about the importance of allocating gold and silver in our portfolios. As Nic mentioned, with the Russian terrorist attack in Moscow, there continues to be higher global uncertainty in the market, which further reinforces the need to own Gold.

Gold hit an all-time high the last week of March - and continues to be HATED by everyone. We love that. And we continue to remain heavily invested in physicals and miners who have strong growth potential in this upcoming super cycle. This is also being contributed by the significant reduction in buying power of the USD.

Silver, in our view, is ready to explode - when gold rips higher, there’s usually a 6-month lag in the silver, but you can’t chase this move as it’s just way too aggressive (kind of like the Meme Coins right now). Better to be in sooner rather than later.

For more on why we remain heavily bullish on both silver and gold, please take a peak at our last two newsletters, where we present our thesis on interest rates.

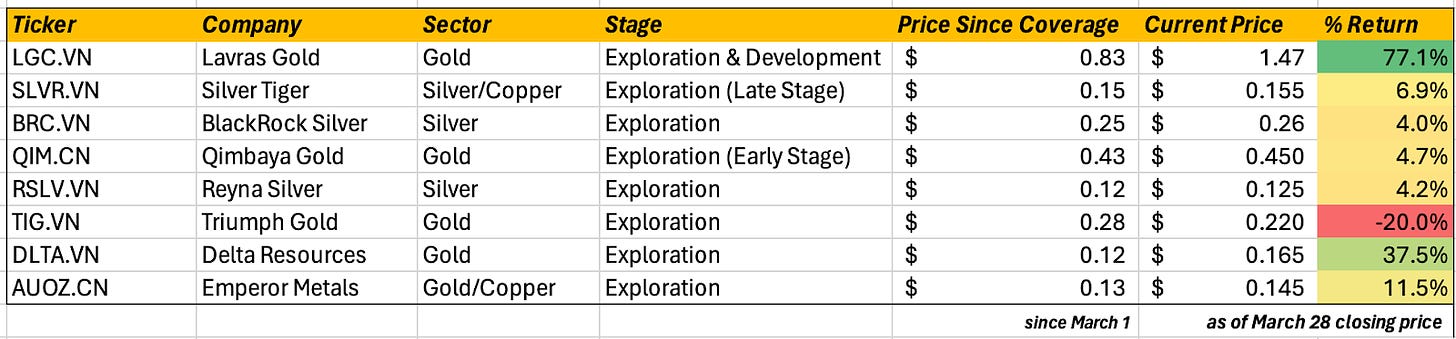

Quick Update on the positions we shared with you last month

The only name we sold was TIG, as we used that capital to accumulate more DLTA and LGC.

For those of you who attended our November Investor Gathering in Montreal last year, you would be familiar with the name. LGC has been on an absolute tear and continues to see significant progress in their Brazil discovery program in Fazenda do Posto.

We’ve also added NAU.TO - NevGold which has an exploration project right next to Hercules Silver. We met with management about a week ago, and have slowly started to accumulate. This is a very high risk play, however given how much the chart has been basing, and the level of interest in Idaho from the major producers has certainly caught our attention - NevGold has stacked land packages in and around Hercules Silver's recent porphyry discovery. The company also has some exploration projects in Nevada, which we really like.

Pure speculative bet - so manage risk accordingly.

Two important Notes on Bigger Positions

DLTA - When we attended PDAC, the one booth we kept seeing packed with investors and interest from majors was Delta Resources. Their Delta 1 project in Thunder Bay, ON, is shaping up to be a potential mine (key word being potential). It's got everything you could want in a mine site - easy access to roads, nearby communities, and electricity, plus it's chilling right next to the TransCanada Highway. And get this, their recent drill holes? check out the highlights here.

Now, here's the kicker: Delta's sitting pretty on $5 million in cash and they've just fired up the drills, extending their drilling campaign by another 3,000 meters. If 2023 was anything to go by, we'd be downright daft not to start stacking up shares at those early-month prices (which we did btw).

The market might've turned its nose up at Delta, but hey, we kept on buying. Now, we're on the edge of our seats waiting for those drill results. If they hit the jackpot, this stock could be on its way to a whopping $0.30 per share - remember, charts have memory.

In addition, there’s some warrant overhang around the $0.18/share level, which, if exercised, could add an additional $2M to the treasury.

In our books, the stock's a steal, especially if gold prices keep on climbing.

In the next month, we believe Delta Resources might just be on the brink of another breakout, if they can announce strong drill results. Manage risk accordingly.

AUOZ - Emperor Metals is in one of the best gold and silver mining jurisdictions in Canada (The Abitibi Region between Quebec and Ontario) - having seen surface level drill results of 15.8 g/t (10.8M) and 5.65 g/t Au (11.7M).

Just recently, Emperor Metals received an order on a private placement from Rob McEwen himself. Luckily for us, we were in the name about a month and a half prior. The private placement of $1M is an additional vote of confidence to the management team - with their drilling campaign about to start in April, we will be accumulating more through the course of the next few weeks.

The chart continues to show a strong up-trend, as gold prices continue to rise - we expect to see more movement in the price action to the upside.

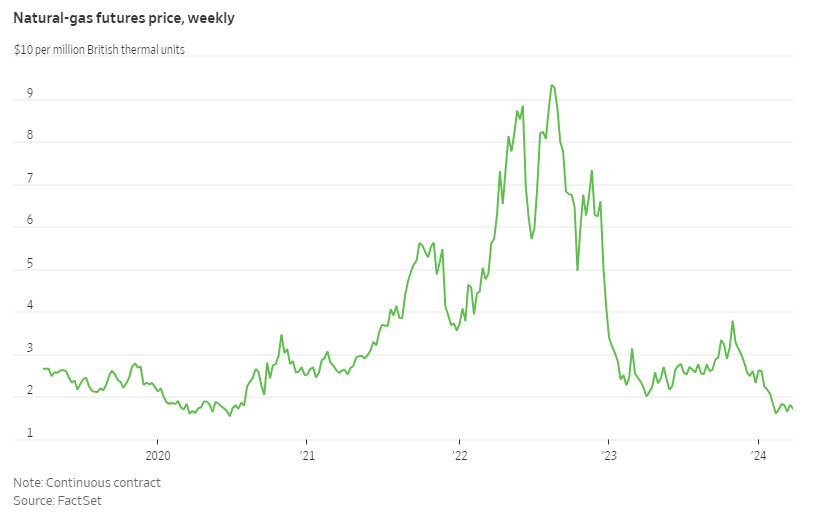

Natural Gas is Hated Right Now - Add These Names To Your Watchlist

It’s no secret this past winter was quite mild in North America; fortunately for most of us on the East Coast, we didn’t experience a heavy dose of snow or cold.

Out West - that story was a little bit different in the early parts of January, when parts of Alberta, Saskatchewan and the Mid and North West United States experienced temperatures of sub 40 degrees celsius for 8 consecutive days. But besides that, the rest was not so bad.

If you were invested in natural gas in the later parts of last year, chances are most of your positions are below your cost - so its been a tough asset to navigate.

Just last month - Natural Gas prices hit their lowest point in almost 2 years and continued to go to lows we haven’t seen since 2020...

The entire natural gas space has underperformed the major indices, so from an investment standpoint, it’s quite clear why money managers have been reluctant to allocate capital to this asset class. The sentiment is getting worse and with reason - winter was almost non-existent.

However, the tide could be turning, but not as quickly as we think, and this gives us some time to assess our allocations accordingly. Most of the forward natural gas prices going into Q4 2024 and 2025 are looking towards $3.50 gas prices, which is almost double from current levels.

Looking ahead into the latter half of 2024 and into 2025, there are some promising trends emerging in the natural gas market. With gas prices projected to rise, and a significant contango indicating sustained demand, it's clear that the appetite for gas long-term, remains strong, although many producers may need to tighten production later on.

Because the vast majority of the investment community currently hates this asset, this is usually the best opportunity to buy names in this space at DIRTY CHEAP prices. Not to mention, most of the names have fallen off by about 20-30%.

Natural Gas isn’t going anywhere - we need it to heat our homes and believe it or not, to charge electric vehicles (those Tesla Chargers in the US are being powered by Nat Gas). We’re bringing some names to you right now so you can take the time to prepare and understand how this asset class moves, going into the following winter seasons.

Liquified Natural Gas - LNG - an offspring of Natural Gas, has the ability to replace coal production and is key to the transition to clean energy - something many gas producers are currently working towards building.

Geopolitical tension will normally contribute to the price action of British Natural Gas; however, to avoid this risk, it's best to find some names that will pay you to wait and are in your own backyard.

Before we jump into two names we’re currently keeping an eye, it's important to understand the relationship between Natural Gas wells and their decline rates.

Natural gas producers need to maintain low decline rates of their wells/assets to ensure consistent production levels and revenue streams over time. Low decline rates mean that the rate of production decrease from the wells is minimal, allowing companies to sustain output without constant drilling of new wells. This stability in production is crucial for meeting supply commitments, optimizing operational efficiency, and maximizing profitability. Additionally, low decline rates provide greater predictability for long-term planning, enabling producers to manage costs effectively and make strategic investment decisions with confidence.

Here are two names we feel should be added to your watch list - and understand, there’s going to be volatility ahead and sentiment is likely to be negative going into the next 6 months. But the positive sentiment comes from the future gas prices being projected to $3.50.

BIR - Birchcliff Energy - Lots of Torque to Nat Gas and High Dividend Yield

Given the recent sell-off, Birchcliff Energy Ltd is well-positioned to capitalize on these developments, offering full exposure to commodity prices and demonstrating a steadfast belief in the future of natural gas. If you like torque to a commodity, this is a name to follow.

The company had forecasted adjusted funds flow of approximately $340 million in 2024, with free funds flow projected to be between $80 million to $100 million. This solid financial performance underscores the company's ability to generate value for its shareholders. Additionally, Birchcliff remains committed to rewarding its investors, as evidenced by the approved 2024 annual base dividend of $0.40 per common share, totaling approximately $107 million in aggregate - you’re getting paid to wait - so why not take advantage. Heck, you’re getting paid a dividend at 7.5%!

Birchcliff prioritizes maintaining a strong balance sheet, targeting a debt range of $405-425 million by 2024, less than 1.0 times forward annual adjusted funds flow, ensuring stability despite market uncertainties.

To enhance financial flexibility, it has extendible revolving term credit facilities worth $850 million, demonstrating confidence in its long-term prospects. With maturity extended to May 11, 2025, and no financial maintenance covenants, Birchcliff is well-prepared for market changes and growth opportunities.

Overall, I think Birchcliff offers an attractive investment with strong financial performance, prudent capital allocation, and focus on shareholder value, poised for sustainable growth and returns in the later half of the year.

Their growth not only underscores the potential of Birchcliff, but also aligns with broader efforts to transition away from coal production. Even in the face of short-term commodity price fluctuations, the outlook appears favorable, with forward prices showing a notable uptick.

In light of these factors, Birchcliff, in my view, presents an enticing opportunity for investors seeking exposure to a sector poised for significant growth and resilience in the later half of the year and heading into next winter.

I’m still anticipating some more weakness in the price action, and as this continues, we’ll begin to accumulate more stock.

Buy when things are hated - that is when you make the highest returns. But the key right now, is to remain patient and let the price of natural gas rebound over the next several months.

PNE - Pine Cliff Energy - High Dividend Low Decline Rate

I’ve held PineCliff for the last 3 years when the entire gas market imploded during COVID. It’s been quite the grind going from $0.33 to $1.45/share. The company did a great job reinstating its dividend and paying down debt as a result of the increase in gas prices - but the weakness in the overall market and lower AECO (Alberta) prices, pushed PNE back below $1 and to me was another buying opportunity.

The company continues to have a great balance sheet and is able to pay investors about a 9% dividend just to hold the stock. I’ve recently trimmed my position to allocate capital into the gold and copper miners, but remain optimistic about PNE and Phil Hodges (CEO) ability to continue to deliver to shareholders because of how he’s structured the company. And with PNE’s gas assets having a low decline rate - they certainly will make much needed gains in preparation for the next winter season.

Add this name to your watch list for the time being - and revisit this in the summer when we see some more movement in Natural Gas prices.

Wrapping Up

Thats all for this month - if you want us to connect you with some of the management teams of the companies we mentioned above, please let us know and we can coordinate a call.

Have a great Q2 and we’ll assess some of our picks in next month's report.

Cheers,

*DISCLAIMER* - READ CAREFULLY

None of the information taken within this newsletter should be considered investment advice and should only be viewed for information purposes only. NewGenMindset is not a broker, or a licensed provider of financial services. All claims made in this newsletter to any listener should not be viewed as offering personalized legal or investment counseling. Any investments made in any companies should be consulted with a licensed financial professional from here on.