Hedging in a World of Chaos

If you are concerned about what's happening globally, you are way ahead of 98% of investors.

Hi there,

Welcome to the inaugural edition of NewGen Mindset - Macro Chronicles, where we attempt to make sense of the global circus from a Politically, Cultural and Economic perspective, all while sprinkling in some investment ideas to spice up the chaos.

We’ll keep it brief and unfiltered - because at the end of the day, most of you reading this are probably sick and tired of the BS our politicians and mainstream outlets have been feeding us.

For simplicity's sake, this newsletter is broken down into two sections. The first trio will furnish you with a macro context on the global Political,Cultural and Economic rollercoaster. As for the grand finale, we'll spill the beans on three vital areas of the commodities sector, we're currently throwing our money at.

After each month - we'll continue dishing out the latest updates and how our investment positions are holding up.

World War 3 - if it's not already happening, we're probably drafting the playbook.

Our noble mission? To enlighten and arm you with knowledge on what warrants your attention.

There’s a saying on the street right now - “If you’re not concerned about what's happening in the world, you are ill prepared for what’s coming.”

Opportunities are lurking in every corner. Shall we take the plunge?

Macro Headliners

written by Nic A. Tartaglia

Political

The geopolitical regression, spanning roughly 60 days, has been a significant development. We can undoubtedly observe the escalating tension between countries, and there seems to be no end in sight. The most crucial conflicts and tensions to monitor between governments and military forces are:

🇹🇼 Taiwan and 🇨🇳 China

There is an economic motivation for this struggle for Taiwan that has the West and China at their doorsteps seeking to ensure a foothold on this country, which China asserts is part of the mainland. A key component in this economic conflict involving Taiwan is the manufacturing of semiconductors where it supplies roughly 50-60% of the global demand. With a growing demand for electrification, semiconductors are clearly a resource governments are trying to secure. It is a game of resources after all. The Taiwanese elections in January of 2024, ended up with William Lai Ching-Te of the Governing Democratic Progressive Party (DDP) winning, and he is a political force who opposes China. And of course, China opposes this and escalation is likely on the table…

🇰🇵 North Korea & 🇰🇷 South Korea

There is a clear escalation between these two neighbors as the US conducts military drills with South Korea, seemingly demonstrating strength against North Korea. However, this is not well-received by Kim Jong-Un. Consequently, he has ordered military acceleration for war preparedness in response to the unprecedented confrontational moves by the US and South Korea. This is evident in their increased missile launches, serving both as a warning and for testing new weapons. North Korea now claims to be testing underwater nuclear-capable drones.

The region appears to be provoking war. It is essential to consider that this is occurring against the backdrop of North Korea redefining South Korea as an "Enemy State" and the dismantling of a monument symbolizing unity with their neighbor. Often overlooked in analysis and discussion is the intricate connection of this conflict with other highlighted global issues. China's Xi and Russia's Putin are actively seeking to expand and strengthen their ties with Kim Jong-Un. There is a sense that North Korea, with a seemingly less strategic dictator, functions as a wildcard with the potential to explode at any moment, akin to a child possessing powerful and dangerous toys.

Moreover, it is crucial not to forget the longstanding cooperation between North Korea and Iran, which began in the mid-1970s. The highlighted risk of this collaboration lies in weapons, particularly nuclear weapons.

Events in this region may unfold sooner than we are led to believe, as the tension shows no signs of abating.

🪆 Ukraine and Russia

This is another significant conflict that demands attention, although amid the ever-growing international conflicts, this story has lost its news appeal, from a mainstream point of view at least. NATO countries persist in advocating for military support to Ukraine. In the Netherlands, Dutch Army Lieutenant General Martin Wijnen has emphasized the need for preparedness for war, basing his stance on his observations of Russia's increasing power. This challenges the Western narrative that sanctions and a Western proxy war would cripple Russia.

NATO commenced 2024 with the largest military exercise since the Cold War. Simultaneously, the British Army Chief issued a warning that the British public might be called into service if the UK engages in war. It's worth noting that the UK military is relatively small compared to its Russian counterparts—a situation described as an absolute Gongshow.

🇮🇱 🇮🇷Middle-East

Although the Israel-Hamas narrative remains crucial to monitor, it is no longer the primary focus of the Middle East conflict, as it has extended its influence into other conflicts in neighboring regions. Monitoring Israel is significant due to its Western alignment and its proximity to numerous Middle Eastern forces that perceive themselves as enemies of the West, particularly the United States, which serves as the backbone of Western forces. This conflict has subsequently expanded, with Hezbollah from Lebanon now engaging in hostilities with Israel - an Iranian proxy.

Iran is heavily intertwined with the other militant groups outside of Iran, and is now also at play in The Red Sea alongside the Houthis (Yemen militants) disrupting a major global shipping route. More than two oil tankers has been attacked from missile attacks launched by Yemen militants. This is clearly leading to the redirection and de-risking of shipping routes as a consequence, especially for Western vessels.

This has escalated to the USA and Britain bombing Yemen, after which Yemen declared they are in direct conflict with America & the UK. There was a mass gathering of the Yemeni people being shown all over social media chanting “We don’t care, we don’t care, make it a major world war”. A highlight of the development between the US and Iran is that January finishes off with 3 members of the US military being killed by a drone attack in Jordan, which is believed to be an Iran-backed militant group.

This has further rippled into conflict with Iran in Iraq where the State of Iran believes there are western forces and spy bases that must be removed, but Iraq denies these claims. There is also Iran launching missile attacks at Pakistan based militant groups, stating that they destroyed two bases of Baluchi militant Jaish al Adl. These are the groups that claimed a December attack which killed Iranian security forces. As a response, Pakistan launched attacks on separatist militants inside Iran. They are now in a supposed discussion.

These Middle East conflicts provide plenty of opportunity for other state nations in the East who oppose the West to make moves. We are clearly seeing this play out and there appears to be no in sight for now. If anything were to kick-off World War 3 - it’s the entire conflict in this region, which should have people very concerned.

🌍 Africa

Africa's quest to distance itself from the West is an evolving development, crucial given its abundant resources – precious metals, base metals, and uranium. Both Western and Chinese powers aim to tap into these resources, though politics often throws a wrench in the works. The early months of 2024 marked the end of France's presence in Niger, as the country officially expelled French influence and banned the export of gold and uranium to them. Niger, a major uranium producer, has also put a hold on new mining licenses, adding complexity to global commodity supply chains.

The repercussions extend beyond Niger, with neighboring African countries experiencing escalations. In Northern Kaduna, Nigeria, a military drone attack claimed 85 lives, including women and children. Additionally, the African Union Commission Chief intervened to ease tensions between Ethiopia and Somalia after Addis Ababa signed the Red Sea pact with Somaliland.

Political dynamics in Africa are reaching a critical juncture, resembling a chessboard where the West and the East vie for influence amid the race for infrastructure and renewable projects. This geopolitical competition is reshaping global commodity supply chains, indicating a potential fracture in the world order. The East-versus-West narrative is becoming a reality, a significant development with far-reaching consequences.

Can you see it now?

The world, like a fragile vase, teetering on the edge of a messy fracture. East versus West – the blockbuster reality show that's turning into a nail-biting thriller.

Who needs Netflix when you have geopolitics?

CULTURAL

Observing shifts in culture within a country or continent is reflective of its political and economic outcomes. In America, the cultural division on the basis of politics is still rooting itself into many facets of its ecosystem.

This shift appears to be mostly dominant and easily observable within the West on the basis of:

🇺🇸 Political affiliations - with the USA being what appears to be the most divided country on this basis (hint: 2024 is an election year). The tensions between conservatives and liberals is rippling into culture wars, with immigration being the primary outlet of this conflict as we begin 2024. After all, we are seeing The Texas National Guard take over at the border crisis, despite the ruling by the Supreme Court to allow federal agents into Texas to remove the razor wires. Instead with full support of the Texas Governor Greg Abbott, they are not backing down and now have nearly 25 states in America who are showing full support to secure the Southern Border. There is even a massive trucker convoy occurring in support of securing the border, in solidarity with Texas and to take initiative as they believe Joe Biden and his administration are intentionally allowing this problem to grow at the border.

🚜 Farmers and truckers in Europe - are fighting back against the government for over imposing regulations, taxes and seeking to remove tax cuts on diesel fuel. There is a clear war on farmers and it is causing a lot of disruption in certain parts of Europe such as in the Netherlands, Germany and France.

French farmer dumping manure in front of government buildings - love to see it!

💢 Protests against the Islamification of certain traditionally Christian countries, primarily observed in Europe, are escalating. Additionally, protests and rioting rooted in concerns about immigration and asylum seekers have surged as Western countries absorb substantial migration from Africa, Latin America, and the Middle East, particularly in Europe. The rise of multiculturalism is increasingly contributing to significant conflicts amid the backdrop of extensive global migrations. This trend may persist, especially as escalating military conflicts worldwide force people to leave their homes and seek new lives elsewhere.

ECONOMIC

Some important economic developments and trends at a macro level to pay attention to is:

🏦 The continued sideways Central Bank decisions to keep rates as are while Western economists are starting to act confident that they have tamed inflation and a soft landing is near achieved or has already been achieved. Don’t forget while they are arguing this as Janet Yellen has been, the USA crossed the $34 trillion USD of debt as of early Jan 2024, showing a pattern of incurring debt at a rate of $1 trillion per quarter. Debt is growing and fast. The Federal Reserve has also reported its greatest operating loss ever of $ 114 Billion USD for 2023. The consequences of these developments can’t be ignored forever. And they will have a global rippling impact.

⏳ Are Central Banks Trapped ? - Globally we are still seeing the traditional metrics of CPI showing inflation to be holding steady in most cases as of Dec 2023, but the USA on the other hand saw inflation post the biggest increase of 2023. We can see that most central banks are still deciding to hold firm on rate hikes or cuts and remain paused for now on any decisions. The FED held rates yesterday but hinted at a rate cut sooner, rather than later….TBD.

💵 Shift Away from USD - The emergence of an alternative monetary and trading ecosystem, independent of the US dollar, appears to be progressing more rapidly than the prevailing narrative suggests, especially from a Western perspective. As the world increasingly polarized into an East-versus-West paradigm, a logical inference would be a departure from the East's primary adversary's instrument—the US dollar. By the end of 2023, one-fifth of global oil trades were settled in currencies other than the US dollar, signaling a notable shift. The inclination to undermine the dominance of the US dollar is exhibiting a sustained momentum extending beyond the petrodollar era. For many on the Eastern side of the global divide, diminishing the influence of the US dollar serves as a means to challenge the supremacy of Western superpowers. The ongoing development of BRICS, now expanded to include Saudi Arabia, UAE, Egypt, Iran, and Ethiopia, underscores the evolving landscape. Concurrently, geopolitical turbulence is on the rise, creating an environment where economic partnerships and even warfare are viewed as potent tools to address political conflicts

🏗️ In the realm of infrastructural development, there is a notable commitment of significant financial resources from governments and major institutions globally. It can be inferred that liquidity will be prioritized for infrastructure and renewable projects, aligning with the persistent climate narrative and the government's commitment to avoiding economic "regression," a pressing political concern for citizens worldwide. To sustain this vision, government spending and subsidies are essential, and historically, infrastructure has been a major beneficiary of such funding. The shift towards electrification emerges as the solution for both economic "growth" and "employment." Therefore, a close examination of the commodities market is crucial, as it constitutes the primary inputs for the green initiatives of governments worldwide.

🔗Global Cyber Security Risk - To provide context regarding the cybersecurity risks for the global financial system, let's examine some developments that occurred in the early months of 2024. First, the Sweden Central Bank filed a police report as their IT systems became inaccessible due to a ransomware attack. Similarly, in the UK, six individuals were arrested in connection with a plot targeting the London Stock Exchange. Although this threat was planned at a physical level, we are seeing these ideas form to target systemic institutions which can escalate to cyber warfare directed at these central institutions. Notably, the US government reported Chinese hackers infiltrating various systems, spanning from water to energy infrastructures. This occurs against the backdrop of global energy challenges, exemplified by Alberta facing grid constraints during a harsh winter. Furthermore, in Sri Lanka, a nationwide power outage transpired due to systemic failures.

To end the month of January, the House Select Committee on the CCP (Chinese Communist Party) held a hearing titled “The CCP Cyber Threat to the American Homeland and American Security.”

Be cautious of all these trends. These are fundamental developments which will have a consequential impact on the world as they develop, and as we begin 2024. The world is absolutely changing. Start positioning yourself accordingly.

Dollars and Sense: What We’re Buying

written by Dan Kozel

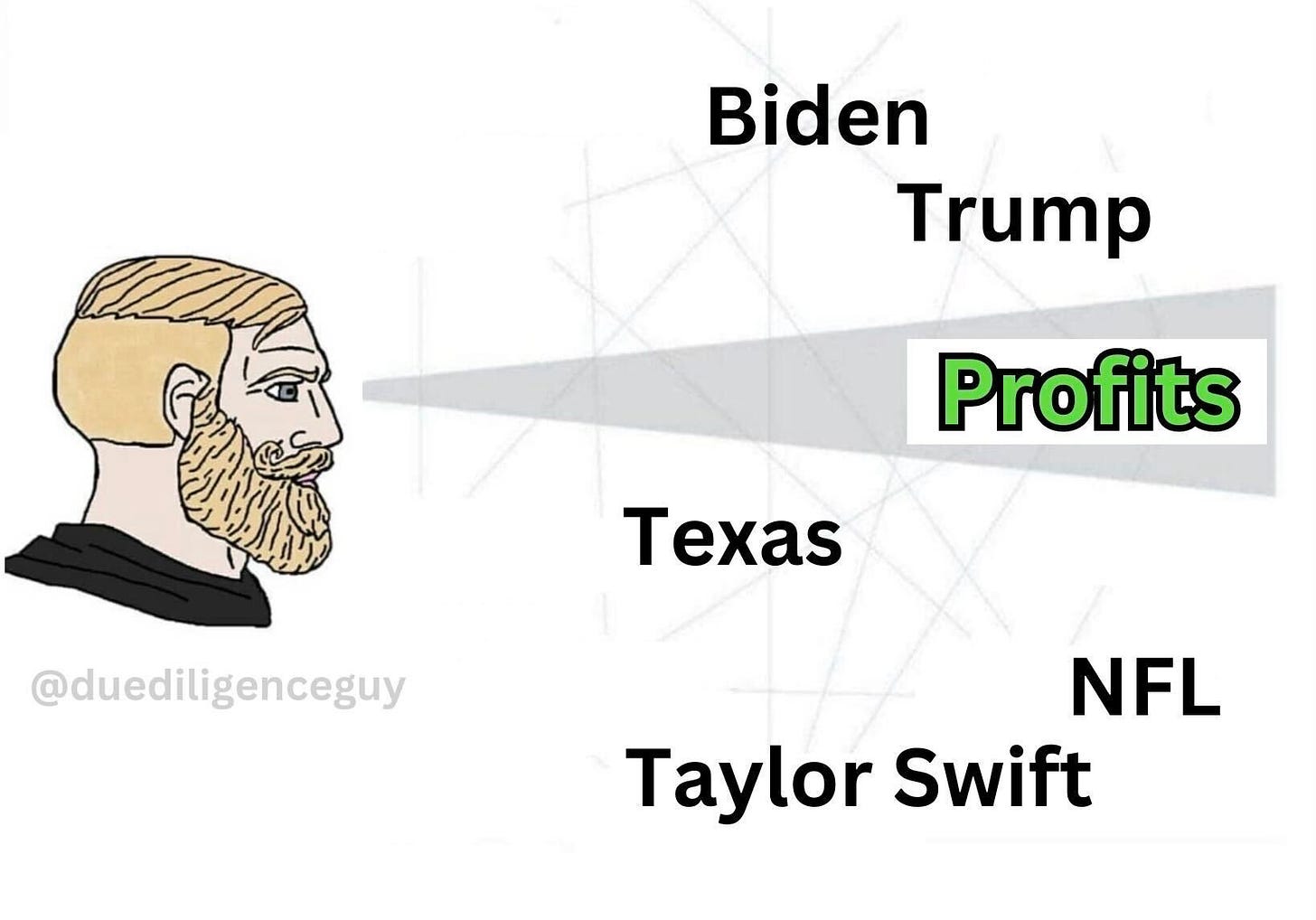

Now that you have a general understanding of what's happening globally, the question now becomes, how do you position for this accordingly in your portfolios.

You’ll need to take some risk here and if you don’t feel comfortable reading past this point, just call your financial advisor instead.

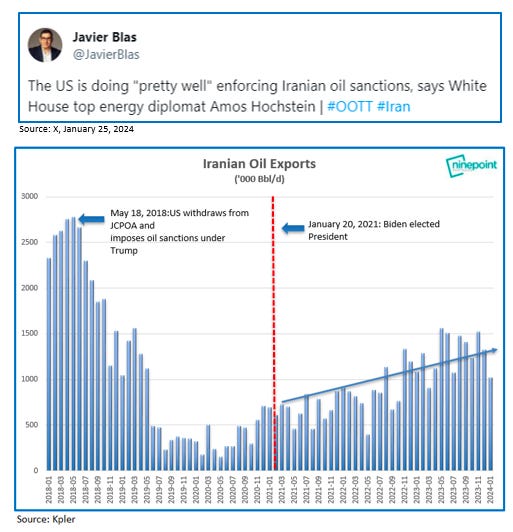

Wars are almost always started because of Natural Resources. It’s not a conspiracy theory to say the Iranian regime has been propping up their Nuclear Program, thanks to the help of the Biden administration's removal of sanctions on oil.

A chart is worth a thousand words…

📈 Is 2024 the year of Gold ?

When there’s blood in the streets, panic begins to settle into the market and many investors flood to the exits. Many older pension retirees currently hold more US stocks than ever in history; this in turn could accelerate a selloff. You need to remember, the market is 95% psychologically driven. Most investors tend to be impatient… you can imagine the level of fear that seeps in, when regular people start panicking…

During this period, it’s always great to have some kind of gold exposure in your portfolio.

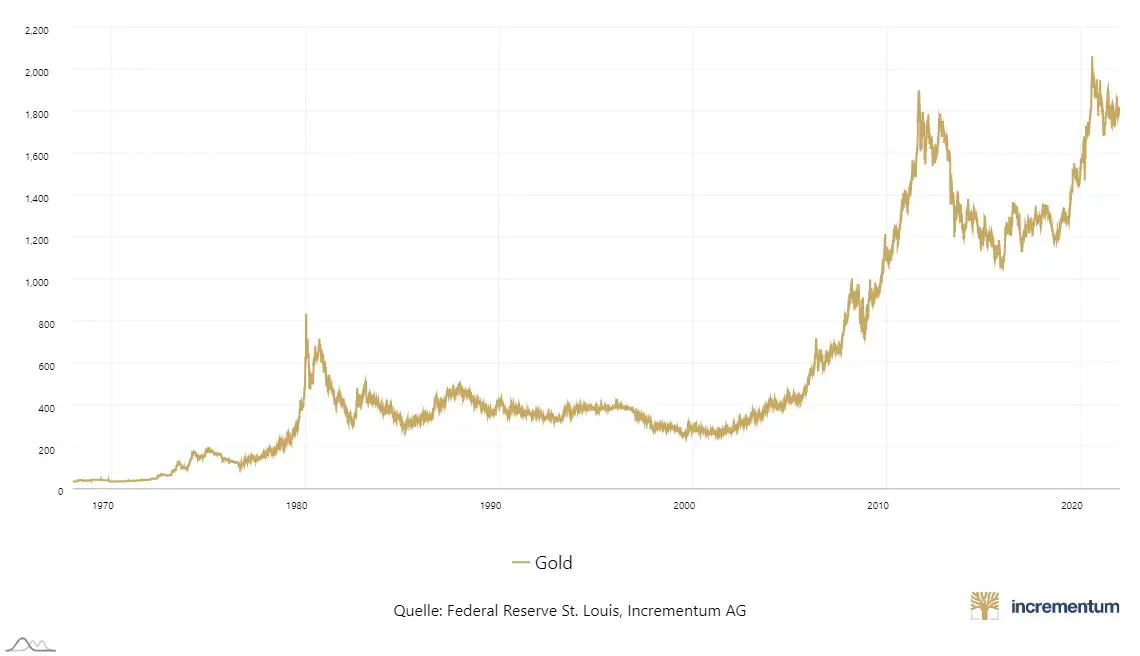

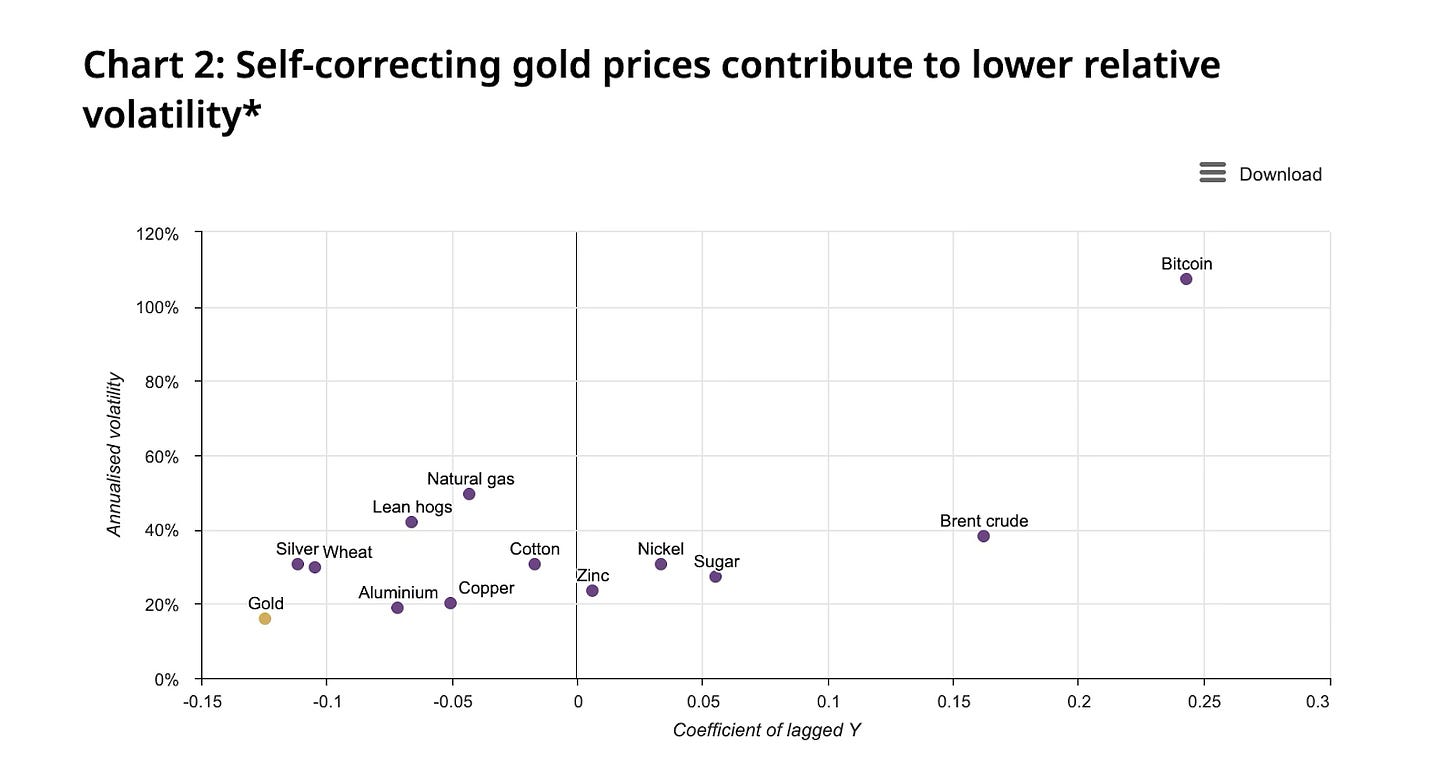

I personally prefer physical gold. And this chart proves exactly why…

The simple thing to understand about this chart is the following - everything on the X-axis is referred to as the Beta of the asset class, relative to the market. Everything right of the zero-line, means that if the S&P moves 1% to the upside, that particular asset class is likely to move in that direction. What you notice about gold, is a negative correlation, which means during a market sell-off, gold tends to do fairly well as a hedge, to a certain degree.

It will be interesting to see what happens to the Bitcoin and Gold correlation when a market sell-off accelerates. Even with the halving coming in April 2024, I tend to believe bitcoin is still a risk-on asset (this doesn’t mean I’m against holding it, btw).

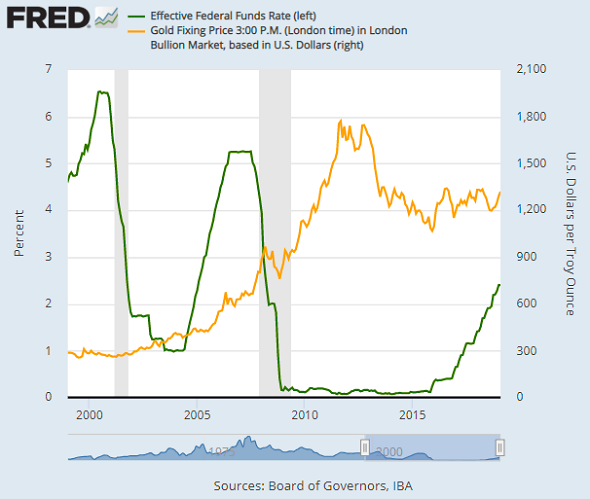

One of the main reasons gold has not been able to hold its new highs is because the FED has not begun cutting rates (among WallStreet usage of the ETF derivative market to manipulate the price). Historically, when the FED begins to cut rates, we have peaked in the market cycle, and Gold has usually moved higher. We expect the same thing to occur this time, when the FED starts cutting rates in March or April - don’t quote us on the exact timing, just peak at the chart below and you’ll understand the significance…

Every time the FED began cutting rates, gold would inch higher…

From a technical stand-point, the long-term chart is forming a nice cup and handle pattern (very bullish); so any form of weakness in price action will simply be another opportunity to add to our current gold exposure.

Our good pal Rick Rule was quoted saying “ I do not own gold for the fact that I believe it's going to $2,500/oz. I own gold for the fear of it going to $6000/oz”.

Food for thought...

☢️ Uranium’s Global Impact goes beyond the Charts

The green commodity broke out of an 11-year high hitting US$106/lbs - and with global tensions rising, the race to secure Uranium supply is on.

Uranium is clean energy - it’s the only form of clean and green energy that can power cities 5x the size of Dallas, Texas. Solar and wind have, unfortunately, contributed to more destruction of the planet than advertised - thanks Greta.

When we attended VRIC in 2023 - there were just four Uranium companies in attendance. All four were small-caps trading well below $0.30/share.

Fast forward to this year, there were 11 Uranium companies at the conference, most have doubled in price since 2023. Additionally, a new company, UEC.TO, presented and holds a Large-Cap status with a $2 billion valuation. (We’ll be having the CEO of the company on our podcast in the coming weeks).

Governments around the world are paying very close attention to this commodity and the current spot price of Uranium tells the story….

I was fortunate enough to put some money into the Sprott Physical Uranium Trust (U.U.TO) - at just under $12. Since then, the trust has almost returned about 100%. I still believe there is more upside, with many of the junior uranium companies lagging.

Like any chart, expect a pullback to the $90-98/lbs range, in the spot price.

Have we forget to mention, that there are only 437 active reactors on the f*cking planet ?

Another 441 are being planned globally to address the growing demand.

And with the largest producer of Uranium in the world located in Kazakhstan - (Kazatoprom) the company’s CEO says they underestimated the amount of current supply they have in order to fill global demand, among their lack of sulphuric acid.

Where it gets even more interesting is how close their facility is to Russia. The geopolitical chaos we’re seeing will continue to contribute to the structural supply challenges facing the Uranium space for the next 2 decades.

The US and Canada are scrambling to begin developing and mining their own Uranium, in order to not have to deal with importing Russian or Chinese Uranium, which the US recently banned.

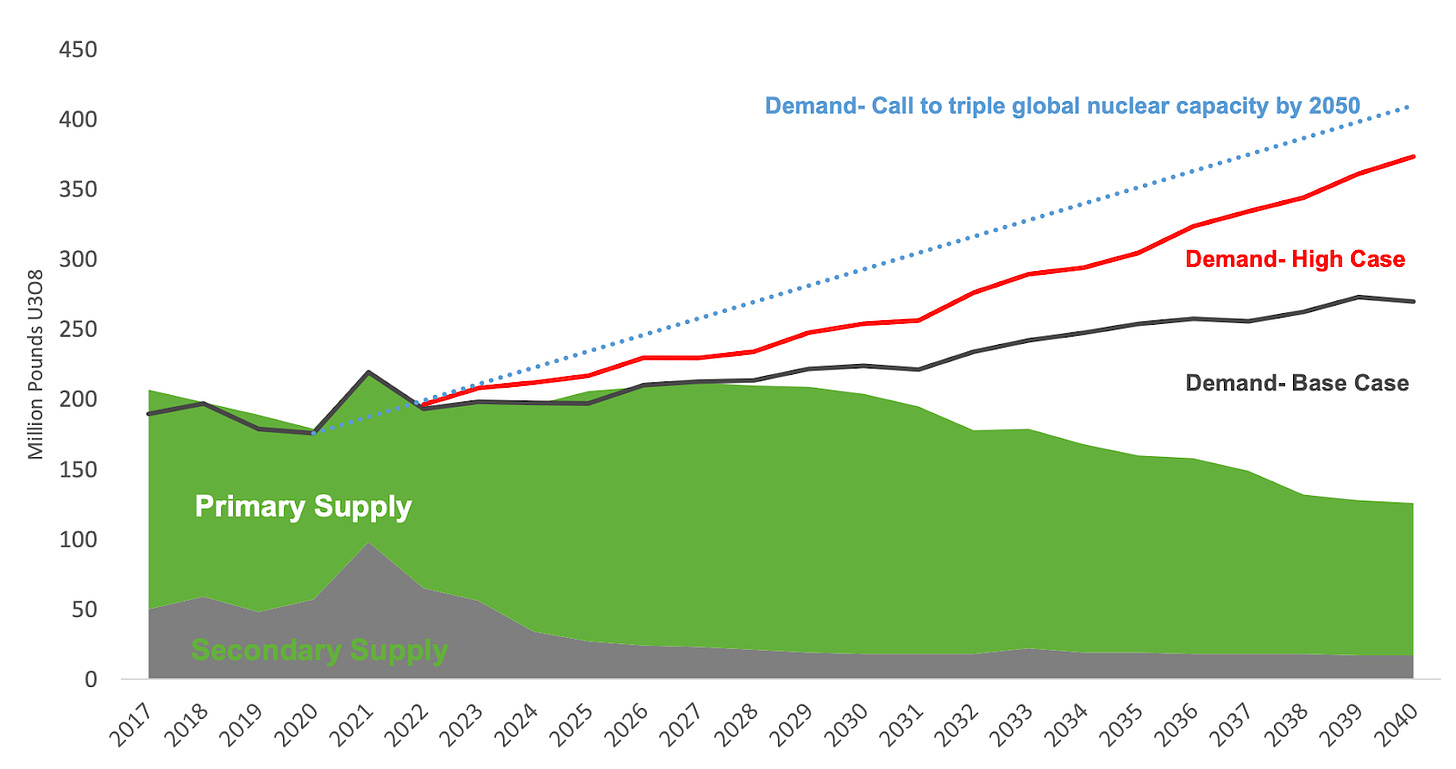

Chart is from, UEC corporate presentation - Q1 2024

I am not making any predictions here on which countries have control of the Nuclear codes or whose atomic bomb is the biggest (probably America); however, seeing the chart above is an alarming case of - holy shit, we’re going to see price-inflation in Nuclear, so why not own a piece of the action.

The Uranium Juniors are an attractive area of opportunity right now. They are lagging, relative to the spot price and the level of funding these companies should expect to receive over the next few years might be historic. I’ve been fortunate to identify some names who have exceptional management.

Most of you reading this, have probably never even heard of the Athabasca Basin in Alberta - this is Canada’s greatest uranium resource opportunity and has seen multiple Uranium discoveries over the last decade.

If only Ottawa could get their shit together….

A junior name I currently hold is a small company called Skyharbour Resources - SYH.V - which owns 100% of the claims on about a 35,000 hectare meter land package in and around the Athabasca basin, and have begun their next drilling program at the Russel Lake Project, located on the Eastern part of the basin. The company has probably one of the more exceptional management teams out there, with Jordan Trimble leading the charge - who's also a great leader. On their board, sits Dave Cates, the current CEO of Denison Mines - DML.TO, a mid-tier explorer/developer and producer in Canada (which I also own).

I’ve been accumulating both of these names over the last 18 months and will continue to add to my exposure on any weakness. If you can’t handle 20% loses, then I’d suggest staying away from these names and stick to the large cap names instead.

Another company that has done very well is NexGen Energy NXE.TO - unfortunately, I missed that one, but the Vancouver Canucks certainly didn’t.

We continue to remain bullish on the space in the near and long term. However, when your Uber driver or the mainstream media starts talking about Uranium (ie: BNN and CNBC), you may want to wait or take some chips off the table.

⛏️ Commodities Super Cycle - Got Copper?

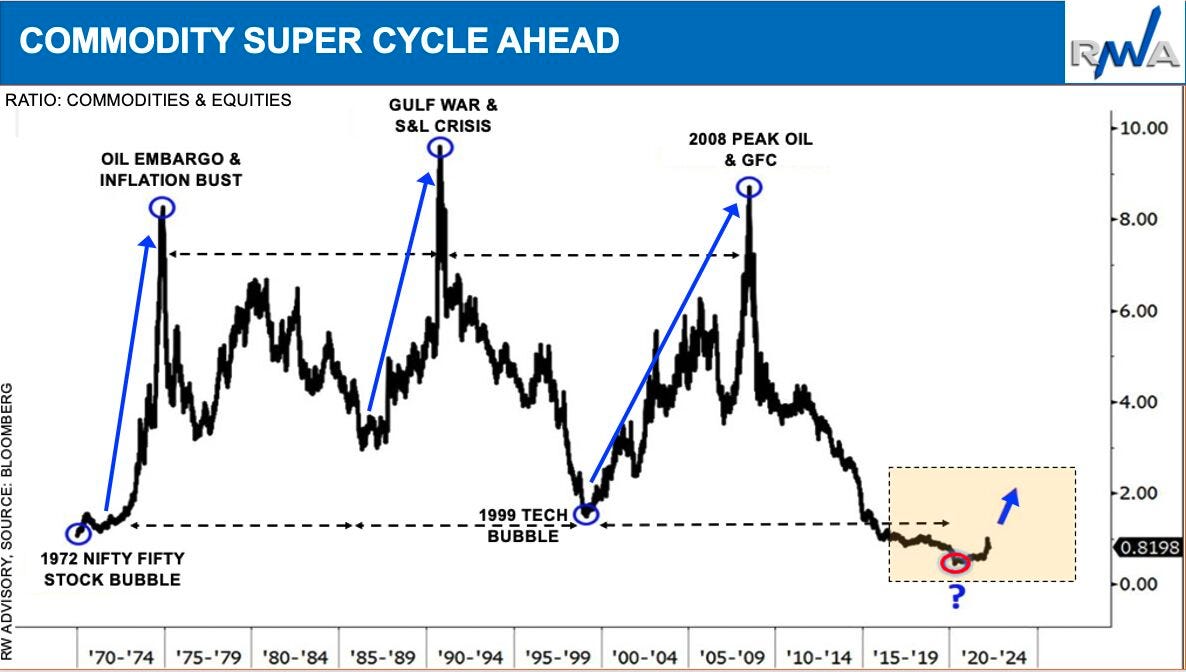

When Geopolitical conflict creeps to an all-time high, this normally signals the bottom of a commodities cycle… But at what cost?

This entire sector has experienced a significant amount of hate over the last few years. As a contrarian, you need to be able to understand that hate is in fact, opportunity.

While Lithium prices seem to have popped and crashed, and we are currently in what seems to be a Uranium bull market - there are still other hard assets which are in short supply globally.

If history is any lesson - just remember - ALL CHARTS HAVE MEMORY - whatever goes up, must come down and vice-versa (regression to the mean). And having chatted with most experts who have made fortunes in the space, we are entering one of the greatest wealth creating opportunities of our lifetime, outside of Bitcoin.

We believe gold is due for a new all-time high in the next year, while having silver exposure should also be considered (the physical kind).

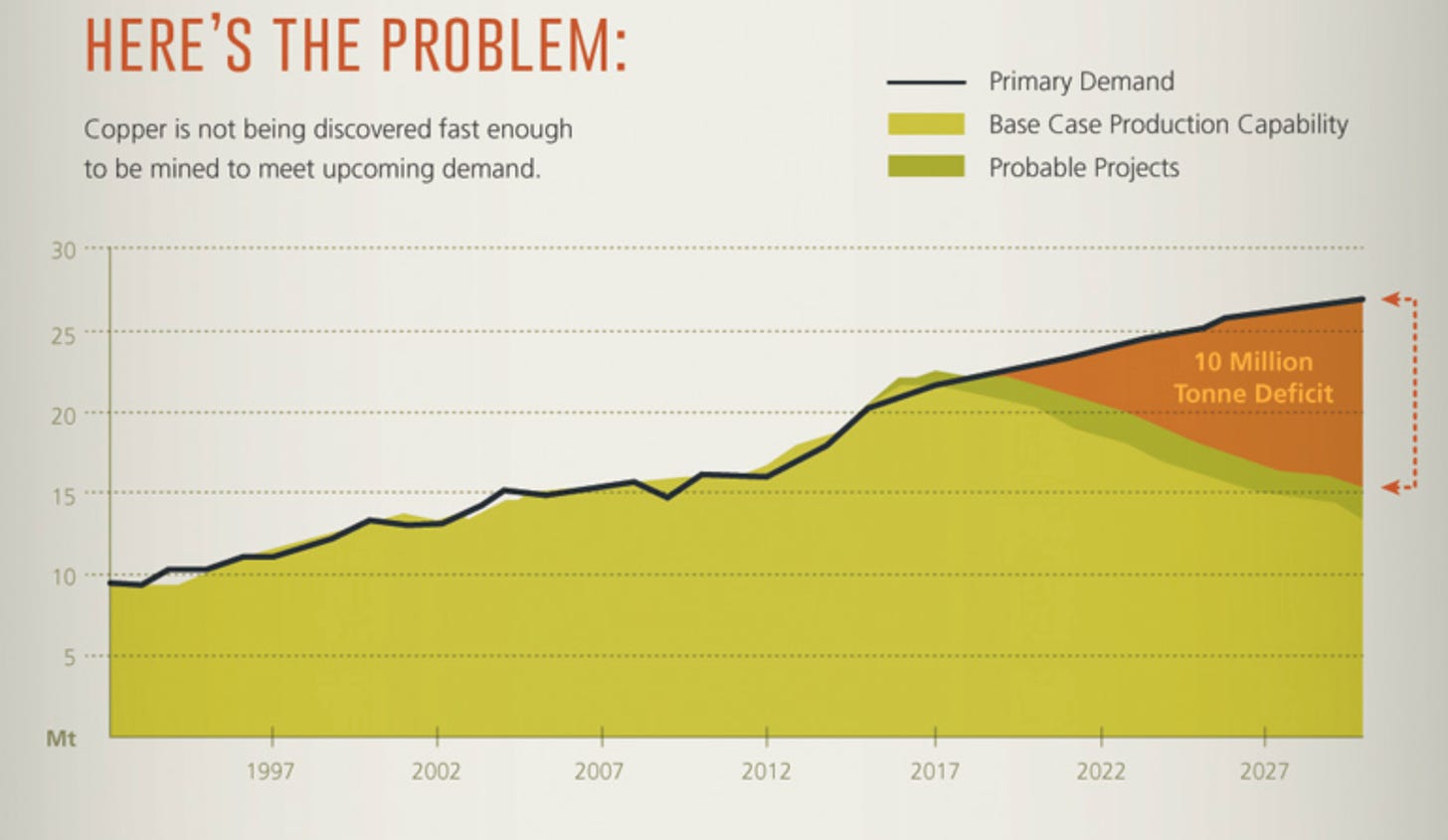

But there is one important metal which will contribute to the overall growth of infrastructure which are both in tight supply - Copper.

Billionaire Mining legend, Robert Friedland has been quoted saying the price of copper is likely going to go higher over the next 4-5 years - in large part because there literally isn’t enough of it anywhere. And thanks to many countries adopting woke (restrictive) policies against the mining industry, getting any kind of permit in Canada or the US can be a financial and legal nightmare.

For most mining investors, the chart below should already be engraved in your mind. And if you are new to this - take a screenshot of this and pin it on your fridge, because at $9,000/tonne copper, there is not enough of it for the industry to even build giant mines. Friedland believes we need to see $15,000/tonne copper prices for anything to be justified.

And he seems to be right…

Source: Visual Capitalist

This is a huge opportunity which has not materialized yet - and we are positioning accordingly to take advantage of this.

Luckily, there still is some time while copper bounces between $3.50-3.90/lbs.

Key here is to be PAY-tient.

📒 Wrapping Up

Here are some names we currently holding and buying in our portfolios:

Gold - physical bars/coins, DLTA.V, LGC.V

Silver- physicals bars/coins, SLVR.V, RSLV.V, BRC.V

Copper - FDY.TO, KC.V, BIG.TO, RIO.TO

Uranium - SYH.V, DML.TO, U.U.TO, URE, GXU.V, CVV.V

CASH.TO - definitely want to have liquidity available and why not have your cash earning 5.14% for the year, while waiting for opportunities.

REMEMBER - DO YOU OWN DUE DILIGENCE - this is not financial advice

If you enjoyed this - send us your feedback on what you would like to have included on our next issue. In the meantime, stay alert and informed because if you are concerned about what’s happening globally, you should not have anything to worry about…

Until Next Month…

We’d LOVE YOUR FEEDBACK

Let us know how we can improve or better our Macro Chronicles to help serve you better.

*DISCLAIMER* - READ CAREFULLY

None of the information taken within this newsletter should be considered investment advice and should only be viewed for information purposes only. NewGenMindset is not a broker, or a licensed provider of financial services. All claims made in this newsletter to any listener should not be viewed as offering personalized legal or investment counseling. Any investments made in any companies should be consulted with a licensed financial professional from here on.