Markets are at an Inflection Point 📈

As chaos continues to build globally, so does overconfidence in the overall market. And Gold is sending a warning...

Hi there,

If you're laying eyes on this newsletter piece for the first time – Welcome.

To those esteemed individuals who graced us with your presence last month, our sincerest gratitude for sticking around.

In this second installment of Macro Chronicles, we shall endeavor to untangle the global circus from its politically, culturally, and economically knotted mess, all while sprinkling a dash of investment wisdom at the end. Because let's face it, navigating through the chaos requires a bit of financial foresight too.

We promise to keep it real because most of you are probably fed up to the back teeth with the baloney our politicians and mainstream media have been serving us.

It's crucial to grasp what's unfolding on the global stage because, whether intentionally or not, the lunatics currently at the helm of nations are steering us into uncharted waters.

This month - we know many of you are looking at a shiny object in the market…

(yes - we talk about Bitcoin - don’t worry…)

But which ones are more important than the others, is yet to be determined.

In fact, the market right now is at an inflection point in the short-term, so this week, we wanted to highlight the importance of what is likely setting up to be a volatile month in March.

The key right now is patience - or as we like to say “PAY-tience” - (trademark pending)

Let’s dive in.

Before we do - please take a brief moment to answer the following question.

Macro Headlines

written by Nic A. Tartaglia

POLITICAL

Presidential Elections That Occurred In February Presidential elections are happening in Azerbaijan, Indonesia, Senegal and El Savador. If you recall, 2/3 of the world is voting this year…. power shifts are happening.

US-India Defense Deal

The US approved a $4 billion sale of attack drones, hellfire missiles, and laser-guided bombs to India might have multiple motivations. While the US claims it's to help India reduce its dependence on Russian defense ties, the economic relationship between Russia and India, especially as BRICS members, suggests a deeper and alternate narrative. Geopolitical strategies, regional influence, and balancing power dynamics could be factors at play. So what gives with this Western narrative?

Military support committed by Western Forces Both Canada and France committed to continued support to Ukraine in 2024. France has said it will commit 3 billion Euros in military support. Canada, on the other hand, has committed to donating nearly 800 SkyRanger R70 multi-mission unmanned aerial drones with an estimated value of $95 million CAD.

US Senate passes yet again another Foreign Aid Package. The approval of a $95 billion USD foreign aid package for Ukraine, Israel, and Taiwan reflects the geopolitical priorities and alliances of the United States. Taiwan is a region not yet officially in conflict. But with this continued military support by the US to a country China has asserted belongs to them, conflict is a likely scenario. China doesn’t appear to want to back down from their dominion over Taiwan. Who will own Taiwan?

Western Actions in the Middle East

US reprisal strikes in Syria and Iraq against Iranian-backed militias after the US lost 3 soldiers. The US White House has announced they will be imposing sanctions on Iran for their support of Russia in the War. If the results of the sanctions are anything like the results of sanctions on Russia, they will do little to nothing and are merely used as a political ploy to create the illusion of strength.

The additional strikes by the US and the UK in Yemen show this region is still an active hotbed for a possible regional war.

Domestic Struggles

🇺🇸 USA

The House Republicans winning impeachment of top Border Official Mayorkas from the Biden administration adds a layer of domestic political dynamics. It is now up to the Democrat Led Chamber to vote for removal.

The DOJ report about President Biden's memory raises questions about his capacity to hold office: “Biden is elderly with poor memory”. Meanwhile the White House has been scapegoating and deflecting from this issue trying to maintain this insane delusional narrative that Biden is sharp, present and capable. You have to be lost in this world to believe that.

New York judicial system after judge orders Trump to pay $355 million in civil fraud. Even Kevin O’leary slams New York and indicates how New York is killing itself, becoming an undesirable place for entrepreneurs and developers setting a horrible precedent for the state to penalize the market based on price mechanisms they (the court) deems accurate. New York AG Letitia James threatens to seize Trump Tower to Settle the fraud case against Trump if he doesn't pay the fine.

Nikki Haley lost her home county of Bamberg, South Carolina to Donald Trump by 30 points.

Hard to see Trump not on his way to the Republican nomination.

🇺🇦 Ukraine

Tensions between Ukraine's top general and President Zelensky which has led to Zelensky's decision to replace his top general, indicate potential internal struggles for power in Kyiv. The evolving situation requires careful observation to understand its implications.

🇵🇭 Philippines

A domestic trend appears to be seen in the Philippines, where its Government warned of using its authority and force to stamp out any attempt to fuel the secession of the country.

🇨🇦 Canada The Trudeau government came under fire after Auditor General Karen Hogan reported that the government overpaid for the ArriveCan app. She stated "an emergency is not an excuse to ignore the most basic requirements of maintaining complete and accurate records." The app cost taxpayers about $60 million, with an original cost expectation of $80,000. The RCMP has announced an official investigation. #ArriveScam

🌏 International Trade Development

Prime Minister Nerandra struck agreement with UAE to continue working on major trade corridors linking India through the Middle East to Europe.

North Korea’s Supreme People’s Assembly has voted to scrap all agreements with the South on promoting economic cooperation. The deterioration of their relationship continues to regress.

The UN Climate chief calls for $2.4 Trillion in climate finance. Is this inflationary? Does the climate “emergency” fuel the next wave of inflation? Meanwhile, the EU came out cautioning against trade measures that would impede the support of the solar sector. Commodities sector just gets more and more interesting by the day when seeing this perpetual development towards metals.

CULTURAL

🚜 Farmer Movement in Europe

The Farmer movement in Europe continues to gain momentum, spreading beyond its initial roots. Countries such as Scotland, Poland, Italy and Greece are now involved in the farmers movement in Europe. The farmers continue to grapple with the consequences of governments and academics distorting markets and prices, leaving farmers to bear the brunt of the fallout, making their livelihoods harder and harder to sustain. The frustration among farmers is boiling, creating rising tensions between European governments and the very providers of our sustenance. Instances of unrest, such as in Brussels where the EU HQ is located, are marked by clashes with riot police and determined farmers pushing tractors through barriers. This trend is an unmistakable attempt by the agricultural sector to push back against bureaucratic interference, highlighting the importance of farmers to mankind.

🪆 Tucker Carlson's Interview with Putin

The surprising and impactful interview between Tucker Carlson and Vladimir Putin has stirred significant interest. Tucker's decision to interview Putin generated excitement and criticism, as many sought alternative perspectives on the conflict in Ukraine, questioning Western narratives. Tucker Carlson’s Interview was insightful into Putin’s intellectual capacity, raising comparisons with other world leaders. There appears to be no current standing world leader who seems capable of matching Putin’s foresight, knowledge and presence. Biden in caparison, the so-called leader of the most powerful nation can barely string a sentence together. Putin's insights include acknowledging the US government's negative impact on the dollar by using it as a tool to sanction and manipulate other countries, critiquing America's propaganda machinery as being the largest and most powerful, NATO's prolonged refusal to engage with Russia and NATO’s promise not to militarize Ukraine.

Tucker Carlson sits down with Russian President Vladimir Putin - Moscow, Feb 4, 2024

⛓️💥 New York as an Example of Cultural Deterioration

New York is experiencing a concerning cultural deterioration, echoing a sentiment captured in Adam Smith's quote: "mercy to the guilty is cruelty to the innocent." The legal and judicial system appears to have become an extension of political whims, contributing to the erosion of cultural values in the city. Illegal immigrants are being emboldened by the lack of enforcement and even attacking people, going as far as attacking police officers. This is also a trend being seen across America, and it is really causing a rift within communities.

🤖 Google's Gemini AI Controversy

Google faces criticism for its Gemini AI, accused of refusing to show pictures and achievements of white people. The tech giant is also under fire for labeling the term 'communism' as 'evil,' sparking debates about censorship and ideological bias. On Monday Feb 26th, Google tanked by $9 billion on the open as this controversy made headlines. There is a clear underlying problem that highlights this ideology of identity politics rooting itself in the coding development.

Seems problematic… #GetWokeGoBroke

🌍 Anti-Western Sentiment in Congo

Protestors in Congo burn US and Belgium flags, signaling a growing anti-Western sentiment in the region. The act reflects broader discontent and opposition to Western influence. This is a trend that isn't noticing a slowdown. Its important because Africa is a very desirable geography that both the West and China want to get a foothold on.

🪦 Passing of Lord Jacob Rothschild - Lord Jacob Rothschild's death at the age of 87 marks the end of an era.

ECONOMICS

Clean Energy, Infrastructure & Mining Developments

India has announced a plan to invest $9 billion towards powering 10 million homes with rooftop solar panels. Along with this commitment, India has also indicated a plan to increase infrastructure spending by 11%. Meanwhile, NTPC, India's largest electricity generator, signed a preliminary agreement for $9.6 billion of clean energy projects in Maharashtra.

Even the Governor of Texas, Gregg Abbott has highlighted this month the need to grow power supply capacity by 15% annually to meet rising demand. In Canada, the energy minister said Canada is planning on boosting energy security by optimizing permitting processes to develop new critical mineral mines and says Ottawa is focused on 6 critical minerals - lithium, graphite, nickel, cobalt, copper and rare earth elements. Even Canada’s Brookfield Global Transition Fund raised $10 billion for its second global transition fund: “investing in the expansion of clean energy, the acceleration of sustainable solutions, and the transformation of companies operating in carbon-intensive sectors to more sustainable business models. The Fund’s seed portfolio includes a UK onshore renewables developer and a solar development partnership in India, and the pipeline of further investment opportunities is robust.”

Remember how I just finished highlighting India's commitment of $9 billion towards solar panels. Regardless of prices in the market when it comes to commodities and mining equities, there is a clear and unquestionable demand wave coming.

The World’s biggest supplier of Solar PV solutions has warned the West to not cut out Chinese suppliers or else costs will double, job opportunities missed and green targets missed.

Some moves in the mining space:

China's Yintai Gold to acquire Canadian gold exploration firm Osino for $272 million.

US Aluminum company Alcoa offers $2.2 billion for Australia's Alumina.

Elliott Management announces plans to spend over $1 billion on mining assets.

Stanley Druckenmiller, who is an American Billionaire investor, philanthropist and former hedge fund manager, enters the mining space with investments in Barrick Gold and Newmont through Stanley Druckenmiller’s Duquesne Family Office. They dumped from their holdings Google, Alibaba, and Amazon.

Job Data and Layoffs

The US Bureau of Labor Statistics reports the addition of 353k jobs in January, prompting skepticism due to potential downward adjustments and questions about the nature of employment, including pensioners returning to work and government-created jobs. Don’t forget though, they always adjust downward.

Also don't forget again to ask yourself, how many people on pension going back to work? How many people are working a second job? How many jobs are being created by the government - our good friend Tavi Costa, believes its about 20%.

2024 is starting off with some very interesting employment data. As rates are inching higher, and fear of recession is being pushed aside, there is a clear trend in the labor market with layoffs beginning to develop:

Bell Canada announces a 9% workforce reduction, cutting 4800 jobs.

Lynx air files for bankruptcy

Enbridge to layoff 650 positions

CPA canada to cut 20% of its workforce

Microsoft is cutting almost 2000 jobs across its gaming divisions Activision Blizzard & Xbox

Deutsche Bank said it was cutting 3500 back office jobs.

UPS to cut 12,000 jobs

Snap plans to cut 10% of its global workforce

Forbes to cut 3%

Docusign to cut about 6%

Citigroup has initiated the plan to begin cutting 20,000 jobs.

Deutsche Bank announces potential job cuts, amounting to nearly 4% of its global workforce, as part of a restructuring plan, representing nearly 3500 jobs.

United Parcel Service plans to cut 12,000 jobs

Small business bankruptcy trend is something we need to keep watching. February marks the possible trend of small business bankruptcies in Canada following the end of pandemic-era government support. We will begin to see the impact on employment and the pressure it will put on the BOC’s employment mandate.

Will these variables add pressure to cut rates? Employment is a mandate after all.

Fiscal & Monetary Development

The UK and Japanese economies fall into recession.

The European Central Bank reports its first annual loss in over 2 decades.

The Bank of England has decided to leave interest rates unchanged, signaling a cautious approach to economic policies and a potential rate cut in the horizon.

Milei secured Argentina's first budget surplus since 2012, recording a nearly $600 million financial surplus in January.

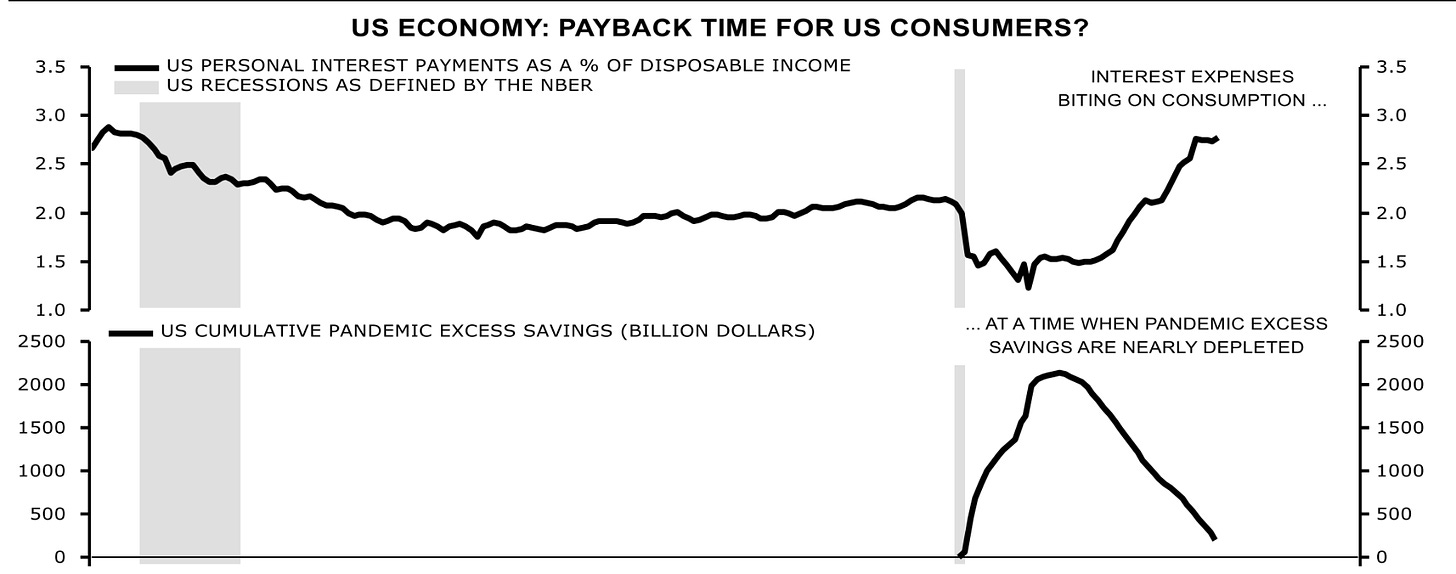

US credit card debt reaches $1.13 trillion, holding at a 38-year high in APRs around 21%. The USA needs to be careful of the compounding effect of this uncontrollable debt.

Senate Banking Committee Chair Sherrod Brown urges Fed Chair Jerome Powell to cut interest rates early, raising concerns about a potential recession. Is the illusion of economic strength running out of steam? Is stagflation coming?

The US has accumulated $190 billion in debt for the month of January.

Janet Yellen openly acknowledges that policies do not need to be aimed at reducing prices, since wages have risen…… supporting that inflation is the desire.

BRICS Development

A Nigerian Senior Advocate suggests joining BRICS and selling Nigerian crude in naira to move away from the US dollar.

New Highs & Market development

Bitcoin reaches a new high since late 2021, reflecting continued interest in the cryptocurrency market. Started February around 42,000. By Feb 29th, it gained 50%, reaching roughly $63,000.

Nasdaq & S&P 500 finishes the last day of February with a record high.

Cocoa prices hit a 40-year high at $865.92/Metric Tones.

Jeff Bezos sells $8 billion worth of Amazon stock.

The Walmart Family sells $2.5 billion of Walmart stock.

Mercedez-Benz reevaluates the "EV Only by 2030" goal, deeming it void of realism. Even Apple has come out saying they will be dropping their EV projects.

Dollars and Sense: What We’re Buying

written by Dan Kozel

Tech Trade running out of steam - Blow-Off Top Imminent?

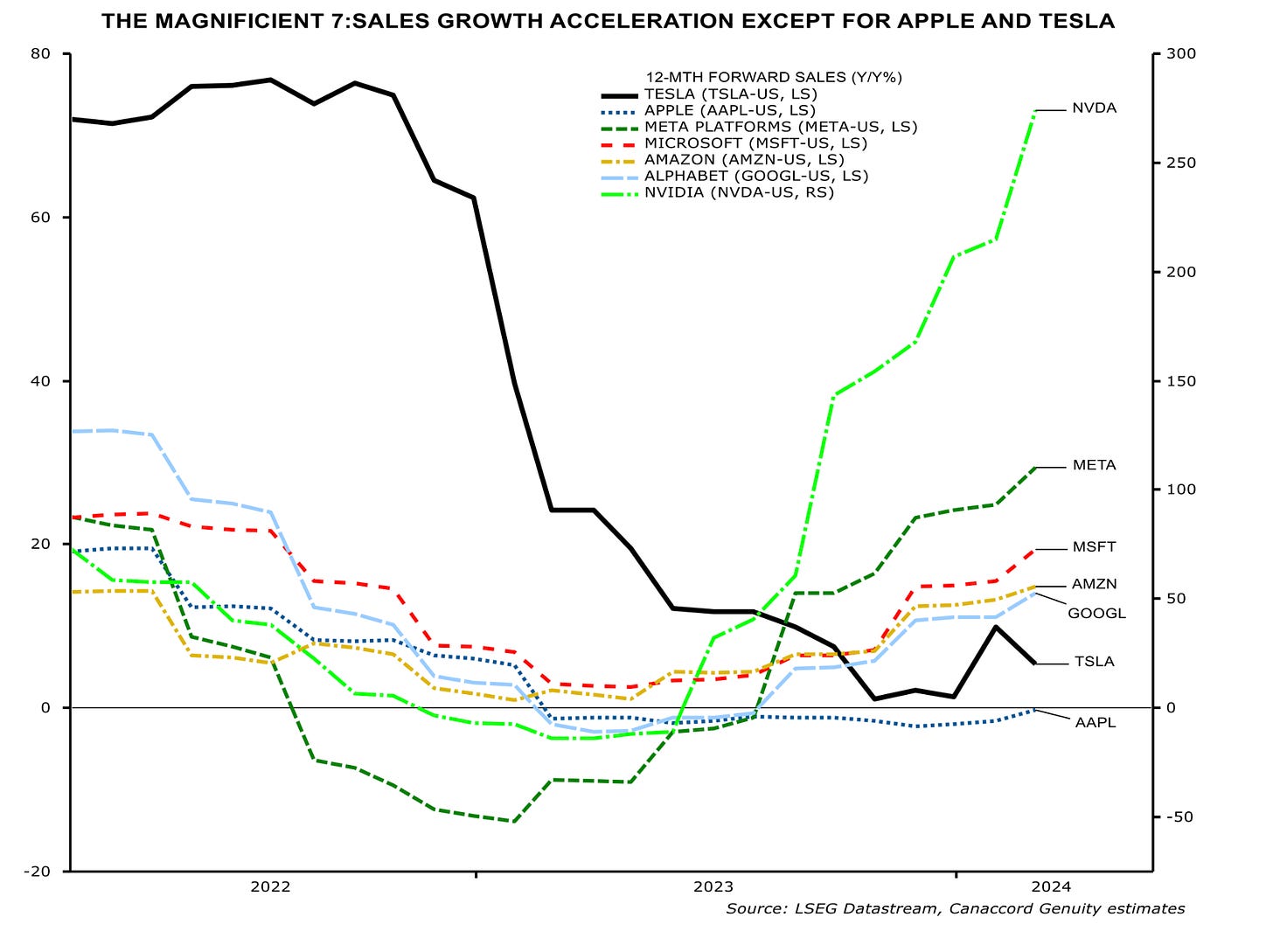

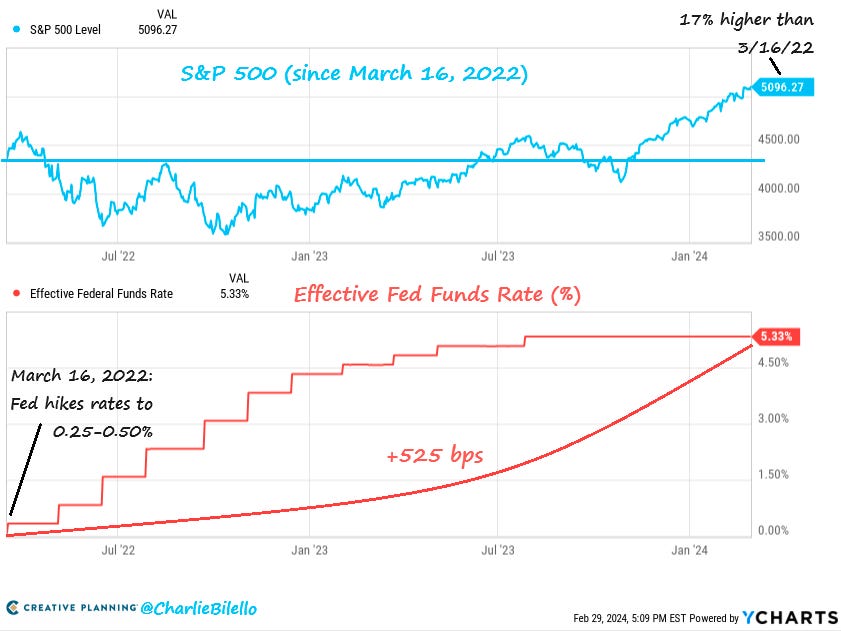

It’s important to understand where and what has caused the market to move up so aggressively over the last several weeks. And quite honestly, the tech trade continues to push markets higher - even with higher interest rates.

Nvidia ($NVDA) is still “undervalued”. After smashing earnings, the company keeps pulling the market even higher. But at what cost?

If anything were to happen that should not surprise you, its to see NVDA hit $1,400. I personally want to avoid this trade because the Implied Volatility in the options market is well above 85-90%, meaning you’ll be paying an insane premium when there are other opportunities in other sectors at cheaper entry points. And playing the name for another $400 move doesn’t excite me.

As we enter March, it has historically been a very volatile month. You simply have to go back to 2020 and 2009 to see the parallels. We think Mega-Cap tech is due for a significant pullback - possibly taking the rest of the market down with it.

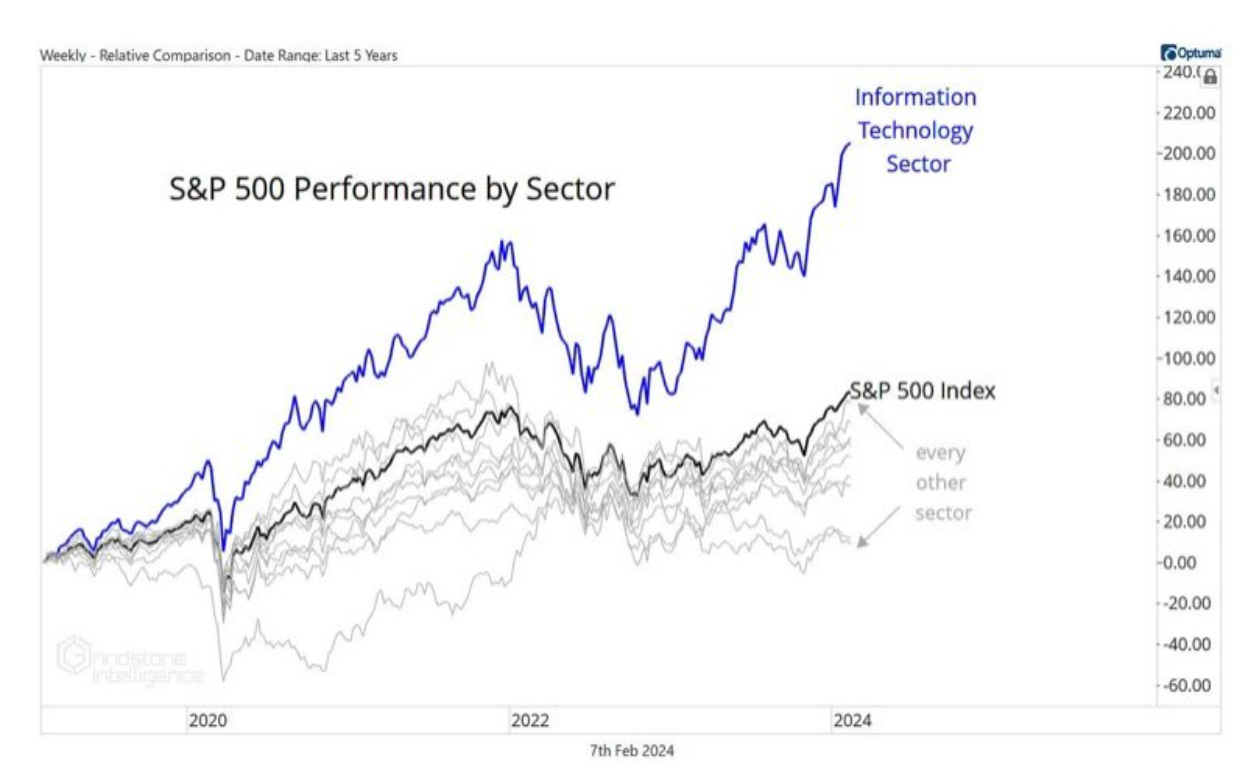

If you look at the last 5 years, the XLK (Tech Sector), has risen over 200% or 2x the return of the S&P 500. This move has become so extreme, that over the last timeframe, every single other sector has lagged or traded below “average”.

We’re not here to question whether or not a company like NVDA is a good or bad company. I think everyone reading this will agree - in fact, the fundamentals since their earnings announcement two weeks ago, further justify the current valuation.

However, charts have memory and over time, will regress back to the mean. If you bought $NVDA 7 months ago - congrats - this was an epic trade, but it may be time to take some chips off the table and add liquidity to prepare for what’s coming.

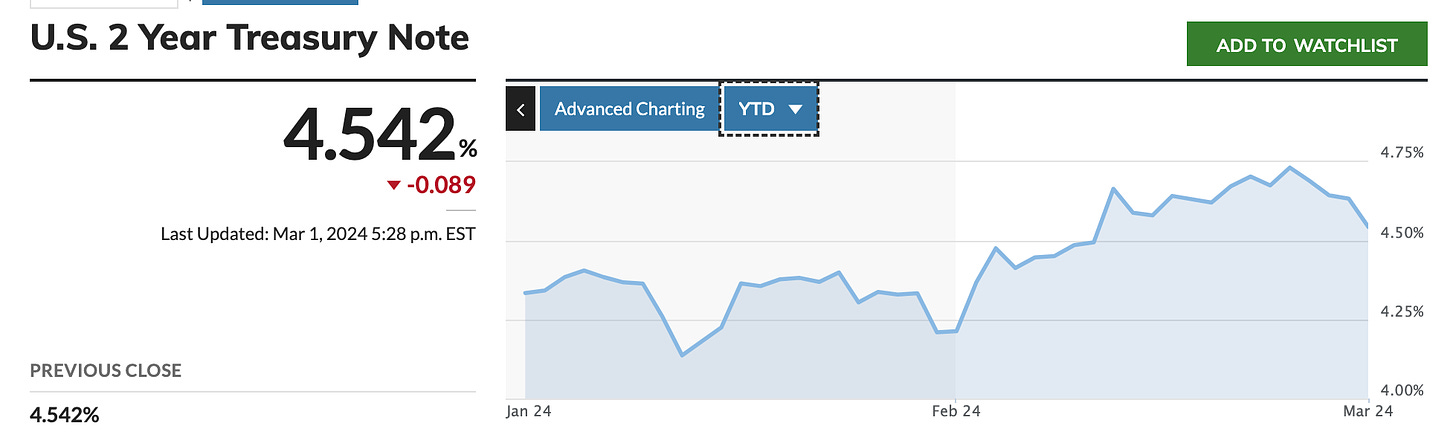

The market is frothy right now - and it doesn’t seem like rates are going down anytime soon. In fact, I’m prepared to predict that rates are going to stay higher for a little bit longer. Take a peak at the 2-Year note - the FED always follows it.

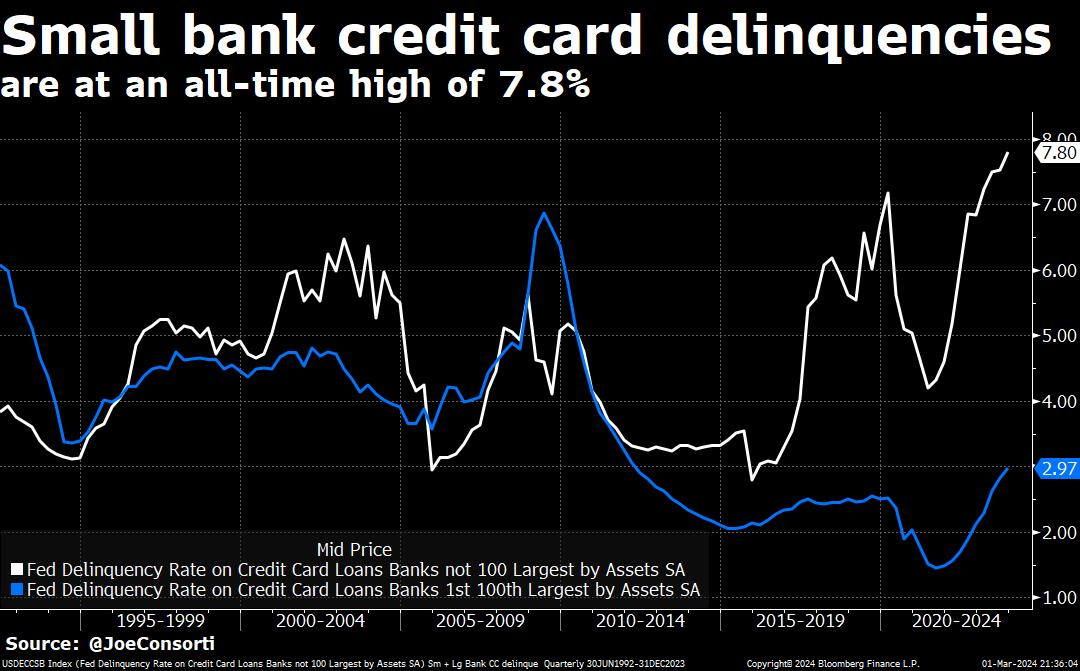

This will eat away at discretionary spending, which will see a slow down on spending in other sectors. (If I’m wrong, I will admit later in the year). But Credit card delinquencies are at an all-time high, at “full employment”.

I’ll be watching this very closely over the next few months.

Source: Canaccord - March 1st 2024 Macro report

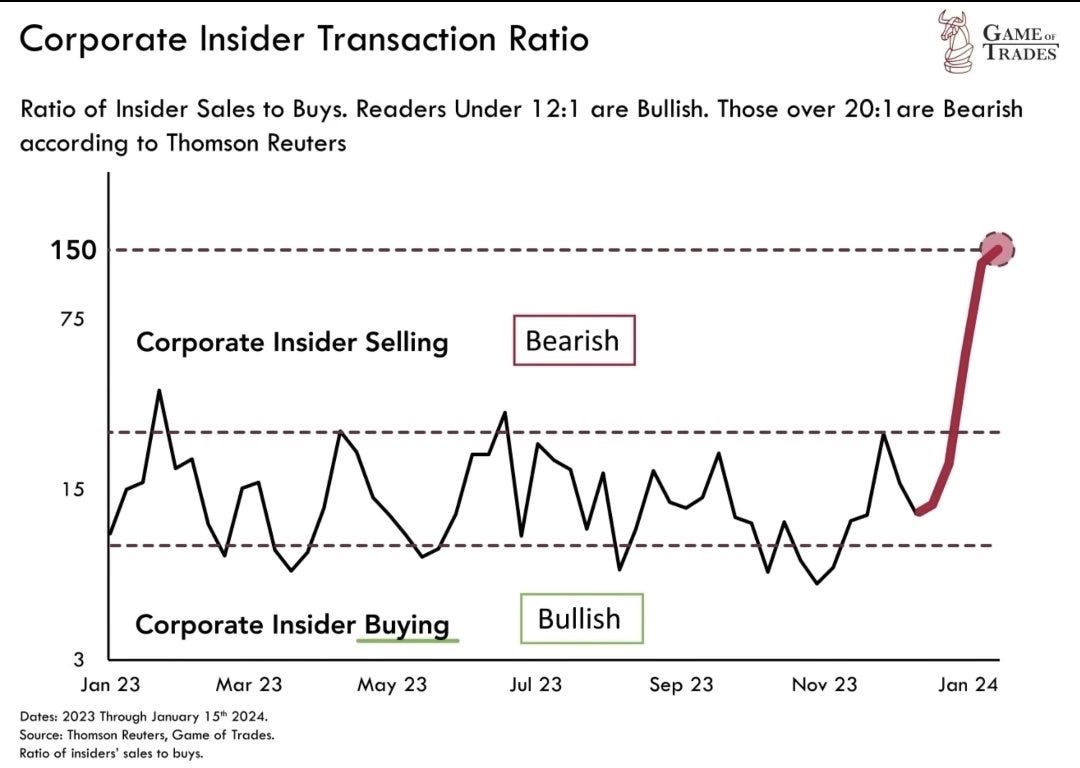

Insiders are Dumping Stock

We’ve seen many insiders sell stocks in the market and this is usually the signal we are approaching an unsustained level in the markets. The following CEO’s have sold a chunk of their positions in the last 2 months.

Jeff Bezos (Amazon) - sold $8B worth of AMZN

Walton Family (Wal-Mart) - sold $2.5B worth of WMT

Mark Zuckerberg (Meta) - sold $151M worth of META

Klarich Lee - (Palo Alto Networks) - sold $38M worth of PANW

John Hess (Hess Corp) - sold $30M wroth of HES

Mark Benioff (Salesforce) - sold $17M worth of CRM

Insiders at Nvidia - sold $80M worth of NVDA

Usually, when insiders sell stock, it trends between the ranges of 7.5-35. This usually happens because company executives are preparing for tax season. But given the magnitude and the volume of shares which have been dumped from some of the best companies in the world - it becomes apparent there’s something bigger brewing on the horizon.

One more chart we thought was super important to bring up was the one below.

This, in itself - is quite an anomaly, and speak volume as to how insanely irrational Mr. Market has been…

Since Jerome Powell began hiking rates on March 16, 2022 - the S&P 500 has risen 17%. So for everyone wondering when the next rate cut is - the moment this happens, the entire risk-on market, is going to fall with it (Gold will rise ! - more on that shortly).

Jobs data will be the determining factor on this, and we’re watching this closely. But every time there’s “strong jobs” numbers - we are likely to see higher rates for much longer. Again - keep an eye on the 2-Year Note.

This gives us more time allocate on ideas we think will do well on the first rate cut.

The Scarcity Trade

Two of the Greatest Wealth Creating Opportunities are Upon us… but can your stomach handle it ?

Meme Source:

Gold & Silver

Let’s start with Gold and Silver - in our last newsletter, we mentioned the importance of having some exposure. These two assets are negatively correlated to the market - meaning they are risk-off.

And over the last month, much of the price action continues to be hated by most market participants, except for the smart money.

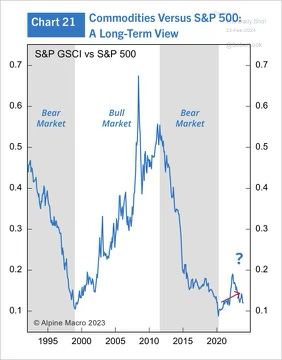

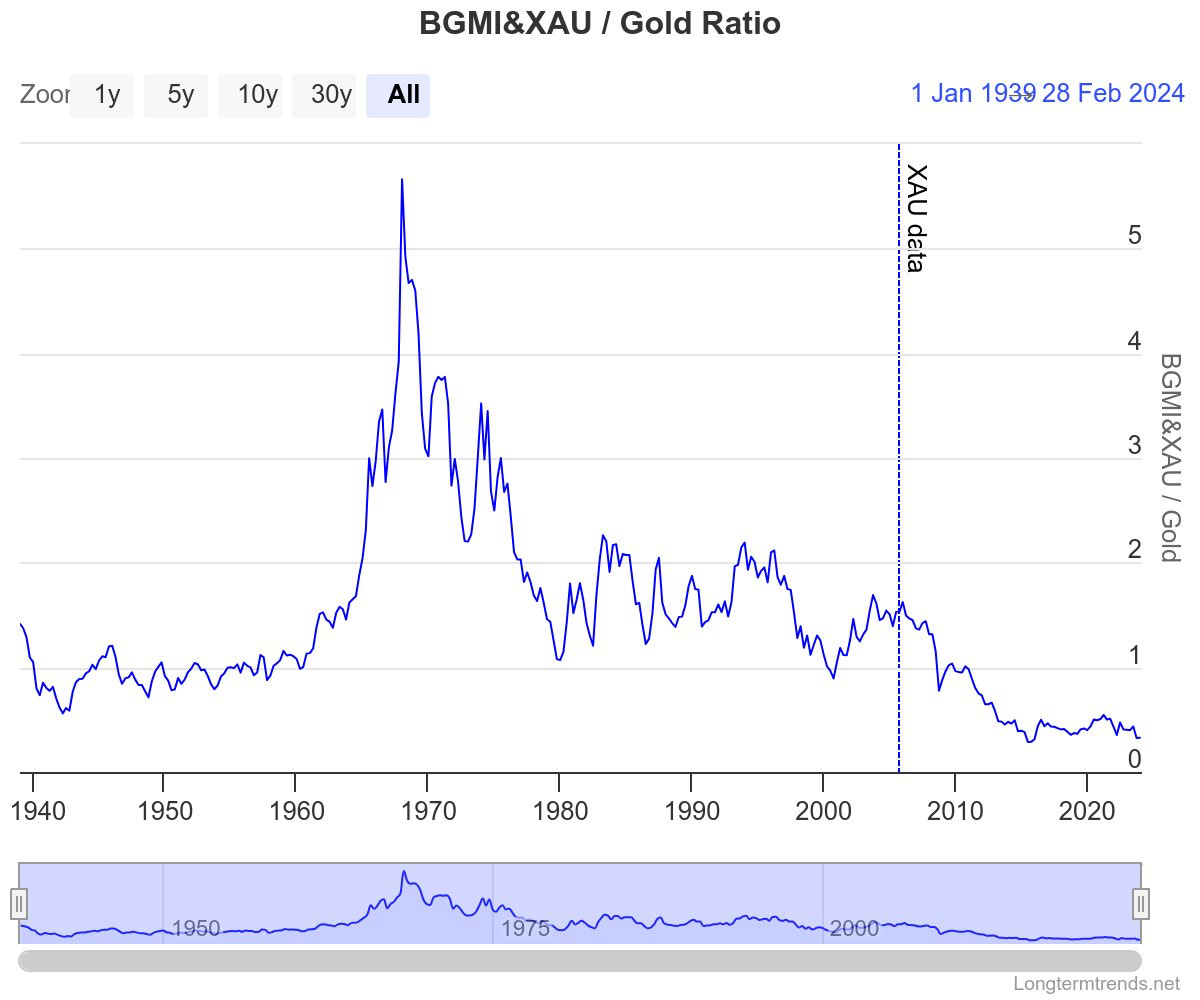

The major producers are seeing record inflows from the world’s smartest investors - they know what’s coming and it’s been very hard to ignore. The chart below, in our view, is setting up to be the largest wealth creating opportunity in our lifetime.

Remember - charts have memory. Everything above is related to commodities. Gold and silver have never been cheaper to own than now.

Many producers are able to produce gold anywhere between $850/oz - $1400/oz USD - if you do simple arithmetic with gold even being at $1900/oz USD - they are still able to squeeze about a 30% margin on their production alone.

When gold reaches above $2,200/oz USD - and companies are trading at around 0.6-1.1x Cash - it makes sense, many value investors are piling into the sector.

If rates do get cut - we expect the price of gold to reach new highs, further making the valuations of the sector at current prices even more attractive.

For the first time in a decade - apart from the Energy sector, the deep value trade is in the precious metals producers, who can even pay you solid dividends to start. Newmont Corporation ($NEM) pays about 3.20%, and is likely going to ride up to the high 60’s, when this rally commences.

Perhaps the bottom is in?

As Nic mentioned - Stanley Drunkenmiller has sold $AAPL and $AMZN and bought positions into $GOLD and $NEM. When a portfolio manager who manages billions of dollars, and has a track record of beating the market for the past 30+ years, is rotating into gold and silver producers - something important is happening.

For Silver - you’ll probably need a lot more patience because historically, this commodity always lags gold by several months, before ripping to the upside when investors least expect it. You do not want to chase this trade - but rather start accumulating when nobody is talking about it.

Take a listen to our recent episode with Peter Krauth - Click Here to Watch Full Episode - to get a better understanding of this asset.

We are bullish on it - physicals first, producers second then sprinkle some juniors explorers for leverage upside.

The Juniors continue to provide some interesting investment opportunities - if you pick the right ones, have an insane amount of leverage and potential return.

We’re talking shitcoin style returns of 10x, 100x, maybe even 1000x potential.

There’s a catch-up trade pending in the market - the chart above is the Barron’s mining stock index, relative to the price of Gold. The sector is dirt cheap to a point where it is hated…. That’s a huge opportunity.

And a lot of the growth in the juniors will come to fruition with other incredible projects still trading at ridiculously cheap valuations. When drill results start coming out from the more prominent companies, with higher gold prices, returns on these assets will be astronomical.

Canada and Mexico, in our view, continue to be very attractive mining jurisdictions.

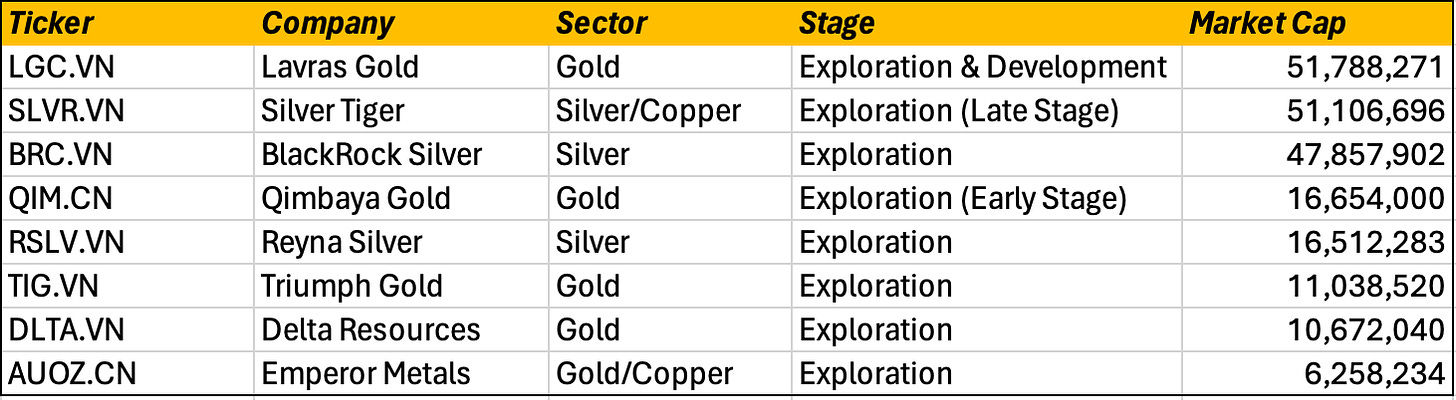

Here are some names we’re currently holding in our portfolios which we feel have tremendous potential - and no, this was not a paid piece of intel, rather our own conviction putting our hard-earned money to work.

Careful - these are high risk, so only put what you’re comfortable losing.

Market Cap data as of March 1st, 2024 closing price - #’s are $CAD

More on Each Name - Click the Links Below

Please do your own due diligence on these - we are not recommending these names. We’re simply sharing some opportunities we currently hold in our own portfolios.

We’re expecting gold prices (see last month’s newsletter) to reach new all-time highs and this will certainly push valuations of undervalued gold companies much higher - the key is patience, good management and the right project.

So if you’re going to invest in this sector, you are going to need a lot of patience.

If you’re impatient, let’s move on to our next section…

Bitcoin - Do You Understand Your Level of Conviction ?

Since BlackRock announced the Bitcoin ETF in January, Bitcoin's price has surged to highs last seen in 2021.

I'm skeptical about investing in ETFs because they mainly serve institutions to profit from fees, without you, the investor, being provided with actual ownership of the underlying asset.

Nevertheless, the demand for Bitcoin has skyrocketed, particularly on the institutional side. Wealthy family offices and hedge funds are experiencing significant demand from their clients for Bitcoin exposure in their portfolios. These clients, who have boatloads of cash, prefer to delegate the complexities of owning actual Bitcoin to others.

Despite claims from "experts" suggesting that this time is different, I argue the contrary. Recent events bear resemblance to the last halving event. Two major players with significant financial resources have influenced the entire narrative.

In 2020, the FTX ponzi scheme, led by the now-disgraced founder Sam Bankman-Fried, manipulated the crypto market, driving up Bitcoin prices. Similarly, in 2024, Wall Street and the wealthiest family offices are the "new money" dictating the narrative of Bitcoin scarcity.

Recent reports indicate a surge in Bitcoin demand, far exceeding available supply. Bitcoin miners claim significance in this space, utilizing sophisticated networks and billions in infrastructure investments to mine more Bitcoin.

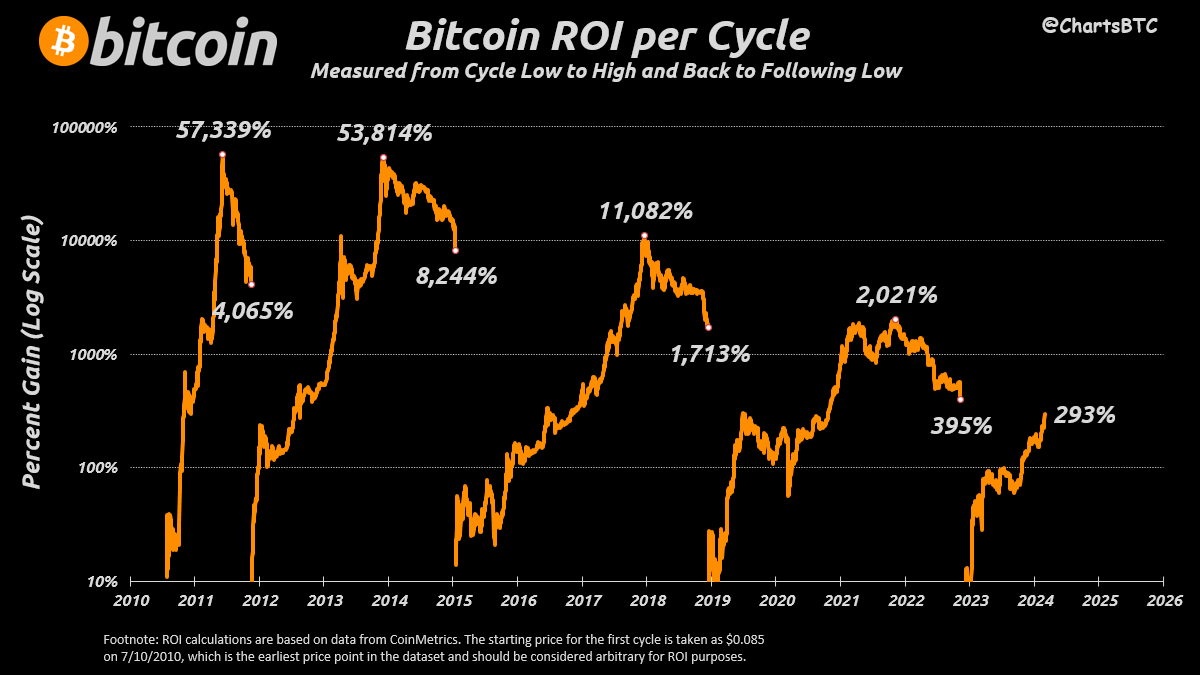

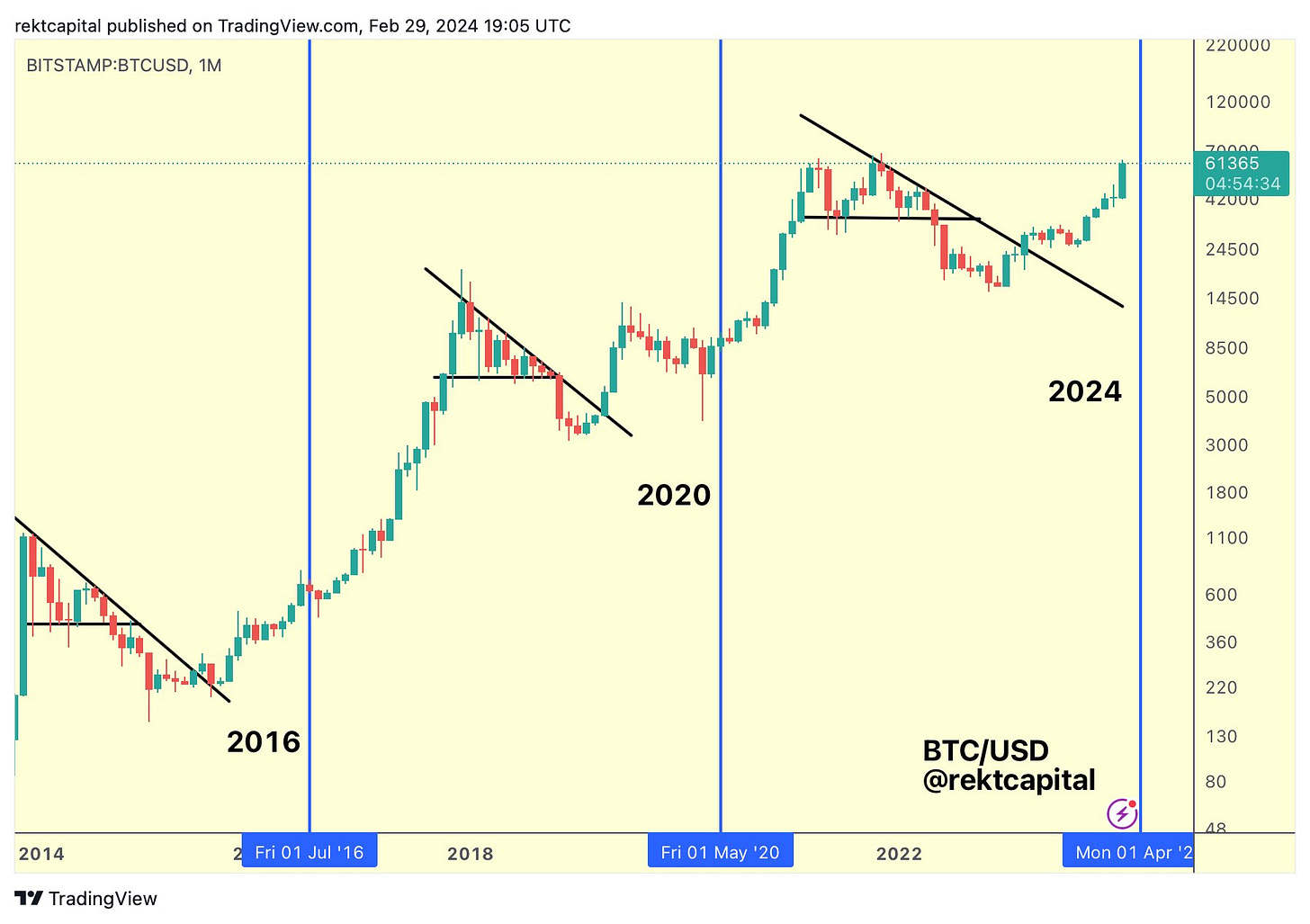

With only 21 million Bitcoin available (inelastic supply), conditions are ripe for what could be another violent and extraordinary bull run. However, a historical observation suggests that Bitcoin typically hits new all-time highs AFTER halving events - I’m skeptical of this current push. Especially given this was the biggest monthly candle to end February, EVER.

Source: https://x.com/martypartymusic/status/1763197172273836105?s=20

Not to mention - until otherwise, Bitcoin is still a risk-on asset (correlated to stocks).

The influx of Bitcoin ETF inflows presents challenges in meeting demand. Institutions like BlackRock must hold physical Bitcoin in inventory to fulfill ETF purchases; otherwise, investors risk being defrauded (how ironic lol).

While I've never been inclined towards trading Bitcoin, individuals like @StockUnlocked excel in this domain - give him a follow. He’ll show you how to trade PEPE Coin and SHIBA INU - I promise.

For macro, generalist investors, viewing Bitcoin as a generational play and adopting a dollar-cost averaging approach might be more prudent.

Examining the returns of the last four halving cycles compared to other asset classes reveals a diminishing risk at each halving and historically superior returns from holding Bitcoin. But the volatility is what kills the weak stomach - and there’s going to be more of it.

To be fair, my real conviction for Bitcoin only began in 2019 - and I have no regrets right now for not participating in the ones prior to that time. The risk and speculation around every Halving prior to 2019 were completely different then in 2024.

But the sentiment and overconfidence we’re seeing all over social media and Twitter, is identical to 2021 and I remain convinced many unsophisticated retail investors are going to get hurt, once again.

So where is BTC ultimately heading - let’s keep it simple.

In 2024 Bitcoin will be at…

$70,000 - there’s a 100% probability of this

$90,000 - there’s a 95% probability of this

$100,000 - there’s a 92% probability of this

There’s also a 96% probability of an aggressive pullback to the high 40,000’s - wait WTF do you mean?!

I still think we are going to see an aggressive pullback the likes of which many market participants will not be able to comprehend.

Before I continue, I want to make something very clear - I am not calling for a collapse of bitcoin, but as mentioned previously, sentiment is the same as in 2021 and this is still a risk-on asset, for now. Greed is slowly creeping higher, and people are literally losing their marbles on Twitter if you mention anything negative about Bitcoin.

You need to remember this forever - markets always move in cycles and regress back to the mean - it doesn’t matter what asset class. Crypto “Gurus” will tell you otherwise and are full of shit.

In addition, markets tend to peak when the bears are all gone and investor sentiment is so high, your damn Uber driver is screaming “I need to buy bitcoin” - we are not there yet.

My main concern on this next move, is that retail investors are going to get dragged in to the next FOMO rally and get their faces ripped off when the institutions rug pull people like your Uber driver or your hair-dresser Sally, who have no clue how markets work.

This quote from Michael Gayed, CFA in his most recent article needs to be plastered on your wall and I encourage you to give him a follow as he has an incredible pulse on the markets.

“I always like to say that “opportunity exists when the crowd thinks it knows an unknowable future.” No one can predict exactly what happens tomorrow. The best any of us can do is identify conditions. Conditions dictate probabilities. Probabilities dictate outcome.”

The current conditions are lining up for what is going to be another win for Wall Street. The smart money always wins - and they do so by stealing your money through the markets.

Is it legal - yes.

Is it ethical - absolutely not.

Until CNBC starts ranting about bitcoin on a daily basis, the FOMO still has yet to kick-in, but we’re getting close. Pay attention to identifying the conditions in this market.

So ask yourself this question, before taking the plunge into this asset. Forget price for just a moment.

WHY do you want to own bitcoin ?

And For HOW LONG….

My answer is simple.

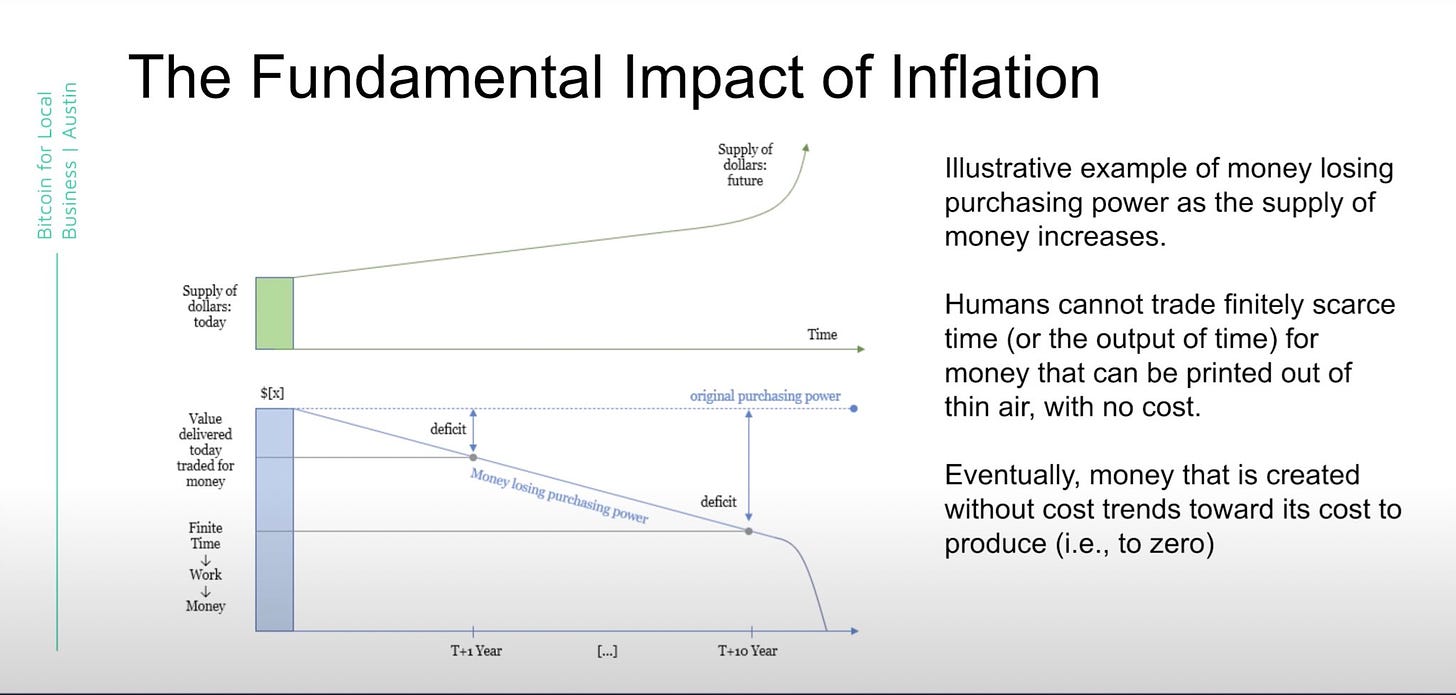

WHY - government’s have injected so much money into the ecosystem, the value of their “debt” currency continues to dwindle over time. And fiat, in the long-run, is worthless.

For How LONG - well, I intend on passing on my Bitcoin to my grandchildren…. I also don’t want to be sitting here looking back when i'm 50 years old saying “why didn’t I put anything into this asset class”

If your Why is because the price is going higher - you’ve missed the point entirely.

Bitcoin, in my view, is what Real Estate was when you can buy a home for just under $79,000USD, back in the 1980s.

Price to me - is irrelevant. And I’ve accepted there’s violent volatility ahead.

The question is - will I ever own enough… 1 BTC could equal financial freedom.

That's all for this month and looking forward to hearing any of your feedback. There’s two massive opportunities right now for generational wealth - go do the work and we’ll regroup in 30 days.

Cheers, ya beauties.

*DISCLAIMER* - READ CAREFULLY

None of the information taken within this newsletter should be considered investment advice and should only be viewed for information purposes only. NewGenMindset is not a broker, or a licensed provider of financial services. All claims made in this newsletter to any listener should not be viewed as offering personalized legal or investment counseling. Any investments made in any companies should be consulted with a licensed financial professional from here on.