U.S. Balance of Power, BRICs & the East Strengthen, while Stocks Surge

October 2024 Edition: Issue 10 - Macro Chronicles: Unfiltered Insights

Hi there,

Tomorrow marks a pivotal day as the US balance of power comes into sharp focus in the West and the world. There’s a palpable tension in the air; no matter which candidate you support, it feels nearly impossible to voice your views without facing judgment.

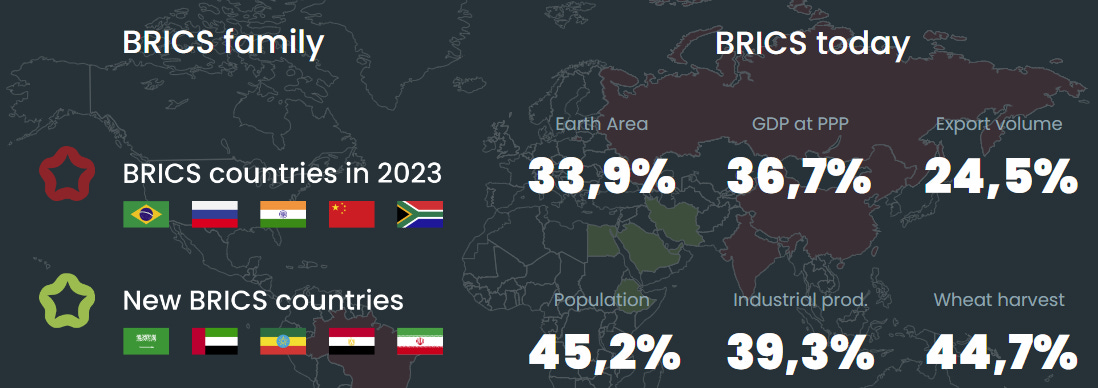

Meanwhile, as October wraps up, there’s been significant activity overseas, notably with the first-ever BRICS summit in Russia—a major event that’s receiving almost no coverage from Western media. The summit’s outcomes could hold serious implications for whoever takes the White House, though we may not know the final results until later this week.

With global debt escalating by the hour, we believe investors need to closely monitor the global shifts in power, which will ultimately impact us all as the divide between East and West grows.

Here’s a brief look at our personal election predictions:

Nic – Given the intense division and heated exchanges on both sides, coupled with the ongoing voter suppression and legal challenges, I doubt we’ll know the winner anytime soon. There’s simply too much chaos to make a prediction.

Dan – If the election is decided on Election Night, the market seems to have priced in a Trump victory and possibly a sweep of the House and Senate. However, if the results are delayed for more than a few days, it’s likely both sides will question the outcome, creating an environment of uncertainty that could linger until Inauguration Day in January. I don think it’s decided until Thursday…

Regardless of who wins, the next President will face a mountain of global challenges.

Let’s dive in.

Macro Headliners

Written by Nic Tartaglia

POLITICS

BRICS Summit 2024

On the political front, this was one of the most interesting political developments for the month of October. The summit was held October 22-24 in Kazan, hosted by Russia, merely 2 weeks out from the American elections.

In attendance were the primary BRICs member’s Head’s of State:

India

Brazil → Their Minister of Foreign Affairs Mauro Vieira was present in the absence of President Lula, who was unable to attend due to a head injury.

China

South Africa

A powerful statement was made by China’s Xi:

“At present, the world is going through changes unseen in a hundred years, the international situation is intertwined with chaos.”

"There is an urgent need to reform the international financial architecture, and BRICS must play a leading role in promoting a new system that better reflects the profound changes in the international economic balance of power."

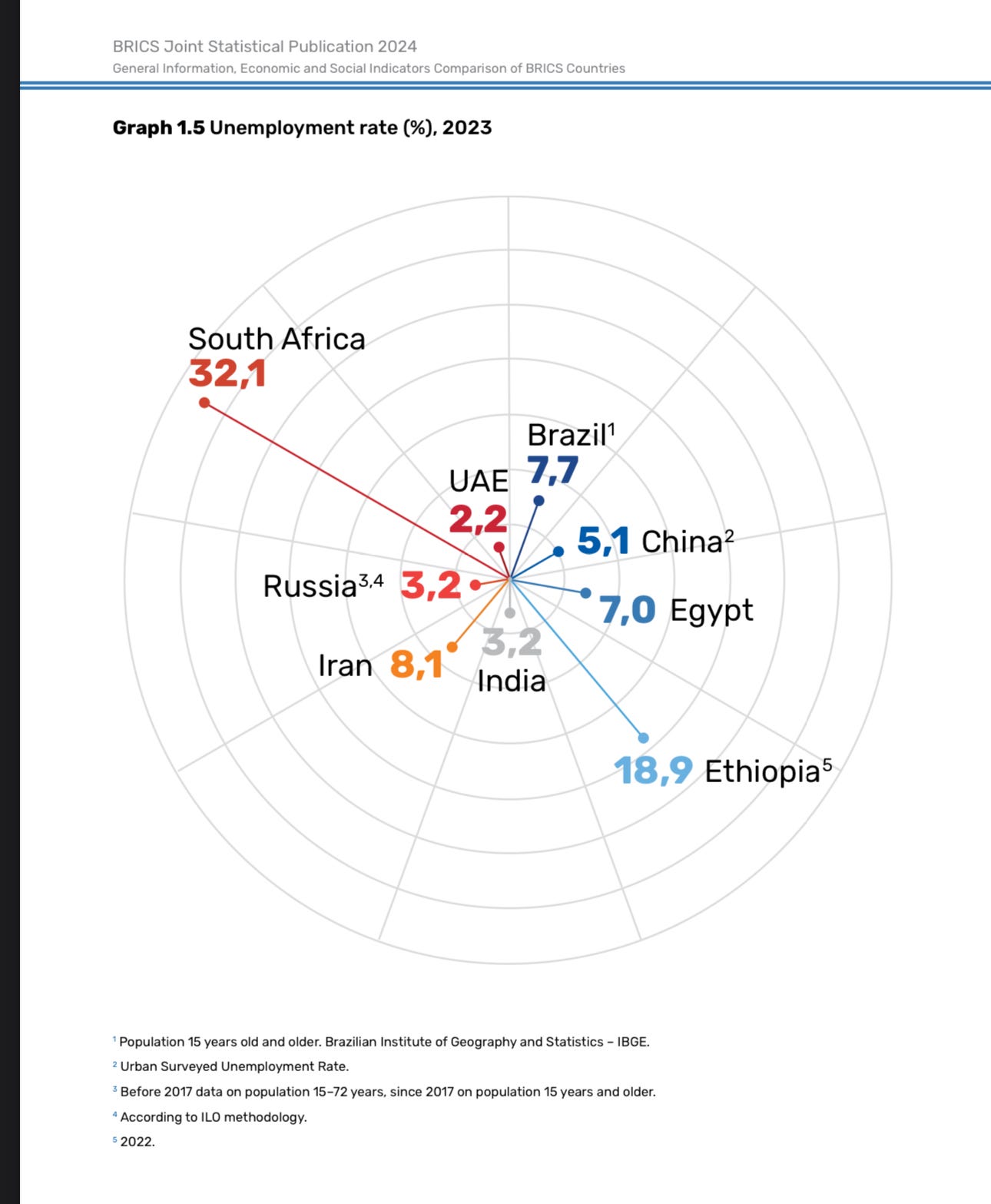

There were also a few other nation Leaders in attendance who appear to be the members accepted into BRICs +, whom of which were featured in a large official report called “The Joint Statistical Report” published by BRICs:

UAE

Iran

Egypt

Ethiopia

The following pictures are from the “The Joint Statistical Report” highlighting some general statistical data on their ‘Population’, ‘Territory’ and ‘Unemployment rate’.

In attendance were also a few other Heads of State:

Saudi Arabia by high ranking officials.

Turkey’s President Recep Tayyip Erdogan

Vietnam’s Prime Minister Pham Minh Chinh

While Saudi Arabia was represented at the summit, they were not adopted as a member or a partner. The Middle Eastern kingdom was also extended an invitation alongside Egypt, Ethiopia, Iran, and the UAE earlier this year but declined to accept.

At the end of the Summit, 13 nations were adopted as “partners’ of the alliance of BRICs. This designation is short of complete membership, but puts them in line to be full members sooner than later. Turkey and Vietnam were included in this list of 13 nations. Included as well as partner countries within the alliance are: Algeria, Belarus, Bolivia, Cuba, Indonesia, Kazakhstan, Malaysia, Nigeria, Thailand, Uganda and Uzbekistan.

What was interesting and very optimistic for the BRICs + was the energy levels and joy seen at the summit. Leaders and senior officials enjoyed laughter and champagne. There was even a mock BRICs note that made its appearance that was gifted to Putin as a symbolic gesture.

Let’s go back and discuss some noteworthy points about Turkey becoming an official BRICs member. This marks the first time a NATO member which they have held since 1952 seeks to join the Eastern Bloc. Could this lead to a loss in their membership status with NATO? Will NATO permit such dual allegiance in the face of such Western Vs. Eastern dynamics?

Turkish President Recep Tayyip Erdogan stated at the Summit:

“As long as bloodshed in the Middle East is not stopped, there can be no talk of justice, peace, or development for the future. Global order of justice, development can only be achieved by establishing peace, security beyond our borders.”

“The United States uses terrorist organizations in the region for its own interests and for the security of Israel.”

Another very relevant development from the summit was the attendance of the UN Secretary General, Antonio Guterres. This is important because it appears he prioritized this event over the competing Western summit, such as the first-ever Peace Summit in Switzerland, hosted by Ukraine. The UN declined to attend, which is very interesting. In fact, Guterres even made a speech at the BRICS summit that was supportive of the BRICS, and its potential role for strengthening global development and security. Israel had even officially banned the UN Chief Gueterres from the country because he failed to condemn Iran attacks. There is some clear internal conflict happening within the Western Bloc, and it appears the East is going to take advantage of it.

“We need peace in Gaza…

We need peace in Lebanon…

We need peace in Ukraine…

A just peace in line with the UN Charter, international law and General Assembly resolutions.

We need peace in Sudan…

Everywhere, we must uphold the values of the UN Charter, the rule of law, and the principles of sovereignty, territorial integrity and political independence of all States. The Summit of the Future charted a course to strengthen multilateralism for global development and security. Now we must turn words into deeds and we believe BRICS can play a very important role in this direction.”

This suggests that the UN’s perception of the global stage is changing and fast. The participation of the UN at the summit clearly did not sit well with some Western elites. For one, the foreign minister of Lithuania branded Guterres’ involvement in the BRICS Summit as “unacceptable”. Meanwhile, Stewart Patrick, a senior fellow at the Carnegie Endowment for International Peace was quoted as saying it would “likely not be well received in Western capitals, because it might be seen as legitimizing Vladimir Putin's Policies,” he told Euronews in an interview during the summit.

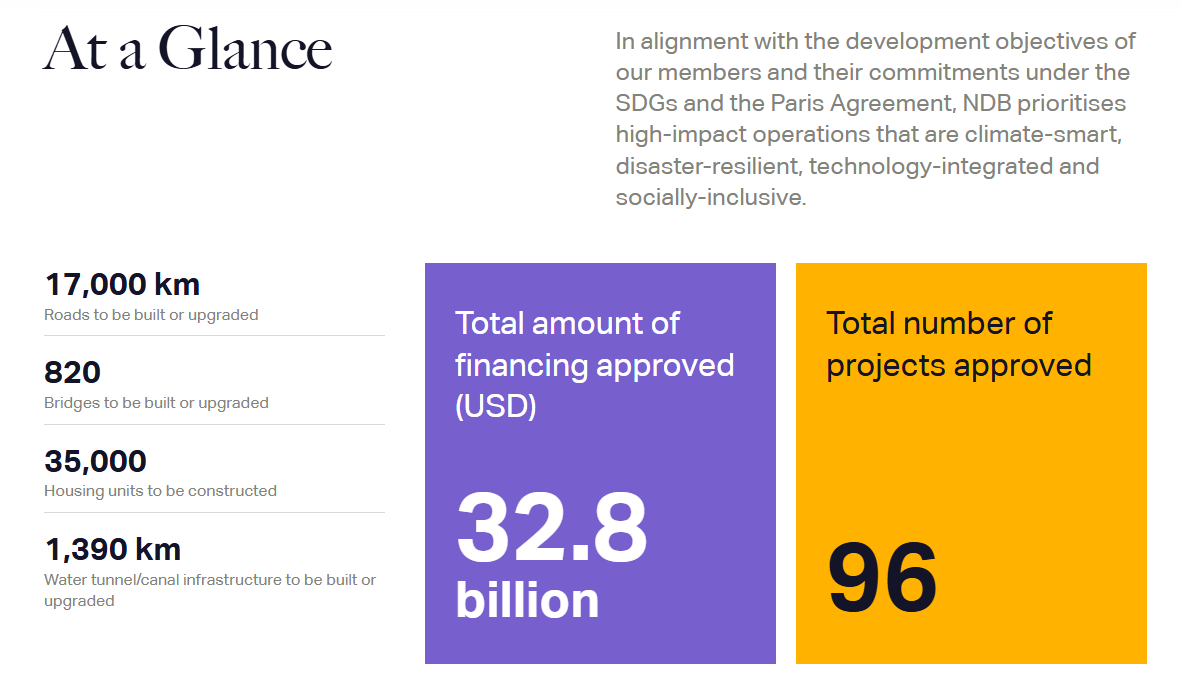

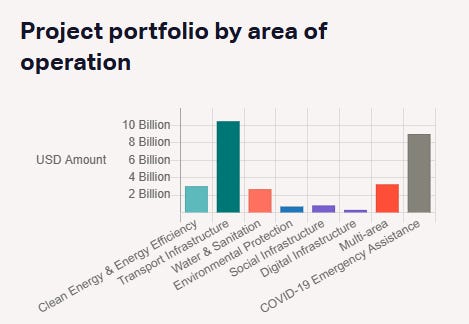

One of the thoughts I get around these Eastern developments is the intention by the BRICS to emulate the ways by which the West has been successful at expanding their power throughout the world. The BRICS appear to be an equivalent institution to that of the EU and the New Development Bank (NDB) appears to be playing the role of the IMF.

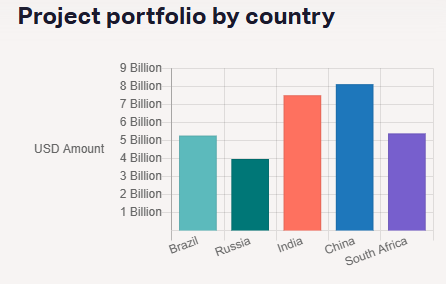

As for how the BRICS intends to expand, the NDB is the mechanism by which new trade routes and infrastructure projects will be established - most of which will be outside of Western countries’ territories. For example, when highlighting the NDB’s impact, Putin said, “Since 2018, the Bank has funded about 100 projects, amounting to a total of $33 billion.”

Now let’s look at the NDB which stands for The New Development Bank. Mrs Dilma Rouseff who is the head of the NDB was in attendance at the Summit. Let me break down the NDB for you a little to better understand its role. “The BRICS Bank, or the New Development Bank (NDB) was established in 2015 to bridge the gap in infrastructure and development financing. It has approved more than 30 billion USD of loans for projects like water and transport infrastructure since its launch.7 In addition to the five founding members, the NDB welcomed four new members in 2021, including Bangladesh, Uruguay, Egypt, and the UAE.”

“The NDB has also established the BRICS Interbank Cooperation Mechanism (BICM) with various national development banks to facilitate payments in local currencies within the bloc. BRICS Pay, a multi-currency digital payments system, enables payment clearing among local currencies and eliminates the need for "vehicle currencies," such as the dollar or the euro, in transactions among member countries.”

Some statistical points about the size, population, project focus and where investments are flowing through the NDB

Not to mention, Mrs. Dilma Rouseff also emphasized a direction of travel whereby new growth will stem from global South countries: “I am of the view that BRICS can also encompass additional countries from the Global South, enabling us to identify new areas and domains for cooperation. In this context, both the expansion of BRICS and our emphasis on ensuring the necessary financial resources for projects in the countries of the Global South are of paramount importance.”

BRICs pay was introduced and appears to be the payment vehicle for sovereign nations. On the website for BRICs pay, it states

“ BRICS pay might be a cornerstone for payments for a sovereign and prosperous nation. Achieving financial independence is paramount for nations seeking political, energy, food, technological, and other forms of sovereignty. Full control over financial resources is necessary for countries to achieve true sovereignty. This pursuit is a shared goal among nations striving for independent policies and the well-being of their citizens.” - BRICS Pay

In the closing remarks, when Putin was answering questions, one question had him stating that:

“What is justice as applied to development? Consider the recent events that took place during the coronavirus pandemic. What happened at that time? I would like to draw your attention and the attention of all the other media representatives to this issue. During that period, the United States printed about $6 trillion, and the Eurozone countries printed about $3 trillion or slightly more than that. All that money was used in the global market to buy everything and anything, primarily food but also medicines and vaccines, which are now being destroyed en masse because they are past their sell-by date. They placed all these products on the market, thereby provoking food inflation and various other kinds of inflation worldwide. What did the world’s leading economies do? They abused their exclusive positions in global finance, in terms of both the dollar and the euro. They printed money and used it to buy up the products they needed the most. They – you – consume more than they produce or have the money to buy. Is this fair? We do not think so, and we would like to change this. This is what BRICS is doing.”

Future members?

Serbia states that it sees joining BRICs as an alternative to joining the EU.

Burkina Faso plans to also join BRICs to “counter the domination of the US dollar and euro.”

Russia-Ukraine Conflict

At the European Parliament, Viktor Orban, President of Hungary delivers an uncomfortable speech stating:

“We are losing on the Ukraine frontlines, and you are all acting as if this isn’t happening.”

And told reporters that

“We don't want to block anything. We just want to convince European leaders to change their strategy [regarding Ukraine] because the current strategy does not work." - Ahead Of EU Speech, Orban Says Current Ukraine Strategy 'Does Not Work'

Zelensky comes out declaring war on other nations who are said to be supporting and aiding Russia:

“Ukraine is at war with three countries – Russia, Iran and North Korea. Everyone sees the Iranian regime helping Putin, while Russia is also working with China, despite their lack of comment.” - Ukrainian-Iranian and Ukrainian-Korean war: Zelensky said that Kyiv is fighting with three countries at once

Mid October, North Korea sent a first wave of 1500 troops to support Russia against Ukraine. Another 12,000 soldiers are then suspected of having joined, followed by a final 1500 soldiers. The US White House confirmed their belief that over 10,000 soldiers had joined Russia from North Korea. Joe Biden states that Ukraine should strike at North Korean Troops if they enter the country to fight Ukraine alongside Russia.

The Russian foreign minister reiterates the peace deal for Ukraine to end the war:

No NATO membership

Neutral status

Restoration of rights of the Russian population in Ukraine

Restoration of the church

No possibility of the West to use Ukraine as a proxy again

Taken territories in Ukraine become Russian

US approves of a $20 billion loan to Ukraine which is part of a greater $50 billion loan package from the G7 backed by Russian assets.

The US also approved a likely sale of advanced medium-range air-to-air missiles to Denmark for an estimated $744 million.. NATO and Western nations backing Ukraine are getting their military and defenses ready. The US looks to be playing the role of Sugar Daddy with military weapons.

Zelensky made the comments at an EU summit in which he said “either Ukraine will have nuclear weapons, which will protect us, or we must have some kind of alliance.”

In a statement he clarified that "We are not building nuclear weapons. What I meant is that today there is no stronger security guarantee for us besides NATO membership.”

One of the things many are looking forward to with Trump is his approach to international conflict, especially with all the wars escalating around the world. Trump appears to be a solution to de-escalating and bringing peace to the conflict in Europe, which Putin says he is open to seeking peace and takes Trump’s claims to ending all this seriously.

GEORGIA - the country

The ruling Georgian Dream party has won the October 26th elections which brought thousands to the streets to protest the elections, even getting warnings from the Western institutions.

Middle East

Some of the developments for the month of October is as followed:

Iran begins the month with a barrage of missiles at Israel. The Iron Dome did not stop all the missiles. Tel Aviv military bases were hit. The US White House came out with an official statement warning Iran would suffer consequences, accusing Iran of escalation. Same response came from the Israel government. Following the attack, Saudi Arabia, Qatar, the UAE, Bahrain and Kuwait have declared their neutrality to Iran in its conflict with Israel, and will not allow the US to use their air bases against Iran. China, Russia, Pakistan and Bangladesh announce support for Iran. North Korea on the other hand comes out calling Israel and the United States “cancer-like” threats to the Middle East. IRGC official ‘If the United States helps Israel with an attack on Iran, we will bomb American bases in the region - and they are much less protected than Israel.”

Are Iranian oil operations at risk?

The month also started off with Israeli forces being ambushed by Hezbollah soldiers while attempting to infiltrate Lebanon, forcing them to retreat, supposedly inflicting a lot of damage, leaving many of the soldiers dead/wounded and or fleeing.

Israel strikes a proclaimed Russian weapons depot in Syria, city of Jableh. As the depot is situated near the Hmeimim Air Base, the largest Russian air base in Syria, both Russian and Syria air defenses were working together to intercept enemy projectiles.

Spies captured by both sides. A supposed Mossad spy was captured in Lebanon. In a video of the capture we see citizens of Lebanon in the street beating the spy and carrying him away. 7 Israelis are arrested on charges of spying for Iran: “Residents of the north who emigrated from Azerbaijan accused of carrying out some 600 missions over two years for their Iranian handlers, causing damage to the country.”

Iraq joins the conflict sending multiple drone strikes throughout the month and in one case. Yemen Houthis continue their attacks striking a British oil tanker Cordelia Moon in the Red Sea. Iran strikes Israel’s Nevatim Air Base, getting 32 strikes in. Then Hezbollah lands 2 missiles in Haifa. Hamas themselves bombed Tel Aviv on the anniversary of October 7th.

Israel then targets a French multinational company Total Energies gas station in Beirut. This is being seen as retaliation by Israel for Macron’s stance.

France’s Macron gets ripped by Israel’s Netanyahu for urging for an arms embargo on Israel which Macron doubles down on after the attacks on UN peacekeepers. Israel forces fired at a watchtower used by UN peacekeepers in southern Lebanon, injuring 2. It was reported that Israel had been firing on their spot for a few days before the incident. Benjamin Netanyahu made a speech afterwards threatening the UN stating

“I am addressing the UN Secretary-General directly, your refusal to evacuate the UNIFIL soldiers is turning them into Hezbollah’s hostages. But you not evacuating your UNIFIL peacekeeper, you are endangering their lives, we have asked you countless times to evacuate, and you keep refusing.”

Later on in the month, Israel declares the Unrwa agency a terrorist organization. They have cut all ties with the agency and the Israel parliament passed a bill banning the UN from operating in Israel and the Palestinian Territories.

Turkey bombs US proxies in Northeast Syria

This conflict is nowhere near over, clearly.

The Islamabad SCO 2024 Summit

The summit was held between the 15th and 16th of October, in Pakistan. At the invitation of H.E. Mr. Muhammad Shehbaz Sharif, Prime Minister of the Islamic Republic of Pakistan, H.E. Mr. Li Qiang, Premier of the State Council of the People’s Republic of China, paid an official visit to Pakistan from October 14 to 17, 2024 and participated in the 23rd Meeting of the Council of Heads of Government of Member States of the Shanghai Cooperation Organization. Pakistan became a full member in 2017, alongside India.

“In his address to the summit, Sharif spoke on the expansion of China’s Belt and Road Initiative (BRI) and the International North-South Transport Corridor (INSTC). While the BRI remains China’s flagship project, Beijing is increasingly showing interest in the INSTC, which involves SCO members Russia, Belarus, Kazakhstan, Kyrgyzstan, Tajikistan, Iran, and India, among others. Though not directly involved, China recognizes the potential of the corridor to enhance its influence across Central Asia, the Middle East, and Europe.

Moreover, the INSTC provides China with an alternative trade route, allowing it to bypass Western-imposed sanctions, particularly in its dealings with Russia and Iran. By promoting trade through these non-Western-aligned routes, China aims to reduce the impact of Western financial dominance, a critical concern following the Ukraine conflict and ongoing tensions with the United States.”

China

China initiates huge military drills around Taiwan in a display of power. An indirect threat to the President of Taiwan William Lai after his speech vowing to “resist annexation” or “encroachment upon our sovereignty”. The latest exercise has been dubbed Joint Sword 2024-B by Beijing. The following image shows the route of the patrol/drill.

Is America going to get divided into 3 major conflicts? Is this a Sun Tzu tactic to see America divide internally while their external forces are scattered across the globe against 3 major forces in the Middle East? Ukraine? South China Sea?

EU Fighting Disinformation?

The President of the EU, Von der Leyen likens Free Speech to infectious disease. She claims to want to “vaccinate” the EU population against “disinformation”/ “wrong thinking”.

She knows best? The god complex of these morally corrupt cowards to think they know better and should tell us where to agree and not agree.

NATO

Former Prime Minister of the Netherlands Mark Rutte becomes the new NATO Secretary General as of October 1st. He ended his term in the Netherlands in July 2024. He was a huge proponent of the Ukraine-Russian conflict and warned other European countries to get ready and prepare for an expected escalation in conflict with Russia. He used to be a human resource manager before moving his way into politics…….

Trump VS Kamala - The Road To The White House

Home Stretch Madness

The road to the White House in 2024 has been nothing short of insane. Here are some brief events that took place this month.

There was 3rd assassination attempt on Trump was found in Coachella, CA.

Trump Works a shift at McDonald’s

In Pennsylvania, Trump paid a visit to a local McDonalds’s - it was the most searched topic on Google, that the tech giant had ever seen. And many political pundits felt it was a stunt that resonated well with the every day working class worker.

”Garbage” Comments

There’s a lot of name-calling and back-and-forth in what is clearly one of the most heated elections yet, with both sides taking jabs at each other. But it seems to be primarily the Left, led by Kamala, that continues to insult not only Trump but also his supporters and voter base.

Biden calls Trump supporters “Garbage”.

In response, the Trump campaign acted swiftly, capitalizing on the former President’s appearance at a rally in Green Bay, Wisconsin. Trump arrived in a garbage truck decorated with his campaign slogan and conducted the rally in a garbage collector’s uniform in front of 18,000 enthusiastic supporters. The timing couldn't have been more perfect, as the event took place just two days before Halloween.

Regardless of your politics, we will likely never see a campaign like this ever again. You have to give credit where credit is due, and Trump’s campaign has done a masterful job of adjusting to daily news story events from their political opponents.

The question is - will this translate on election night ?

Fascist Nazi and Women?

Kamala then claims to want to end division and bring back unity, and labels Trump a Nazi?

Talk about a message of Unity…

In addition, Mark Cuban publicly came out and said “The woman who surround Trump are not intelligent….”; there was a very proactive response from many in the Trump Campaign that begged to differ.

Full Story here:

https://thedailybs.com/2024/11/03/dont-believe-mark-cuban-trump-surrounds-himself-with-strong-women/

Joe Rogan and Donald Trump’s interview has almost 45M views.

On X → https://x.com/joerogan/status/1851117181964046431?s=46

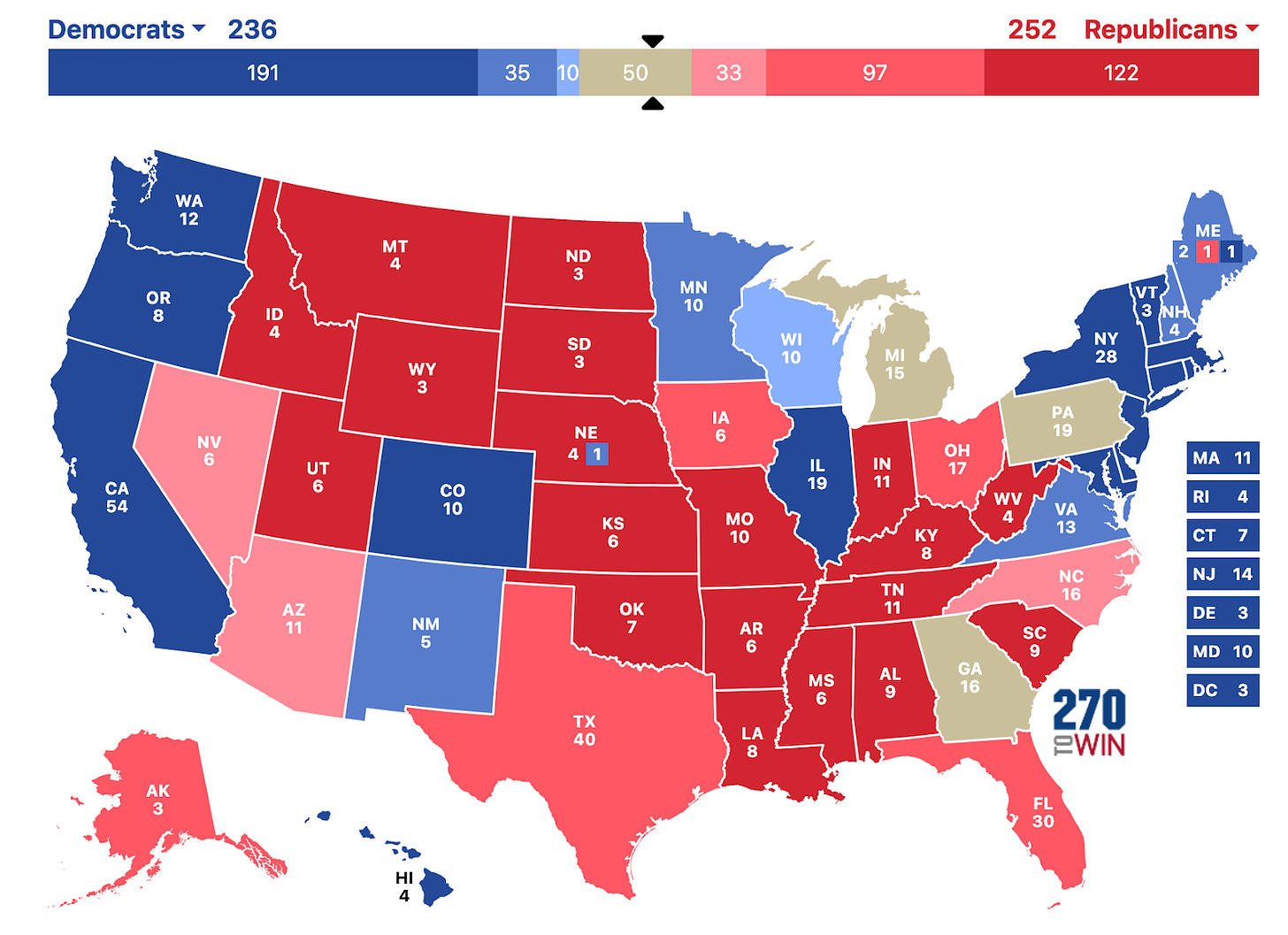

Key Battleground States - These States will decide the Presidency

Commentary from Dan Kozel

Going into tomorrow’s election, these states will determine who will be the next President of the United States.

MICHIGAN (MI) - 15 Electoral Votes - Pay attention to the Arab-American vote here. A Democrat Mayor (Amir Ghalib) endorsed Trump and this has been the most heated state in relation to the Israel Gaza Conflict. Many polls have this as a toss-up state - it’s way too close to call.

PENNSYLVANIA (PA) - 19 Electoral Votes - The historical Blue Wall, known as a Democrat stronghold, has only gone GOP, once in the last 6 elections, when Trump won the state in 2016. Important counties to watch are Bucks County, Philadelphia and the Western PA state, where fracking is a major issue. Whoever wins this state, will likely become the next president. Both candidates have been campaigning aggressively here and it’s expected we will not know the winner of the Keystone Stone until Thursday.

GEORGIA (GA) - 16 Electoral Votes- Concerns here are centered around early voting, where a pending lawsuit against the election committee on ballot counts - these lawsuits were initiated by the Georgia GOP committee. Fulton County will be on everyones radar. But exit polls are favoring Trump. There are also rumors circulating that Georgia will not have a decision on election night.

ARIZONA (AZ) - 11 Electoral Votes - A border state with Mexico and has seen a massive surge in undocumented illegal immigrants. The exit polls currently lean towards Trump, however, as we saw in 2020, Biden, somehow, managed to win this state with 51% of the votes counted… currently leaning Trump.

NEVADA(NV) - 6 Electoral Votes - An important senate race here could heavily determine which presidential candidate will win the state. Many of the rural voters have turned out in droves - and Trump could win this state early on in the night. The state elected Joe Biden in 2020.

NORTH CAROLINA (NC) -16 Electoral Votes- The Western part of the state was heavily affected by Hurricane Helene, and the current administration's response with FEMA was abysmal; this should have voters favor Trump. Although many pollsters are saying this state is a swing state, we believe Trump will carry the votes here needed.

WISCONSIN (WI) - 10 Electoral Votes - probably the most heated after Michigan and Pennsylvania, given how it has swung back and forth the last two elections, and is part of the Democrat Blue Wall. The main issues in this state are centered around the economy and manufacturing jobs - something that favors Trump. But at this point - it’s still leaning towards a Democrat light blue.

As of today - it’s going to be a battle till the very end.

If Kamala holds on to The Blue Wall (PA/WI/MI), she will win.

But if Trump can break at least one of the Blue Wall States (ideally PA) and carry AZ,NV, GA and NC, he will be the next President of the United States.

The Harris Campaign mobilized their ground game in PA and MI - I think they know where Georgia and North Carolina stand.

While Trump will be pushing hard in PA and closing out his last campaign rally in MI.

I don’t trust the polls or anything going on in the betting markets, however,

as of this morning - this is where the current electoral map stands.

Source: https://www.270towin.com/

Hard to see it being called on Election night - but we will have to see how markets react over the next 48-72 hours.

CULTURE

The Port Strike

The US port strike ends in a deal on the third day of the strike. Members of the International Longshoremen’s Association, the union representing 50,000 members covered under the contract with the United States Maritime Alliance were back to work. The maritime alliance, which operates under the acronym USMX, agreed to raises of $4 an hour for the union members on top of the current base pay of $39 an hour, an immediate raise of just more than 10%. Then union members will get additional $4-per-hour raises every year during the life of the six-year tentative deal. That will raise pay by a total of $24 an hour during the life of the contract, or by 62% in total.

Miners Killed in Pakistan

21 miners were killed when dozens of unidentified attackers stormed an area with many small private coal mines in Pakistan’s mineral rich Balochistan province. The attack by 40 armed men, days before Pakistan hosts a summit of the Shanghai Cooperation Organisation, is the worst in weeks in the mineral-rich province of Balochistan bordering Afghanistan and Iran.

Ukraine

Still seeing a lot of tension internally with citizens in Ukraine as they aim to remove capable fighting men from the streets to force them into the fight. A concert in Kiev was attended by the military recruitment to drag young men to force them to sign for conscription.

Is Ukraine a moral country? Absolutely not.

Serbia

Protestors rally to oppose Rio Tinto’s lithium mine project

Mozambique

Police clash with protestors in the capital Maputo after a disputed election. Authorities cracked down on unrest following the presidential elections. “Tensions were high in the southern African country in the buildup and immediate aftermath of the Oct. 9 vote, but more unrest was stoked when two senior officials of an opposition party were killed in their car in the capital, Maputo, on Oct. 18 after being ambushed by unidentified gunmen late at night. The opposition says the attackers fired 25 bullets at the car.” Daniel Chapo of the ruling Front for the Liberation of Mozambique was announced as the winner of the election on Oct. 24.

El Savador

President Nayib Bukele deploys 2000 soldiers and 500 police officers to neighborhoods to find and remove all gang members, apparently hiding in the 10 de Octubre neighborhood in San Marcos, South San Salvador.

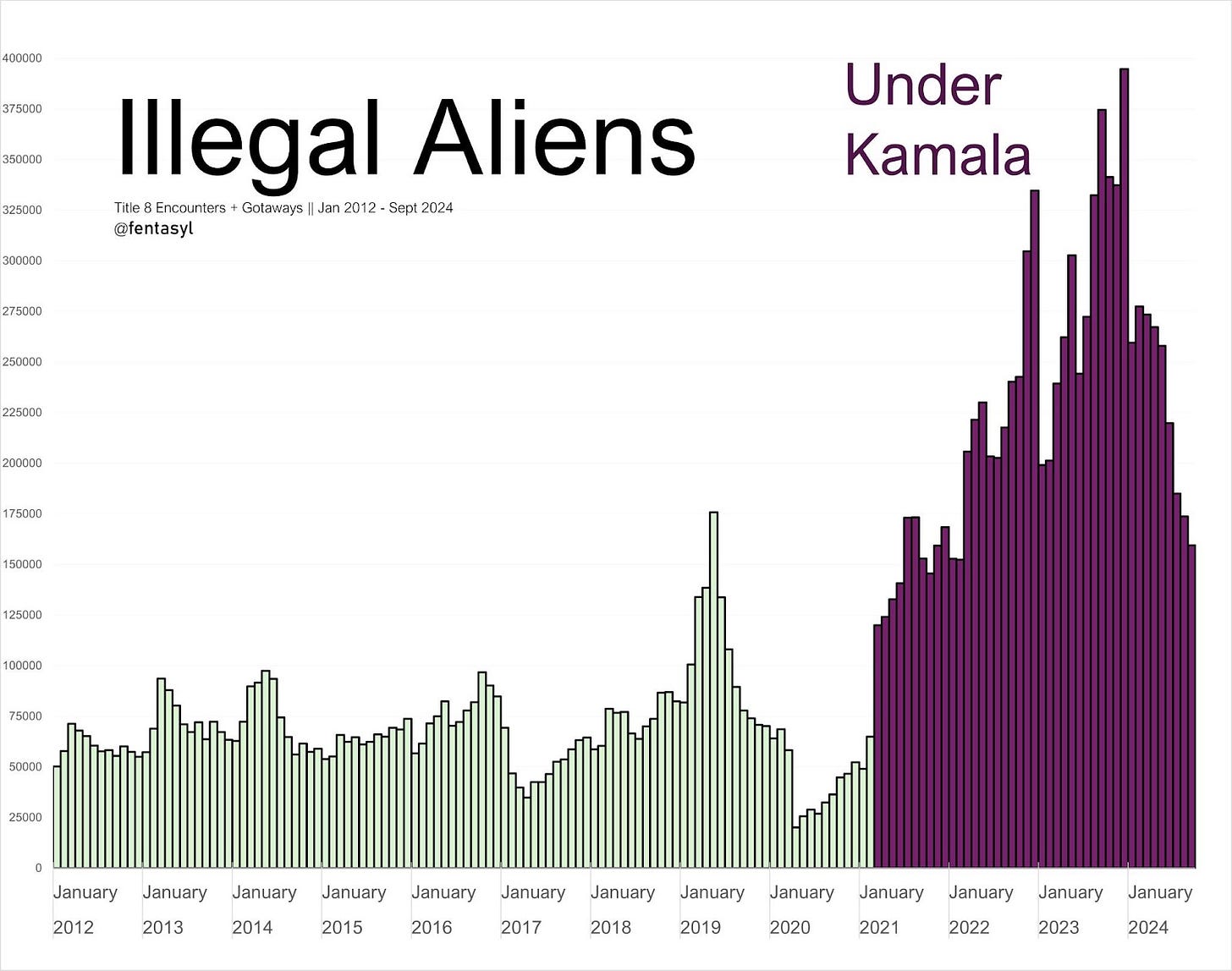

Gangs in America

San Antonio police arrested over 2 dozen gang members who had taken over a nearly 300 unit apartment complex. With the influx of migrants being welcomed in without hesitation, much of the latin gang world will find refuge in the USA.

We also saw this in Colorado, with the Venezuelan gang members taking over an entire complex.

ECONOMICS

Central Banks

BOC - Bank of Canada

Cut rates by 0.5 basis points down to 3.75%

PBOC - People’s Bank of China

The one-year loan prime rate (LPR) was lowered by 25 basis points to 3.10% from 3.35%, while the five-year LPR was cut by the same margin to 3.6% from 3.85% previously.

FED - Federal Reserve - US

FED Bank of Dallas President Lorie Logan has reiterated her call for the US central bank to lower rates at a careful pace as the economic environment remains uncertain

Kansas City Fed president Jeff Schmid called for a "cautious and gradual"

Minneapolis Fed president Neel Kashkari said he expects "modest cuts over the next quarters."

ECB - European Central Bank

ECB’s governing council member Martins Kazaks said officials will need to consider a range of options in the coming meetings, including standing flat and cutting interest rates in a bigger step.

ACB - Australian Central Bank

Recorded its 4th straight year of accounting losses in 2024. A $2.78 USD billion loss. The bank reported an A$8.3 billion loss for underlying earnings and a A$4.2 billion valuation gain, mostly thanks to changes in its domestic government bond and foreign currency positions.

USA Economy

On the matter of banks, we saw the Bank of America experience widespread outages with customer accounts showing zero balances. → Warren Buffet a few days later sold $8 billion worth of Bank of America stock. He’s currently sitting on $285B worth of cash.

The Federal Repo Facility for emergency liquidity has been tapped for $2.6 billion USD. Largest amount since June of 2020. Appears to be as a consequence of Bank of America’s crises. But that is speculation. Just an odd coincidence of the timing.

The US Treasury calls for new steps by the IMF and World Bank to ease liquidity strains.

Jay Shambaugh stated : “If you are a country committed to sustainable development and if you are willing to engage with the IMF and MDBs to unlock significant financing alongside significant reform measures, there needs to be a financing package from bilateral, multilateral, and private sector sources to bridge your liquidity needs in a way that is supportive of your sustainable long-run development," Shambaugh said.

The plan "will require hard work and innovation" at the international financial institutions, he said, adding that they will need to design their lending and reform programs in a way that avoids having temporary fiscal adjustments lead to permanent harm due to cuts to important investments, such as for infrastructure. - US Treasury Calls for New IMF, World Bank Steps to Ease Liquidity Strains

Janet Yellen is the head of the Treasury and she also recently defended the benefits of immigration (which is actually State funded immigration) arguing that it has been an important source of labor supply and innovation helping bring growth for the US economy. Are the gaps and labor problems not a by-product of manipulating and intervention creating major distortions and problems down the line in the economy and then pretending their open borders and debt use is the saving grace.

Just as the US interest burden hits a 28 year high - roughly $2.4 billion a day on net interest payments is being spent - $882 billion in the fiscal year through September. The weighted average interest on outstanding US debt was 3.32% at the end of September. - US Interest Burden Hits 28-Year High, Escalating Political Risk – BNN Bloomberg

Precisely on the issue of debt and inflation:

Gary Cohn, the former National Economic Council Director, who is now IBM’s vice chairman states that “the only way to really deal with the debt problem is to grow the economy.”

With that, he implies we must inflate our way out of the debt. If we never allow any bust to happen, and fear any recession to unwind all those malinvestments, then naturally the only path that the central institutions can take is to cause inflation.

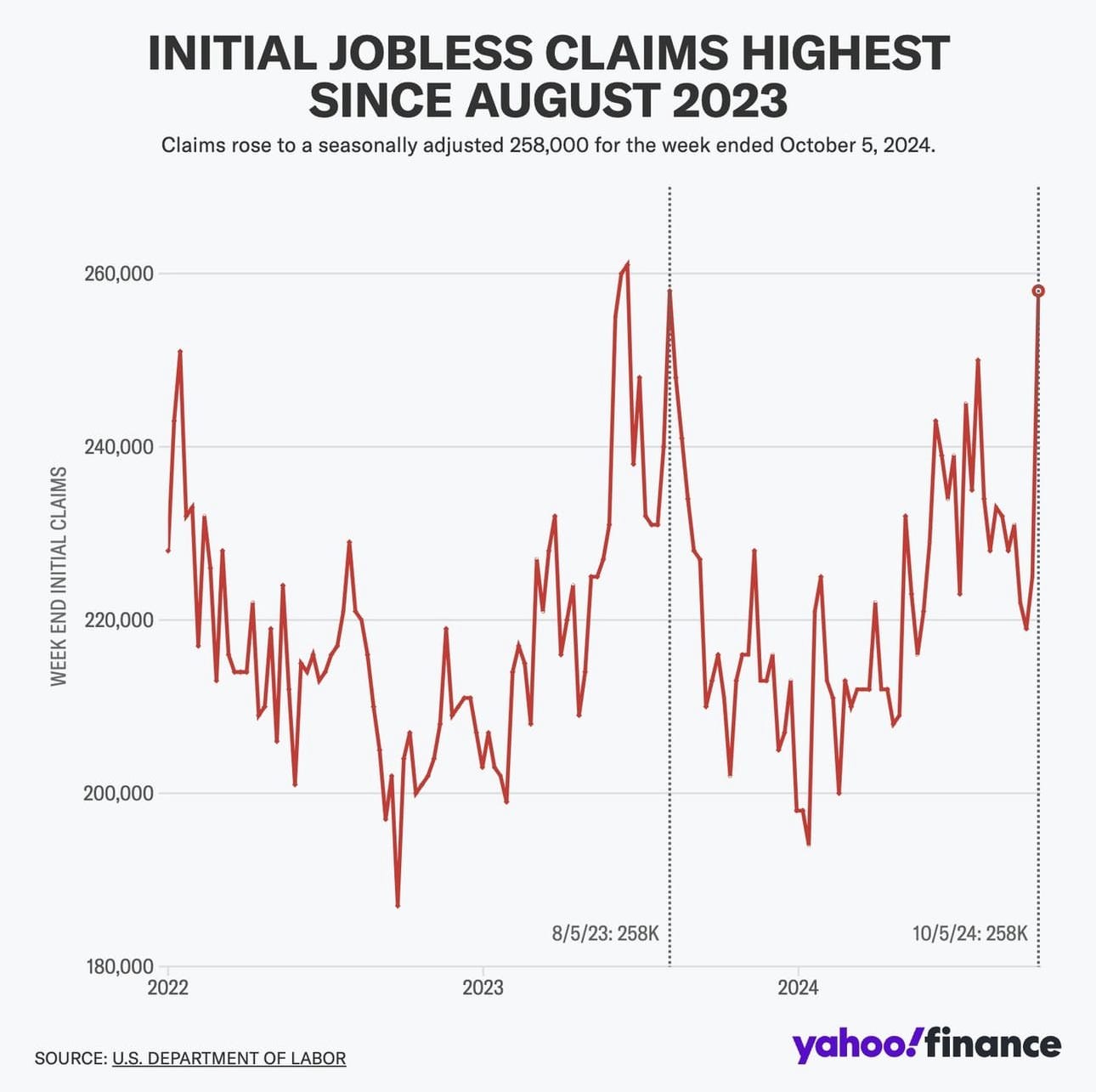

According to household data, 86% of jobs created in September were government jobs with jobless claims rising. The stagflation is beginning to creep in. This is why the government will need to create jobs directly or indirectly to distort the reality and keep the illusion of strength going.

At the same time, perceptions among American households that they might become delinquent on debts increased last month to the highest levels since April 2020.

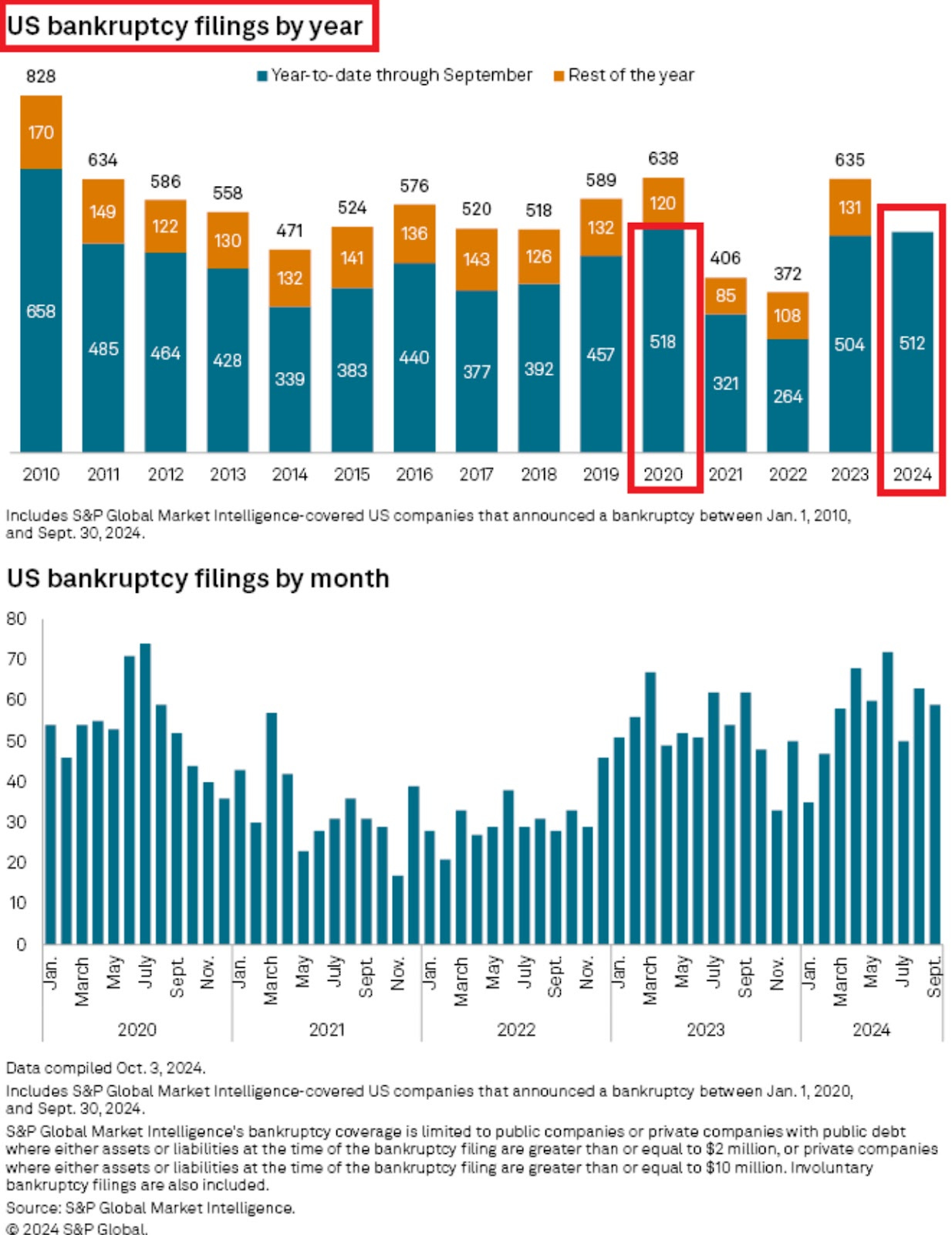

US bankruptcies hit the 2nd highest level in 14 years.

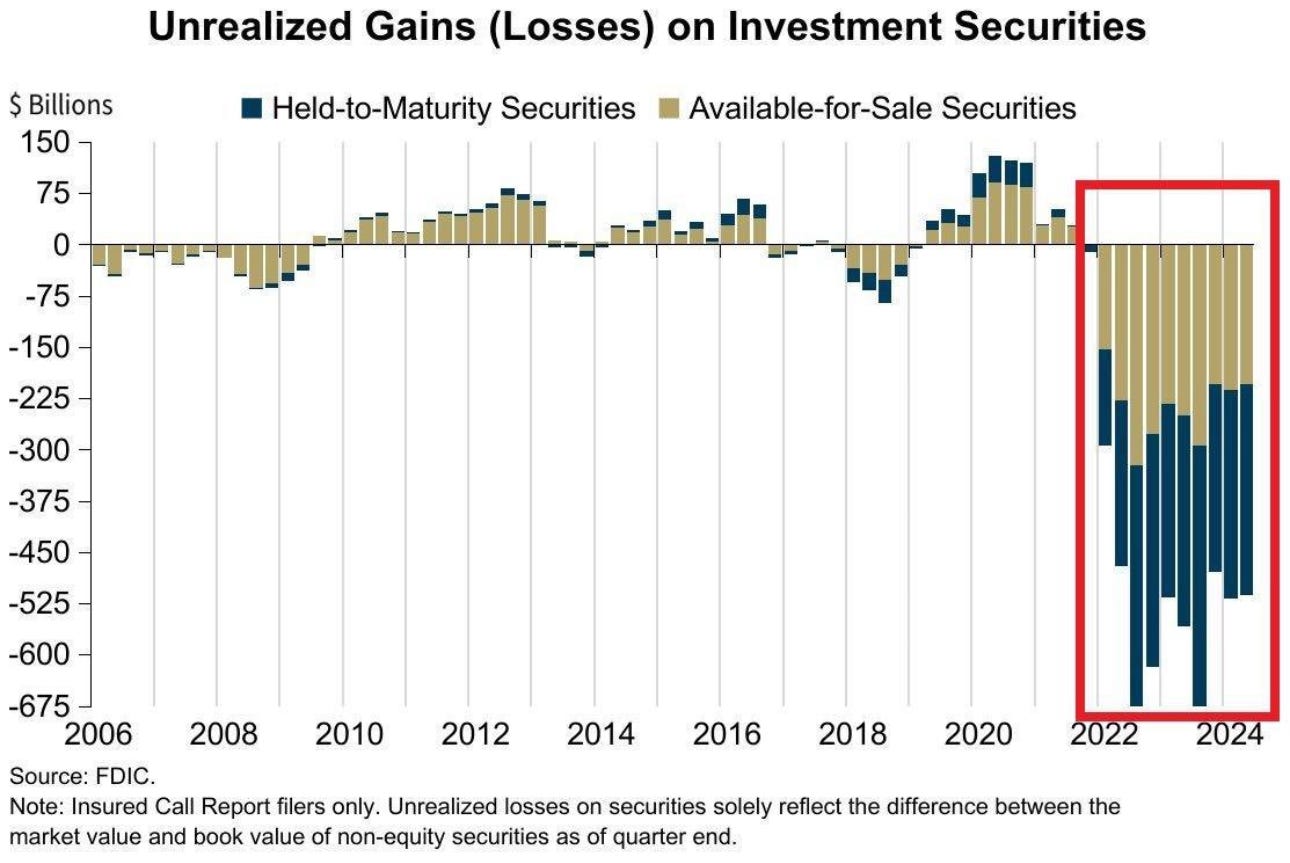

Unrealized losses by the U.S. Banks are 7x higher than the 2008 financial crisis, reaching an estimated $750 billion, much of the unrealized losses concentrated in portfolios that are crucial to bank products. The most at risk portfolios are 1) AFS - available for sale & 2) HTM - held to maturity

TD bank becomes largest bank in US history to plead guilty to money laundering, agreeing to pay over $1.8 billion in penalties.

Attorney General Merrick B. Garland stated: “Today, TD Bank also became the largest bank in U.S. history to plead guilty to Bank Secrecy Act program failures, and the first US bank in history to plead guilty to conspiracy to commit money laundering. TD Bank chose profits over compliance with the law — a decision that is now costing the bank billions of dollars in penalties. Let me be clear: our investigation continues, and no individual involved in TD Bank’s illegal conduct is off limits.”

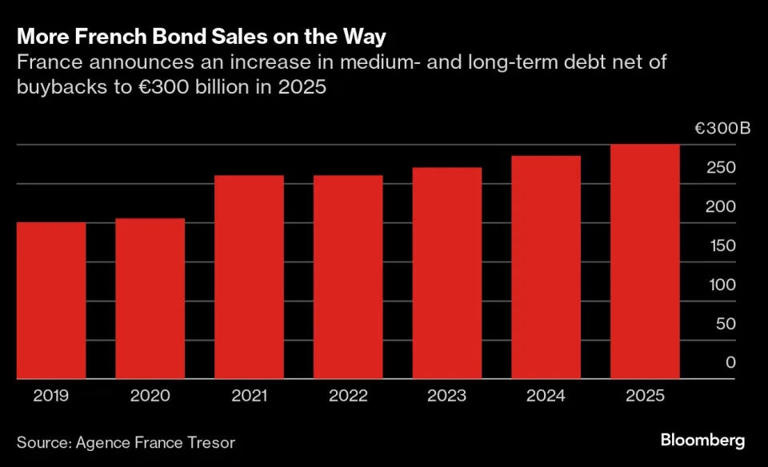

France

France announced plans to sell 300 billion Euros in government bonds in 2025 to finance its budget, an increase of 15 billion Euros from this year 2024. The proceeds from the bond issuance will help finance a projected budget deficit of €136 billion in 2025.

UK

According to a Think Tank, the UK will need to hike taxes by 20 billion pounds to stop spending cuts. But then at the end of the month, the UK's labour government announced a new budget plan that raises taxes by 40 billion pounds.

Chancellor of the Exchequer Rachel Reeves also changed the U.K.'s debt rules, allowing the government to borrow more to 'invest, invest, invest,' she said. She also stated that “the government will change its self-imposed debt rules in order to free up billions for infrastructure spending……so that we can grow our economy and bring jobs and growth to Britain".

"We need to invest more to grow our economy and seize the huge opportunities there are in digital, in tech, in life sciences, in clean energy, but we'll only be able to do that if we change the way that we we measure debt," she said at a meeting at the International Monetary Fund (IMF) in Washington DC. They will change definitions and rework the books to keep the illusion going.

Talk about wanting to cook the books to do as you please with the economy. The arrogance and god complex of these bureaucrats.

Global Financial Markets

NYSE to extend trading hours on ARCA equities exchange to 22 hours a day.

Texas Stock Exchange formed their senior leadership this past month.

TXSE Group Inc announces veteran leadership team | Texas Stock Exchange

Hang Seng Index falls by 9.41% in its largest loss in 16 years and 2nd largest loss this century

Hong Kong stocks plunge more than 9%, biggest fall in 16 years

Japanese stocks saw the largest outflow in history of $8.8 billion in 20 years

China set to plan a 10 trillion Yuan expansion in extra debt for fiscal stimulus.

Some other interesting videos to watch on youtube

Evolving Global Monetary System

Commercial and Central banks will be able to conduct live trails of digital-asset transactions on SWIFT starting next year.

“Starting next year banks across North America, Europe, and Asia will embark on live trials of digital assets and currency transactions over the Swift network. The ability to execute digital asset and currency transactions over the Swift network is moving from experimentation to reality. Starting in 2025, global financial institutions will have the ability to use Swift’s global platform to conduct pilot transactions for the settlement of digital assets and currencies. These trials will demonstrate how financial institutions can transact interchangeably across both existing and emerging asset and currency types using their current Swift connection.”

Live trials of digital asset transactions on Swift to start in 2025 | Swift

US dollar global reserves fall below 60% for the first time since 1995.

Nigeria says it will begin selling crude oil in local currencies (Naira), and removing the US dollar.

IMF upgrades Russia to the world’s 4th largest economy based on purchasing power parity.

“In its World Economic Outlook published on Tuesday, the IMF said Russia’s gross domestic product (GDP) in 2024 amounts to 3.55% of global GDP in terms of PPP, outperforming Japan, which has 3.38%. According to the report, Russia ranks fourth in terms of PPP after China (18.8%), the US (15%), and India (7.9%).”

So much for all those sanctions by the West that would “cripple” the Russian Economy.

LME to approve Hong Kong for warehousing by end of 2024 to expand its global metals warehousing.

Exclusive: LME to approve Hong Kong for warehousing by end-2024, sources say | Reuters

Gold Reserves

Tanzania's central bank said it will buy gold at market prices from miners who were ordered to sell at least 20% of the gold they hold to diversify their reserves.

Czech National Bank gold reserves rose by another 1.6 tonnes in September, making it the 19th consecutive month of buying, with a gold holding in excess of 46 tonnes.

Kenya to restrict raw exports of gold and other minerals.

Gold & Silver

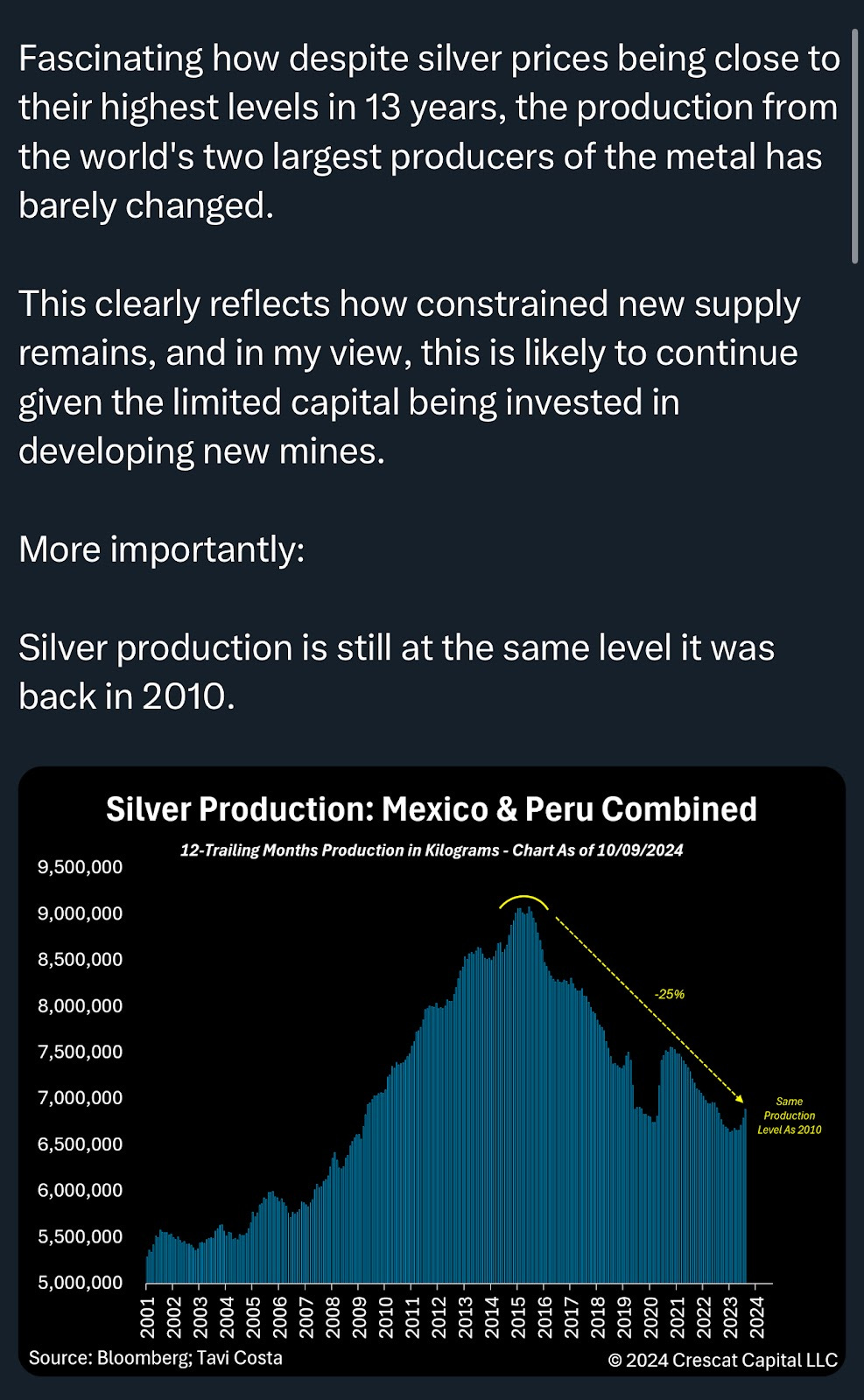

All time highs for Gold - nearly 2 weeks of daily all time highs. Reached a final ATH for the month of $2790 USD, merely $10 away from the $2800 mark.

Decade plus highs with Silver reaching $34.86, inches away from crossing $35.

Some other interesting data on silver market:

Bank Losses as Silver prices spike

https://finance.yahoo.com/news/five-us-banks-face-billions-180018774.html

Electrification & Energy

US resurrect shuttered Michigan Nuclear Power Plant

EU voted to impose tariffs as high as 45% on EVs imported from China

BMW says EU ban on gasoline cars from 2035 is no longer realistic.

Amazon to invest $500 million in small modular nuclear reactors to power AWS.

Italy to present state-backed newco to produce nuclear reactors

2 refineries that make up roughly 14% of the produced gasoline in California are set to close due to “regulatory pressure.”

India has become Europe’s largest supplier of refined fuels, surpassing Saudi Arabia. India is a massive buyer of crude oil from Russia, then reselling it refined to Europe at much higher prices.

Mining

Claudia Sheinbaum, who is the newly placed President of Mexico released her 100 promises to the people of Mexico. She mentioned nothing of open pit banning. This is good and beneficial for the speculation of Mexico mining stocks.

One of China’s top gold producers has acquired a gold mine from Newmont, the world’s largest gold producer in a $1 billion cash deal.

Crypto

Bitcoin runs going back over $72k before pulling back.

Denmark’s Tax Law Council recommended introducing a bill to impose a 42% tax on unrealized crypto gains starting 2026 covering all holdings since bitcoin's 2009 inception.

Tether is being investigated by the US Federal Government for possible violations of sanctions and anti-money laundering rules.

Dollars & Sense - What We’re Buying

Written by Dan Kozel

With all the attention on the US election, it’s going to be difficult for many people to focus over the next few weeks on what’s ultimately going to happen. Assuming we do have some certainty on who the winners will come this week, the dynamics of the market still remain the same.

Historically, every election year, the markets tend to return, on average, 13%. I expect this trend to continue - with the current market returning about 24% YTD - at least at the end of Q1 2025.

This is great news for the stock market, but not great for the economy or the consumer. I’m concerned the economic disconnect between jobs and housing starts could signal a recession in the later parts of 2025. Canada first, followed by the United States.

My thesis still remains the following - as mentioned in all of our previous monthly newsletter.

Gold will continue to be a great place to hedge in this world of uncertainty.

Commodities are in the early stages of a bull run

Deferensives are good place to have cash

Crypto is about to embark on some kind of a run - including the meme coins

Precious Metals & Commodities

With gold continuing to make new all-time highs, the last week of October saw a nice reset of the metals insane rally. This is healthy and quite frankly, I wouldn’t want Gold to move parabolically, because this would imply something even crazier is on the horizon.

But the reality is, Gold’s YTD return of 32% has hardly gotten any love - but I feel this is about to change. The BRICS’s summit - which garnishes no mainstream media attention, will likely become a main point of discussion going into 2025. And if the US election drags out for more than a week, this creates the perfect environment of uncertainty. The Central Banks in the East, have and will continue buying up gold to protect their currencies. It still blows my fucking mind, that in Canada, we have ZERO oz backing our currency - more trouble ahead for the Loonie is expected.

If Kamala wins - Gold will rise - because of her insane government expansion policies and unfortunate alignment with the military industrial complex. I fear we as a civilization are in trouble if this happens…

If Trump wins - Gold will rise as well, but not by much. Everyone keeps talking about Trump’s tariffs doing harm to the economy. And while this may be true, I believe he’s using this language as more of a negotiating tactic, to renegotiate existing trade deals. So we’ll have to see.

Either way - regardless of the outcome, I think the losing side is going to refuse the results, which may complicate the transition period between November 6 and January 20, 2025.

In the near term however, the Gold Producers are likely to see record margins and so here one we really like, as a low-risk play.

Newmont Corp - Holding - adding to weakness.

We first mentioned Newmont Corp. (NGT.TO / NEM) - in our April newsletter. Afterning gaining 39% and reach a 52-week high of $81.16 (or $58.72 on the NYSE) - the major producer dropped almost 15% on it’s last earnings announcement after it “missed” analyst expectations.

In Q3 2024 - Newmonth’s revenues was $4.6B USD, with an adjusted EBITDA of $2B, generating Free Cash Flow of $760M. Not to mention, they’re sitting on $3.1B worth of cash.

Now here’s where it gets juicy - their all-in cost for producing gold is $1475/oz USD… just do the math. If gold is at $2,700/oz USD - their margins are at $1,225/oz USD. With 1.8Moz reported in Q3 - this company is going to be hoarding so much free cash flow, it’s going to be hard to ignore.

If you bought in the spring, you’re a happy shareholder. The drop on October 23 was in fact a gift, and we ended up buying more. This is definitely one of the safer plays in the space, as Newmont has many tier 1 assets across the world.

Now technically - right now, if you are looking for an entry - you need to be patient. There could be some more turbulence ahead, if price volatility continues. As you can see below NGT is trading below it’s 200 MA, which means there could be more down side. And $55 price level would quite frankly be a steal, given their recent performance.

We’ll have to find a way and see how this plays out, but if you’re willing to ride out, Newmont will pay a dividend as well. Give this name some time, but I wouldn’t be surprised to see it trade back into the mid $70’s, if Gold prices continued to rise.

Physicals - Gold and Silver

You really can’t go wrong buying these when there’s a correction in the prices of both gold and silver. We’ve been accumulating small amounts of physical coins and bars over the past severals months - the main thesis for this is because our own damn government has zero gold backing it’s currencies.

If a bank failure were to happen - how would you get your cash out?

Gold and silver are an alternative here.

The Coin Shoppe - Buy & Sell With 100% Guarantee

Buy Gold, Silver Coins & Bars Online | AU BULLION

Junior Exploration Updates.

Big Winners from last month

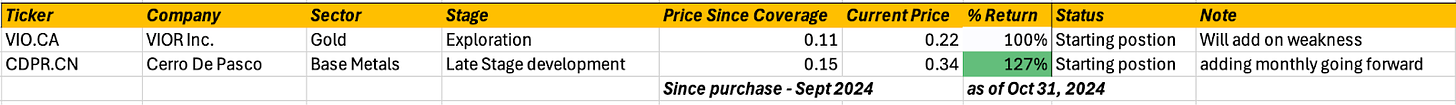

CDPR - Cerro De Pasco +127%

Read last month's newsletter - this name has exploded to the upside and recently announced a financing at $0.30. Full thesis can be found here. Not to mention, Canadian mining legend Eric Sprott has a huge position in this story.

VIO - Vior Inc. + 100%

Read last month’s newsletter - Vior’s current 60,000m drilling program is well underway and we expect to see results come in, to the later parts of November. There’s been more buying in this story and we encourage you to take a look at our Capital Market Series episode with CEO Mark Fedosiwich.

Something is Brewing Here

DLTA - Delta Resources - still flat.

Delta announced another expansion of their land package in Thunder Bay, Ontario.

This recent expansion adds another 19 claims on strike with the Eureka gold deposit at Delta-1.

I do not believe they would be doing something so aggressive, if the M&A deals in precious metals mining would be heating up - we’ve seen more deals this year, than in the last 5 years.

This continues to be a large position of ours and it’s fair to speculate there might be something in the hooper here. The chart looks very nice too - as the base around the 0.125-0.13/range continues to get larger.

Remember, the bigger the base, the bigger the space - we’re speculating here, but this is just part of the game we are playing.

Other Core Position Updates

Defensive Play - Mid-Cap - Industrial

ARE.TO - Aecon Group

When you are able to get government contracts and have exceptional management running a company, this gives you a lethal combo of execution and likely an increase in shareholder returns.

AECON has built some of the most important pieces of infrastructure in Canada. This is a very old company, which started in the late 1870’s. The company was also responsible for the construction of the St-Lawrence seaway, the 401 highway, the CN Tower and the Toronto and Montreal airports.

Going into 2025 - infrastructure is going to be a big piece which many investors will likely need to capitalize on. Especially with rising commodity prices, it wouldn’t hurt to have a little bit of exposure.

Aecon is diversified in 6 revenue streams - civil, nuclear, industrial, utilities, urban transport. These are vital to the future development of a functioning society. Furthermore, the company’s main contracts come from the Federal government - this is a guaranteed receivable.

I bought ARE.TO at the end of the summer, around $17/share - and on the last day of the month, the company blue out it’s earnings expectation and surged to as high as $27/share… and the company is still undervalued.

A quick peak at the chart suggest to be patience and wait for a pullback.

And Canaccord has initiated an analyst report, which you can read here.

Put this name on your watchlist.

Small-Cap Special Situations - Sleeper Picks

The Good Shroom Co. - MUSH

For those who attended our May Investor Gathering in Montreal, you will remember CEO, Eric Ronsse chatting about launching cannabis infused dips. This is similar to the popular Nicotine pouches from Philip Morris, ZYN’s. Well guess what, this past month, Health Canada recently approved the companies request to have DYPS enter the Alberta market.

Full Press Release here - from October 22, 2024 https://www.newswire.ca/news-releases/the-good-shroom-to-launch-innovative-thc-infused-dyp-pouches-in-alberta-819652719.html

I chatted with Eric back in the later days of the summer, and was completely perplexed by how the stock looked like it was trading on the verge of bankruptcy, but internally, the business was growing and stronger than ever. It remains to be seen how the market reacts to this new product development - but I bought another 17,000 shares at the $0.085/share mark.

I believe by Q1 2025 - the results of the this new product launch are going to surprise alot people in a pleasant way. Perhaps a rerating might be in order in the early days of spring. You need to be patient, but its business as usual for The Good Shroom Co.; not to mention, zero debt, all excise taxes paid and profitability increasing.

Diamond Estates Winery - DWS.V

Now here’s a name you have probably never heard of…

Diamond Estates Winery - what is this?

Well, if you live in Canada, you are certainly familiar with the Oasis juice brand, especially for those of us who remember drinking these juices in elementary and high school. The company behind this brand is Lassonde - a large multinational corporation with headquarters in Quebec.

And guess what - they happen to be the largest shareholder of DWS and with good reason. Lassonde owns about ⅔ of the shares outstanding on DWS with an average price of $0.70 and $1.80, from the previous private placements.

Diamond Estates Wines & Spirits stands out as a leading producer of premium wines and ciders, with a national footprint in marketing and sales that brings a diverse portfolio of international brands to the Canadian market.

With a proven track record of strategic acquisitions—including nine wineries and agencies—Diamond Estates is well-positioned to capitalize on the fragmented nature of Canada’s winery industry. The Company’s growth strategy is focused on consolidating assets and identifying value-driven opportunities to expand its brand portfolio, setting the stage for continued growth and shareholder value.

We’ve been accumulating stock and hold close to 42,000 shares below $0.30/share and plan on holding for at least 9 months -as the company rolls out is strategy across Canada and the LCBO’s.

Bitcoin and Crypto - Trump W would start an insane meme-coin rally.

It was revealed in the last week of October, that the largest purchaser of almost 2% of the entire bitcoin supply, was in fact Blackrock. If you need any indication as to where Bitcoin is heading - just follow the smart money.

I’ve spoken extensively as to why I hold bitcoin in our previous newsletter, so I won't spend too much time on it here.

But Trump has been pro-bitcoin since August and the crypto vote, as seen below, may be a determining factor in key battleground states.

However, the writing is on the wall for Bitcoin - and we appear to be at an important inflection point, where a Trump victory, in my opinion, is going to send Bitcoin into price discovery, possibly hitting as high as $80,000 USD.

Crypto Speculation - DOGE - Department of Government Efficiency - HIGH RISK play

Assuming the above scenario plays out - I think DOGE, is going to go on an insane rally. Possibly as high as $0.55USD - the chart shows us that this is possible.

What started off as a joke from Elon Musk, could turn into a self-fulfilling prophecy. If Trump is elected, Elon will be leading the charge on the Department of Government Efficiency (DOGE - lol!)

Now this is pure speculation, so don’t go throwing in money you cannot afford to lose. But I think given the circumstances, I’ve been accumulating around $2,000 worth of DOGE and will be watching this closely over the next month - lets see how this plays out.

This is High risk play, and I don’t recommend it to anyone who hates volatility.

All jokes aside - this is going to be a nail biting finish for the balance of power in the West.

Wrapping Up

With less than 36 hours to go before the rise or collapse of the West (kidding), we expect to see more market voltailty and exciting week ahead, as investors adjust to this new reality.

If you enjoyed this piece - drop a comment below!

If you made it this far, we appreciate you and your support.

Until next month - let’s enjoy the circus.

*DISCLAIMER* - READ CAREFULLY

None of the information taken within this newsletter should be considered investment advice and should only be viewed for information purposes only. NewGen Mindset is not a broker, or a licensed provider of financial services. All claims made in this newsletter to any listener should not be viewed as offering personalized legal or investment counseling. Any investments made in any companies should be consulted with a licensed financial professional from here on.